Nebraska Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time

Description

How to fill out Irrevocable Trust For Future Benefit Of Trustor With Income Payable To Trustor After Specified Time?

If you want to complete, obtain, or print legitimate document templates, utilize US Legal Forms, the premier source of legal forms that are available online.

Use the site’s user-friendly search feature to find the documents you require.

A wide selection of templates for business and personal purposes are categorized by type and state, or by keywords.

Step 4. After finding the form you need, click the Acquire now button. Choose the payment method you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to access the Nebraska Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time in just a few clicks.

- If you are a current US Legal Forms customer, Log Into your account and click the Acquire button to obtain the Nebraska Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time.

- You can also access forms you have previously saved from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

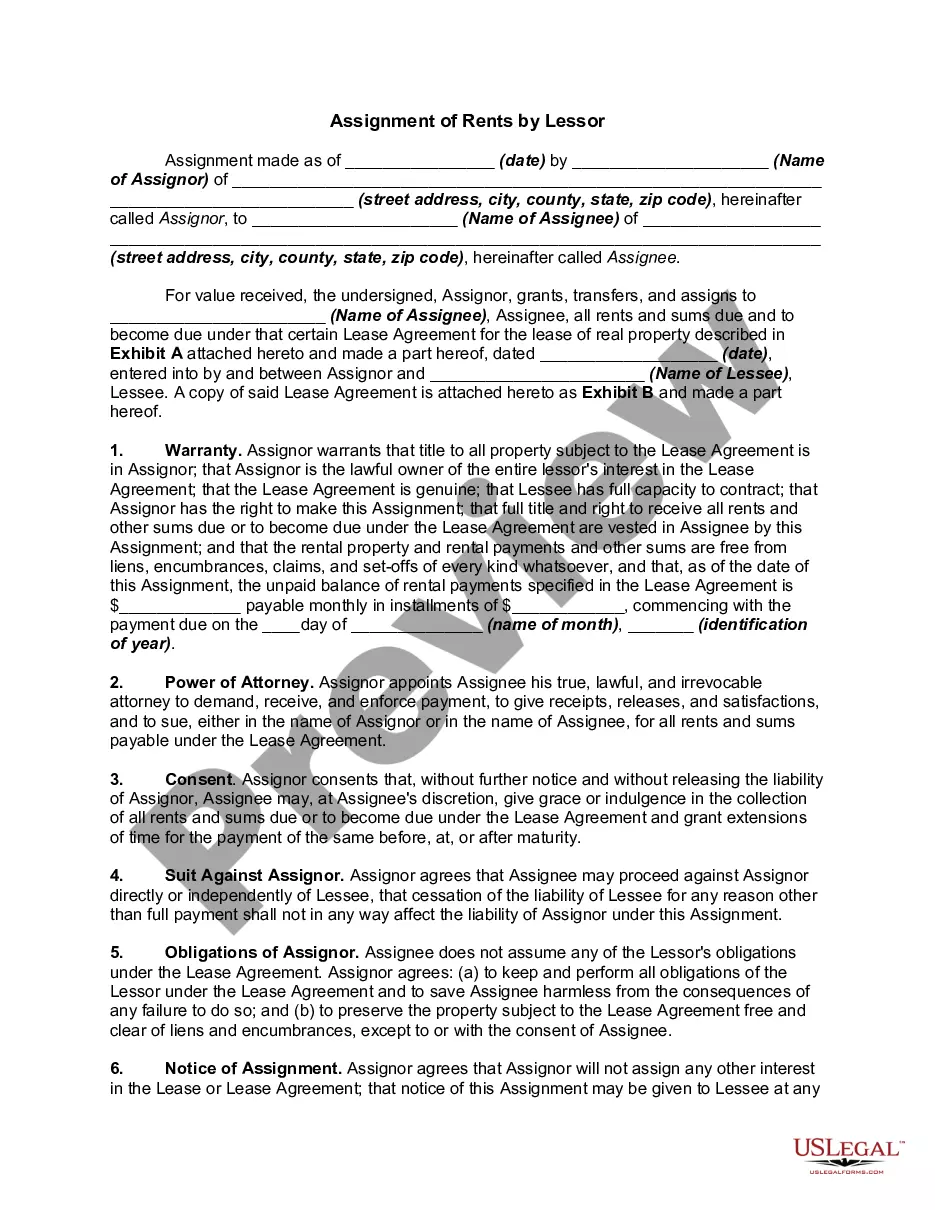

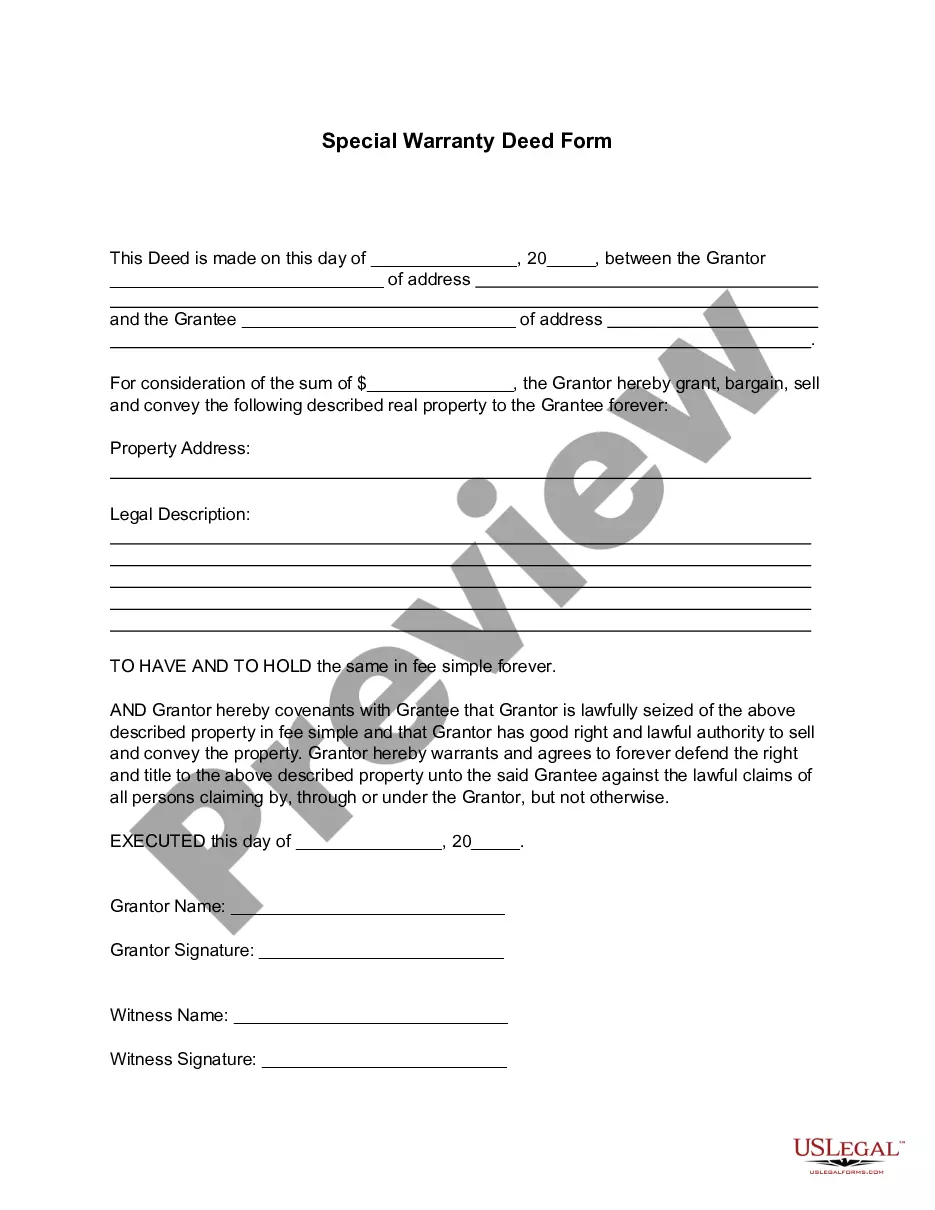

- Step 2. Use the Review option to browse through the form’s content. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find other forms in the legal form template.

Form popularity

FAQ

Too bad, says the IRS, unless you are an estate or trust. Under Section 663(b) of the Internal Revenue Code, any distribution by an estate or trust within the first 65 days of the tax year can be treated as having been made on the last day of the preceding tax year.

Preservation Family Wealth Protection & Planning Under Section 663(b) of the Internal Revenue Code, any distribution by an estate or trust within the first 65 days of the tax year can be treated as having been made on the last day of the preceding tax year.

When a trust is irrevocable but some or all of the trust can be disbursed to or for the benefit of the individual, the look-back period applying to disbursements which could be made to or for the individual but are made to another person or persons is 36 months.

Irrevocable Trusts Generally, a trustee is the only person allowed to withdraw money from an irrevocable trust. But just as we mentioned earlier, the trustee must follow the rules of the legal document and can only take out income or principal when it's in the best interest of the trust.

Some of the grantor trust rules outlined by the IRS are as follows: The power to add or change the beneficiary of a trust. The power to borrow from the trust without adequate security. The power to use the income from the trust to pay life insurance premiums.

The 65-Day Rule applies only to complex trusts, because by definition, a simple trust's income is already taxed to the beneficiary at the beneficiary's presumably lower tax rate.

The grantor (as an individual or couple) transfers their assets to an irrevocable trust. However, unlike other irrevocable trusts, the grantor can be the income beneficiary. Their children or spouse would be the residual beneficiaries.

The 65-day rule relates to distributions from complex trusts to beneficiaries made after the end of a calendar year. For the first 65 days of the following year, a distribution is considered to have been made in the previous year.

Under current law assets in a grantor trust do not receive a step up in basis upon the grantor's death and are not included in the taxable estate of the grantor.

The trustee of an irrevocable trust can only withdraw money to use for the benefit of the trust according to terms set by the grantor, like disbursing income to beneficiaries or paying maintenance costs, and never for personal use.