Nebraska What To Do When Starting a New Business

Description

How to fill out What To Do When Starting A New Business?

Are you currently in the situation where you require documents for either business or personal purposes almost every day.

There are numerous legal document templates available online, but locating reliable ones can be challenging.

US Legal Forms offers a vast array of form templates, such as the Nebraska What To Do When Starting a New Business, designed to comply with federal and state requirements.

Select the pricing plan you prefer, fill out the necessary information to create your account, and pay for the order using your PayPal or credit card.

Choose a convenient document format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After logging in, you can download the Nebraska What To Do When Starting a New Business template.

- If you don’t have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

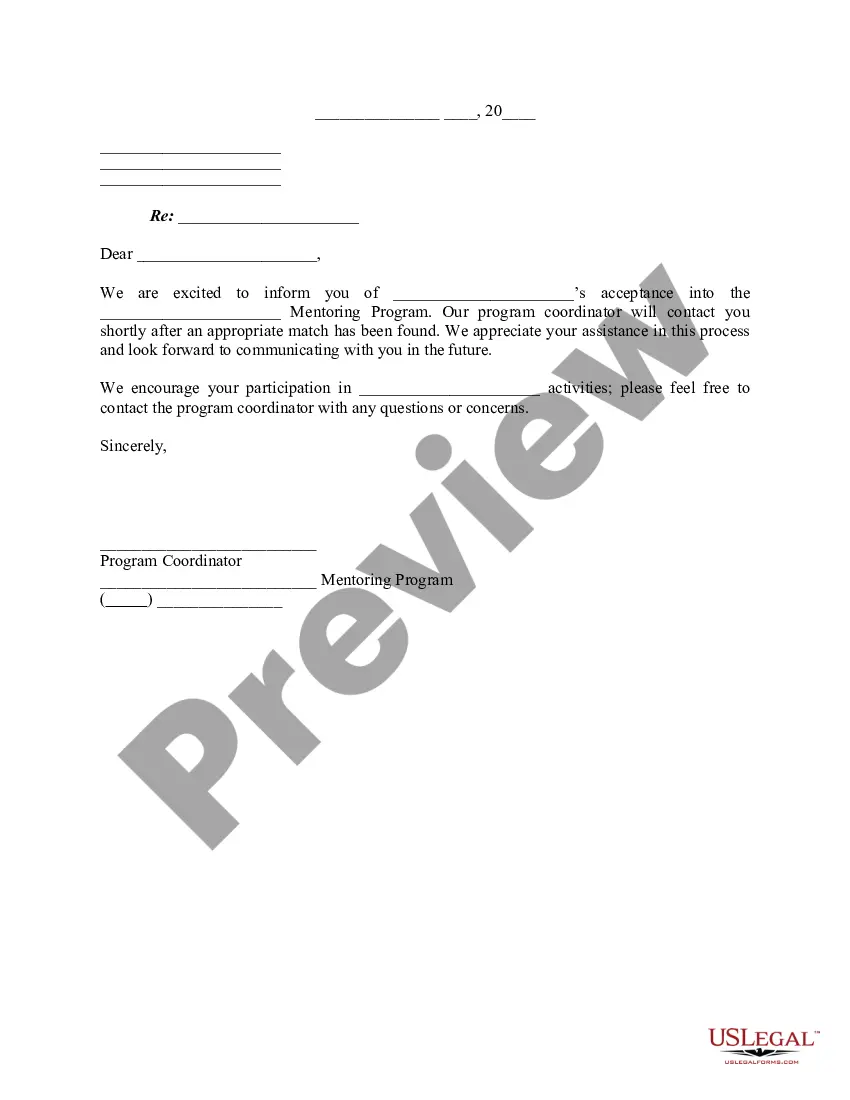

- Use the Review button to examine the form.

- Check the summary to confirm you have selected the appropriate form.

- If the form isn’t what you require, use the Search field to find the form that meets your needs.

- Once you find the correct form, click Acquire now.

Form popularity

FAQ

A DBA is not required in the State of Nebraska in order to do business under an assumed name, DBA, or as it is known in Nebraska, a "trade name." That said, there are a number of reasons to file for a DBA.

It's Easy to Incorporate in NebraskaStep 1: Create a Name For Your Nebraska Corporation. When naming your Nebraska Corporation, you will need to:Step 2: Choose a Nebraska Registered Agent.Step 3: Choose Your Nebraska Corporation's Initial Directors.Step 4: File the Articles of Incorporation.Step 5: Get an EIN.

Depending on the type of license you are applying for, the state license can be any where from $10- $100.

Conduct market research. Market research will tell you if there's an opportunity to turn your idea into a successful business.Write your business plan.Fund your business.Pick your business location.Choose a business structure.Choose your business name.Register your business.Get federal and state tax IDs.More items...

The fee is $100, and you cannot renew online. You can withdraw your Nebraska trade name by filing a voluntary request for cancellation with the Secretary of State. Call (402) 471-4079 for more information.

How to Start a Business in NebraskaChoose a Business Idea. Take some time to explore and research ideas for your business.Decide on a Legal Structure.Choose a Name.Create Your Business Entity.Apply for Licenses and Permits.Pick a Business Location and Check Zoning.File and Report Taxes.Obtain Insurance.More items...

Nebraska does not have a statewide basic business license. Businesses may be required to register with the Nebraska Secretary of State or the Nebraska Department of Revenue for business income taxes, sales tax or payroll taxes.

While the sole proprietor is such a simple business classification that Nebraska doesn't even require a business registration process or any type of fees, depending on how you use your sole proprietorship and what industry you operate in, you still might have some important steps that need to be taken.