Nebraska Packing Slip

Description

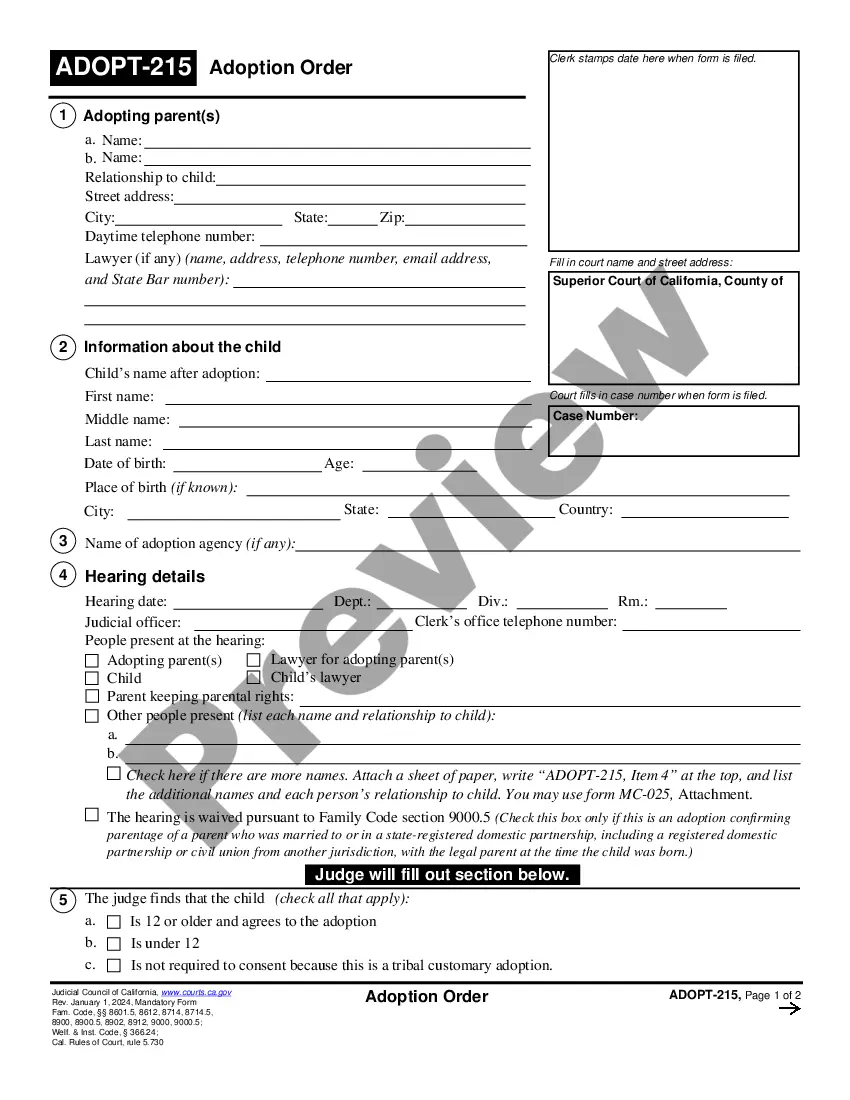

How to fill out Packing Slip?

You might spend hours online looking for the legal document format that fulfills the state and federal requirements you need.

US Legal Forms provides thousands of legal documents that are assessed by experts.

It is easy to download or create the Nebraska Packing Slip from our service.

If you want to find another version of the form, use the Search section to locate the format that suits your needs and requirements.

- If you possess a US Legal Forms account, you can sign in and select the Download option.

- Then, you can complete, modify, create, or sign the Nebraska Packing Slip.

- Each legal document format you obtain is your property for a long duration.

- To get another copy of any purchased document, go to the My documents section and click on the corresponding option.

- If you're using the US Legal Forms website for the first time, follow the basic instructions below.

- First, ensure you have selected the correct document format for the area/city of your choice.

- Review the document description to confirm you have chosen the correct form.

Form popularity

FAQ

If you meet specific income thresholds or are a resident, filing a Nebraska tax return is mandatory. The process ensures that you are compliant with state tax laws. For guidance, you can turn to platforms like USLegalForms, which can help you navigate filing requirements effectively, including supporting documents like your Nebraska Packing Slip.

Generally, you do not need to attach your federal return when filing your Nebraska return. However, it's essential to keep your federal documents for your records and refer to them as needed. Using the Nebraska Packing Slip can help streamline your record-keeping for both federal and state returns.

Yes, even if you file a federal tax return, a separate Nebraska tax return is necessary for residents and those earning income in the state. This allows Nebraska to assess your tax liability accurately. Solutions like USLegalForms can assist you in preparing your return, ensuring you include your Nebraska Packing Slip as needed.

Certain individuals, like those with very low income or specific exemptions, may not need to file a return in Nebraska. Additionally, if your income comes solely from retirement benefits or social security, you might avoid filing. It's always wise to check the guidelines or use resources like USLegalForms to clarify your situation regarding the Nebraska Packing Slip.

To register for Nebraska withholding tax, you can complete the online application through the Nebraska Department of Revenue website. Once you register, you'll receive the necessary information and forms to manage your payroll taxes effectively. Ensure you have your Nebraska Packing Slip handy for accurate records during the process.

Yes, if you earn income that is sourced from Nebraska or meet residency requirements, you typically need to file a Nebraska return. Failing to file may lead to penalties, so it's crucial to understand your obligations. Utilizing a Nebraska Packing Slip can help you keep track of your transactions for smooth filing.

Nebraska offers an array of interesting facts, including its status as the only state with a unicameral legislature. It boasts the Sandhills, a unique landscape formed by grass-covered sand dunes. Nebraska also plays a crucial role in the production of the nation's food supply. Moreover, it is recognized for its strong educational institutions and small-town charm. For businesses, accurate documentation like a Nebraska Packing Slip is vital to maintaining smooth operations in this dynamic environment.

Nebraska is most popular for its vibrant agriculture, strong community spirit, and friendly atmosphere. Visitors and residents alike appreciate the state's local cuisine, outdoor activities, and historical sites. From the annual Nebraska State Fair to local farmer markets, there is much to celebrate. Don’t forget to include a Nebraska Packing Slip with your orders to ensure smooth deliveries and happy customers.

Nebraska leads in producing various agricultural products, particularly corn and beef. It is one of the top states for cattle ranching, ensuring a strong livestock market. Many businesses leverage Nebraska’s agricultural strength to provide quality products nationwide. A Nebraska Packing Slip can help you manage and document these shipments efficiently.

Nebraska is best known for its diverse agriculture and impressive natural parks. It is home to landmarks such as Chimney Rock and the scenic Sandhills. Additionally, Nebraska has a vibrant cultural scene, with numerous events and festivals held throughout the year. If you engage in local commerce, ensure your records are in order by utilizing a Nebraska Packing Slip for all transactions.