Nebraska Software Installation Agreement between Seller and Independent Contractor

Description

An independent contractor is a person or business who performs services for another person pursuant to an agreement and who is not subject to the other's control, or right to control, the manner and means of performing the services. The exact nature of the independent contractor's relationship with the hiring party is important since an independent contractor pays his/her own Social Security, income taxes without payroll deduction, has no retirement or health plan rights, and often is not entitled to worker's compensation coverage.

How to fill out Software Installation Agreement Between Seller And Independent Contractor?

Selecting the appropriate authorized document template can be a challenge.

Of course, there are numerous templates accessible online, but how do you locate the authorized document you require.

Utilize the US Legal Forms website. This service offers thousands of templates, including the Nebraska Software Installation Agreement between Seller and Independent Contractor, suitable for both business and personal needs.

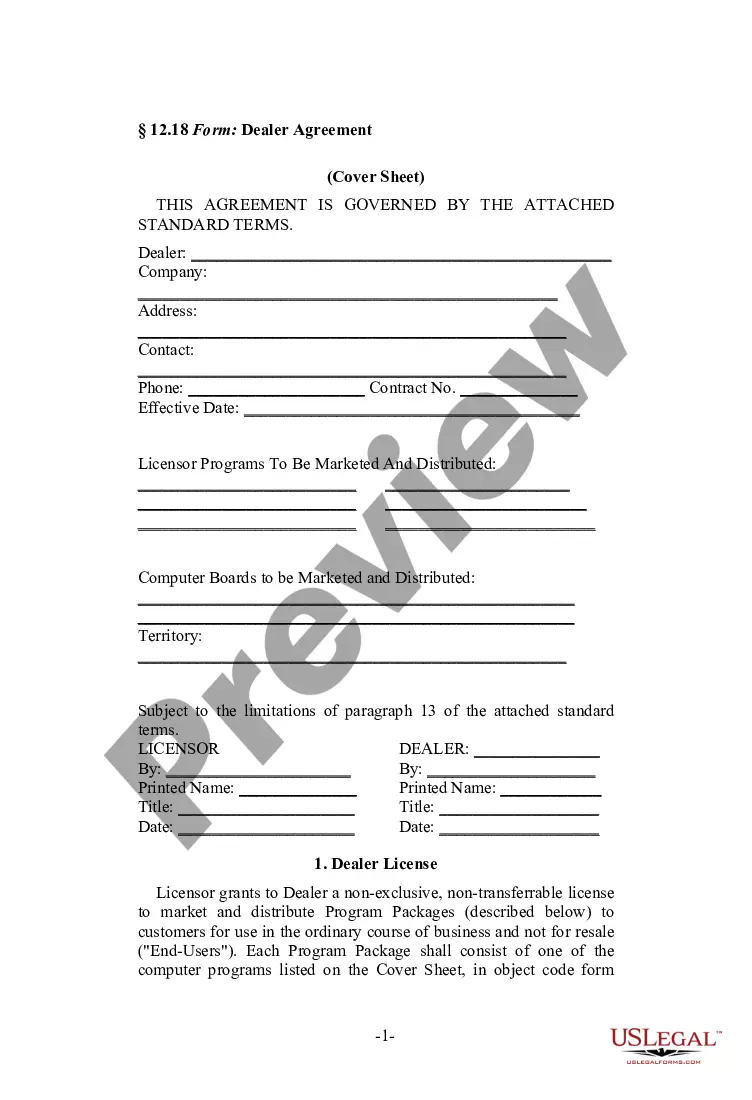

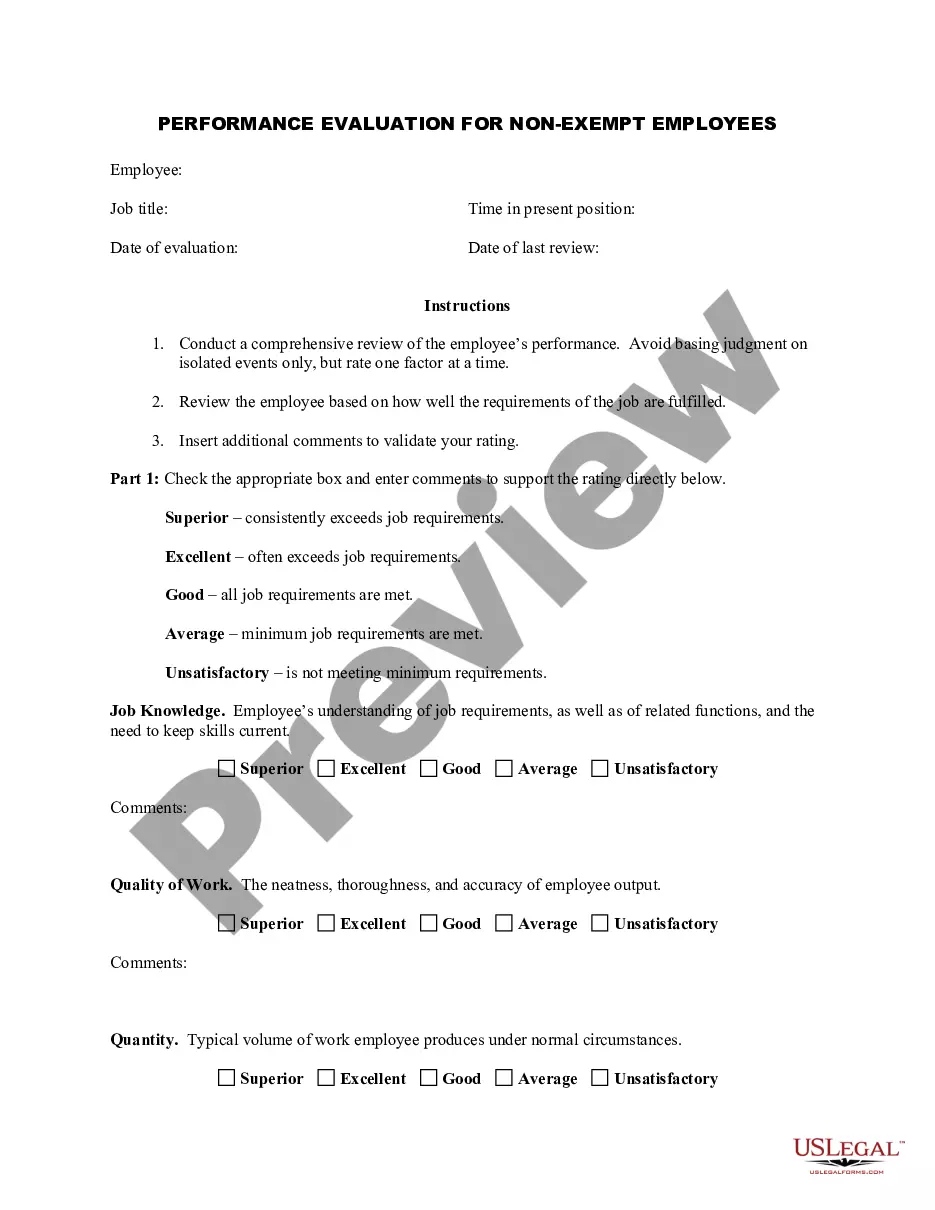

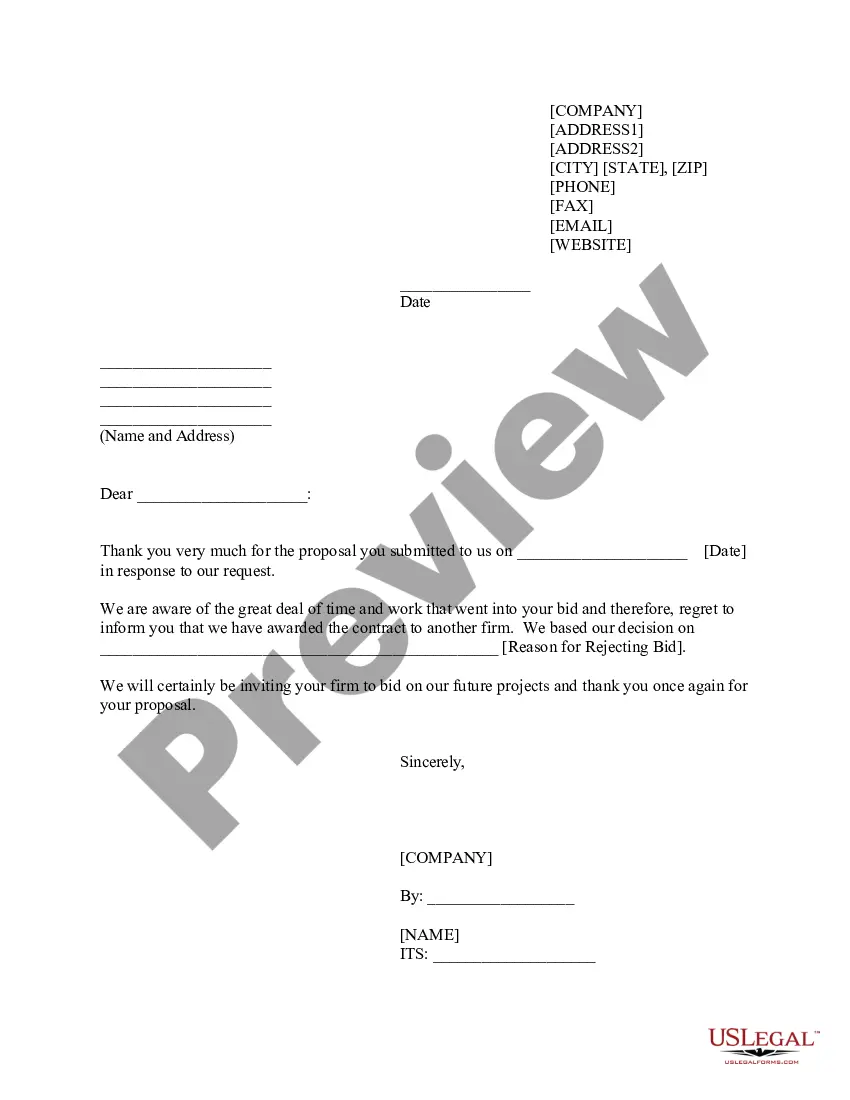

You can review the form using the Preview button and read the form description to confirm it is suitable for you.

- All templates are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Nebraska Software Installation Agreement between Seller and Independent Contractor.

- Use your account to search among the legal forms you have previously purchased.

- Navigate to the My documents tab in your account and obtain another copy of the document you need.

- If you are a new customer of US Legal Forms, follow these simple instructions.

- First, ensure you have selected the correct form for your city/region.

Form popularity

FAQ

Setting up an LLC can provide advantages for an independent contractor, including limited liability protection and potential tax benefits. This structure separates personal and business assets, which can be a wise choice for financial security. If you plan to operate under a Nebraska Software Installation Agreement between Seller and Independent Contractor, an LLC can add a layer of professionalism and credibility to your business.

In Nebraska, whether you need a contractor's license often depends on the type of work you perform. For certain trades, such as electrical or plumbing, a specific license may be required. However, for general independent contracting work, a Nebraska Software Installation Agreement between Seller and Independent Contractor is typically sufficient. Always check local regulations to ensure compliance.

Setting up an independent contractor agreement involves several key steps. Begin with detailing the responsibilities and expectations of each party involved. Specify payment terms, including rates and billing schedules, and consider using a template for a Nebraska Software Installation Agreement between Seller and Independent Contractor. This ensures that all crucial elements are covered and legally binding.

To create an effective independent contractor agreement, start by clearly defining the roles of both parties. Include terms related to payment, project scope, and deadlines. Incorporate important clauses, such as confidentiality and termination rights. Using a Nebraska Software Installation Agreement between Seller and Independent Contractor template can help streamline this process.

Form 13 in Nebraska is a tax form related to the income generated within the state. For those entering into a Nebraska Software Installation Agreement between Seller and Independent Contractor, correctly filling out this form is essential for reporting purposes. Utilizing platforms like uslegalforms can streamline the process of understanding and completing Form 13 to ensure adherence to state regulations.

The controlling interest transfer tax in Nebraska applies when ownership of a business is transferred. This tax is important for Sellers and Independent Contractors who may alter their business structure. Understanding this tax is crucial when creating a Nebraska Software Installation Agreement to ensure compliance and predict financial responsibilities.

In Nebraska, the taxation of Software as a Service (SaaS) depends on the specifics of the service provided. Generally, SaaS can be subject to sales tax if it includes the transfer of data. When entering into a Nebraska Software Installation Agreement with Independent Contractors, understanding these tax implications is vital, and uslegalforms can help clarify your obligations.

Reg 1 020 in Nebraska details the rules regarding the classification of workers for tax purposes. This regulation is crucial for Sellers discussing a Nebraska Software Installation Agreement with Independent Contractors, as it helps clarify their employment status. Proper classification can prevent potential tax complications, which uslegalforms can assist you with.

Being exempt from Nebraska withholding means that you are not required to withhold state taxes from certain payments. For individuals entering into a Nebraska Software Installation Agreement between Seller and Independent Contractor, this status can affect the financial arrangements. It's advisable to consult a tax professional to understand eligibility for exemptions.

Reg 1 013 in Nebraska outlines the guidelines for withholding tax on income derived from independent contractors. This regulation specifies that a Seller entering into a Nebraska Software Installation Agreement with an Independent Contractor must understand their tax obligations. Proper documentation can ensure compliance, and using a service like uslegalforms can simplify this process.