Nebraska Contract for Part-Time Assistance from Independent Contractor

Description

How to fill out Contract For Part-Time Assistance From Independent Contractor?

Selecting the appropriate legal document template can be quite challenging.

Certainly, numerous templates are available online, but how do you find the legal document you require.

Utilize the US Legal Forms website. This service provides a vast array of templates, including the Nebraska Contract for Part-Time Support from Independent Contractor, suitable for both business and personal use.

If the document does not align with your needs, utilize the Search field to find the correct document.

- All documents are verified by experts and meet state and federal regulations.

- If you are already subscribed, Log In to your account and click the Download button to access the Nebraska Contract for Part-Time Support from Independent Contractor.

- Use your account to browse the legal documents you have previously acquired.

- Proceed to the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- First, ensure you have selected the correct document for your city/area. You can view the document using the Preview button and read the document description to confirm it fits your needs.

Form popularity

FAQ

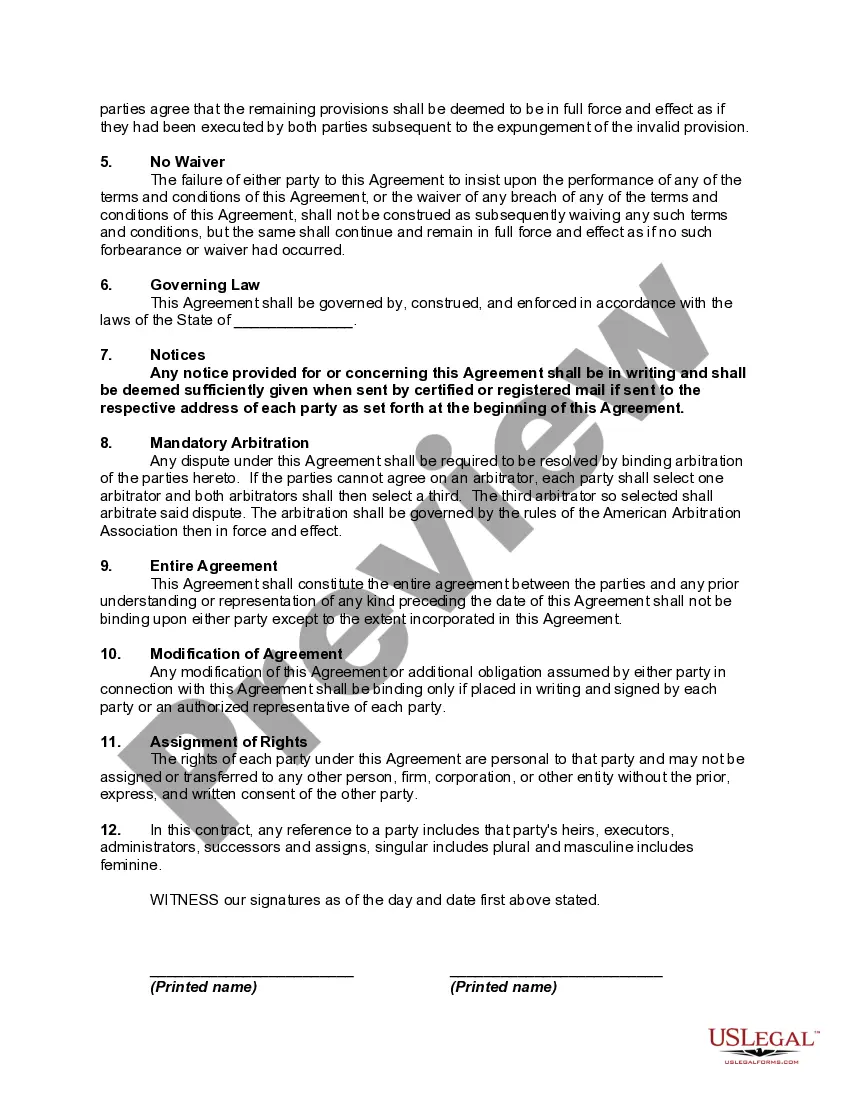

A good contract should include essential components like the scope of work, payment terms, and timelines. In a Nebraska Contract for Part-Time Assistance from Independent Contractor, it is also crucial to specify confidentiality clauses and any applicable termination conditions. Clear definitions within the contract help prevent misunderstandings and provide a solid foundation for the working relationship. Consider using tools like USLegalForms to streamline the process of creating a comprehensive contract.

Filling out an independent contractor agreement involves a few key steps. First, clearly state the scope of work and any deadlines in the Nebraska Contract for Part-Time Assistance from Independent Contractor. Next, outline payment terms, including rates and invoicing details, to solve any financial queries upfront. Finally, both parties should review the terms together to ensure mutual understanding and sign the contract to formalize the agreement.

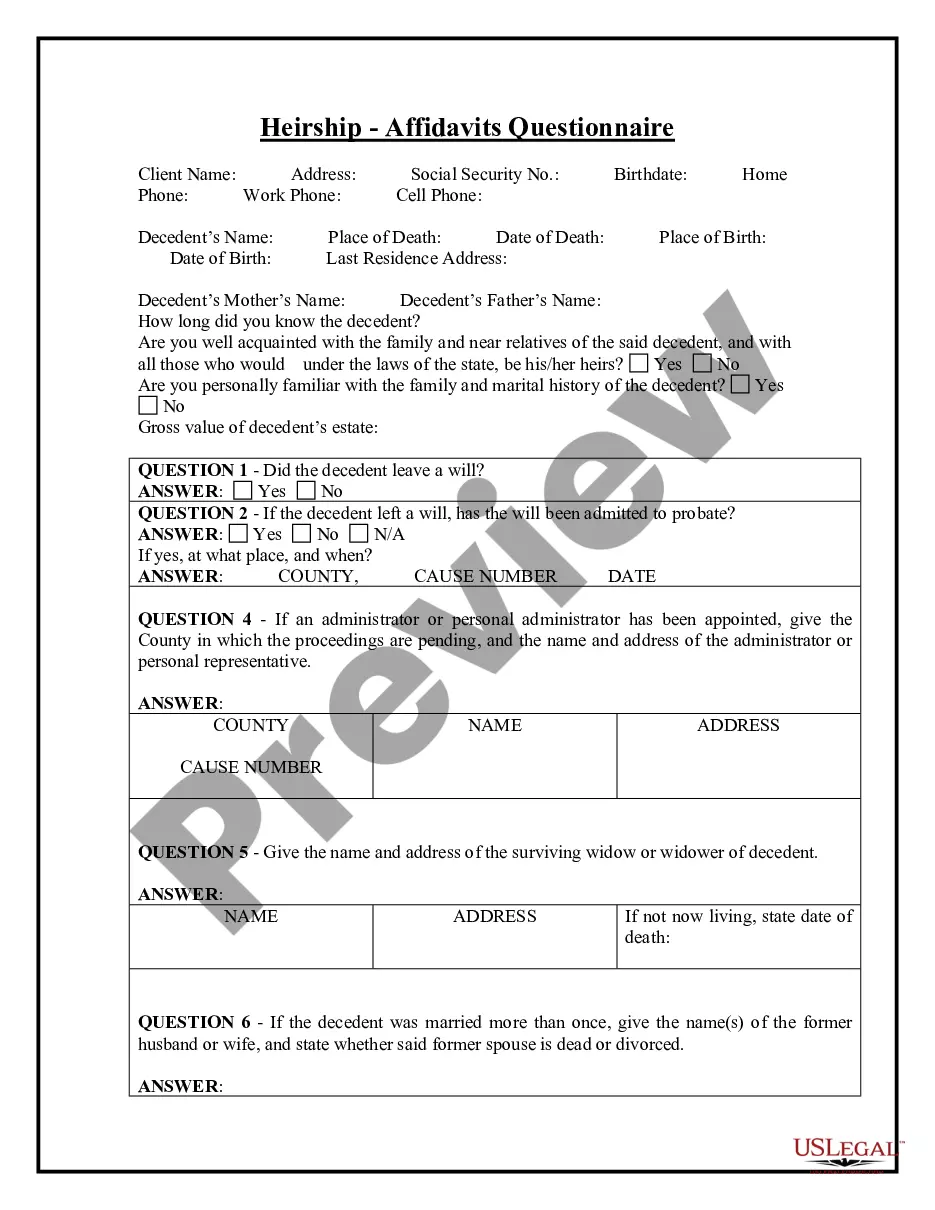

While you can technically work as a 1099 employee without a contract, it is not advisable. A Nebraska Contract for Part-Time Assistance from Independent Contractor ensures both you and your client are on the same page regarding expectations and responsibilities. Without a contract, you expose yourself to potential miscommunication and lack clarity on your compensation. It's essential to formalize the relationship to avoid these issues.

If you do not have a contract, you may face various risks. Without a Nebraska Contract for Part-Time Assistance from Independent Contractor, misunderstandings about work scope or payment can arise, leading to conflicts. Additionally, you lack legal protection, which may complicate any disputes regarding the working relationship. It’s always wiser to have a written agreement to safeguard your interests.

Yes, independent contractors should always have a contract. A Nebraska Contract for Part-Time Assistance from Independent Contractor defines the terms of the working relationship, including payment and responsibilities. This contract helps protect both parties by setting clear expectations and reducing potential disputes. When you establish a formal agreement, it fosters trust and accountability.

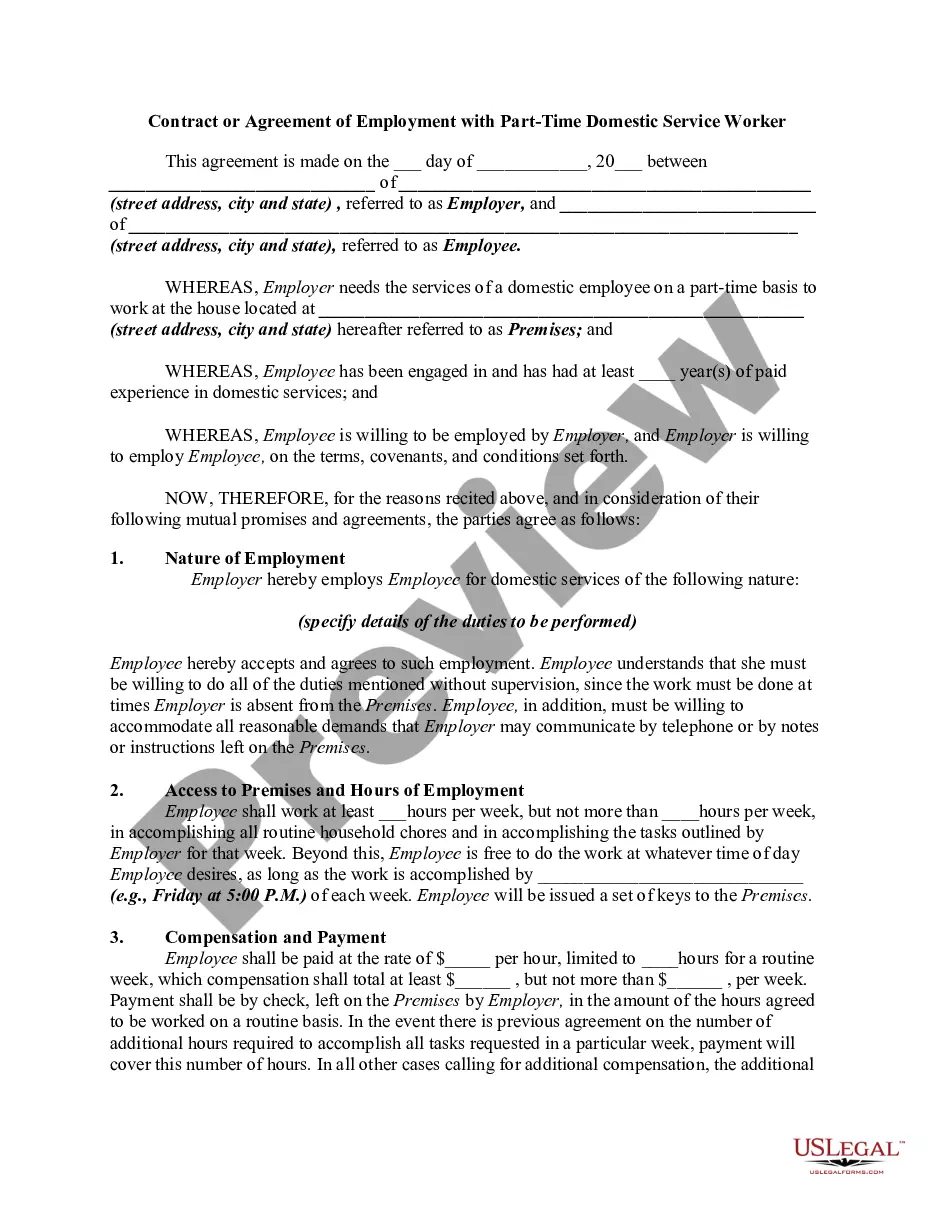

Yes, you can definitely be a part-time independent contractor under a Nebraska Contract for Part-Time Assistance from Independent Contractor. This arrangement allows individuals to offer services without committing to a full-time schedule, providing flexibility for both the contractor and the client. Many businesses benefit from hiring part-time independent contractors, as it enables them to acquire specialized skills without a long-term commitment. This structure not only aligns with your lifestyle but also meets the evolving needs of today's work environment.

Yes, there are specific contracts designed for part-time work arrangements. The Nebraska Contract for Part-Time Assistance from Independent Contractor outlines the terms and conditions for part-time service engagements. Using a formal contract helps both parties understand their roles and responsibilities, promoting better collaboration.

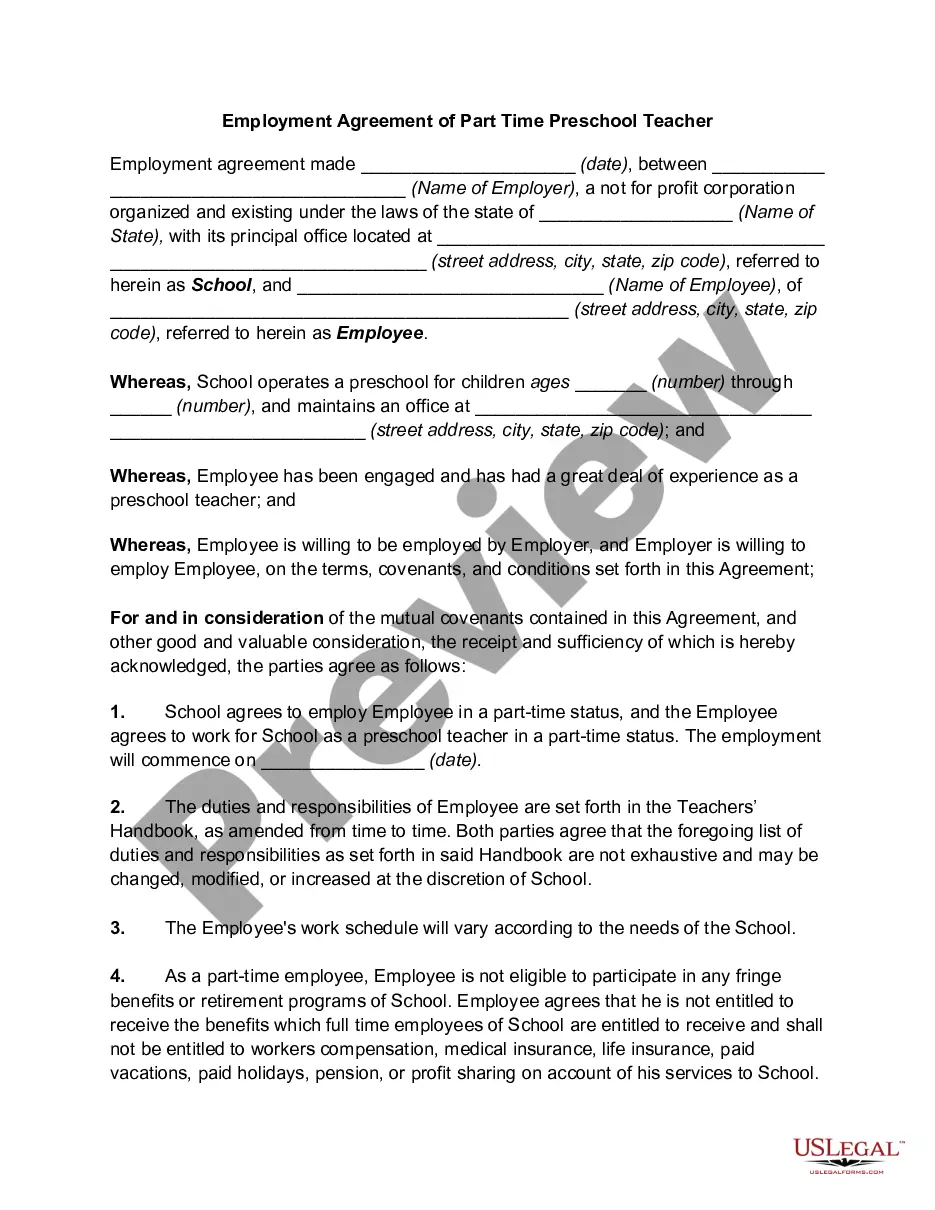

Yes, a part-time employee can potentially receive a 1099 form if they are classified as an independent contractor. This classification depends on the nature of the work arrangement. If you are guiding someone through a Nebraska Contract for Part-Time Assistance from Independent Contractor, clarify their status upfront to avoid any misclassification.

Yes, as an independent contractor, you have the freedom to set your own hours. This flexibility allows you to manage your time according to your personal and professional needs. When you enter a Nebraska Contract for Part-Time Assistance from Independent Contractor, make sure to communicate your preferred working hours and any expectations with your clients.

Typically, you do not offer traditional benefits to independent contractors. They operate as separate entities, so they usually receive compensation for their services instead of employee benefits. However, you can discuss terms in a Nebraska Contract for Part-Time Assistance from Independent Contractor, ensuring they understand what is included in your agreement.