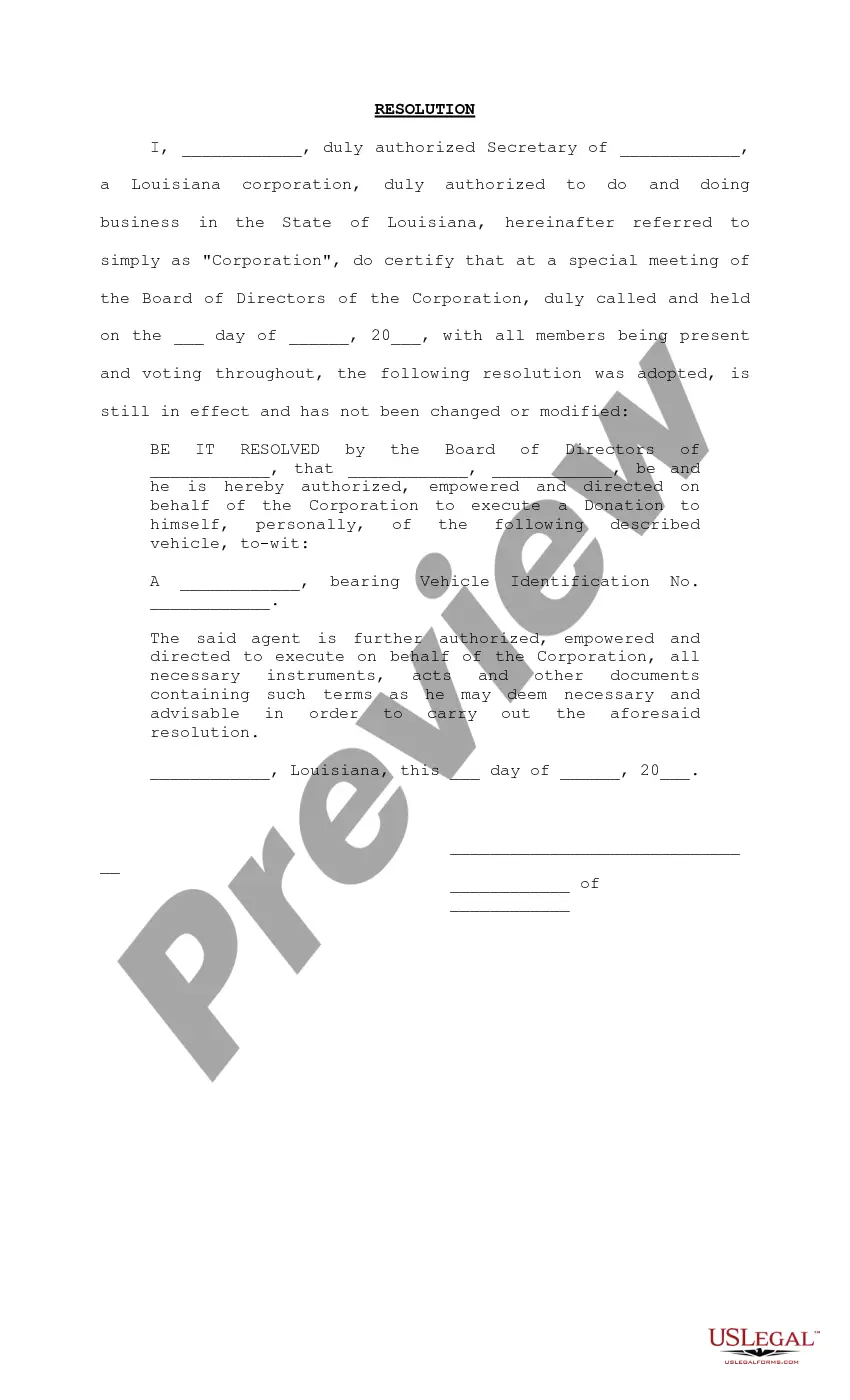

Montana Unsatisfied Problems Identified in Seller's Files

Description

How to fill out Unsatisfied Problems Identified In Seller's Files?

Choosing the right authorized document format can be a battle. Of course, there are a variety of themes accessible on the Internet, but how can you find the authorized form you require? Take advantage of the US Legal Forms site. The support offers a large number of themes, like the Montana Unsatisfied Problems Identified in Seller's Files, that can be used for company and private requirements. All of the varieties are inspected by pros and meet federal and state needs.

If you are currently registered, log in to the profile and then click the Download key to have the Montana Unsatisfied Problems Identified in Seller's Files. Make use of your profile to look from the authorized varieties you may have acquired previously. Proceed to the My Forms tab of your own profile and get an additional backup of your document you require.

If you are a new customer of US Legal Forms, listed here are simple instructions that you should comply with:

- First, be sure you have selected the appropriate form for your metropolis/area. It is possible to look over the form making use of the Preview key and study the form information to ensure this is basically the best for you.

- In the event the form is not going to meet your requirements, use the Seach industry to discover the right form.

- Once you are positive that the form is suitable, select the Purchase now key to have the form.

- Opt for the prices program you would like and enter the needed details. Create your profile and pay for the order using your PayPal profile or charge card.

- Pick the submit structure and down load the authorized document format to the device.

- Full, edit and produce and indication the obtained Montana Unsatisfied Problems Identified in Seller's Files.

US Legal Forms will be the largest local library of authorized varieties in which you can discover different document themes. Take advantage of the service to down load professionally-produced papers that comply with status needs.

Form popularity

FAQ

An adverse material fact is defined as ?a fact that should be recognized by a broker or salesperson as being of enough significance as to affect a person's decision to enter into a contract to buy or sell real property? and includes a fact that ?materially affects the value, affects structural integrity, or presents a ...

In Montana, the seller usually pays for the homeowner's title policy. Whereas, the buyer has to purchase the lender's title policy in Montana to protect the mortgage broker's interests in the transaction. While applying for a refinance, the homebuyer or the lender is at liberty to choose the title company.

How Much Are Closing Costs in Montana? Closing costs in Montana run around $2,496 for an average home priced at $272,986, ing to a 2021 report by ClosingCorp, which provides research on the U.S. real estate industry. That amount makes up 0.91 percent of the home's price tag.

When it comes to a Title Commitment vs Title Insurance Policy, the one major difference is the commitment is issued BEFORE closing and all items in the Schedules must be satisfied. After the closing occurs, THEN the Title Insurance Policy is provided to the buyer(s).

A title commitment is a legal document administered by a title company that outlines the requirements necessary to guarantee the buyer's ownership. Essentially, it is an assurance by the title company that they will offer insurance coverage for any problems that arise with the title to the property.

Understanding the Different Types of Deeds in Montana A deed transfers real property from a grantor to the grantee. There are three main types of deeds: the general warranty deed, the special warranty deed, and the quitclaim deed.