This form is an amendment or modification to a partnership agreement

Nebraska Amendment or Modification to Partnership Agreement

Description

How to fill out Amendment Or Modification To Partnership Agreement?

Are you presently in a situation where you frequently require documents for business or personal reasons.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms provides a large selection of form templates, such as the Nebraska Amendment or Modification to Partnership Agreement, designed to meet federal and state standards.

After finding the correct form, click on Get now.

Select the payment plan you prefer, provide the necessary details to process your payment, and complete the transaction using PayPal or Visa/Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Once logged in, you can download the Nebraska Amendment or Modification to Partnership Agreement template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it pertains to the correct state/region.

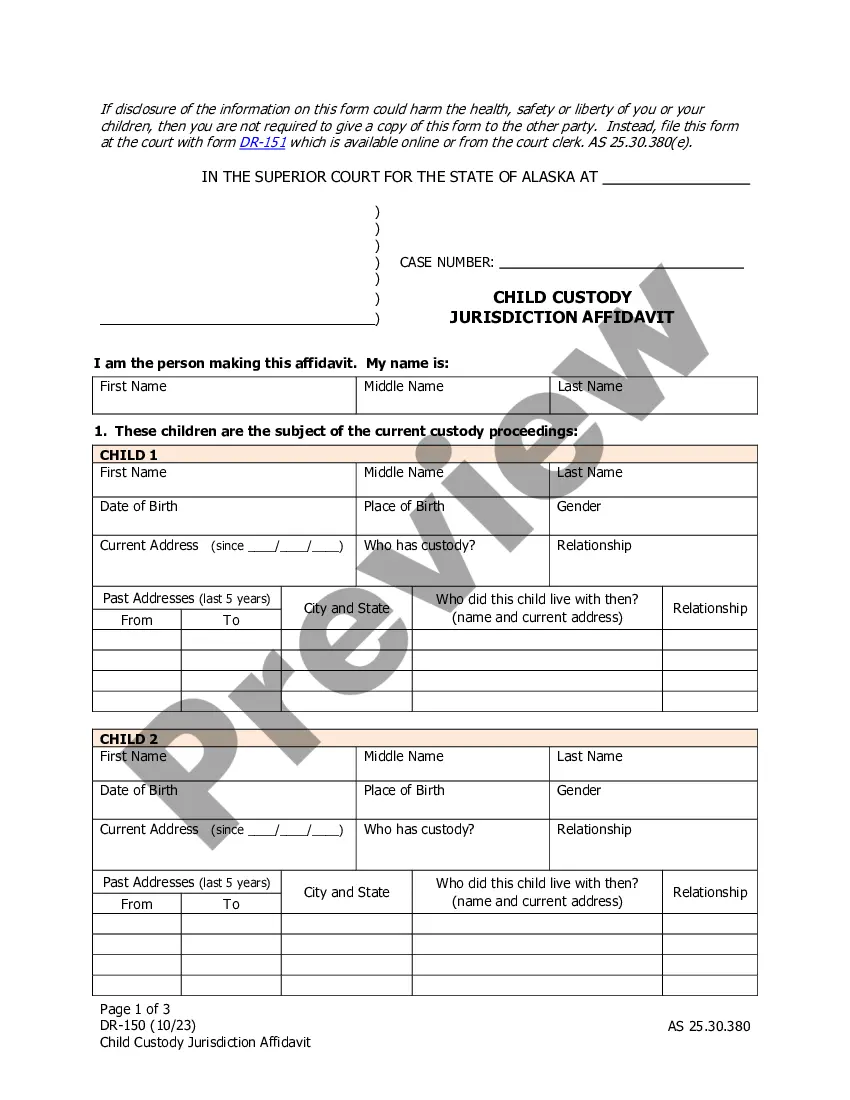

- Utilize the Preview button to review the document.

- Read the description to ensure that you have selected the right form.

- If the form isn’t what you’re looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

Filing requirements for a partnership in Nebraska include submitting the Partnership Registration form and any amendments, along with any applicable fees. If there are changes that affect the agreement, such as new partners joining or existing partners leaving, you may need a Nebraska Amendment or Modification to Partnership Agreement. It's crucial to maintain accurate records and stay within the regulations to avoid potential issues. Services like uslegalforms can assist you in navigating these requirements efficiently.

To legally form a partnership, you should file a Partnership Registration form with the state of Nebraska. This document outlines the partnership's name, address, and the names of all partners involved. If changes arise in the Partnership Agreement, consider preparing a Nebraska Amendment or Modification to Partnership Agreement to keep your records updated. Using platforms like uslegalforms can streamline this filing process and ensure compliance.

To establish ownership in a partnership, all partners must agree on the terms outlined in the Partnership Agreement. Each partner's contribution, responsibilities, and profit-sharing ratios should be clearly defined. A Nebraska Amendment or Modification to Partnership Agreement may be necessary if changes occur in ownership structure or roles. Therefore, ensure you have genuine discussions with all partners to align on expectations.

To change your LLC address in Nebraska, you must file an address change form with the Nebraska Secretary of State. This process helps keep your business records up-to-date and ensures you receive important communications. If your partnership needs adjustments after relocating, a Nebraska Amendment or Modification to Partnership Agreement can facilitate any necessary updates to your agreement.

To form a partnership in Nebraska, you need to choose a suitable name for your business and ensure it complies with state regulations. Next, you should draft a partnership agreement, detailing the terms of your collaboration. If you later require changes to the initial agreement, you can utilize a Nebraska Amendment or Modification to Partnership Agreement to update your terms smoothly.

A partnership agreement can indeed be amended with the consent of all partners. This process should be reflected in a Nebraska Amendment or Modification to Partnership Agreement to ensure that all changes are legally binding. Utilizing uslegalforms can guide you through drafting the necessary documentation for a smooth and efficient amendment process.

A partnership agreement may be voided under certain conditions, such as illegal activities or failure to meet statutory requirements. Additionally, if the agreement lacks essential elements like mutual consent, it could be considered void. Consulting a legal expert or using services such as uslegalforms can help you understand the validity of your agreement better.

Yes, an agreement can be modified with the approval of all parties involved. In the context of a Nebraska Amendment or Modification to Partnership Agreement, this process should be documented carefully. Just like creating the original agreement, using a reliable legal service like uslegalforms simplifies the modification process.

To change the terms of a partnership agreement, gather the agreement and discuss the desired changes with your partners. Ensure that everyone agrees, and document the changes formally in a Nebraska Amendment or Modification to Partnership Agreement. This will protect your interests and clarify the new terms in writing, making it easier for all parties involved.

You can amend a partnership agreement at any time, as long as all partners consent to the changes. A Nebraska Amendment or Modification to Partnership Agreement establishes new terms that may benefit the partnership. By documenting these changes properly using a formal process or a platform like uslegalforms, you can avoid future disputes.