Nebraska Reorganization of Partnership by Modification of Partnership Agreement

Description

How to fill out Reorganization Of Partnership By Modification Of Partnership Agreement?

If you need to acquire, procure, or print legal document forms, utilize US Legal Forms, the largest collection of legal templates available online.

Employ the website's straightforward and convenient search to locate the documents you require. Various templates for business and personal purposes are organized by categories and regions, or keywords.

Use US Legal Forms to access the Nebraska Reorganization of Partnership by Modification of Partnership Agreement with just a few clicks.

Each legal document template you purchase belongs to you permanently. You will have access to every form you downloaded in your account. Click the My documents section and select a form to print or download again.

Stay proactive and download and print the Nebraska Reorganization of Partnership by Modification of Partnership Agreement with US Legal Forms. There are numerous professional and state-specific templates available for your business or personal needs.

- If you are currently a US Legal Forms member, Log In to your account and click the Download button to retrieve the Nebraska Reorganization of Partnership by Modification of Partnership Agreement.

- You can also retrieve templates you previously downloaded from the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps outlined below.

- Step 1. Ensure you have chosen the form for the correct city/state.

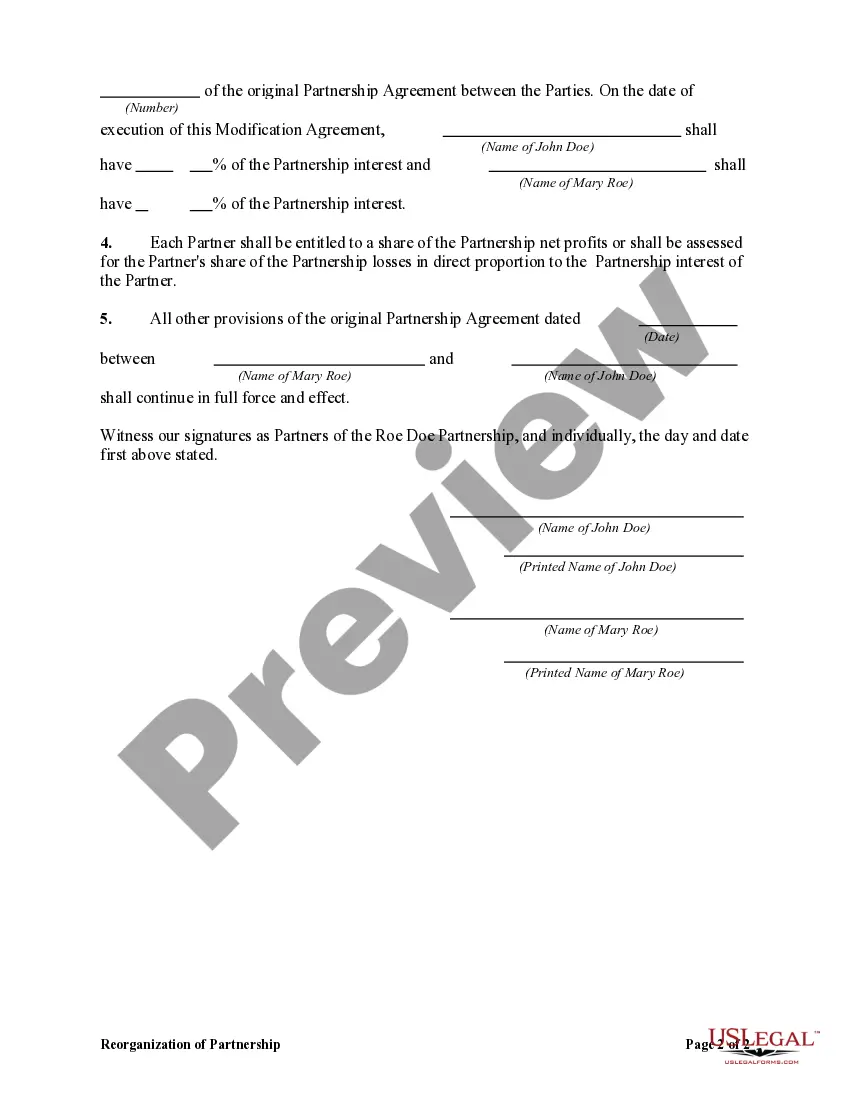

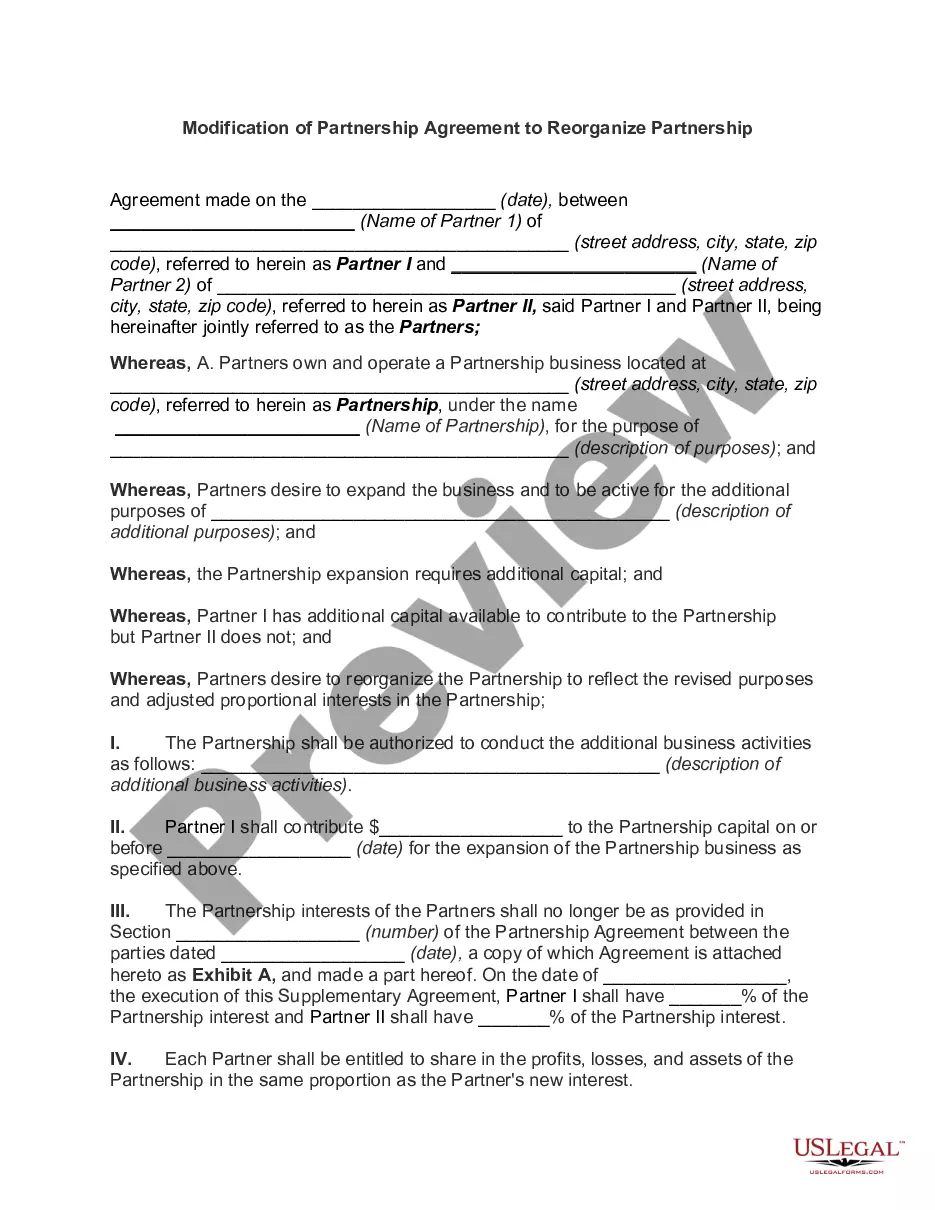

- Step 2. Utilize the Preview option to review the form's content. Be sure to read the details carefully.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to locate alternative versions of the legal document template.

- Step 4. Once you have found the form you need, click the Purchase now button. Select the payment plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account for the payment.

- Step 6. Choose the format of your legal document and download it to your device.

- Step 7. Fill out, modify and print or sign the Nebraska Reorganization of Partnership by Modification of Partnership Agreement.

Form popularity

FAQ

Filling out Schedule L, which details the partnership's balance sheet, is mandatory for certain partnerships, particularly those with gross receipts exceeding a specified threshold. If your partnership's financial situation requires it, be prepared to provide a clear snapshot of your financial health. This requirement may come into play during a Nebraska Reorganization of Partnership by Modification of Partnership Agreement, ensuring transparency during restructuring.

Most partnerships are required to file Form 1065, barring some exceptions, such as partnerships that meet specific criteria. By filing this form, partnerships communicate their financial status to the IRS. For partnerships involved in a Nebraska Reorganization of Partnership by Modification of Partnership Agreement, filing Form 1065 is essential to executing this organizational change smoothly and legally.

Yes, partnerships must file Form 1065 along with Schedule K-1 for each partner. The K-1 form reports each partner's share of the partnership's income, deductions, and credits. This process is especially relevant during a Nebraska Reorganization of Partnership by Modification of Partnership Agreement, as accurate reporting ensures each partner gets their correct income allocation.

Partnerships need to fill out Form 1065, which operates as an informational return. This form allows partnerships to provide the IRS with a comprehensive overview of their financial activities. For those handling a Nebraska Reorganization of Partnership by Modification of Partnership Agreement, using Form 1065 is a critical component of maintaining compliance while also sharing significant financial data.

Form 1065 is not used for S Corporations or C Corporations. Instead, this form is specifically designed for partnerships to report their income, deductions, gains, and losses. If you're involved in a Nebraska Reorganization of Partnership by Modification of Partnership Agreement, understanding Form 1065 is crucial for your partnership's tax obligations.

Yes, a partnership agreement can be amended as long as all partners agree to the changes. This process typically requires a written document outlining the modifications and any necessary signatures from the partners. Amending your partnership agreement can be a vital component in navigating a Nebraska Reorganization of Partnership by Modification of Partnership Agreement.

Creating a simple partnership agreement involves detailing the names of the partners, the business purpose, and how profits and losses will be shared. It's also crucial to include terms related to decision-making authority and how disputes will be resolved. By focusing on clarity in this agreement, you set a foundation for a future Nebraska Reorganization of Partnership by Modification of Partnership Agreement.

Filing a partnership return in Nebraska requires you to complete Form 1065, also known as the U.S. Return of Partnership Income. This form reports the partnership's income, deductions, and other tax-related information. Understanding how to effectively complete this return can simplify the process in case of any impending Nebraska Reorganization of Partnership by Modification of Partnership Agreement.

Dissolving a partnership in Nebraska involves several steps, including settling debts, distributing remaining assets, and filing necessary documents with the state. It's essential to review your partnership agreement, as it may outline specific procedures for dissolution. To ensure compliance during this process, consider a Nebraska Reorganization of Partnership by Modification of Partnership Agreement.

To form a partnership in Nebraska, you need at least two partners who agree to share profits and losses. While an official written agreement is not mandatory, it is highly advisable to outline each partner's roles and obligations. A well-crafted partnership agreement can facilitate a smoother Nebraska Reorganization of Partnership by Modification of Partnership Agreement down the line.