Nebraska Revocable Trust for Lottery Winnings

Description

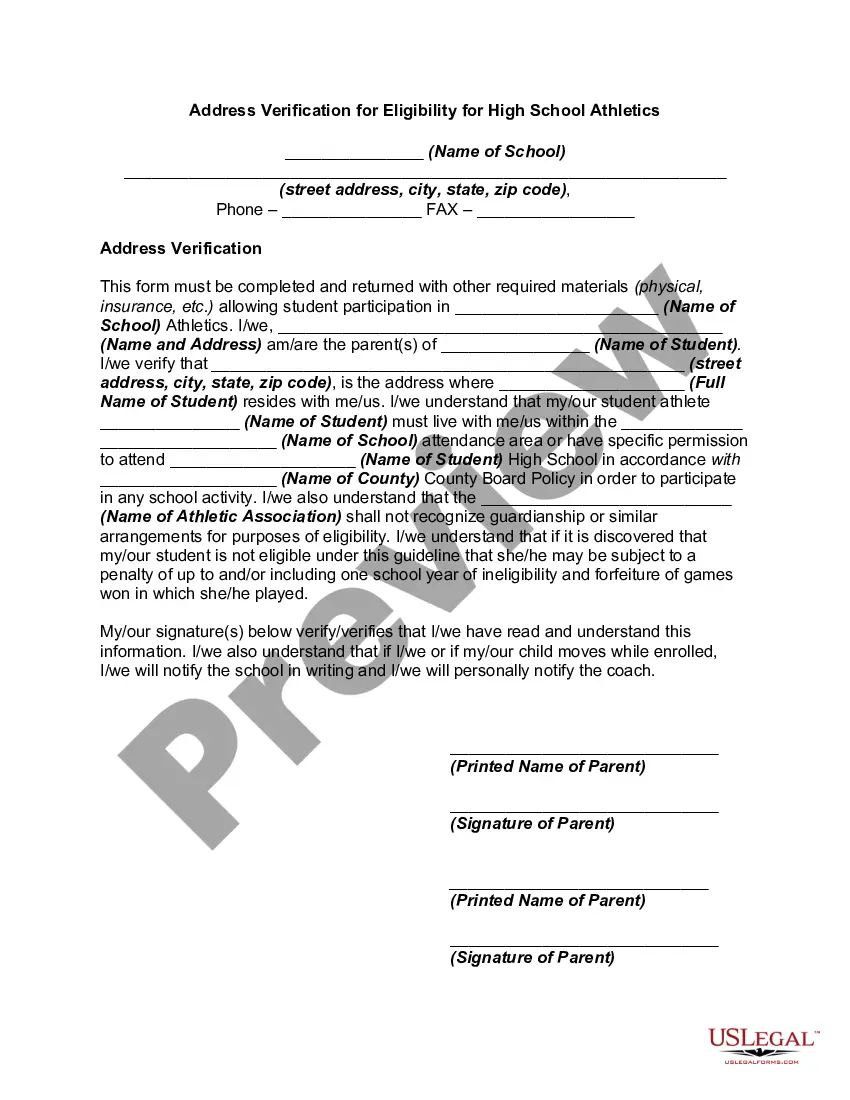

How to fill out Revocable Trust For Lottery Winnings?

US Legal Forms - one of the largest collections of official templates in the United States - provides a range of legitimate document templates that you can download or print.

By utilizing the website, you will access thousands of templates for business and personal use, organized by categories, states, or keywords. You can find the latest versions of templates like the Nebraska Revocable Trust for Lottery Winnings in moments.

If you already have a membership, Log In to download the Nebraska Revocable Trust for Lottery Winnings from the US Legal Forms archive. The Obtain button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Make edits. Fill out, modify, print, and sign the downloaded Nebraska Revocable Trust for Lottery Winnings.

Every template you add to your account does not have an expiration date and is yours permanently. Thus, to download or print another copy, simply go to the My documents section and click on the form you need. Access the Nebraska Revocable Trust for Lottery Winnings with US Legal Forms, the most extensive collection of official document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal requirements.

- If you are using US Legal Forms for the first time, here are some simple steps to guide you.

- Make sure to have chosen the correct form for your city/state. Click the Preview button to review the details of the form. Check the form summary to ensure you have selected the right one.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, select your preferred pricing plan and provide your details to register for the account.

- Process the transaction. Use a credit or debit card or PayPal account to complete the purchase.

- Select the format and download the form to your device.

Form popularity

FAQ

Handling large lottery winnings requires careful planning and strategy. One effective approach is to create a Nebraska Revocable Trust for Lottery Winnings, which helps manage and protect your newfound wealth. By placing your funds in a trust, you can control disbursements and safeguard your assets against potential legal claims. Seeking advice from financial professionals will also ensure a structured plan that aligns with your long-term goals.

The best place to deposit your lottery winnings is a reputable bank or credit union that offers strong security and services tailored for high-value accounts. Consider establishing a Nebraska Revocable Trust for Lottery Winnings to provide both protection and efficient management of your funds. This trust can help you shield your winnings from unnecessary taxes and ensure your wealth is preserved for future generations. Additionally, working with a financial advisor can help you navigate the best options for your unique situation.

In the U.S., all lottery winnings are typically subject to federal income tax, regardless of the amount. However, gifts you give to others can be exempt under certain conditions. By structuring your lottery winnings with a Nebraska Revocable Trust, you may find ways to minimize your tax liabilities while ensuring your wealth is protected. Consulting a tax professional can help identify specific exemptions related to your situation.

When you win the lottery, you can give up to the annual gift tax exclusion limit to any individual without incurring gift tax. For 2023, this limit is set at $17,000 per person. Utilizing a Nebraska Revocable Trust for Lottery Winnings can facilitate these gifts while providing additional benefits, such as flexibility and control over asset distribution. Always keep informed about the current gift tax limits and consider strategic gifting through trusts.

To share lottery winnings with family without paying taxes, consider setting up a Nebraska Revocable Trust for Lottery Winnings. This type of trust allows you to distribute your winnings to family members in a tax-efficient manner. Additionally, adhering to gift tax exclusions can help you avoid taxes while still sharing your good fortune. It's wise to consult with a legal expert to ensure compliance with tax laws while maximizing tax benefits.

The loophole for gift tax lies in the annual exclusion limit. In the United States, you can give a certain amount each year to as many people as you want without incurring gift tax. By using a Nebraska Revocable Trust for Lottery Winnings, you can effectively manage your gifting strategy and maximize your tax benefits. This estate planning tool allows you to make gifts within the allowable limit while protecting your assets.

To avoid gift tax on lottery winnings, consider establishing a Nebraska Revocable Trust for Lottery Winnings. This trust structure enables you to manage and distribute your winnings while minimizing tax liabilities. By planning effectively, you can ensure you remain compliant with tax regulations. Consulting with a financial advisor can help you explore strategies that are right for you.

One way to avoid gift tax on lottery winnings is to use a Nebraska Revocable Trust for Lottery Winnings. This allows you to manage how benefits are distributed to others while preventing accidental gift tax implications. Careful planning, including setting up the trust correctly, can help ensure compliance with tax laws. It's advisable to work with a tax professional for tailored strategies.

The best investment for lottery winnings often depends on your financial goals, but real estate and diversified investment portfolios are common choices. Additionally, a Nebraska Revocable Trust for Lottery Winnings can help in managing these investments effectively. It's wise to consult a financial advisor to explore options that fit your circumstances. Making informed decisions is key to safeguarding your newfound wealth.

The best type of trust for lottery winnings is usually a Nebraska Revocable Trust for Lottery Winnings. This trust allows you to keep your winnings safe and offers privacy concerning your financial affairs. It can also provide a structured way to distribute your funds to your loved ones. Always consult a professional to tailor the trust to your individual circumstances.