Nebraska Revocable Trust for Asset Protection

Description

How to fill out Revocable Trust For Asset Protection?

Selecting the appropriate legal document template can be challenging. Surely, there are numerous templates available online, but how can you acquire the legal form you need? Utilize the US Legal Forms website.

The service provides thousands of templates, including the Nebraska Revocable Trust for Asset Protection, suitable for both business and personal requirements. All the forms are reviewed by professionals and comply with federal and state regulations.

If you are already a registered user, sign in to your account and click the Acquire button to obtain the Nebraska Revocable Trust for Asset Protection. Use your account to search through the legal forms you have bought previously. Navigate to the My documents section of your account and download another copy of the document you need.

Choose the file format and download the legal document template to your device. Complete, edit, and print and sign the obtained Nebraska Revocable Trust for Asset Protection. US Legal Forms is indeed the largest collection of legal forms, where you can find numerous document templates. Take advantage of the service to obtain professionally crafted documents that adhere to state requirements.

- First, ensure you have selected the correct form for your location/region.

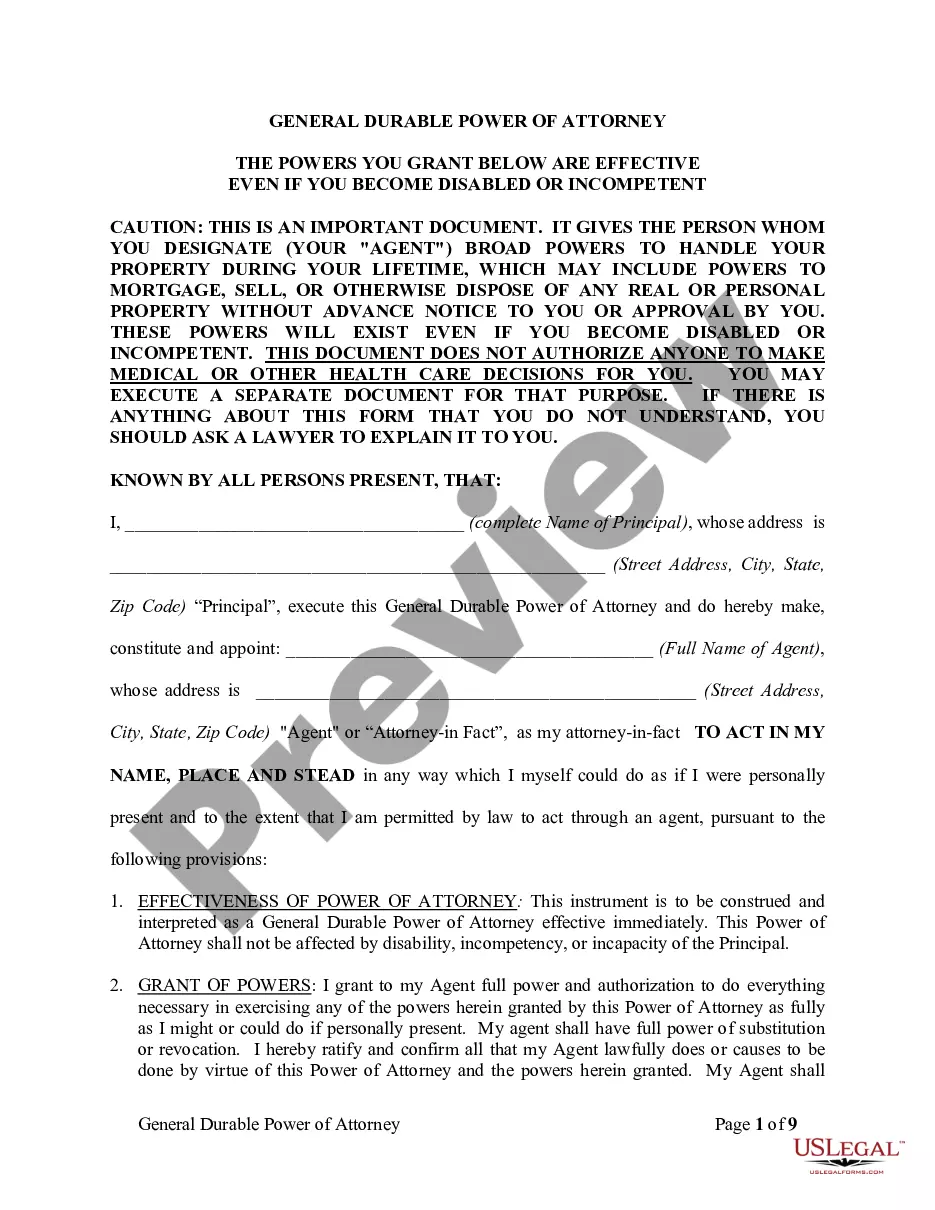

- You can review the form using the Preview button and read the form description to ensure it is suitable for you.

- If the form does not meet your needs, utilize the Search area to find the right form.

- Once you are confident the form is correct, click the Buy now button to purchase the form.

- Select the pricing plan you prefer and enter the required information.

- Create your account and place an order using your PayPal account or credit card.

Form popularity

FAQ

A Nebraska Revocable Trust for Asset Protection provides some level of asset protection, but it's essential to understand its limitations. While it can shield assets from probate and maintain privacy, it does not protect against creditors or lawsuits. If you seek greater protection, consider additional strategies or tools, such as irrevocable trusts or insurance policies, in conjunction with your revocable trust.

When seeking asset protection, a Nebraska Revocable Trust is often considered among the best options, especially for its flexibility and control. It allows you to retain control over the assets while also enabling you to make changes as your situation evolves. However, consult with a legal expert to determine if you also need more robust protections, such as an irrevocable trust, depending on your specific needs.

A Nebraska Revocable Trust for Asset Protection offers various forms of protection for your assets. It allows you to manage your assets during your lifetime while providing a clear plan for distribution after your death. Moreover, it can help prevent probate, which can complicate the distribution process and tie up your assets. This type of trust keeps your financial matters private and ensures your assets are distributed according to your wishes.

While a Nebraska Revocable Trust for Asset Protection is beneficial for many assets, some should be kept out. For example, retirement accounts like 401(k)s and IRAs typically do not belong in a revocable trust due to tax implications. Similarly, any assets with a designated beneficiary, such as life insurance policies, should remain outside the trust to ensure they transfer directly to the chosen beneficiaries.

To start a Nebraska Revocable Trust for Asset Protection, you first need to identify the assets you wish to include in the trust. Then, you can work with an estate planning attorney or utilize online platforms like US Legal Forms to draft the trust document. Once completed, sign the document and fund the trust by transferring ownership of your assets. This process will help ensure your assets are managed according to your wishes.

Setting up a protective trust involves several steps, starting with determining what assets you want to protect and who will be the beneficiaries. Next, you need to create a legal document that outlines the trust's terms and appoint a trustee. A Nebraska Revocable Trust for Asset Protection can serve your needs well, and consulting a professional can streamline the process, ensuring all legal criteria are satisfied.

To establish an asset protection trust, certain requirements must be met, including having clear ownership of the assets and creating a legally binding document. The trust must also comply with Nebraska laws, particularly if you choose a Nebraska Revocable Trust for Asset Protection. It’s advisable to consult a legal professional to navigate these requirements efficiently and effectively.

One major mistake parents often make when setting up a trust fund is failing to communicate their intentions clearly to their beneficiaries. This miscommunication can lead to disputes and misunderstandings down the road. Utilizing a Nebraska Revocable Trust for Asset Protection can clarify your wishes and set guidelines, helping to avoid conflicts while ensuring your assets are distributed as you intended.

The best trust structure for asset protection often hinges on individual circumstances, but a Nebraska Revocable Trust for Asset Protection is highly effective for many. This type of trust allows you to retain control over your assets while safeguarding them from creditors and legal claims. Working with an expert can help you determine the most suitable structure tailored to your financial situation.

To write an asset protection trust, you first need to define your goals for asset protection. It is essential to specify the terms of the trust within the legal document, detailing how the assets will be managed and distributed. Consulting with a knowledgeable attorney who specializes in Nebraska Revocable Trust for Asset Protection can help ensure that all legal requirements are met and that your intentions are clearly expressed.