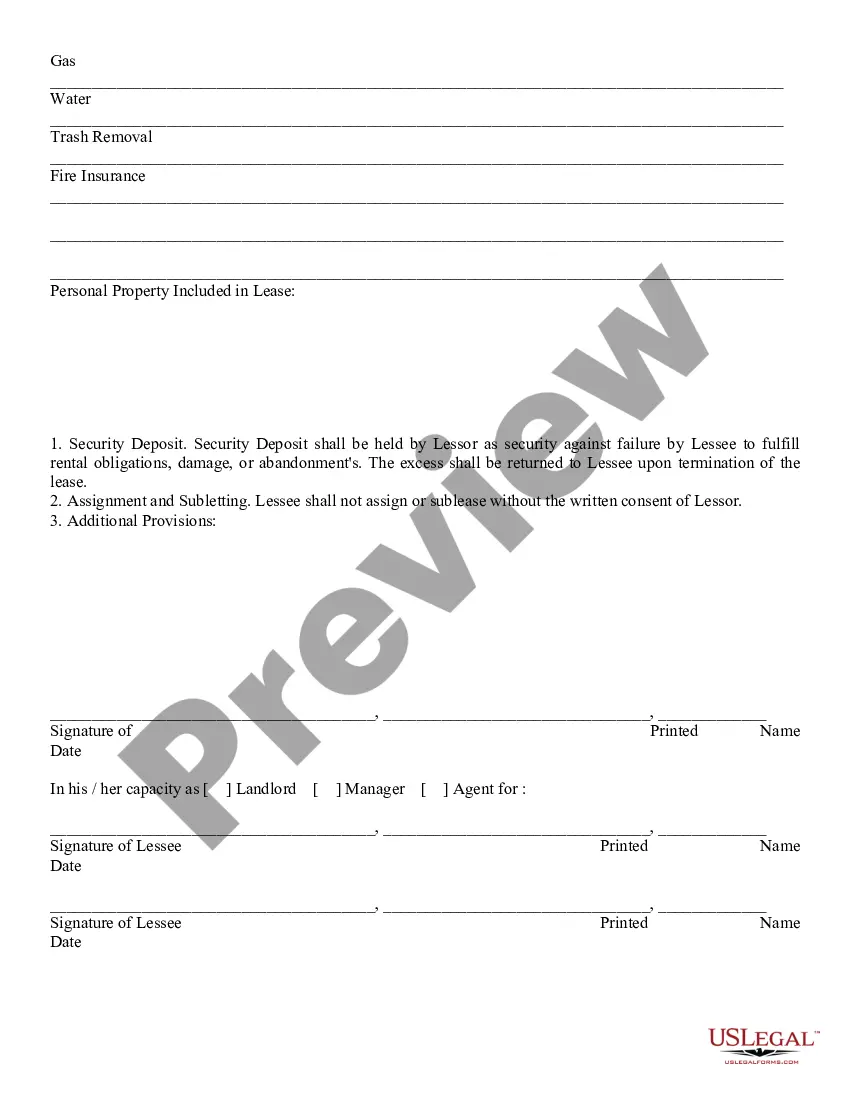

Nebraska Nonresidential Simple Lease

Description

How to fill out Nonresidential Simple Lease?

Are you currently in a situation where you need documents for either business or personal reasons almost every day.

There are numerous legal document templates accessible online, but finding reliable forms can be challenging.

US Legal Forms offers a vast selection of document templates, including the Nebraska Nonresidential Simple Lease, which are designed to comply with federal and state regulations.

Select the pricing plan you prefer, complete the required information to create your account, and make a purchase using your PayPal or credit card.

Choose a convenient document format and download your copy.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Nebraska Nonresidential Simple Lease template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and verify that it is for your specific city/region.

- Utilize the Review button to evaluate the document.

- Check the description to ensure you have selected the correct form.

- If the form is not what you are seeking, use the Lookup field to find the document that fits your needs and requirements.

- If you identify the correct form, simply click Get now.

Form popularity

FAQ

A lease agreement may be invalidated for several reasons, including lack of mutual consent, failure to meet legal requirements, or if the lease involves illegal activities. Additionally, if critical terms are missing, courts may not enforce the agreement. Ensuring your lease is a professionally crafted Nebraska Nonresidential Simple Lease can help you avoid these pitfalls and safeguard your rights.

Yes, handwritten leases are legal as long as they adhere to state laws and include necessary elements such as terms and signatures. However, relying on a professionally drafted Nebraska Nonresidential Simple Lease can offer added security and transparency. Clear documents help both parties understand their obligations, potentially reducing future conflicts.

Handwritten contracts can be enforceable in court, provided they meet certain legal criteria. However, they may raise questions about proof and intent. It's advisable to create a Nebraska Nonresidential Simple Lease for clarity, as written agreements eliminate ambiguity and provide a stronger foundation for legal issues.

Nonresidents wishing to establish a rental or business presence in Nebraska need to file specific documents, which may include proof of identity and registration with the state. It's essential to have a thorough understanding of local laws. Utilizing a Nebraska Nonresidential Simple Lease can simplify the rental process and clearly outline responsibilities, helping nonresidents comply with requirements effectively.

Verbal rental agreements can be tricky when it comes to legal enforcement. While they may be valid, they often lack the clarity and proof necessary for strong legal standing. In contrast, a written Nebraska Nonresidential Simple Lease provides clear terms for both parties, which can help prevent disputes and misunderstandings.

If you are not on the lease, your boyfriend might have the legal right to ask you to leave, depending on the lease agreement terms. However, this can depend on the nature of your relationship and any informal agreements you may have. It is best to communicate openly and resolve issues amicably. If disputes arise, referring to the Nebraska Nonresidential Simple Lease and seeking legal advice may be beneficial.

In Nebraska, evicting someone without a lease can be a complicated process. If there are no formal agreements in place, it may be necessary to demonstrate that the person is trespassing or violating some aspect of property rights. Legal advice or resources, such as US Legal Forms, can help navigate such situations effectively. Understanding your rights as a property owner is crucial.

The simplest type of lease is often considered a month-to-month lease or a Nebraska Nonresidential Simple Lease. This type of agreement allows for flexibility, as either party can terminate the lease with minimal notice. It is straightforward and easy to understand, making it suitable for many renters. For those seeking clarity, using a resource like US Legal Forms can provide templates and guidance.

Generally, your girlfriend can stay with you even if she is not on the lease. Nevertheless, this depends on the landlord's rules regarding guests and tenants. It's a smart idea to have a conversation with the landlord to clarify any potential issues. Understanding the Nebraska Nonresidential Simple Lease can help both of you find a suitable living arrangement.

Yes, you can live in a place without being on the lease. Many people do this informally, especially with friends or family. However, this arrangement may lack legal protections, making it important to communicate openly with the leaseholder. It might also be beneficial to consult a resource like US Legal Forms for more information on lease agreements.