A guaranty is an undertaking on the part of one person (the guarantor) that is collateral to an obligation of another person (the debtor or obligor), and which binds the guarantor to performance of the obligation in the event of default by the debtor or obligor. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law.

Nebraska Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability

Description

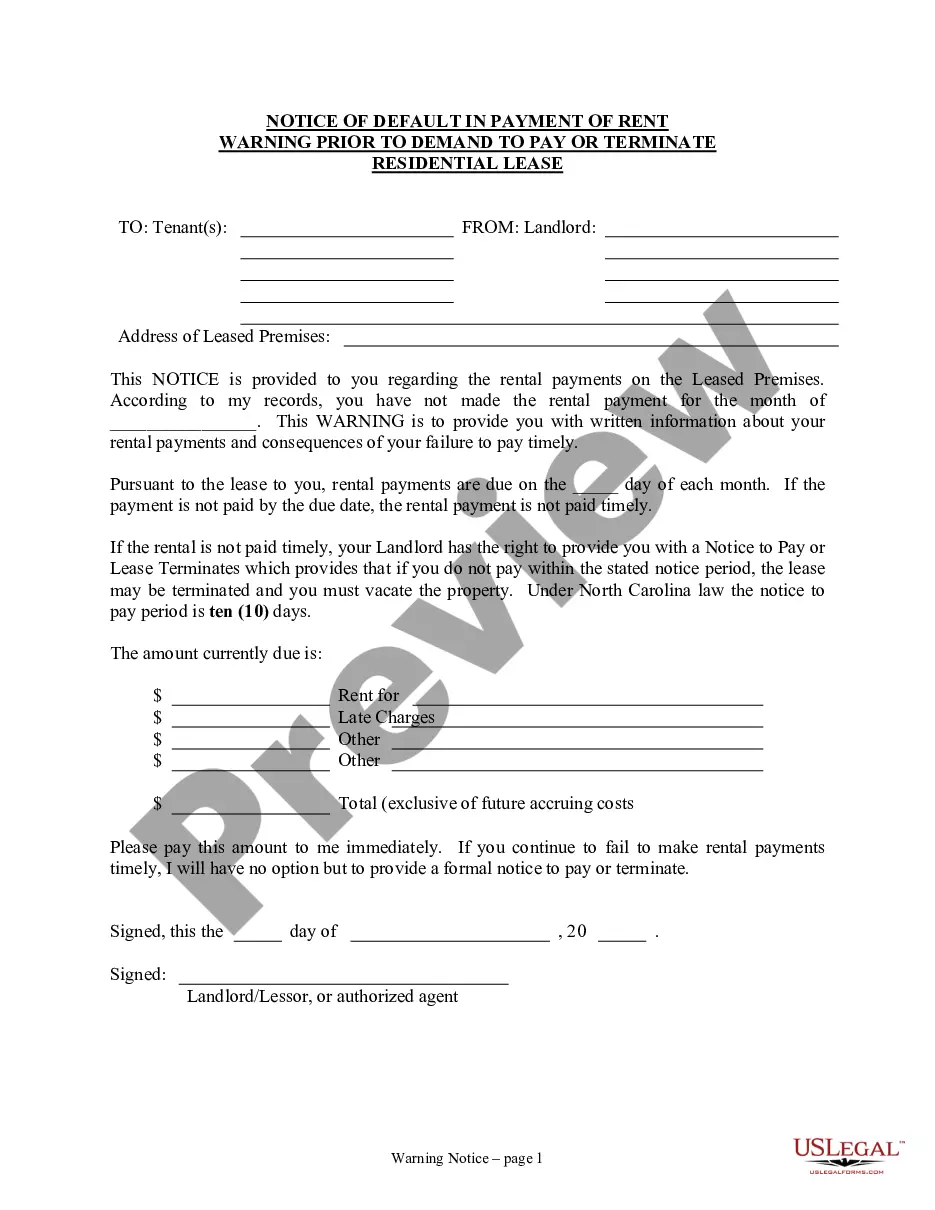

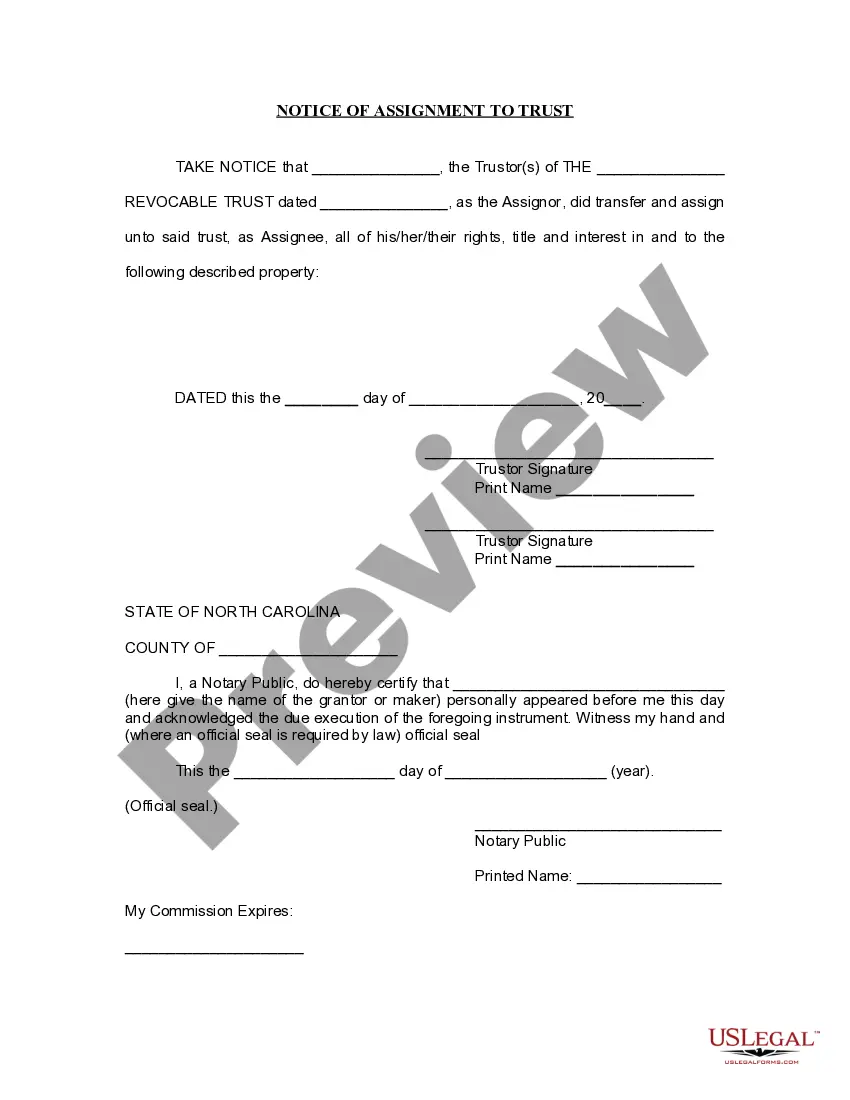

How to fill out Continuing Guaranty Of Business Indebtedness With Guarantor Having Limited Liability?

Are you currently in a situation that you need documentation for either business or personal reasons almost every time.

There are numerous legal document templates accessible online, but finding reliable ones is challenging.

US Legal Forms offers a vast array of form templates, such as the Nebraska Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, designed to comply with federal and state regulations.

Choose the pricing plan you want, provide the necessary information to set up your account, and pay for your order using PayPal or a credit card.

Select a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms site and hold an account, simply Log In.

- Then, you can download the Nebraska Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to the right city/state.

- Use the Review feature to verify the form.

- Check the summary to be sure you have selected the right document.

- If the form isn't what you are looking for, utilize the Search bar to locate the form that fits your needs and requirements.

- Once you find the correct form, click Acquire now.

Form popularity

FAQ

To fill out a personal guarantee, start by entering your full name and the details of the party responsible for the obligation. Clearly specify the financial amount guaranteed and reference the agreement associated with the Nebraska Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability. Double-check all entries for accuracy and ensure your signature is present, as this verifies your acceptance of the terms. If needed, consider using a template or service to ensure completeness.

Filling out a letter of guarantee requires you to include essential information such as your name, the recipient's name, and the specifics of the obligation you are backing. Clearly state the amount, terms, and any conditions involved in the Nebraska Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability. Concluding with your signature, date, and possibly a notary seal can lend further authority to your commitment. For more assistance, utilizing a platform like uslegalforms can simplify this process.

The process of a personal guarantee begins with understanding the terms of the agreement you are guaranteeing. Next, you will need to write and sign a document that clearly states your agreement to be responsible for the debt if the primary borrower defaults. It is advisable to seek guidance on the Nebraska Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability to ensure you adhere to all legal requirements. Finally, provide a copy of the signed guarantee to all relevant parties.

A guarantee typically covers the full amount owed, while a limited guarantee may specify a capped responsibility. In legal terms, a Nebraska Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability allows for structured reparation measures. Choosing between these options depends on your comfort with financial risk and your relationship with the primary borrower.

Yes, being a guarantor can show up on your credit report. When you engage in a Nebraska Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, the obligation you undertake may be recorded. This can potentially impact your credit score, especially if the primary debtor defaults. Monitoring your credit regularly can help you stay informed about how your guarantor role affects your financial profile.

A guarantee is a commitment to fulfill a debt or obligation if the primary borrower defaults, while a guarantor is the individual or entity that provides that commitment. The relationship between the two is critical in the context of business financing. People looking to engage in Nebraska Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability should be well-informed about these concepts to effectively navigate their financial responsibilities.

Loopholes in a personal guarantee may arise from ambiguous language in the contract, lack of proper signing procedures, or failure to disclose certain risks. For example, if the guarantee was not adequately explained, a legal challenge could emerge. Understanding these nuances in the Nebraska Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability can help you identify potential weaknesses.

Defending against a personal guarantee involves reviewing the terms of the agreement for any inconsistencies or unfair clauses. If conditions were met under duress, faulty contract formation can provide grounds for defense. Legal experts familiar with the Nebraska Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability can assist in building a strong defense strategy.

Exiting a personal guarantee is possible, but it generally requires fulfilling certain conditions outlined in the contract, such as repayment of debt or a change in business structure. You might also negotiate a release with the creditor. Understanding your rights under a Nebraska Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability may offer strategies to dissolve your obligations.

To protect oneself as a guarantor, consider negotiating terms that limit your liability or ask for a personal guarantee release when it's no longer needed. Additionally, reviewing the Nebraska Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability carefully ensures you understand what you are agreeing to. Imploring legal or financial advice can provide guidance tailored to your specific situation.