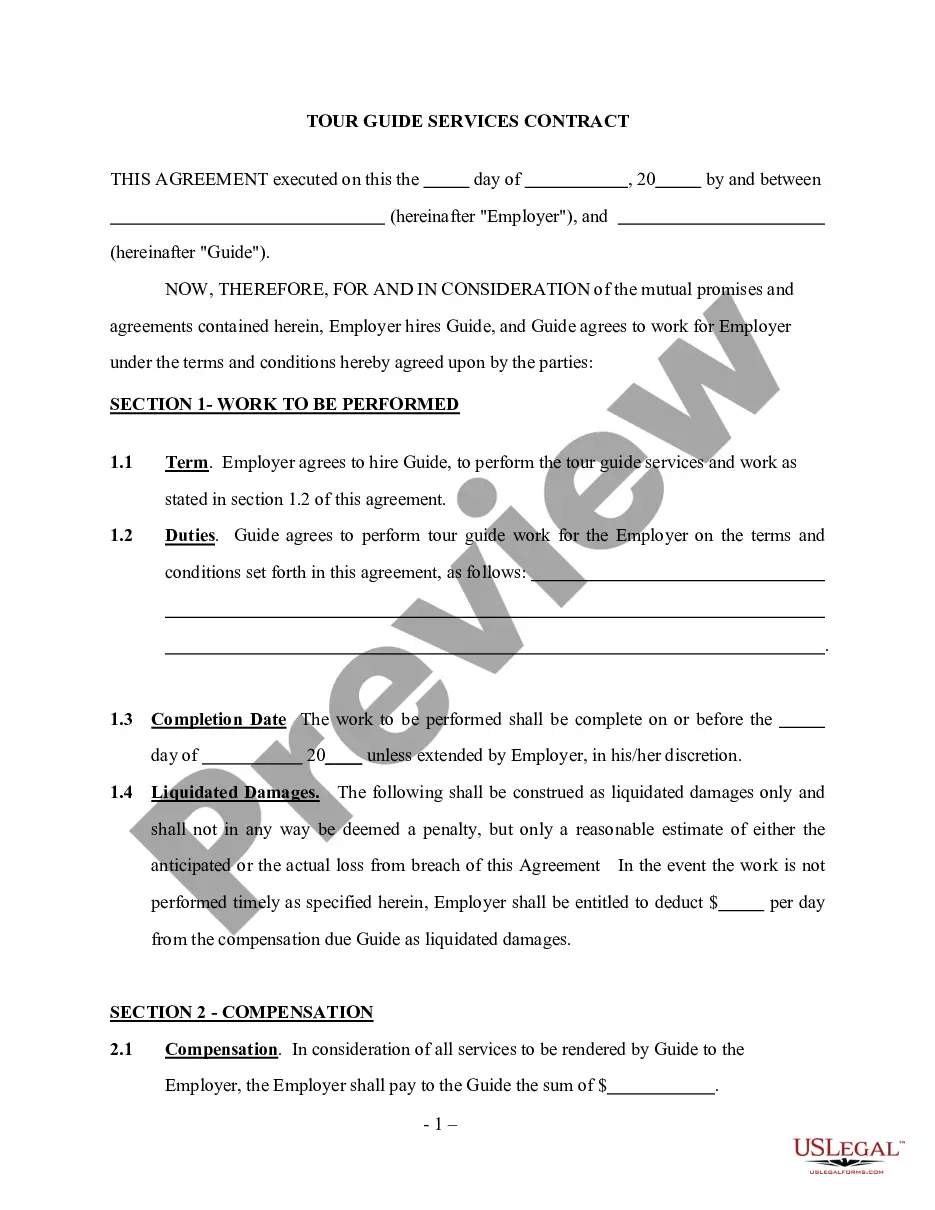

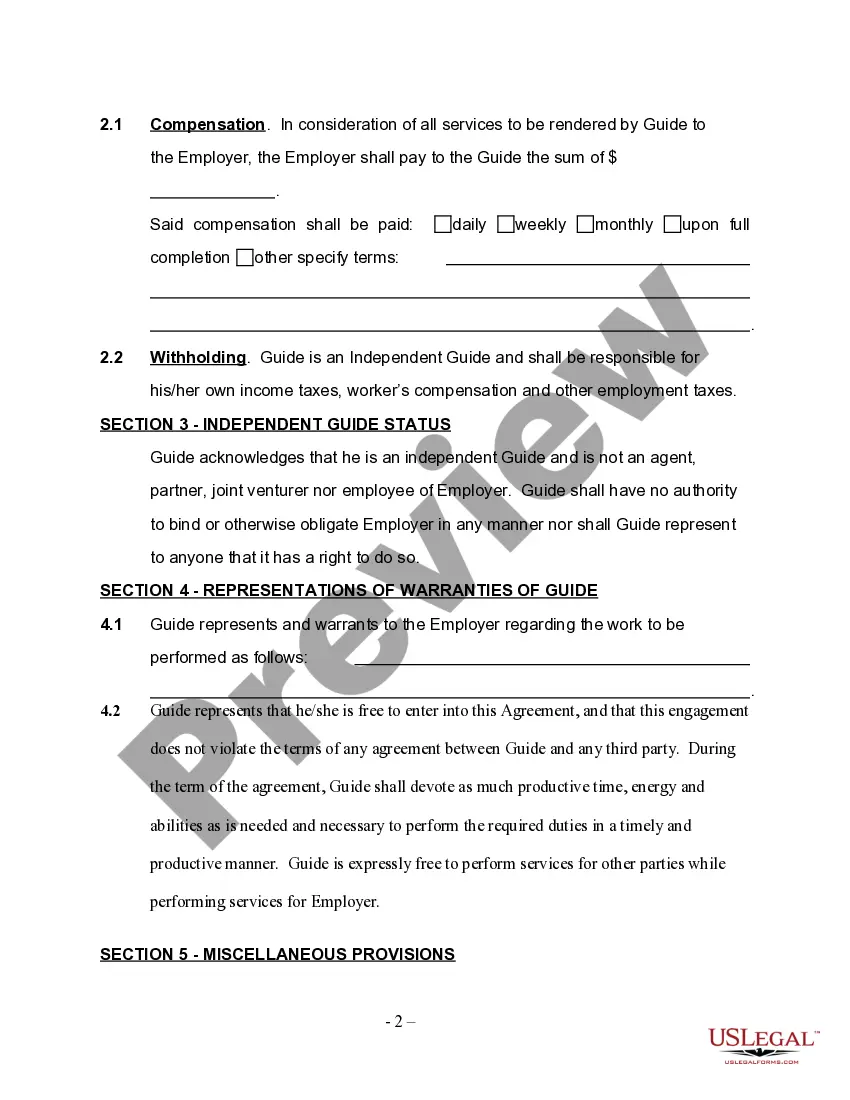

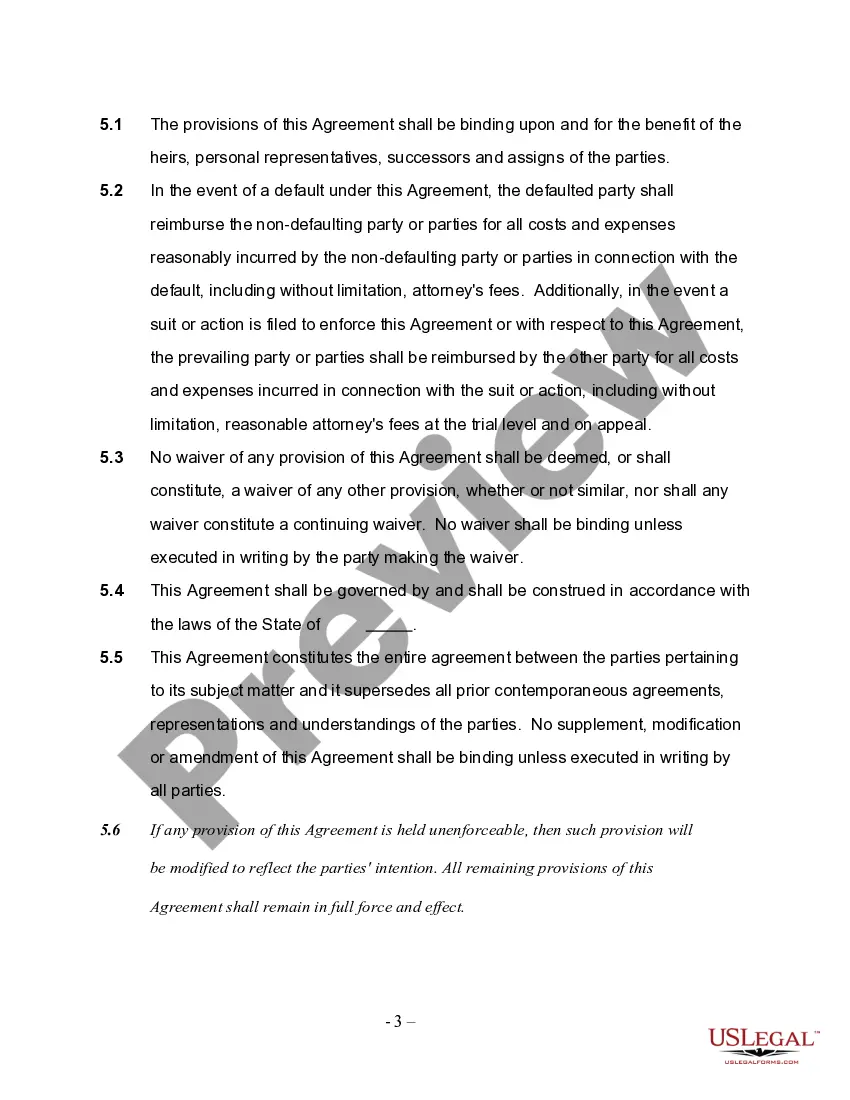

Arizona Self-Employed Tour Guide Services Contract

Description

How to fill out Self-Employed Tour Guide Services Contract?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal paper templates that you can download or print. By using the website, you can find numerous forms for business and personal purposes, organized by categories, states, or keywords. You can access the latest versions of forms like the Arizona Self-Employed Tour Guide Services Agreement in moments.

If you already have a monthly subscription, Log In and download the Arizona Self-Employed Tour Guide Services Agreement from the US Legal Forms library. The Download option will appear on every form you view. You can access all previously saved forms from the My documents tab in your account.

To use US Legal Forms for the first time, here are simple instructions to help you get started: Ensure you have selected the correct form for your city/region. Click the Preview option to review the form's content. Check the form summary to confirm you have chosen the correct form. If the form does not meet your requirements, use the Search section at the top of the screen to find the one that does. If you are satisfied with the form, confirm your choice by clicking the Get now option. Then, select the payment plan you prefer and provide your information to register for an account. Process the payment. Use your credit card or PayPal account to complete the transaction. Choose the format and download the form onto your device. Make modifications. Fill out, edit, and print and sign the downloaded Arizona Self-Employed Tour Guide Services Agreement.

Each document you have added to your account will not expire and is yours indefinitely. Therefore, if you want to download or print another version, simply navigate to the My documents section and click on the form you desire.

Gain access to the Arizona Self-Employed Tour Guide Services Agreement with US Legal Forms, known for having one of the most extensive collections of legal document templates. Take advantage of thousands of professional and state-specific templates that cater to your business or personal needs.

- Every document you add to your account does not have an expiration date and belongs to you permanently.

- So, if you wish to download or print another copy, just go to the My documents section and click on the form you need.

- Access the Arizona Self-Employed Tour Guide Services Agreement with US Legal Forms, one of the most comprehensive collections of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- This service makes it easy to obtain the legal forms you need quickly and efficiently.

- Simplifying the process of finding and managing legal documents for various uses.

Form popularity

FAQ

Independent contractors should complete a W-9 form for clients and may need to fill out invoices for payment. Additionally, if you plan to claim business expenses, consider keeping a record of all receipts. This documentation is vital for managing your income and complying with your Arizona self-employed tour guide services contract.

Legal requirements for independent contractors generally include obtaining necessary permits, providing a W-9 form to clients, and maintaining proper records of income and expenses. In Arizona, understanding your responsibilities will ensure smooth operations as a self-employed tour guide. Ensure your Arizona self-employed tour guide services contract reflects these requirements to protect your business.

As an independent contractor, you need to file your income tax using the 1040 form along with Schedule C. You should include all earnings from your tour guide services and any deductible expenses. Maintaining good records will facilitate this process, ensuring compliance with your Arizona self-employed tour guide services contract.

Yes, in many locations, you need a permit to operate as a tour guide. This requirement varies by city or region, so check local laws in Arizona. Securing the correct permits ensures compliance and builds trust with your clients, enhancing your Arizona self-employed tour guide services contract.

To become a self-employed tour guide, start by researching local regulations and obtaining necessary permits. You should build your knowledge about the areas you will guide, as well as your target audience. Once you are prepared, draft an Arizona self-employed tour guide services contract to formalize agreements with clients.

The W-9 form and the 1099 form serve different purposes. You provide a W-9 to clients, while they issue a 1099 form to report the payments they made to you. For your Arizona self-employed tour guide services contract, you will typically deal with the W-9, but the 1099 is crucial for tax reporting once the year ends.

As an independent contractor in Arizona, you typically need to fill out a W-9 form. This form provides your taxpayer information to clients who will report payments made to you. It's essential for any self-employed tour guide services contract as it helps ensure proper tax reporting. Additionally, you might need to provide an invoice for your services.

Private tour guides generally have the potential to earn more than freelance guides, with rates typically ranging from $50 to $100 per hour. This higher rate often reflects the personalized service and specialized knowledge that private tours provide. To protect your interests and outline service expectations, consider using an Arizona Self-Employed Tour Guide Services Contract for your private tour engagements.

To become a tour guide in Arizona, you typically need a high school diploma or equivalent. Additionally, obtaining a certification or training in tourism or hospitality can enhance your credentials. While specific licenses may not be mandatory, having an Arizona Self-Employed Tour Guide Services Contract can establish your professionalism and clarify your responsibilities.

In Arizona, an operating agreement is not legally required for independent contractors, but it is highly recommended. This document details the terms of your business operations and can protect your interests. For those engaged in Arizona Self-Employed Tour Guide Services, having an operating agreement can clarify roles and responsibilities, ensuring a smoother operation.