An escrow may be terminated according to the escrow agreement when the parties have performed the conditions of the escrow and the escrow agent has delivered the items to the parties entitled to them according to the escrow instructions. An escrow may be prematurely terminated by cancellation after default by one of the parties or by mutual consent. An escrow may also be terminated at the end of a specified period if the parties have not completed it within that time and have not extended the time for performance.

Nebraska Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow

Description

How to fill out Instructions To Title Company To Cancel Escrow And Disburse The Funds Held In Escrow?

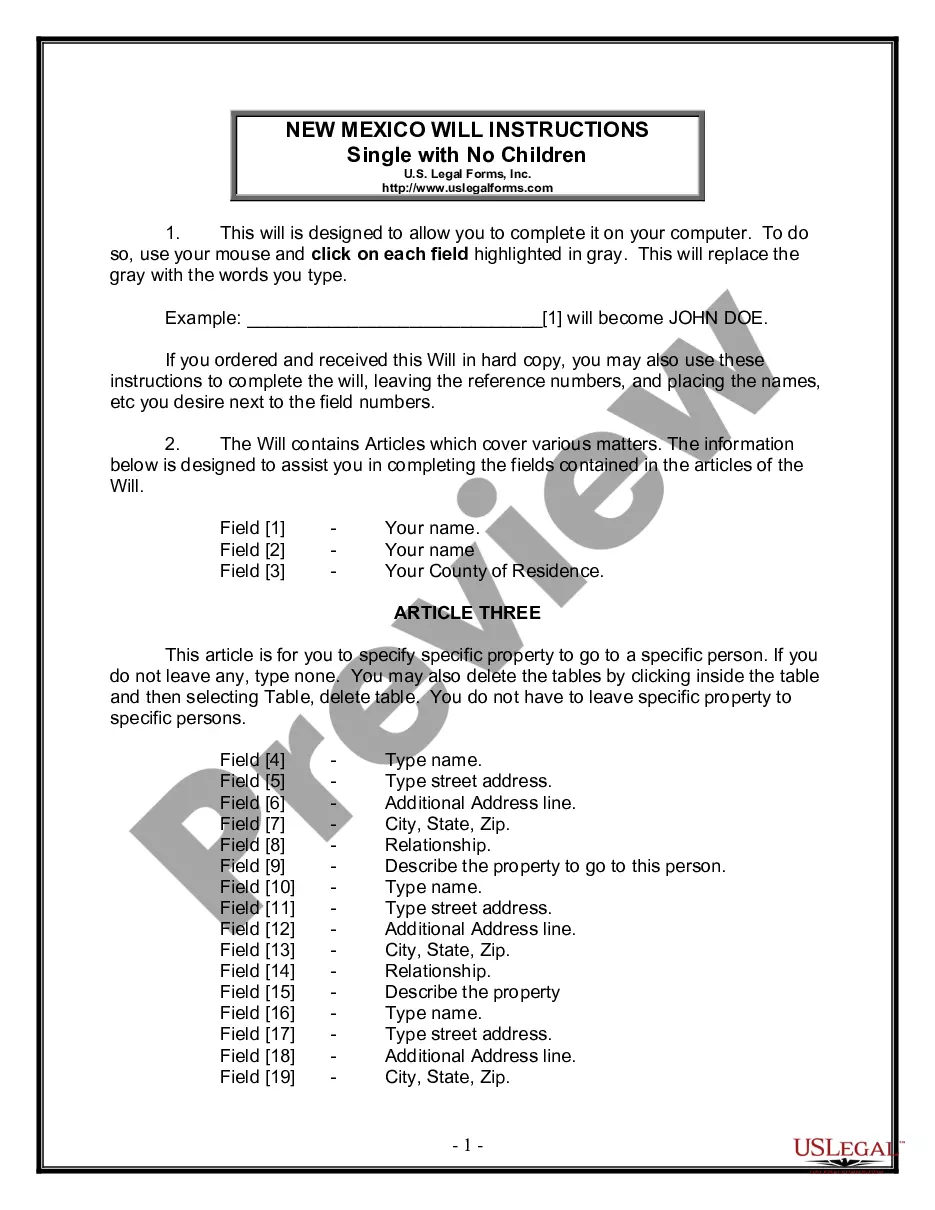

Are you in a situation where you require documents for both organizational or specific purposes almost every time? There are numerous legal document templates available online, but finding ones you can trust isn't straightforward. US Legal Forms provides thousands of form templates, such as the Nebraska Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow, that are designed to meet federal and state requirements.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. Then, you can download the Nebraska Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow template.

If you do not have an account and wish to start using US Legal Forms, follow these instructions: Get the form you need and ensure it is for the correct city/county. Utilize the Preview button to examine the form. Read the description to confirm that you have chosen the appropriate form. If the form isn’t what you need, use the Search field to find the form that suits your requirements. When you find the correct form, click Get now. Choose the payment plan you want, enter the required information to set up your account, and pay for the order using your PayPal or Visa or Mastercard. Select a convenient file format and download your copy. Locate all the document templates you have purchased in the My documents section. You can obtain an additional copy of Nebraska Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow at any time if needed. Just access the desired form to download or print the document template.

- Utilize US Legal Forms, the most extensive collection of legal forms, to save time and prevent errors.

- The service offers professionally crafted legal document templates for various purposes.

- Create an account on US Legal Forms and start simplifying your life.

Form popularity

FAQ

Escrow instructions are guidelines that define how and when a title company can release escrow funds. These instructions include important details like transaction specificities, timelines, and the roles of the involved parties. It is essential to understand and adhere to the Nebraska Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow to streamline the process and avoid misunderstandings.

The escrow agent, typically representing the title company, holds the responsibility for disbursing funds at closing. They act according to the specified escrow instructions and will release funds only when all conditions are satisfied. Following the Nebraska Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow helps ensure an efficient and accurate process.

Closing an escrow account involves fulfilling all contractual obligations outlined in the original escrow agreement. Once the conditions are met, you need to provide the title company with instructions to cancel the escrow and disburse the funds held in escrow. This process is vital for ensuring that all parties receive what they are owed, based on the valuation of the agreement.

A title company can hold funds in escrow for as long as necessary to fulfill the terms of the agreement. In Nebraska, it’s essential to adhere to the guidelines set by relevant authorities. Typically, the funds remain in escrow until all conditions are met or the Nebraska Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow are executed.

Escrow closing instructions are detailed documents provided to the title company that outline the conditions under which the escrow agent can release funds. These instructions typically specify the parties involved, terms of the agreement, and need-to-know dates. Following the Nebraska Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow is crucial for smooth transaction closure.

The escrow method refers to a financial arrangement where a third party holds funds until certain conditions are met in an agreement, such as real estate transactions. In Nebraska, you may need to follow specific instructions to the title company to cancel escrow and disburse the funds held in escrow. Utilizing this method adds security to the transaction, ensuring trust among all parties involved.

An escrow break occurs when a buyer or seller decides to terminate the escrow agreement before the transaction is finalized. This could happen for several reasons, including failure to meet conditions outlined in the agreement. Knowing the implications of a break is vital, especially concerning the Nebraska Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow. Use USLegalForms to clarify your rights and understand the steps needed when you encounter this situation.

An escrow agreement to hold documents is a legal arrangement where a neutral third party temporarily holds important documents during a transaction. This ensures that the documents are safely kept until all parties have fulfilled their obligations. In relation to Nebraska Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow, understanding this agreement is crucial for a smooth transaction. You can find reliable assistance through the USLegalForms platform to navigate this process.

The closure of an escrow account signifies the completion of the conditions outlined in an escrow agreement. This process involves the title company receiving the necessary Nebraska Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow. Upon closure, the title company will release any remaining funds to the appropriate parties, ensuring a smooth transaction. If you need assistance with this procedure, uslegalforms can provide you with the necessary documents and guidance.

A letter of instruction for escrow is a document that directs the title company on how to handle the funds and finalize transactions in escrow. This letter must be clear and concise to avoid misunderstandings. Utilizing the Nebraska Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow will ensure your instructions are understood and followed correctly.