For use in all states except AK,FL,ME,NY,PR,VT,VA,WV,WI

Nebraska Multistate Promissory Note - Unsecured - Signature Loan

Description

How to fill out Multistate Promissory Note - Unsecured - Signature Loan?

If you intend to be thorough, acquire, or print authentic documents categories, utilize US Legal Forms, the largest selection of valid templates, available on the web.

Employ the site’s simple and user-friendly search to locate the files you need.

Different categories for commercial and personal objectives are organized by classifications and states, or keywords.

Every legal document template you obtain is yours permanently. You will have access to each form you have acquired in your account. Access the My documents section and select a form to print or download again.

Complete and download, and print the Nebraska Multistate Promissory Note - Unsecured - Signature Loan with US Legal Forms. There are countless professional and state-specific templates available for your business or personal requirements.

- Utilize US Legal Forms to quickly find the Nebraska Multistate Promissory Note - Unsecured - Signature Loan with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to access the Nebraska Multistate Promissory Note - Unsecured - Signature Loan.

- You can also find forms you have obtained earlier in the My documents section of your account.

- If you are using US Legal Forms for the first time, adhere to these steps.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Utilize the Review feature to examine the form's content. Be sure to read the description.

- Step 3. If you're not satisfied with the form, use the Search section at the top of the page to find other forms in the legal format.

- Step 4. Once you've found the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your credentials to create an account.

- Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Retrieve the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Nebraska Multistate Promissory Note - Unsecured - Signature Loan.

Form popularity

FAQ

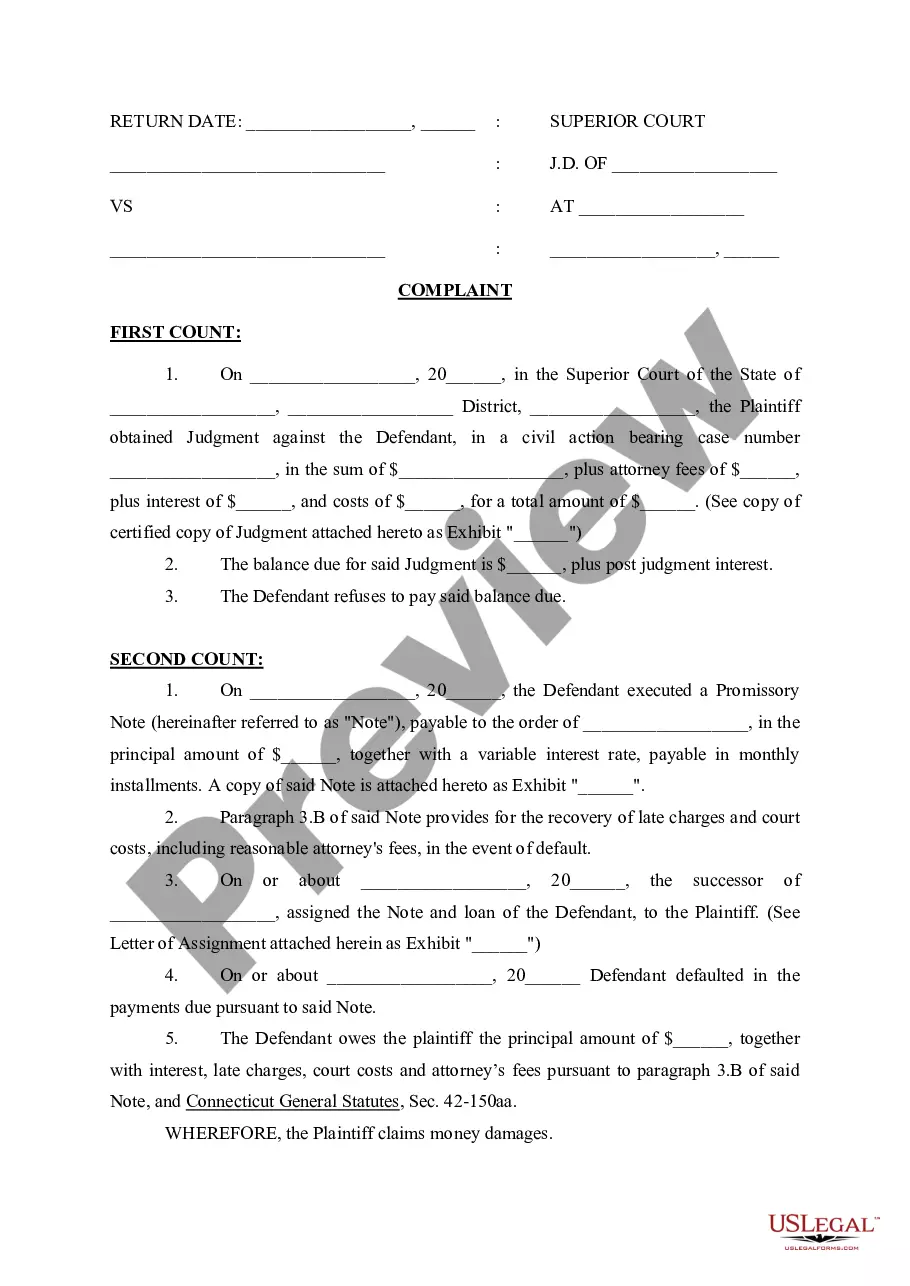

Filling out a promissory demand note requires you to specify the borrower's details, the amount owed, and any applicable interest rates. You also must include a clause that indicates the note will be payable upon demand. Using tools like USLegalForms can simplify this process.

An unsecured promissory note is an obligation for payment without any property securing the payment. If the payor fails to pay, the payee must file a lawsuit and hope that the payor has sufficient assets that can be seized to satisfy the loan.

A form of debt instrument, a promissory note represents a written promise on the part of the issuer to pay back another party. A promissory note will include the agreed-upon terms between the two parties, such as the maturity date, principal, interest, and issuer's signature.

A promissory note is often included in a mortgage, student loan, car loan, business loan or personal loan agreement. Borrowers will typically sign the promissory note as one of the last steps to receiving their borrowed funds.

Types of Promissory NotesSimple Promissory Note.Student Loan Promissory Note.Real Estate Promissory Note.Personal Loan Promissory Notes.Car Promissory Note.Commercial Promissory note.Investment Promissory Note.

An unsecured note is a loan that is not secured by the issuer's assets. Unsecured notes are similar to debentures but offer a higher rate of return. Unsecured notes provide less security than a debenture. Such notes are also often uninsured and subordinated. The note is structured for a fixed period.

An unsecured promissory note is a legally binding contract between two parties where one party agrees to pay the other a certain amount of money at a specific time in the future. The reason it is called 'unsecured' is because the borrower does not want to pledge any assets as collateral for the loan.

In common speech, other terms, such as "loan", "loan agreement", and "loan contract" may be used interchangeably with "promissory note".

A Promissory note is essentially an unconditional written promise to repay a loan or other debts, at a fixed or determinable future date. Although it is legally enforceable, a promissory note is less formal than a loan agreement and is suitable where smaller sums of money are involved.

A Promissory note is essentially an unconditional written promise to repay a loan or other debts, at a fixed or determinable future date. Although it is legally enforceable, a promissory note is less formal than a loan agreement and is suitable where smaller sums of money are involved.