This is a Promissory Note for use in any state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

Nebraska Unsecured Installment Payment Promissory Note for Fixed Rate

Description

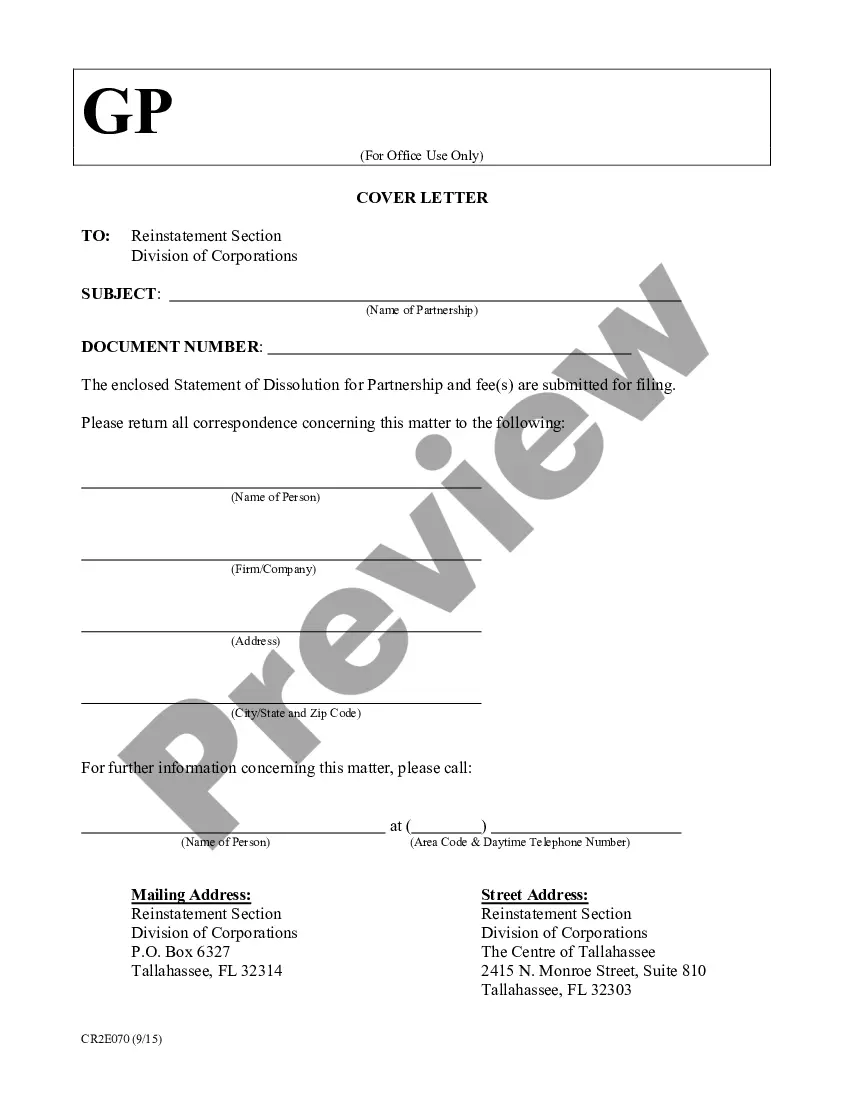

How to fill out Unsecured Installment Payment Promissory Note For Fixed Rate?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal document templates that you can download or print.

By using the website, you can access thousands of documents for business and personal use, organized by categories, states, or keywords. You can obtain the most recent versions of documents such as the Nebraska Unsecured Installment Payment Promissory Note for Fixed Rate in minutes.

If you already have a subscription, Log In and download the Nebraska Unsecured Installment Payment Promissory Note for Fixed Rate from the US Legal Forms library. The Download button will appear on every document you view. You can access all previously downloaded documents from the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction. Select the format and download the document to your device.

Make modifications. Fill out, edit, print, and sign the downloaded Nebraska Unsecured Installment Payment Promissory Note for Fixed Rate. Every template you added to your account has no expiration date and is yours indefinitely. So, if you wish to download or print another copy, simply go to the My documents section and click on the document you need. Access the Nebraska Unsecured Installment Payment Promissory Note for Fixed Rate with US Legal Forms, the most comprehensive collection of legal document templates. Utilize a multitude of professional and state-specific templates that cater to your business or personal needs and requirements.

- If you want to use US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct document for your area/state.

- Click the Review button to view the document's details.

- Read the document information to confirm you have chosen the right document.

- If the document does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the document, confirm your selection by clicking the Buy now button.

- Next, select the payment plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

To enforce a Nebraska Unsecured Installment Payment Promissory Note for Fixed Rate, you must first ensure that the note is properly drafted and signed by both parties. If the borrower fails to make payments, you can begin by sending a formal demand for payment. If the issue persists, you may need to file a lawsuit in a Nebraska court to obtain a judgment. Utilizing the US Legal Forms platform can help you create a compliant promissory note and provide guidance on the enforcement process.

To write a secured promissory note, you start by outlining the terms similar to an unsecured note, but also include collateral details. Specify the asset being used as collateral and the process for reclaiming it if the borrower defaults. By clearly stating these terms in the Nebraska Unsecured Installment Payment Promissory Note for Fixed Rate, both parties can understand their rights and responsibilities. Consider using resources from uslegalforms for structured guidance.

In Nebraska, a promissory note does not necessarily have to be notarized to be considered legal. However, having it notarized can provide an additional layer of security and verification for both parties involved. This step may be beneficial if you want to ensure clarity and enforceability of the Nebraska Unsecured Installment Payment Promissory Note for Fixed Rate. It's always wise to consult legal advice for your specific situation.

A promissory note does not have to include an interest rate, but most do for clarity and to ensure compensation for the lender. In the case of a Nebraska Unsecured Installment Payment Promissory Note for Fixed Rate, the interest rate is typically fixed, providing predictability in monthly payments. This setup helps borrowers plan their finances effectively while meeting their repayment obligations.

Promissory notes can be either secured or unsecured, depending on the agreement between the parties. A Nebraska Unsecured Installment Payment Promissory Note for Fixed Rate falls into the unsecured category, allowing borrowers to receive funds without collateral. This flexibility benefits those who may not have assets to pledge but still need financing.

Promissory notes do not necessarily need to be secured. While secured notes offer protection to lenders through collateral, a Nebraska Unsecured Installment Payment Promissory Note for Fixed Rate provides a flexible option for borrowers. This means you can access funds without putting assets at risk, although lenders may impose stricter terms.

Yes, a promissory note can indeed be unsecured. This is particularly true for a Nebraska Unsecured Installment Payment Promissory Note for Fixed Rate, where the borrower does not provide collateral. However, keep in mind that lenders may perceive unsecured notes as riskier, which could lead to higher interest rates.

To collect on an unsecured promissory note like the Nebraska Unsecured Installment Payment Promissory Note for Fixed Rate, start by communicating directly with the borrower. You may send reminders and payment requests to encourage repayment. If necessary, consider legal action, such as filing a claim in small claims court, to recover the owed amount. Using a platform like uslegalforms can help streamline the documentation process, ensuring you have the right legal forms to support your collection efforts.