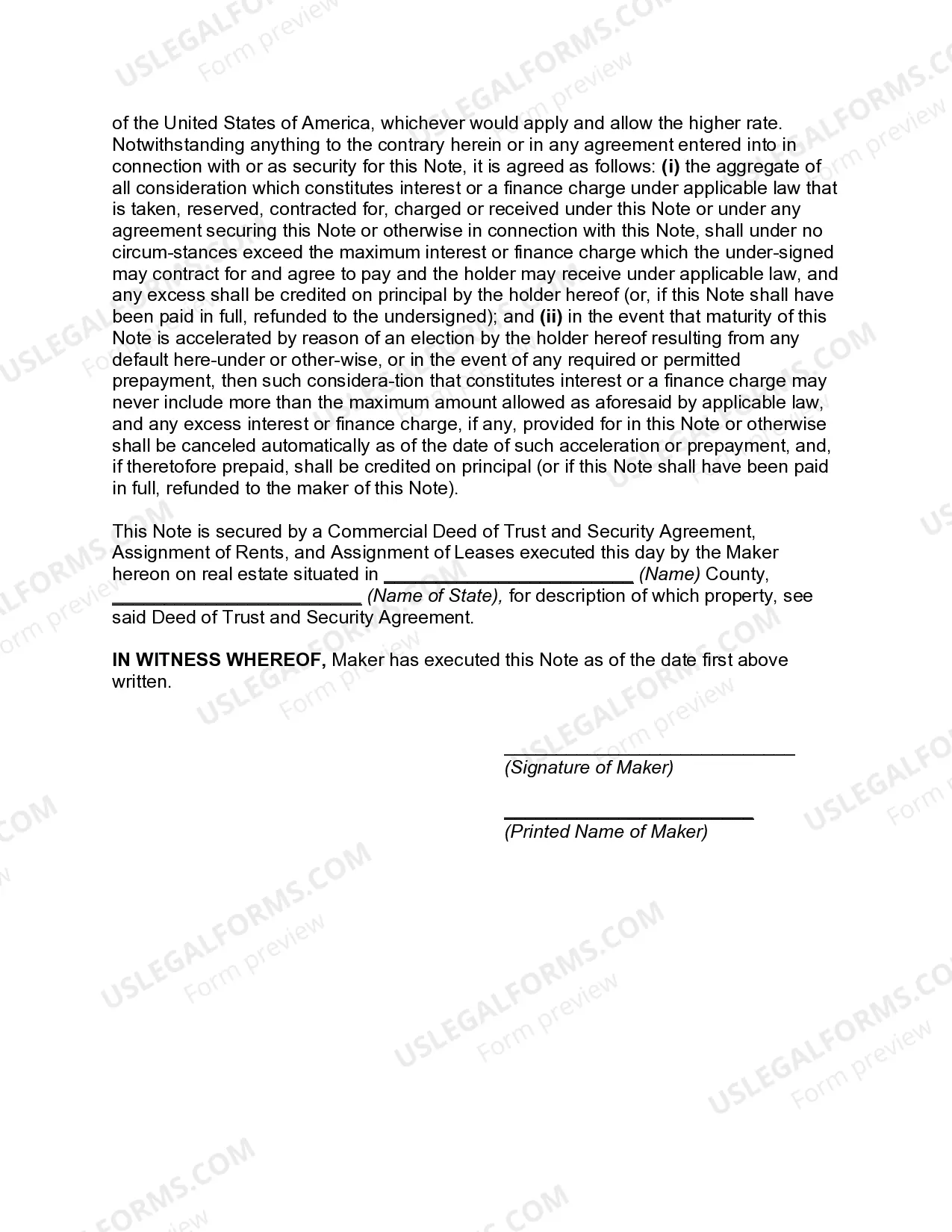

Nebraska Promissory Note for Commercial Loan Secured by Real Property

Description

How to fill out Promissory Note For Commercial Loan Secured By Real Property?

It is feasible to spend time online looking for the valid document format that meets the state and federal stipulations you need.

US Legal Forms provides thousands of valid templates that have been assessed by professionals.

You can actually download or print the Nebraska Promissory Note for Commercial Loan Secured by Real Property from the service.

If available, utilize the Preview button to examine the format as well.

- If you possess a US Legal Forms account, you can sign in and then click the Download button.

- Afterward, you can complete, modify, print, or sign the Nebraska Promissory Note for Commercial Loan Secured by Real Property.

- Each valid document format you obtain is yours indefinitely.

- To acquire another copy of a purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple steps below.

- First, ensure that you have selected the correct format for the location/city you choose.

- Read the form description to confirm you have picked the right document.

Form popularity

FAQ

A promissory note is a key piece of a home loan application and mortgage agreement, ensuring that a borrower agrees to be indebted to a lender for loan repayment. Ultimately, it serves as a necessary piece of the legal puzzle that helps guarantee that sums are repaid in full and in a timely fashion.

Secured Promissory Notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document.

A secured promissory note, as the name partially implies, is secured by some form of property (i.e. collateral), while an unsecured promissory note does not involve collateral. If the borrower defaults on a Secured Promissory Note, the lender gets to keep the collateral (the property that was used to secure the loan).

What is a Secured Promissory Note? A Secured Promissory Note is a legal agreement that requires a borrower to provide security for a loan. With this lending document, the borrower puts forth their personal property or real estate as collateral if the loan isn't repaid.

A mortgage is a loan secured by property that is used as collateral, which the lender can seize if the borrower defaults on the loan. The promissory note is exactly what it sounds like the borrower's written, signed promise to repay the loan.

A Secured Promissory Note is a legal agreement that requires a borrower to provide security for a loan. With this lending document, the borrower puts forth their personal property or real estate as collateral if the loan isn't repaid.

Q. What are Real Estate Secured loans? A. Often referred to as private money, hard money, or bridge financing, these short-term loans offer greater flexibility than traditional bank financing.

Generally, a Secured Promissory Note will be secured using an additional document. If the property being used as collateral is personal property, the Note will be secured using a Security Agreement. If the property being used as collateral is real property, the Note will be secured using a Deed of Trust.

Secured Promissory Notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.