Nebraska Complaint regarding Group Insurance Contract

Description

How to fill out Complaint Regarding Group Insurance Contract?

Are you currently within a placement that you need to have papers for sometimes business or personal functions nearly every day? There are plenty of authorized record templates accessible on the Internet, but getting kinds you can rely is not effortless. US Legal Forms delivers a large number of form templates, like the Nebraska Complaint regarding Group Insurance Contract, which can be created in order to meet state and federal demands.

In case you are already knowledgeable about US Legal Forms website and have your account, merely log in. Next, you are able to down load the Nebraska Complaint regarding Group Insurance Contract web template.

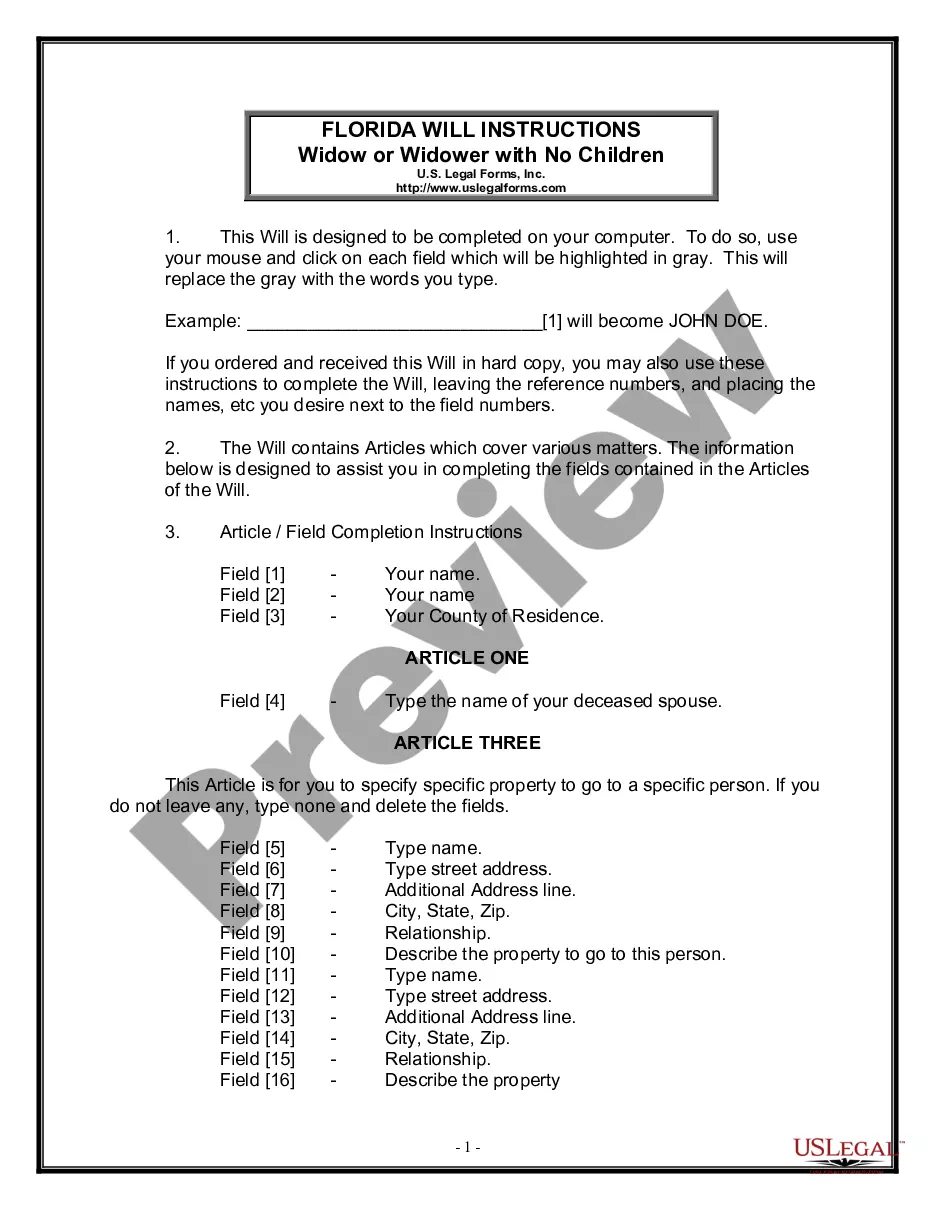

Should you not have an profile and wish to begin using US Legal Forms, adopt these measures:

- Obtain the form you need and make sure it is for your correct town/county.

- Take advantage of the Preview switch to review the form.

- Read the explanation to actually have chosen the proper form.

- If the form is not what you`re searching for, utilize the Research discipline to discover the form that meets your requirements and demands.

- When you find the correct form, click on Get now.

- Pick the rates plan you need, fill out the necessary info to produce your bank account, and pay money for the order with your PayPal or Visa or Mastercard.

- Choose a convenient document structure and down load your backup.

Discover each of the record templates you may have purchased in the My Forms food selection. You can aquire a extra backup of Nebraska Complaint regarding Group Insurance Contract whenever, if necessary. Just select the essential form to down load or print the record web template.

Use US Legal Forms, by far the most considerable collection of authorized types, to conserve time and avoid errors. The services delivers skillfully produced authorized record templates that can be used for a selection of functions. Make your account on US Legal Forms and initiate making your way of life a little easier.

Form popularity

FAQ

Types of Insurance Fraud False or inflated theft repair claim. Owner ?give up? (false stolen car report) ?Jump in? (someone not in vehicle at time of accident) Staged accident. Intentional damage claim. Falsifying the date or circumstances of an accident to get coverage. Rate evasion.

You can call your state's insurance department. If none of this helps, you can try an out-of-court settlement because most likely, once you've hired an attorney and they contact your insurance company, the dispute will be settled out of court.

Eric Dunning - Director of Insurance - INSURANCE, NEBRASKA DEPARTMENT OF | LinkedIn.

File an online complaint: Once received, your complaint will be assigned to an Insurance Complaint Examiner who will send you an acknowledgment letter with a case tracking ID number. ... We will send a copy of your complaint to the company and/or agent and request a detailed explanation.

Ask a third party such as an ombudsman to help with your dispute. File a complaint with your state department of insurance, which regulates insurance activity and insurer compliance with state laws and regulations. Seek arbitration if that is an option in your policy. File a legal claim against the insurer in court.

Information To Include in Your Letter Give the basics. Tell your story. Tell the company how you want to resolve the problem. Be reasonable. File your complaint. Your Address. Your City, State, Zip Code. [Your email address, if sending by email] Date.

If you intend to seek compensation in your car accident claim, then you have the right to negotiate for more money. You will be, through your attorney, negotiating with the insurance company, and specifically, the claims adjuster, for the money you are entitled to.

Your right to appeal You may ask your insurance company to conduct a full and fair review of its decision. If the case is urgent, your insurance company must speed up this process. External review: You have the right to take your appeal to an independent third party for review. This is called an external review.