Nebraska Personal Property Inventory

Description

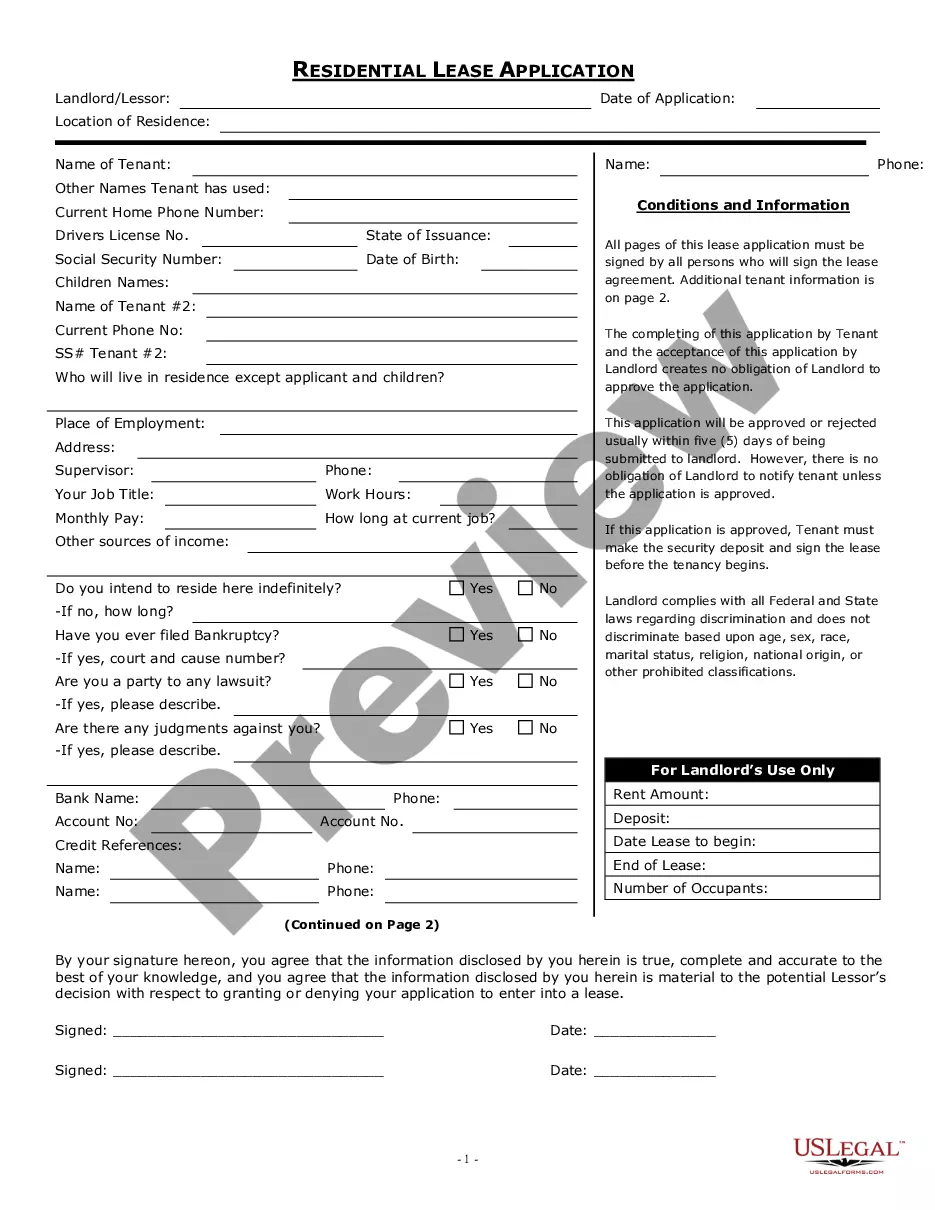

How to fill out Personal Property Inventory?

You have the ability to dedicate hours online searching for the authentic document template that meets the state and federal requirements you need.

US Legal Forms offers thousands of authentic forms that can be reviewed by experts.

You can easily download or print the Nebraska Personal Property Inventory from our platform.

To find another version of the form, use the Search field to locate the template that meets your needs and requirements.

- If you possess a US Legal Forms account, you can sign in and click the Obtain option.

- Then, you can fill out, modify, print, or sign the Nebraska Personal Property Inventory.

- Every document template you purchase is yours indefinitely.

- To get an additional copy of any purchased form, go to the My documents tab and click the relevant option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions listed below.

- First, ensure you have selected the correct document template for the state/city of your choice.

- Review the form outline to make sure you have selected the right form.

Form popularity

FAQ

To find the assessed value of your property in Nebraska, you can start by consulting your local tax assessor's office or their website. Assessors often provide resources for property owners to view their assessment records. Understanding your assessed value helps you accurately report it in your Nebraska personal property inventory and assess your tax obligations effectively.

Filling out a personal property inventory form can be straightforward if you break it down into steps. Start by listing each item one by one, ensuring you follow any specific guidelines provided on the form. Include necessary details such as the condition and estimated value of each item to create an accurate representation of your Nebraska personal property inventory. US Legal Forms offers useful resources to aid in this process.

In Nebraska, personal property tax deductions typically apply to items used for business purposes, such as equipment and inventory. If you use certain assets primarily for personal enjoyment or household use, they usually do not qualify. It's essential to review the specifics of Nebraska personal property tax laws to ensure you're maximizing your deductions. Consider using US Legal Forms to gather necessary documentation.

A personal property inventory typically includes items like furniture, electronics, jewelry, artwork, and vehicles. Consider documenting household items that hold value, as they may be essential for insurance claims or asset management. Keeping an updated Nebraska Personal Property Inventory helps ensure that all significant items are accounted for and adequately covered.

Yes, you are generally required to report personal property to local authorities in Nebraska for tax purposes. This includes assets like vehicles, machinery, and rental property. A well-maintained Nebraska Personal Property Inventory can simplify the reporting process, ensuring you provide accurate and complete information.

Creating a personal property inventory begins with gathering your belongings and assessing their value. Use a digital tool or a simple spreadsheet to list your items, include descriptions, and note any relevant information. An efficient Nebraska Personal Property Inventory can assist you in tracking your assets and ensuring you are adequately insured.

In Nebraska, there is no specific age at which individuals automatically stop paying property taxes. However, certain exemptions may apply to seniors or disabled residents, which can reduce tax liability. It’s advisable to review your Nebraska Personal Property Inventory regularly to identify any exemptions you might qualify for.

Yes, Nebraska does impose personal property tax on vehicles, which includes cars, trucks, and motorcycles. When you register your vehicle, be prepared to report its value as part of your Nebraska Personal Property Inventory. It's important to stay informed about local tax regulations to ensure compliance and avoid penalties.

You can inventory personal property by systematically reviewing each space in your home or office. Take photos of items to provide visual confirmation and use an organized spreadsheet or app to keep track of everything. This method not only aids in insurance claims but also helps maintain your Nebraska Personal Property Inventory in an organized fashion.

In a Nebraska Personal Property Inventory, you should list all significant items that you own, including furniture, electronics, vehicles, and collectibles. It's important to note the condition, value, and location of each item. Including receipts or photographs can further enhance your inventory's accuracy. A comprehensive inventory can aid in insurance claims or assist with estate planning, providing peace of mind in managing your assets.