Nebraska Leased Personal Property Workform

Description

How to fill out Leased Personal Property Workform?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal form categories you can download or print.

While navigating the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You will find the latest versions of forms such as the Nebraska Leased Personal Property Workform in just a few moments.

If you have a monthly subscription, Log In and download the Nebraska Leased Personal Property Workform from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents area of your account.

Complete the purchase. Use your credit card or PayPal account to finalize the transaction.

Choose the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded Nebraska Leased Personal Property Workform. Every template you add to your account has no expiration date and is yours indefinitely. Thus, to download or print another copy, simply go to the My documents section and click on the form you need. Access the Nebraska Leased Personal Property Workform with US Legal Forms, the largest collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

- Make sure you have selected the correct form for your city/county.

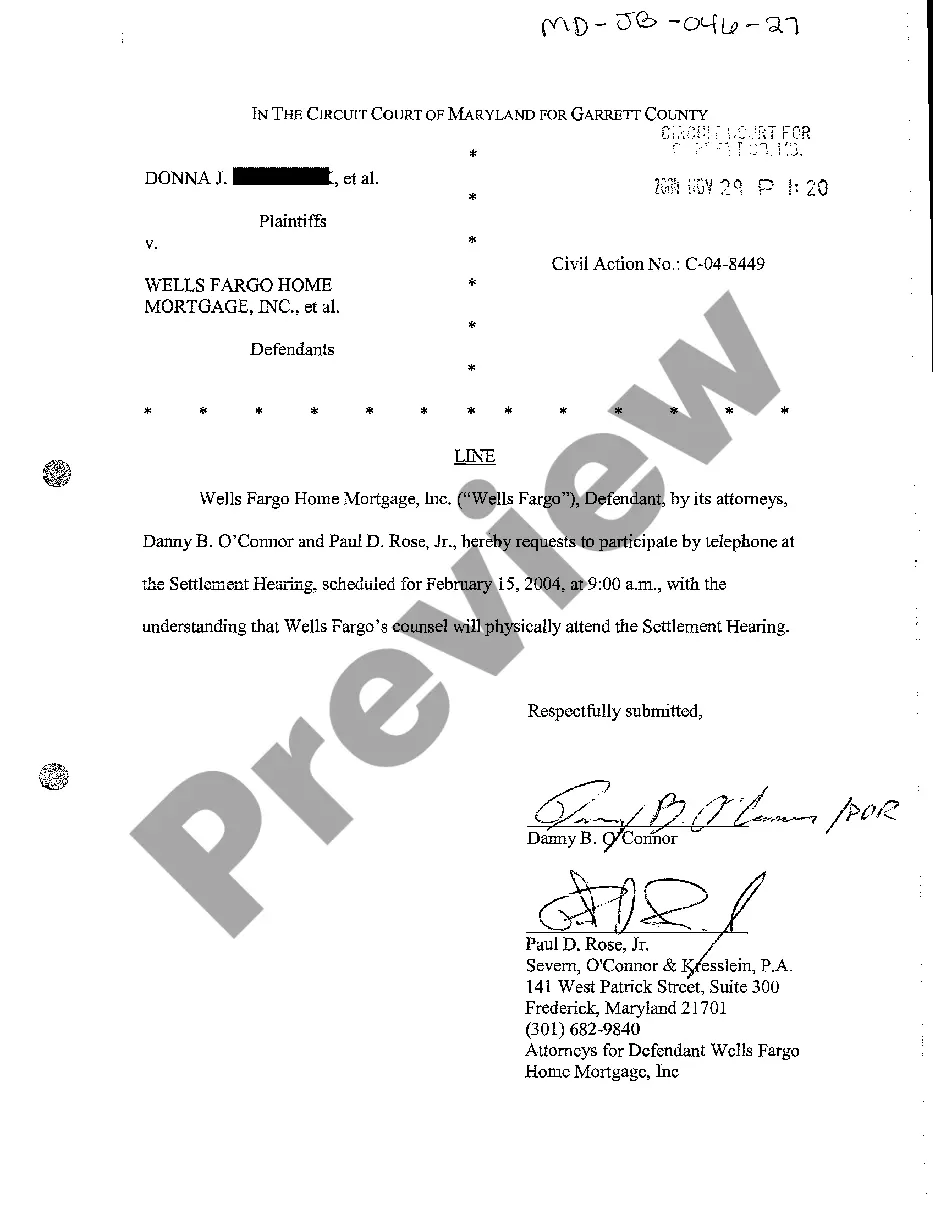

- Click the Preview button to review the contents of the form.

- Read the form description to verify that you have selected the correct document.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find the one you need.

- If you are satisfied with the form, confirm your choice by clicking the Buy Now button.

- Then, choose your preferred pricing plan and provide your details to register for an account.

Form popularity

FAQ

In Nebraska, seniors may qualify for property tax exemptions or reductions under certain conditions, typically after they reach 65 years old. It's important to review local regulations and programs, as benefits can vary by county. Utilizing the Nebraska Leased Personal Property Workform can help seniors effectively manage any property they own and ensure they receive appropriate benefits. This form simplifies the process of tracking and confirming property details that can impact tax responsibilities.

Yes, Nebraska imposes a personal property tax on vehicles. However, the amount varies based on the vehicle's value and age. If you're navigating the complexities of vehicle taxation, using the Nebraska Leased Personal Property Workform can streamline your process. By properly documenting your vehicle, you can ensure compliance and possibly reduce your tax burden.

The Nebraska personal allowance worksheet is an essential form used to calculate your allowable deductions and credits on your property tax return. Utilizing this worksheet in conjunction with the Nebraska Leased Personal Property Workform ensures that you account for all relevant expenses and deductions accurately. By filling out this worksheet, you can clearly understand your tax situation, which can lead to substantial savings.

In Nebraska, personal property tax is based on the value of tangible items such as machinery, equipment, and furniture owned by businesses or individuals. Each year, when you file the Nebraska Leased Personal Property Workform, you must declare the estimated value of your leased personal property. Tax authorities then use this information to assess the tax liability. It's essential to understand this process to comply with state regulations.

To qualify for a personal property tax deduction in Nebraska, your personal property must be used for business purposes. This includes equipment, tools, and supplies necessary for your trade. Keep in mind that using the Nebraska Leased Personal Property Workform can help you accurately assess and claim these deductions. Ensure you maintain proper records of your property’s use to benefit fully from the deductions available.

A Form 22 change request in Nebraska allows you to update or correct previously submitted information regarding your leased personal property. This form is essential if there are modifications to the original details filed in the Nebraska Leased Personal Property Workform. By submitting a Form 22, you ensure that your records are accurate, thus maintaining compliance with Nebraska tax regulations. If you need assistance with this process, US Legal Forms offers tools and resources to help you navigate these changes efficiently.

Filling out Form 13 in Nebraska requires you to provide specific details about your leased personal property. Start by entering the property description, including lease terms and value, as stated in the Nebraska Leased Personal Property Workform. It’s crucial to ensure that all information is accurate and complete to avoid processing delays. For additional guidance, consider accessing templates from US Legal Forms to assist you in the completion of Form 13.

To claim personal property tax, you need to report the value of your leased personal property on your tax return. You can use the Nebraska Leased Personal Property Workform specifically designed for this purpose. Ensure you gather all necessary information regarding your personal property, as accurate reporting helps you avoid issues with tax authorities. Utilizing resources like US Legal Forms can simplify your filing process and ensure compliance with Nebraska tax regulations.