Nebraska Leasehold Interest Workform

Description

How to fill out Leasehold Interest Workform?

Have you ever been in a situation where you need documents for either business or personal purposes almost constantly.

There are numerous authentic document templates accessible online, but finding ones you can trust is challenging.

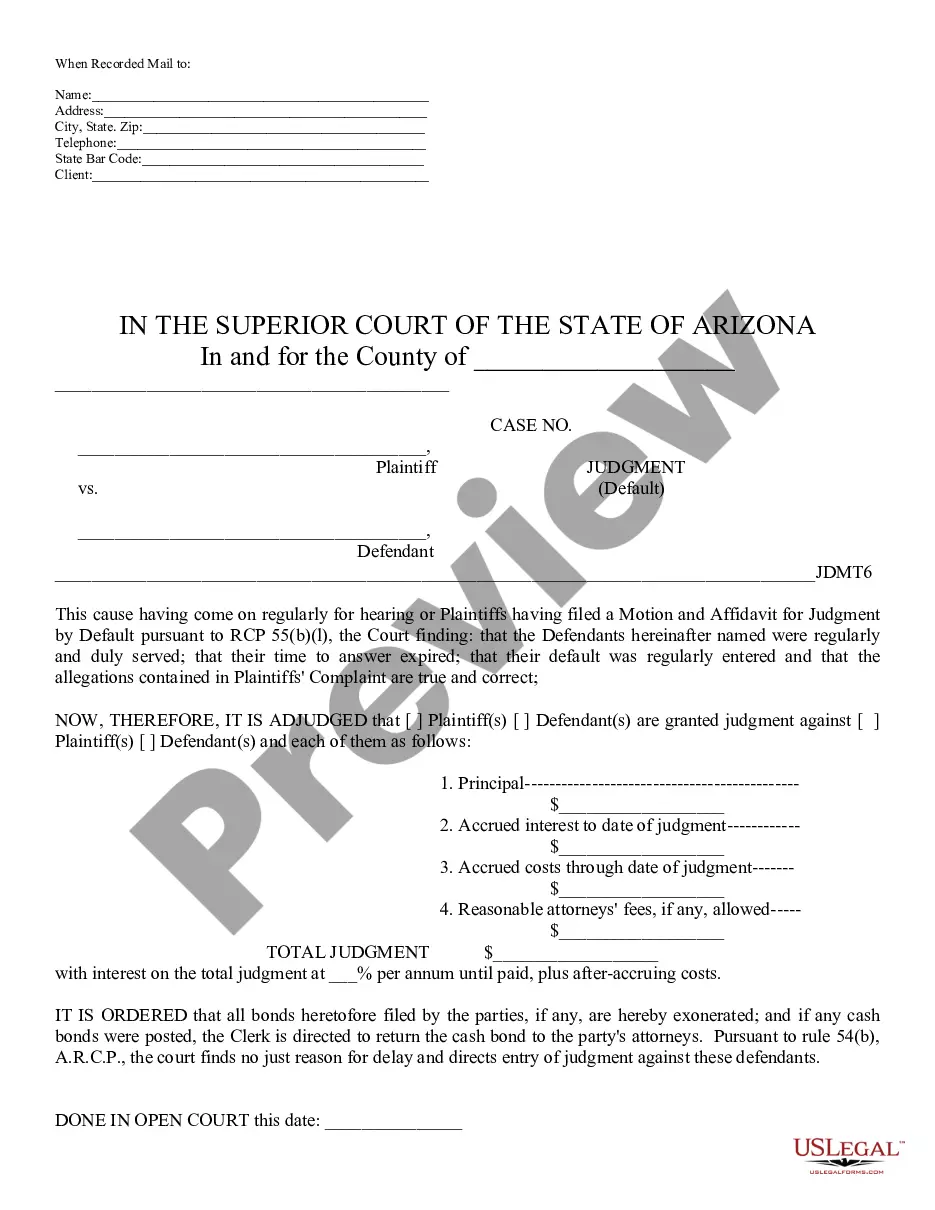

US Legal Forms provides thousands of form templates, such as the Nebraska Leasehold Interest Workform, designed to meet federal and state requirements.

When you find the appropriate form, click on Acquire now.

Select the payment plan you wish, complete the required information to create your account, and place your order using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Nebraska Leasehold Interest Workform template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/county.

- Use the Review option to examine the form.

- Check the description to confirm that you have selected the right form.

- If the form is not what you are looking for, utilize the Search field to find the form that suits your requirements.

Form popularity

FAQ

Typically, rental leases in Nebraska do not have to be notarized to be legally binding. However, a notarized Nebraska Leasehold Interest Workform can offer added peace of mind, verifying the identities and intentions of all parties involved. While notarization is not a requirement, it can be beneficial in protecting your rights. Always consider your unique situation when deciding whether to notarize your lease agreements.

To terminate a farm lease in Nebraska, you must provide written notice to the tenant or landlord, adhering to any specific timeframe outlined in the lease. Utilizing a Nebraska Leasehold Interest Workform can streamline this process by including all required details for termination. Clear communication and following the legal protocols are crucial in preventing misunderstandings. Always keep a copy of the termination notice for your records.

tomonth lease agreement in Nebraska is a rental agreement that automatically renews every month, allowing flexibility for both landlords and tenants. This type of lease can be easily terminated by either party with proper notice, typically 30 days. If you are looking to simplify your lease management, consider using a Nebraska Leasehold Interest Workform for clarity and efficiency. It outlines all necessary terms while ensuring that legal requirements are met.

In Nebraska, leases do not generally need to be notarized. However, having a Nebraska Leasehold Interest Workform notarized can provide an additional layer of security and authenticity, especially for long-term or significant agreements. It is wise to check specific lease requirements and consult legal guidelines to ensure compliance. Notarization adds credibility and can help resolve disputes if they arise.

Nebraska tax refunds can be delayed for a variety of reasons, including excessive claims, incomplete documentation, or audits. The state reviews each claim thoroughly to ensure accuracy and compliance, which can slow the refund process. By utilizing the Nebraska Leasehold Interest Workform and ensuring all forms are completed accurately, you may help mitigate potential delays in your tax refunds.

A Form 22 change request is a document submitted to request changes in property tax assessments or related issues in Nebraska. This form helps provide clarity regarding changes in property use or ownership. When dealing with leasehold interests, the Nebraska Leasehold Interest Workform can support the necessary changes while ensuring proper documentation.

In Nebraska, property taxes can generally go unpaid for a period of three years before a tax lien is placed on the property. After this period, the county may initiate a tax sale to recover owed taxes. Staying proactive by utilizing resources like the Nebraska Leasehold Interest Workform can help you manage your property responsibilities and avoid tax complications.

To avoid paying Nebraska inheritance tax, consider strategies such as utilizing tax exemptions and proper estate planning. Gifting assets prior to death can help transfer your estate without incurring taxes. Additionally, using the Nebraska Leasehold Interest Workform can facilitate the smooth transfer of leasehold interests, ensuring your estate remains compliant with tax laws.

The amendment form in Nebraska is used to make changes to previously filed documents, such as modifications to a lease or property agreement. This form ensures that all parties are aware of the changes and helps maintain accurate records. For leases specifically, the Nebraska Leasehold Interest Workform is beneficial in drafting and filing these amendments.

In Nebraska, a notice to divide is a legal document that informs relevant parties about the separation of property into distinct parcels. This is essential for the accurate division of leasehold interests and property ownership. Utilizing the Nebraska Leasehold Interest Workform can help streamline this process and ensure compliance with state regulations.