Nebraska Dissolution Package to Dissolve Corporation

Definition and Meaning

A Nebraska Dissolution Package to Dissolve Corporation refers to the set of legal documents required for voluntarily dissolving a corporation registered in Nebraska. This package facilitates the official cessation of corporate existence, ensuring all necessary steps are taken to wind down operations in compliance with state law.

Legal Use and Context

The dissolution process in Nebraska, governed by the Nebraska Business Corporation Act, is initiated when a corporation chooses to cease operations. This occurs through voluntary dissolution, which is undertaken by the corporation's board of directors and approved by its shareholders. Proper execution of this package is vital to legally terminate corporate status and mitigate future liabilities.

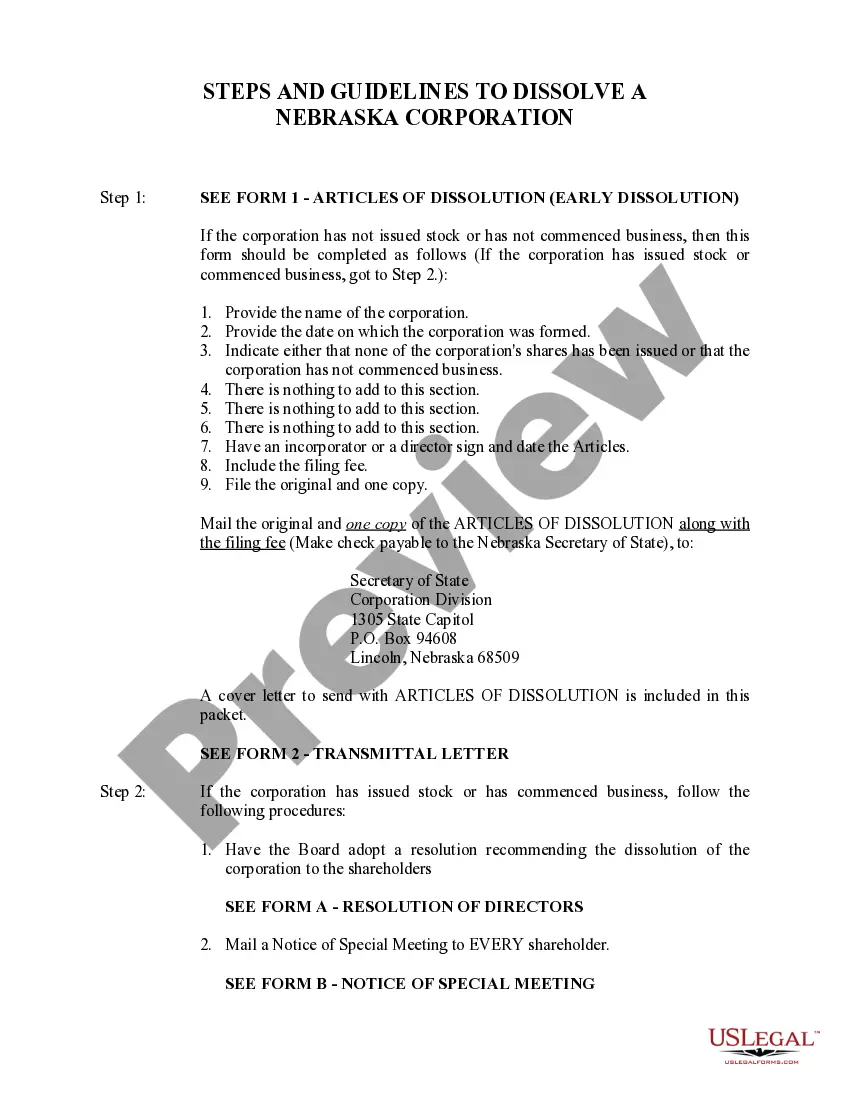

Step-by-Step Instructions

Follow these steps to properly complete the Nebraska Dissolution Package:

- Verify Eligibility: Ensure the corporation has not issued shares or commenced business operations, or if it has, confirm the proper procedures have been followed.

- Prepare Articles of Dissolution: Complete the required Articles of Dissolution form, specifying the corporation's name, formation date, and confirmation of outstanding debts.

- Sign and Submit: Ensure the form is signed and submit it, along with any required fees, to the Nebraska Secretary of State.

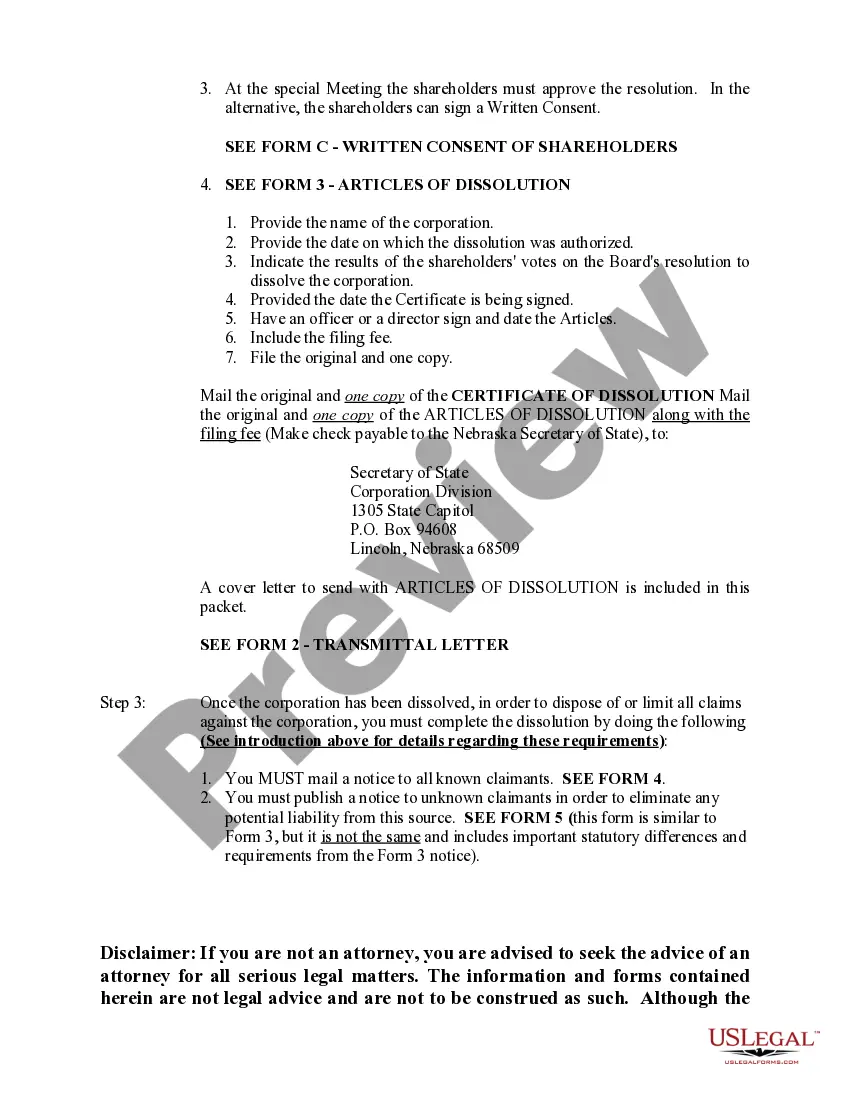

- Notify Shareholders: If applicable, provide written notice to shareholders of the proposed dissolution and call a special meeting for voting.

- Final Notices: After dissolution, send out notices to all known claimants, and if necessary, publish a notice to unknown claimants.

Common Mistakes to Avoid When Using This Form

When using the Nebraska Dissolution Package, it's important to avoid the following common errors:

- Failing to notify all shareholders or skipping the voting process on the dissolution.

- Omitting details in the Articles of Dissolution, such as the date dissolution was authorized.

- Neglecting to pay the required filing fees or submitting incomplete forms.

- Not following up on notification to claimants, leading to potential future liabilities.

What Documents You May Need Alongside This One

In addition to the Nebraska Dissolution Package, you may need the following documents:

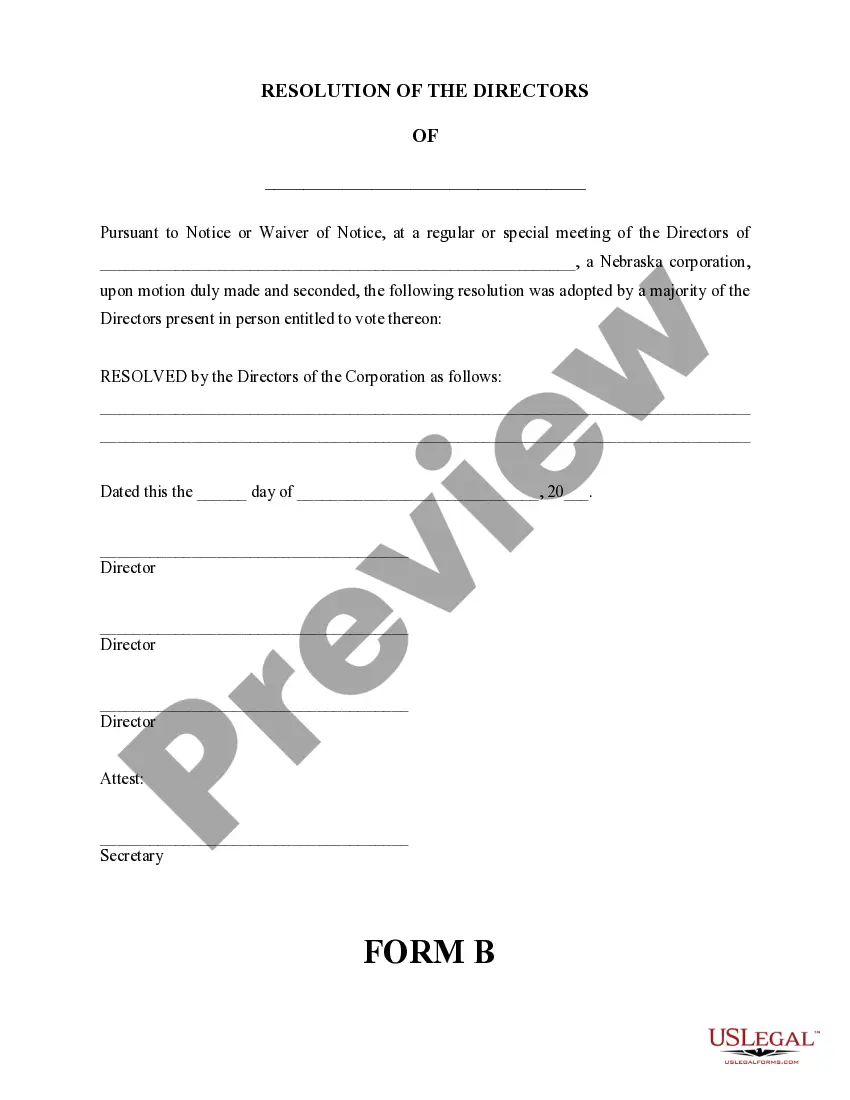

- Resolution of Directors: A document stating the board's agreement to dissolve the corporation.

- Notice of Special Meeting: A notice sent to shareholders about the meeting to discuss and vote on dissolution.

- Records of Shareholder Vote: Documentation of the outcome of the shareholders' vote, whether conducted in person or via written consent.

Key Components of the Form

Key components of the Nebraska Dissolution Package include:

- Corporation Name: The official name of the corporation to be dissolved.

- Date of Incorporation: The date when the corporation was originally formed.

- Status of Shares: Declaration of whether shares have been issued or business has commenced.

- Debt Status: Confirmation that no outstanding debts exist.

- Authorization for Dissolution: Signature from a majority of incorporators or directors authorizing the dissolution.

Form popularity

FAQ

If the company has ceased trading and is closed owing money and your debt is with that company then your liability ends with that company.

Hold a Directors meeting and record a resolution to Dissolve the Nebraska Corporation. Hold a Shareholder meeting to approve Dissolution of the Nebraska Corporation. File all required Biennial Reports with the Nebraska Secretary of State.

In legal terms, when a company is dissolved, it ceases to exist. It cannot still be trading - although a person may trade (misleadingly) using its name.

After a company is dissolved, it must liquidate its assets. Liquidation refers to the process of sale or auction of the company's non-cash assets.Assets used as security for loans must be given to the bank or creditor that extended the loan, or you must pay off the loan before selling such assets.

Definition. The ending of a corporation, either voluntarily by filing a notice of dissolution with the Secretary of State or as ordered by a court after a vote of the shareholders, or involuntarily through government action as a result of failure to pay taxes.

After dissolution, you cannot use the funds remaining in your business bank account for new business. LLC members no longer have the authority to conduct business or do anything that would indicate that the LLC is still active. Your bank account can cover only essential winding up affairs.

Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved. Pay Any Outstanding Bills. You need to satisfy any company debts before closing the business. Cancel Any Business Licenses or Permits. File Your Final Federal and State Tax Returns.

When a corporation is dissolved, it no longer legally exists and, in most cases, its debts disappear as well. State laws usually give additional time beyond the dissolution for creditors to file suits for failure to pay any corporate debts or for the wrongful distribution of corporate assets.

Failing to dissolve the corporation allows third parties to continue to sue the corporation as if it is still in operation. A judgment might mean that shareholders use the money received from distributed assets when the corporation closed down to satisfy judgments against the corporation.