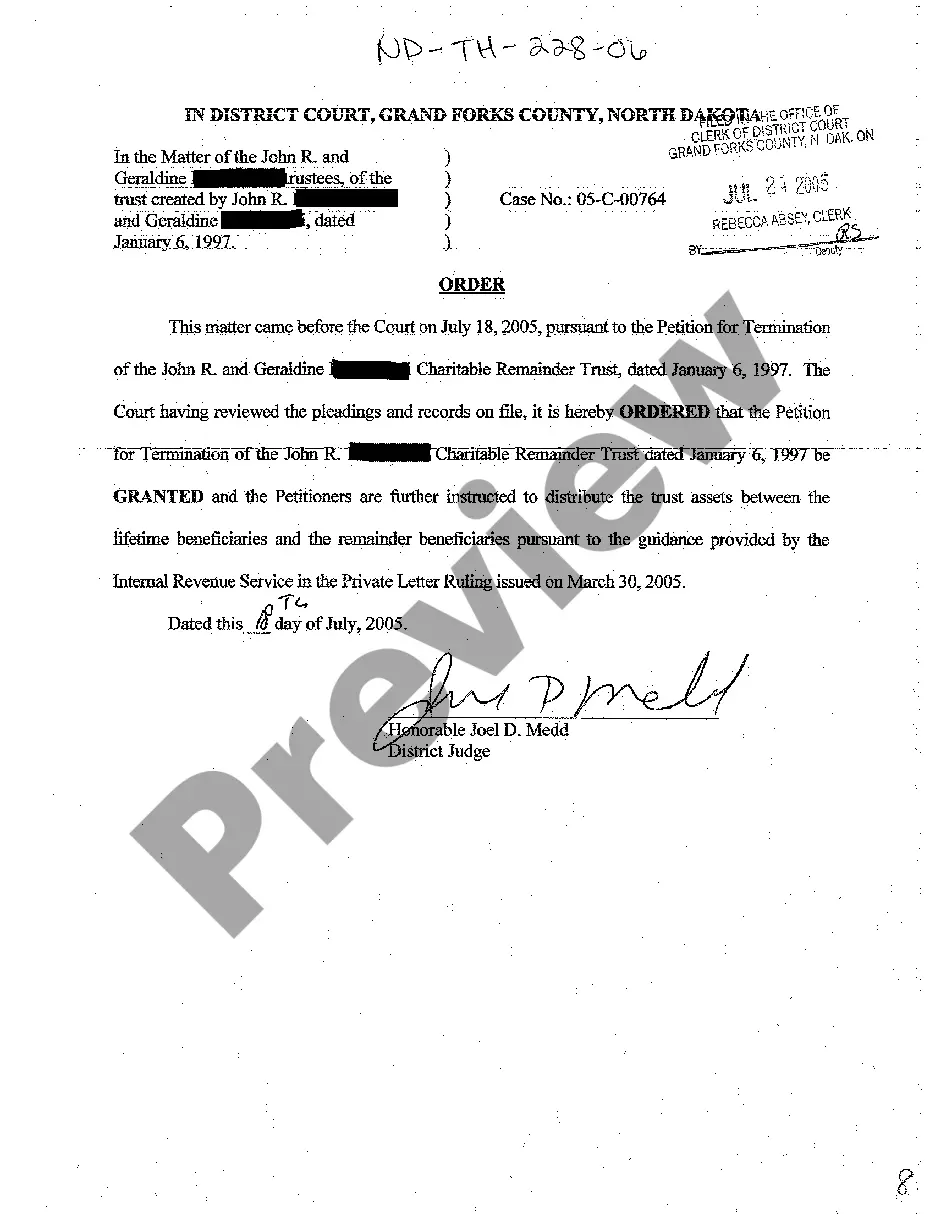

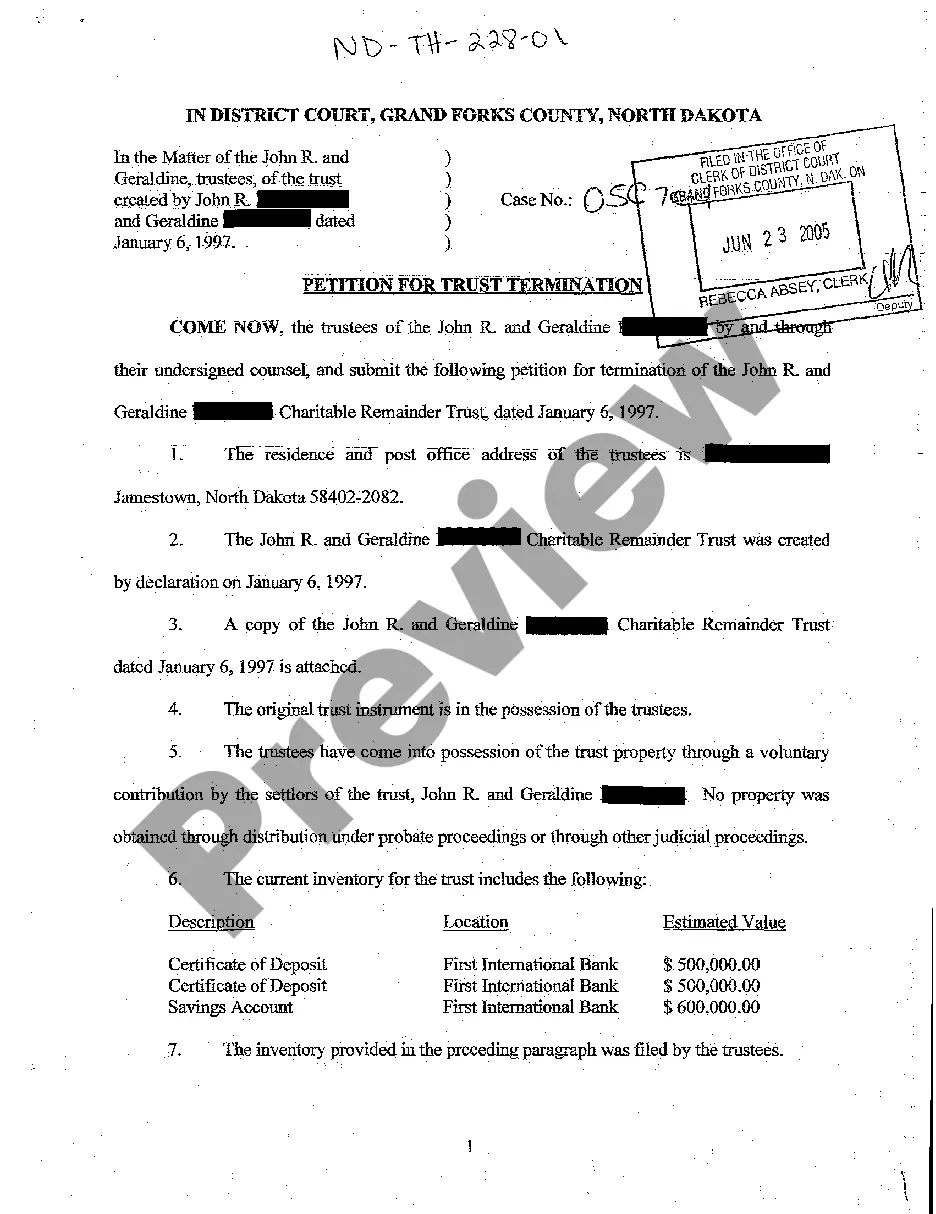

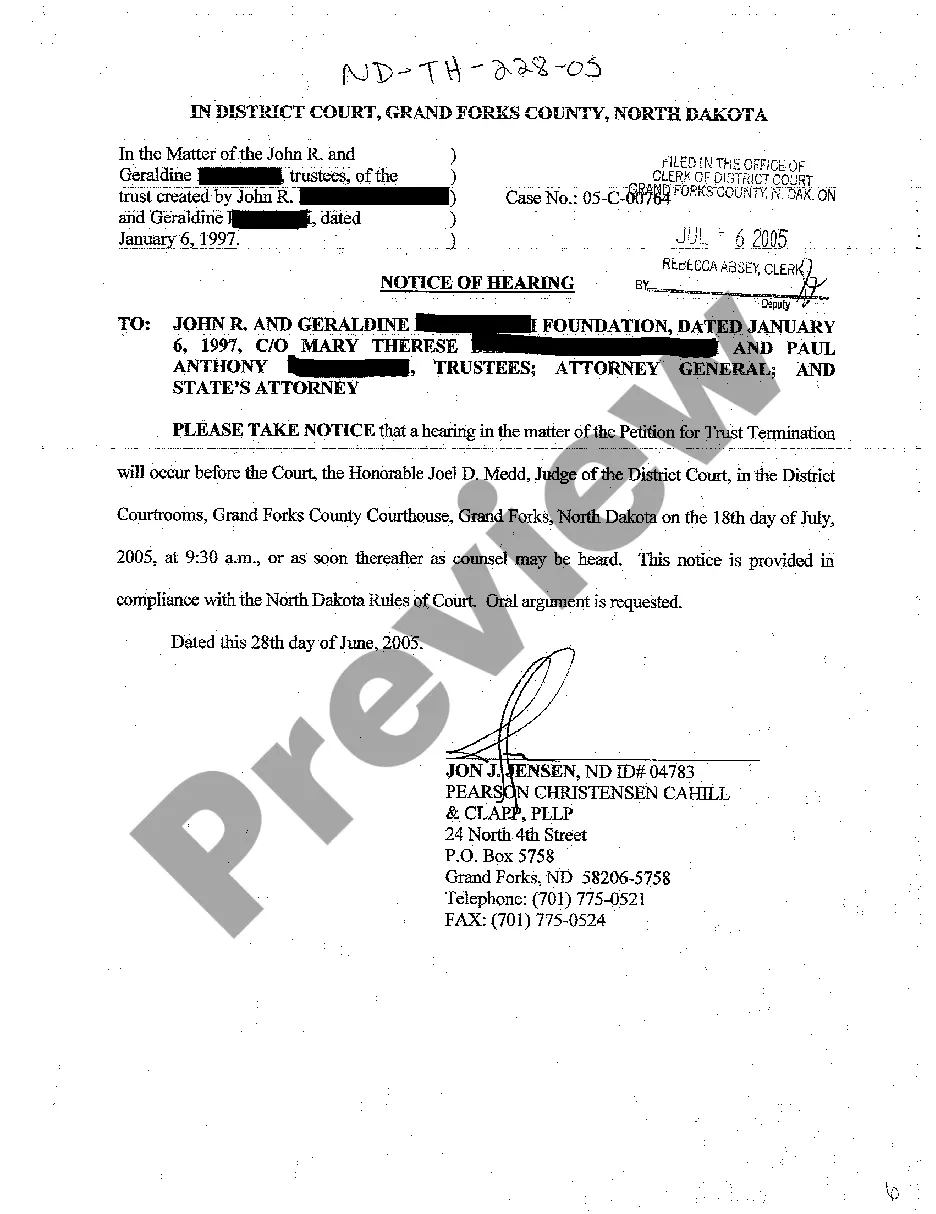

North Dakota Order that Petition for Termination of Trust be Granted

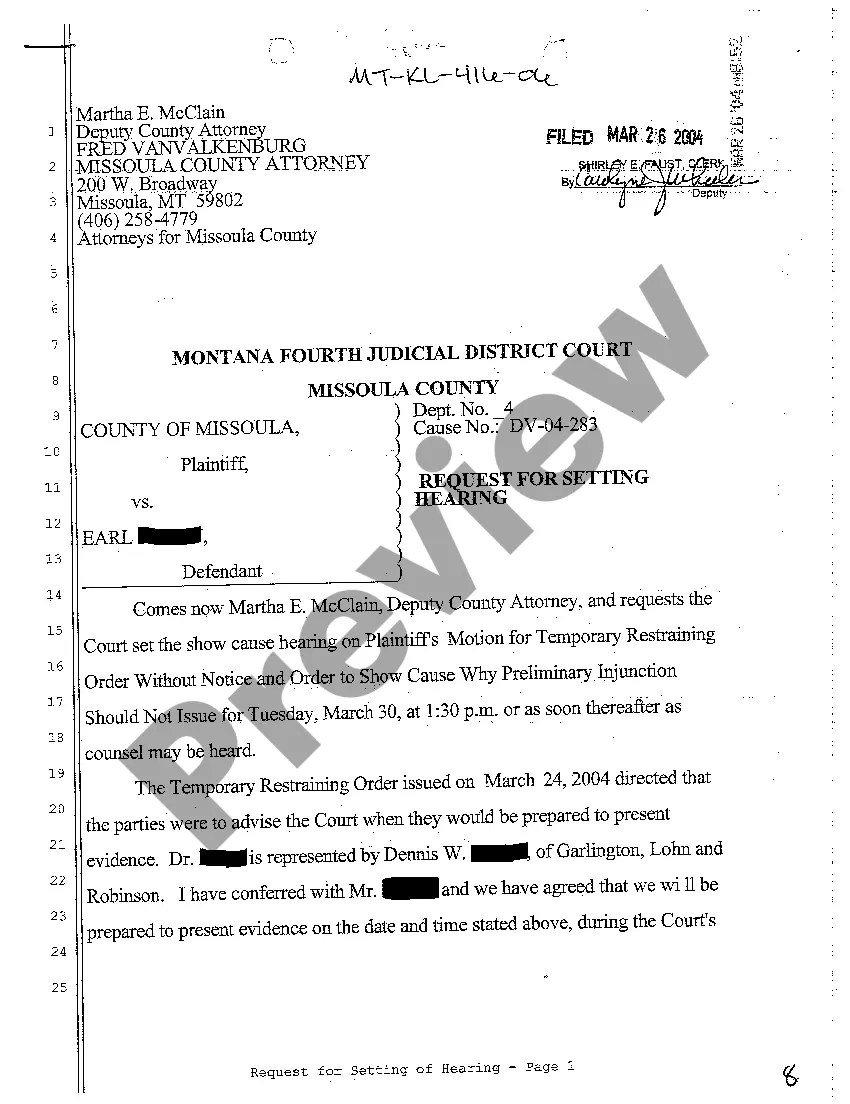

Description

How to fill out North Dakota Order That Petition For Termination Of Trust Be Granted?

Avoid expensive lawyers and find the North Dakota Order that Petition for Termination of Trust be Granted you want at a affordable price on the US Legal Forms website. Use our simple categories function to find and obtain legal and tax forms. Go through their descriptions and preview them before downloading. Moreover, US Legal Forms provides customers with step-by-step instructions on how to download and fill out every single template.

US Legal Forms clients merely must log in and obtain the particular document they need to their My Forms tab. Those, who haven’t got a subscription yet should stick to the guidelines below:

- Ensure the North Dakota Order that Petition for Termination of Trust be Granted is eligible for use where you live.

- If available, look through the description and make use of the Preview option prior to downloading the templates.

- If you’re sure the template meets your needs, click Buy Now.

- In case the template is incorrect, use the search field to get the right one.

- Next, create your account and choose a subscription plan.

- Pay by card or PayPal.

- Choose to obtain the document in PDF or DOCX.

- Click Download and find your form in the My Forms tab. Feel free to save the form to the device or print it out.

After downloading, you can complete the North Dakota Order that Petition for Termination of Trust be Granted by hand or an editing software program. Print it out and reuse the form many times. Do more for less with US Legal Forms!

Form popularity

FAQ

Can a trustee steal from a family trust? A trustee is the individual or entity charged with managing the trust.If through the accounting, or otherwise, beneficiaries learn that a trust stole money, they can charge the trustee with breaching their fiduciary duty and have them removed and surcharged.

Further, a trust will be considered as terminated when all the assets have been distributed except for a reasonable amount which is set aside in good faith for the payment of unascertained or contingent liabilities and expenses (not including a claim by a beneficiary in the capacity of beneficiary).

The first step in dissolving a revocable trust is to remove all the assets that have been transferred into it. The second step is to fill out a formal revocation form, stating the grantor's desire to dissolve the trust.

In other words, a California court may now terminate an irrevocable trust if all beneficiaries of the trust agree despite the presence of a spendthrift provision in the trust as long as the court finds good cause to do so.

Yes, a beneficiary can sue a trustee, but be aware, a judge will only entertain it if you have used reasonable care and allowing time for the trustee to respond. Transparency and bookkeeping will be the primary focus. Fiduciary duty calls out to be transparent and gives updates to beneficiaries and heirs.

In most situations, beneficiaries can remove a trustee who is not doing his or her job. However, you will need to show that certain conditions have been met to warrant removal.

An irrevocable trust is a trust with terms and provisions that cannot be changed. However, under certain circumstances, changes to an irrevocable trust can be made and a trust can even be terminated. A material purpose of the trust no longer exists.

If the settlor and all of the beneficiaries consent, an irrevocable inter vivos trust may be modified or terminated. A testamentary trust can be terminated by consent of all of the beneficiaries as long as a material purpose of the trust does not exist.

Yes, a beneficiary can sue a trustee. But a beneficiary must prove that a trustee has breached their fiduciary duty. A beneficiary cannot mount a successful challenge simply because he/she has a personal grudge against the trustee or because he/she simply feels the trust is unfair as it was created by the trust owner.