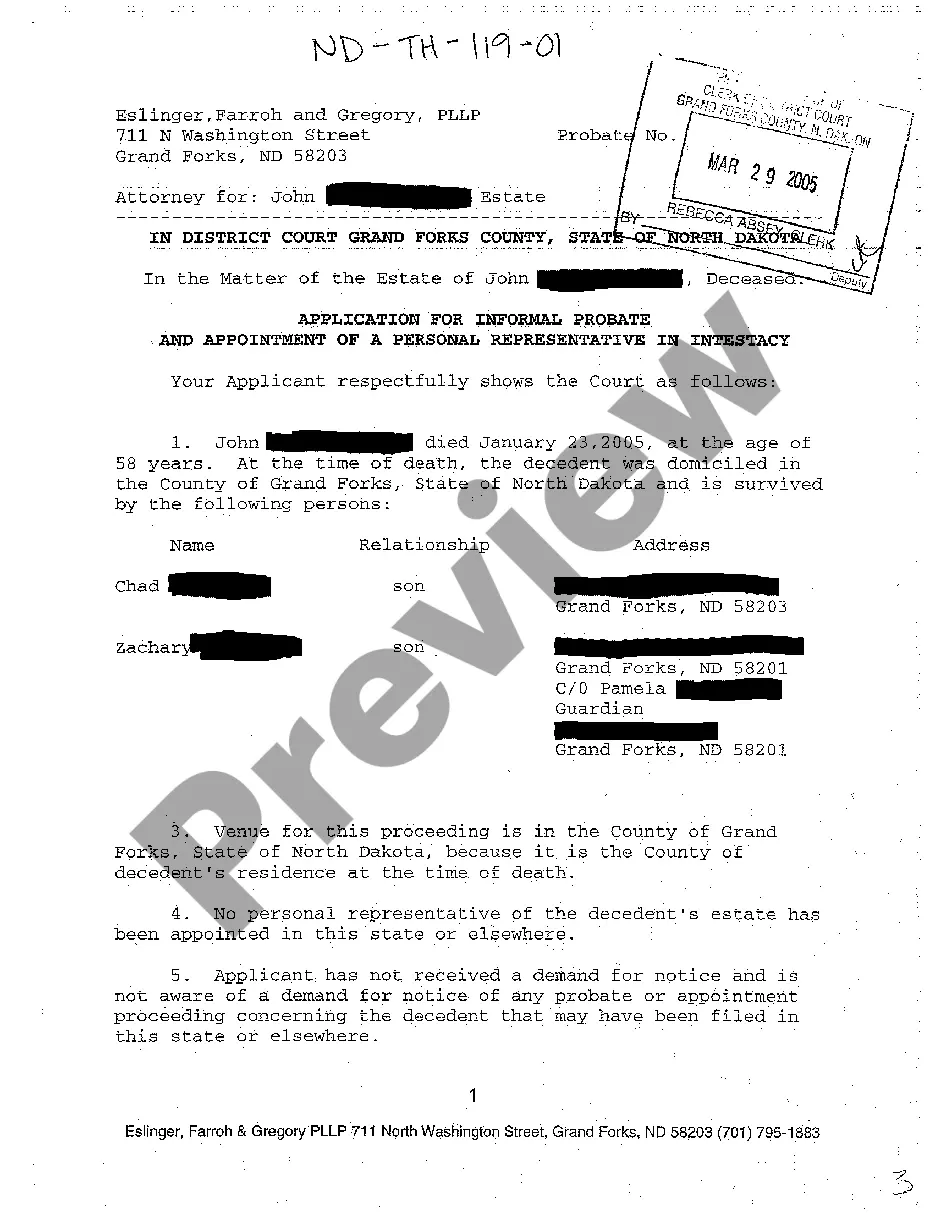

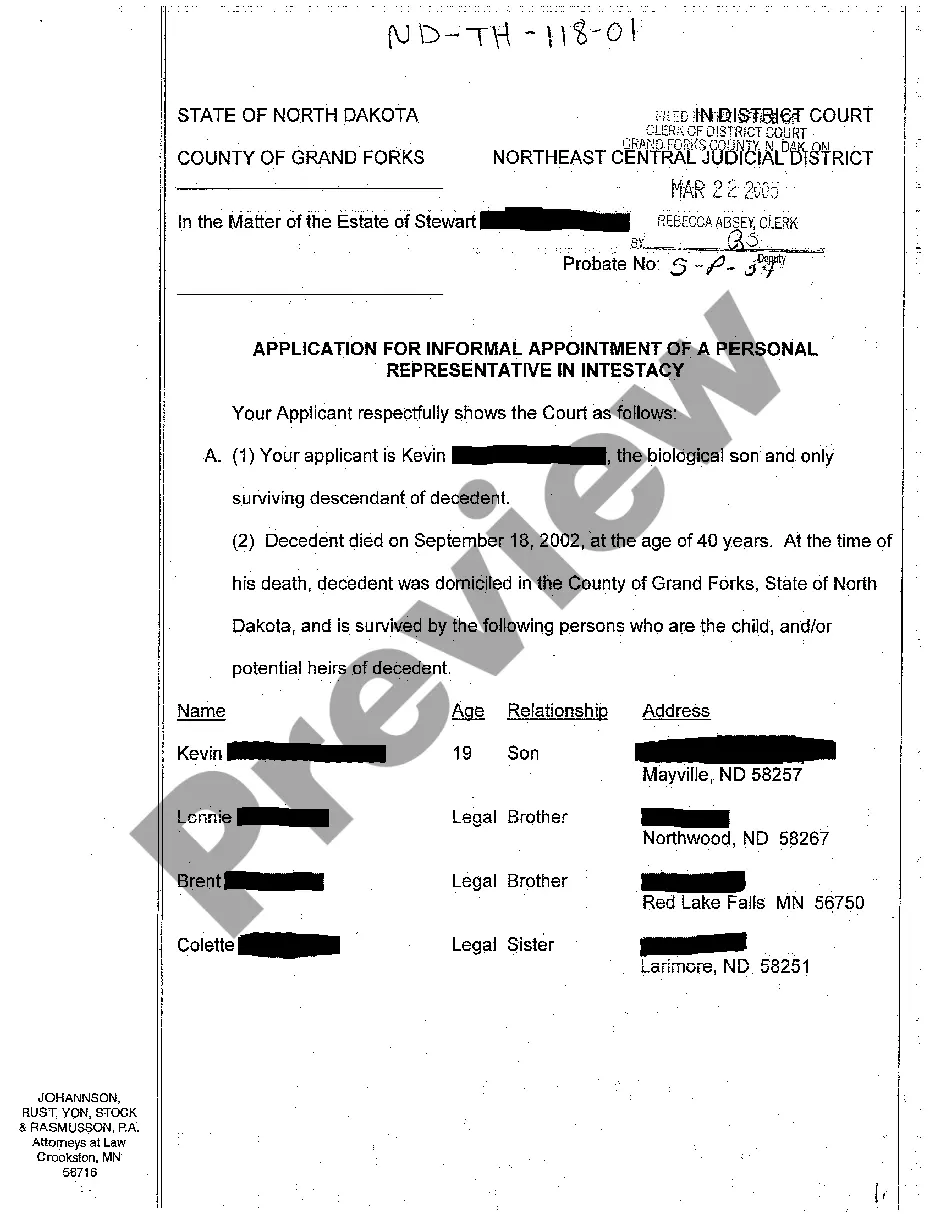

North Dakota Application for Informal Probate and Appointment of a Personal Representative in Intestacy

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

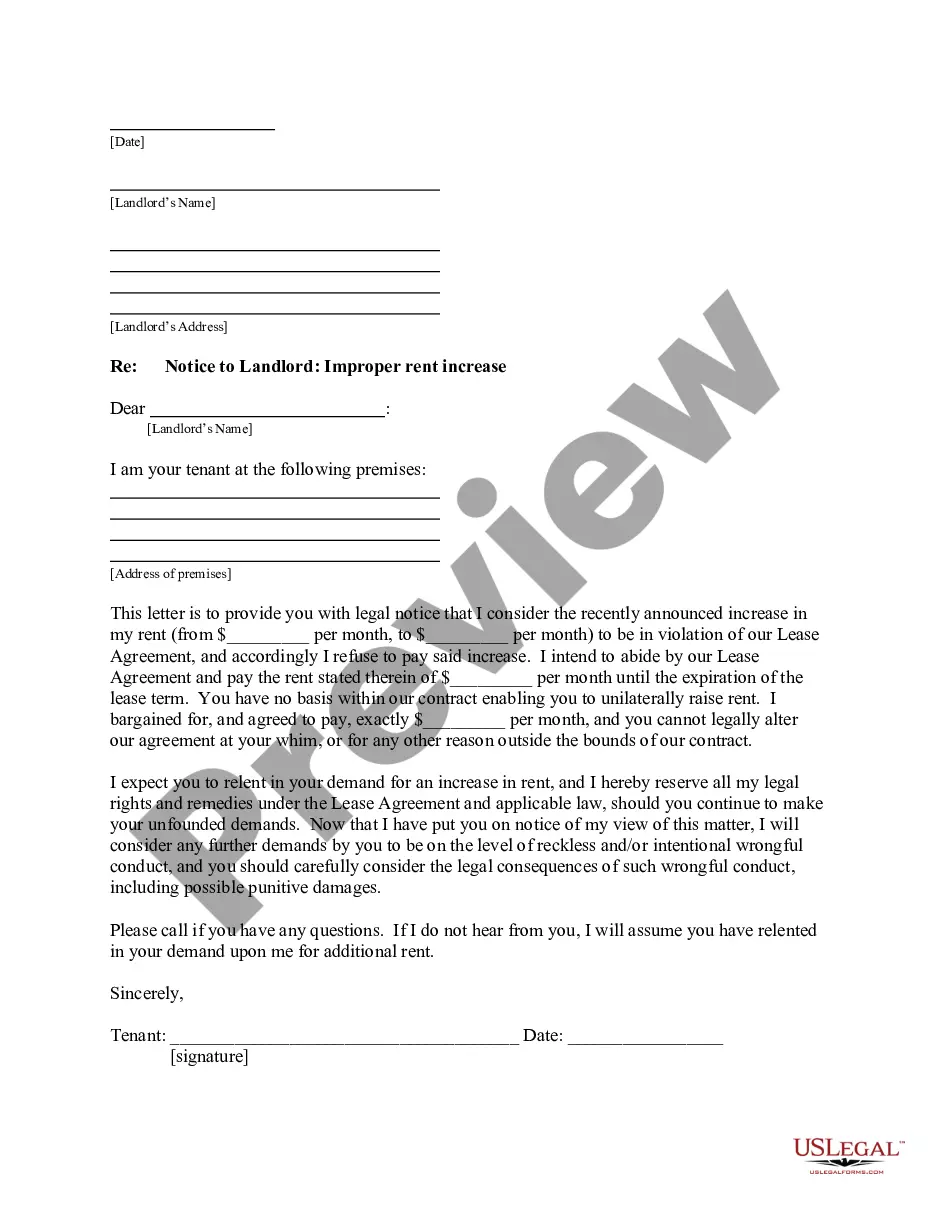

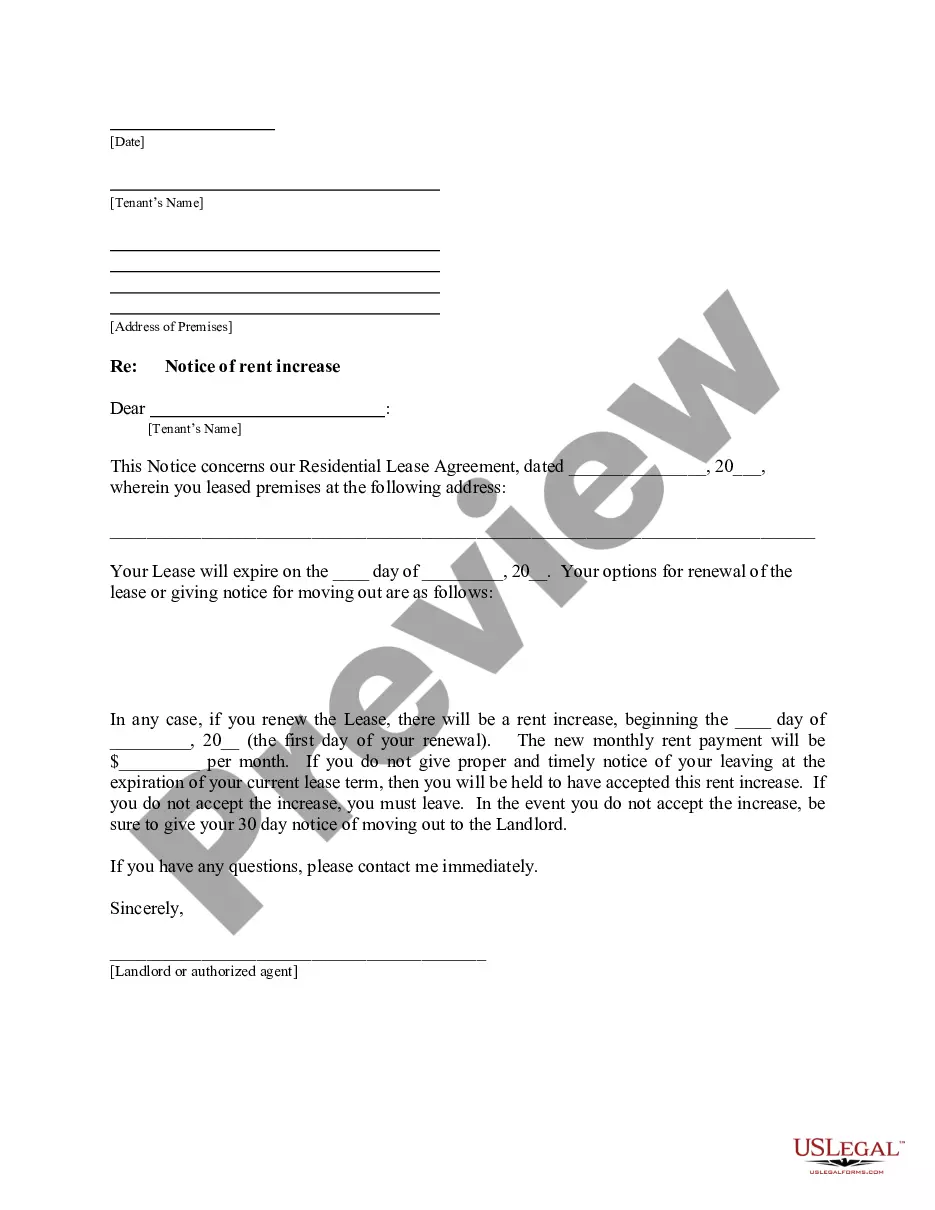

How to fill out North Dakota Application For Informal Probate And Appointment Of A Personal Representative In Intestacy?

Among hundreds of paid and free examples that you can find online, you can't be sure about their accuracy and reliability. For example, who created them or if they’re competent enough to take care of what you need them to. Always keep calm and make use of US Legal Forms! Get North Dakota Application for Informal Probate and Appointment of a Personal Representative in Intestacy samples made by professional attorneys and avoid the expensive and time-consuming process of looking for an attorney and then having to pay them to write a papers for you that you can find on your own.

If you have a subscription, log in to your account and find the Download button next to the file you are trying to find. You'll also be able to access your previously downloaded documents in the My Forms menu.

If you’re using our website the first time, follow the guidelines listed below to get your North Dakota Application for Informal Probate and Appointment of a Personal Representative in Intestacy easily:

- Ensure that the document you discover applies in the state where you live.

- Look at the file by reading the description for using the Preview function.

- Click Buy Now to begin the purchasing process or look for another example using the Search field in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted format.

Once you have signed up and bought your subscription, you may use your North Dakota Application for Informal Probate and Appointment of a Personal Representative in Intestacy as many times as you need or for as long as it stays active in your state. Edit it in your favored online or offline editor, fill it out, sign it, and print it. Do much more for less with US Legal Forms!

Form popularity

FAQ

An executor is someone named in your will, or appointed by the court, who is given the legal responsibility to take care of any remaining financial obligations. Typical duties include: Distributing assets according to the will. Maintaining property until the estate is settled (e.g., upkeep of a house)

By River Braun, J.D. If a will's executor dies or is unable to serve for other reasons, the court appoints another person. After your death, this person, also called an agent, personal representative, or fiduciary, handles your estate.

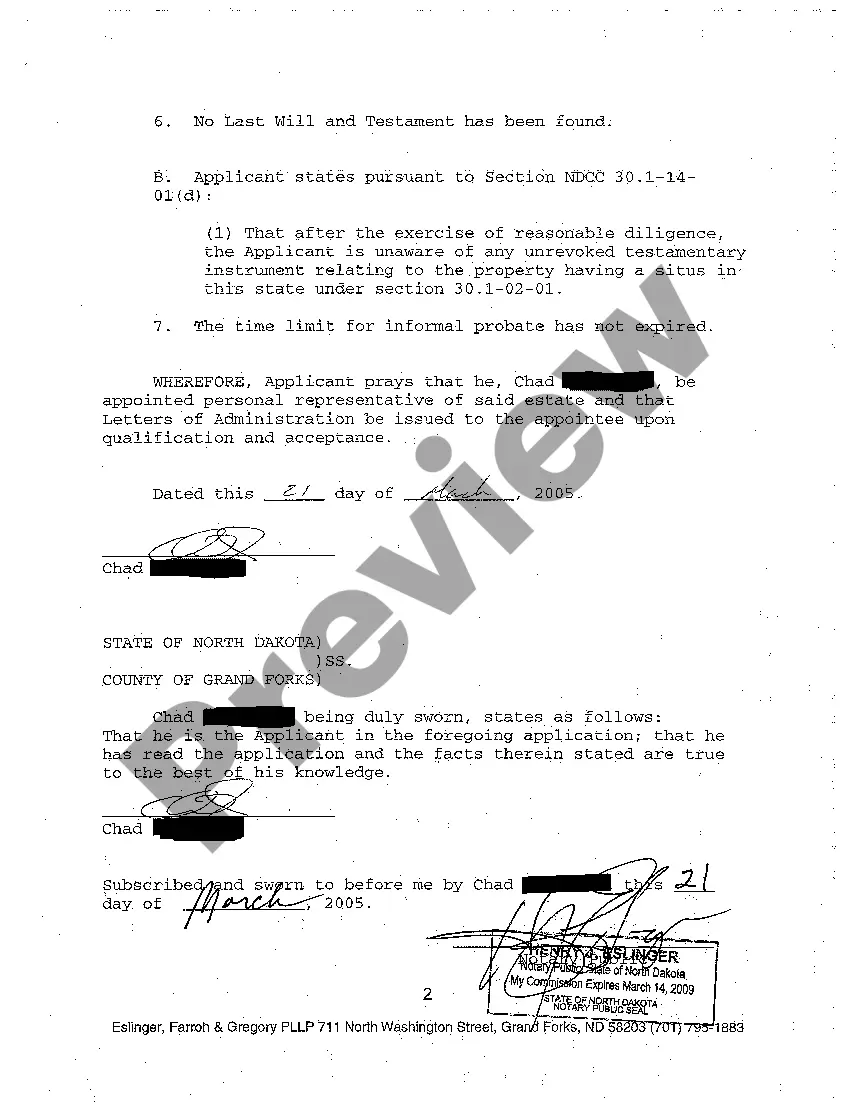

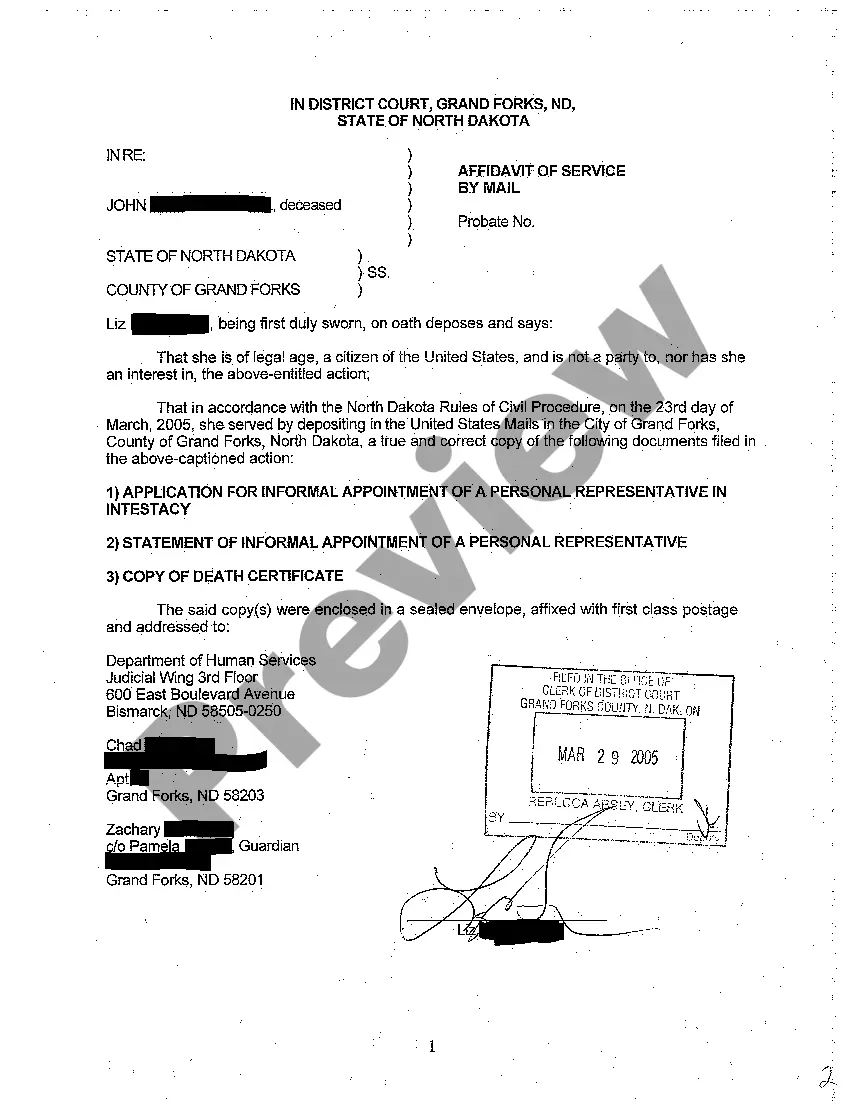

A personal representative usually is named in a will. However, courts sometimes appoint a personal representative. Usually, whether or not the deceased left a will, the probate court will issue a finding of fact that a will has or has not been filed and a personal representative or administrator has been appointed.

When a person dies, his or her property must be collected by the personal representative. After debts, taxes, and expenses are paid, the remaining assets are distributed to the decedent's beneficiaries.

Determine Your Priority for Appointment. Receive Written Waivers From Other Candidates. Contact Court in the County Where Deceased Resided. File the Petition for Administration. Attend the Probate Hearing. Secure a Probate Bond.

Locate Documents. Record the preferences of the testator. Check status of property and accounts. Confirm beneficiaries are correct. Make a list of personal possessions. Create a schedule of assets. Make a list of credit cards and debts. Electronic access to information.

To be appointed executor or personal representative, file a petition at the probate court in the county where your loved one was living before they died. In the absence of a will, heirs must petition the court to be appointed administrator of the estate.

You can administer an estate even if the deceased died without a will or failed to specify an executor. If your relationship to the deceased doesn't make you the probate court's default choice for administrator, you'll need to get permission from the relatives ahead of you in the priority order.

A beneficiary, or heir, is someone to which the deceased person has left assets, and a personal representative, sometimes called an executor or administrator, is the person in charge of handling the distribution of assets.