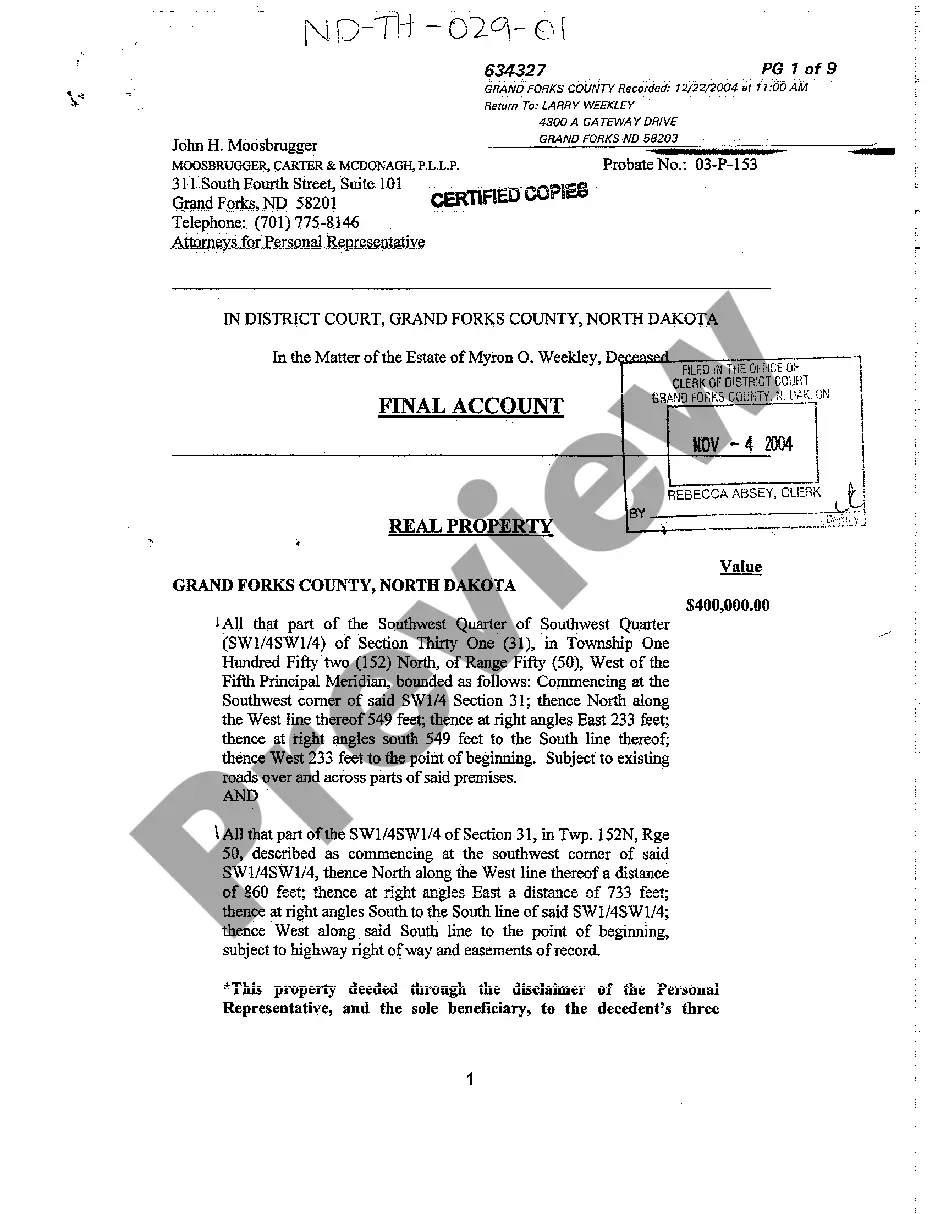

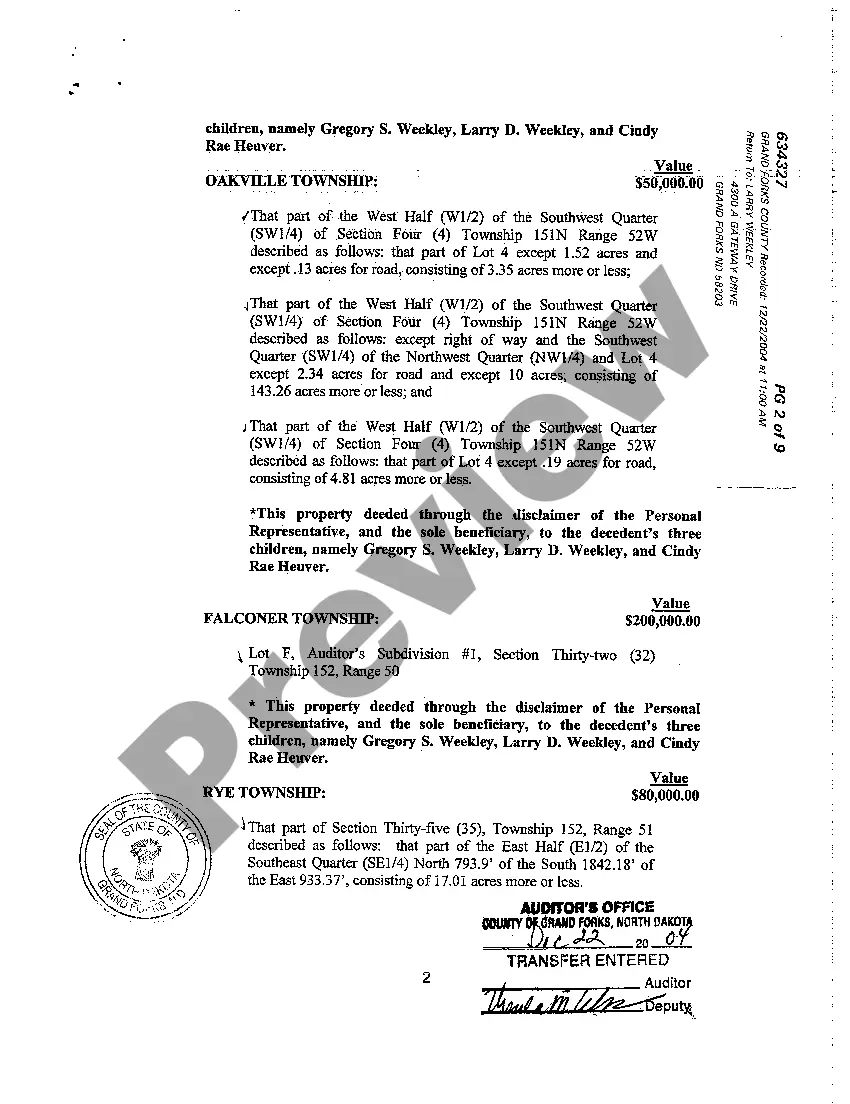

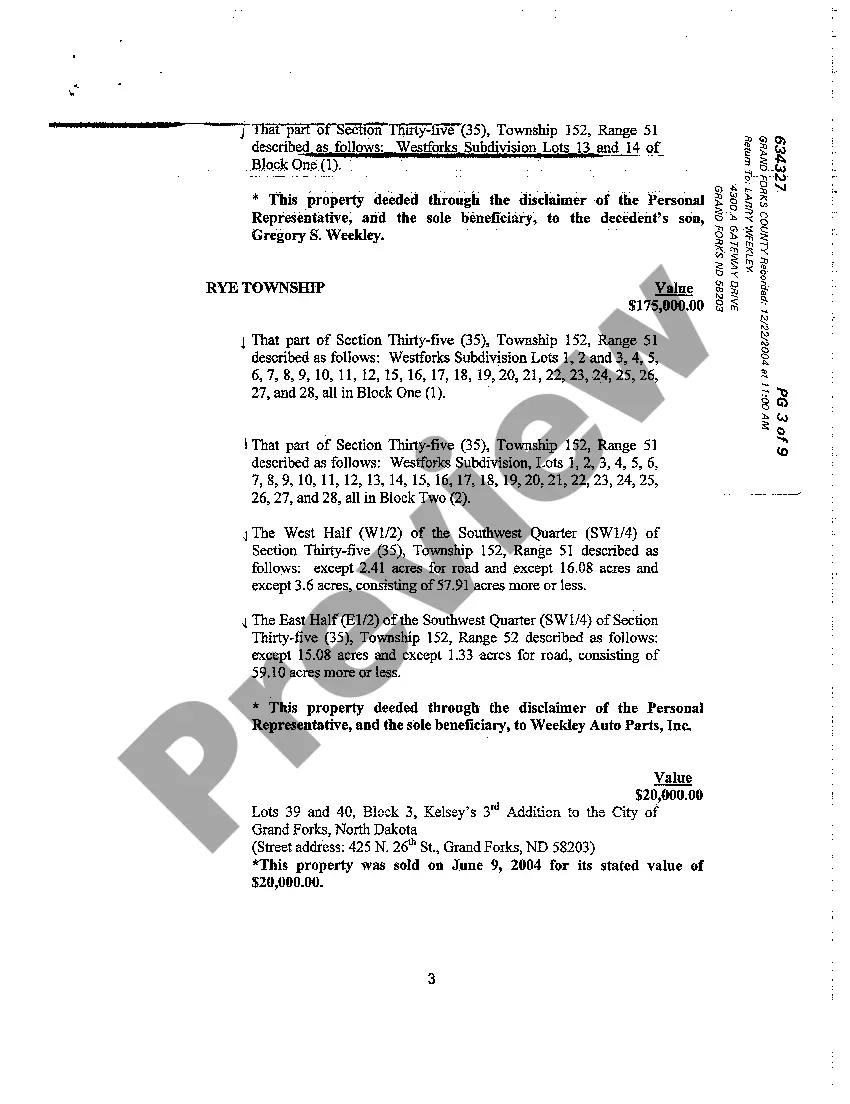

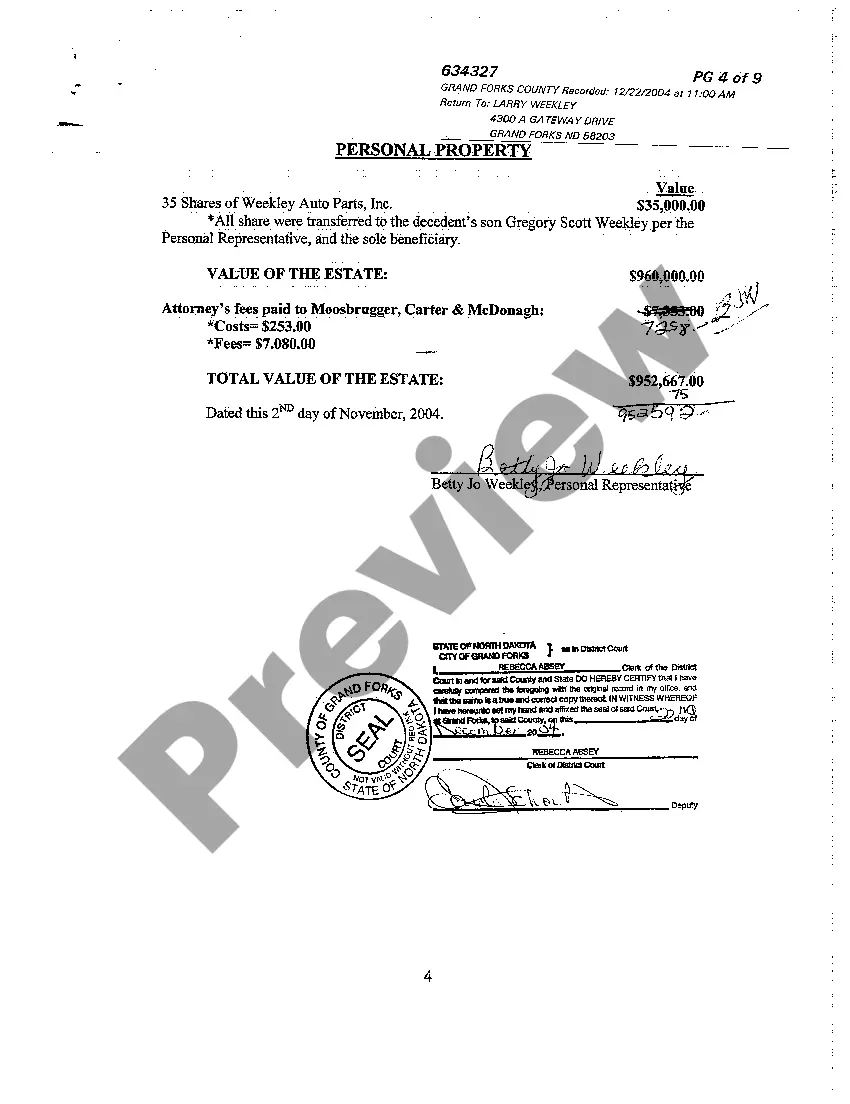

North Dakota Final Account Appraisal of Decedent's Property

Description

How to fill out North Dakota Final Account Appraisal Of Decedent's Property?

Among lots of paid and free examples that you can find on the net, you can't be certain about their accuracy. For example, who made them or if they’re qualified enough to deal with the thing you need them to. Always keep relaxed and utilize US Legal Forms! Get North Dakota Final Account Appraisal of Decedent's Property samples made by professional legal representatives and get away from the expensive and time-consuming process of looking for an attorney and then paying them to draft a papers for you that you can easily find on your own.

If you already have a subscription, log in to your account and find the Download button next to the file you’re looking for. You'll also be able to access all of your previously saved templates in the My Forms menu.

If you are using our service for the first time, follow the instructions below to get your North Dakota Final Account Appraisal of Decedent's Property quick:

- Ensure that the document you find is valid in the state where you live.

- Review the template by reading the description for using the Preview function.

- Click Buy Now to begin the ordering procedure or find another example utilizing the Search field in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the needed file format.

When you’ve signed up and bought your subscription, you may use your North Dakota Final Account Appraisal of Decedent's Property as many times as you need or for as long as it continues to be valid in your state. Edit it in your preferred online or offline editor, fill it out, sign it, and create a hard copy of it. Do far more for less with US Legal Forms!

Form popularity

FAQ

By Stephanie Kurose, J.D. Closing a person's estate after they die can often be a long, detailed process. This includes paying off debts, filing final tax returns, and, finally, distributing the estate's assets according to the wishes of the deceased.

After someone dies, it can be a number of months before the assets are distributed to the beneficiaries. If a Grant of Probate is necessary, the Supreme Court needs to be informed of the current assets and liabilities of the deceased before probate can occur.

If there's enough money in the estate account, an interim payment can be made to beneficiaries, with executors holding back some money to cover potential costs. These payments should be recorded by asking the beneficiaries to sign a written receipt.

Determine Your State's Laws Regarding Inventory Forms. Review the Instructions Provided. Identify Real Property. Identify Personal Property. Identify Bank Accounts. Identify Retirement Accounts. Identify Non-Probate Assets. File the Form With the Court.

If an Executor breaches this duty, then they can be held personally financially liable for their mistakes, and the financial claim that is made against them can be substantial. In an extreme example of this, one Personal Representative failed to settle the Inheritance Tax bill before distributing the Estate.

Q: How Long Does an Executor Have to Distribute Assets From a Will? A: Dear Waiting: In most states, a will must be executed within three years of a person's death.

Find the will, if any. File the will with the local probate court. Notify agencies and business of the death. Inventory assets and get appraisals. Decide whether probate is necessary. Coordinate with the successor trustee. Communicate with beneficiaries. Take good care of estate assets.

When the executor has paid off the debts, filed the taxes and sold any property needed to pay bills, he can submit a final estate accounting to the probate court. Once the probate court approves the accounting, he can distribute assets to you and other beneficiaries according to the terms of the will.

Those requirements are: That the estate assets are distributed at least 6 months after the deceased's date of death; That the executor has published a 30 day notice of his/her intent to distribute the estate; and. That the time specified in the notice has expired.