North Dakota Reservation of Production Payment

Description

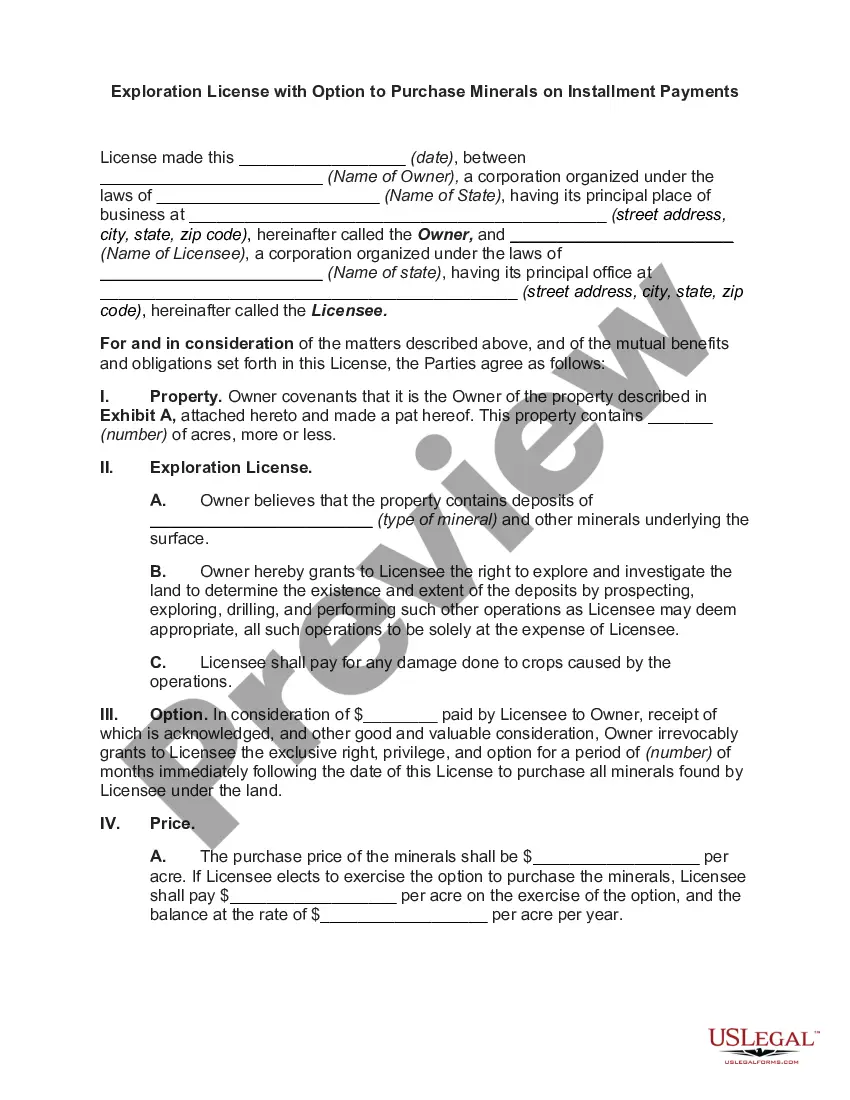

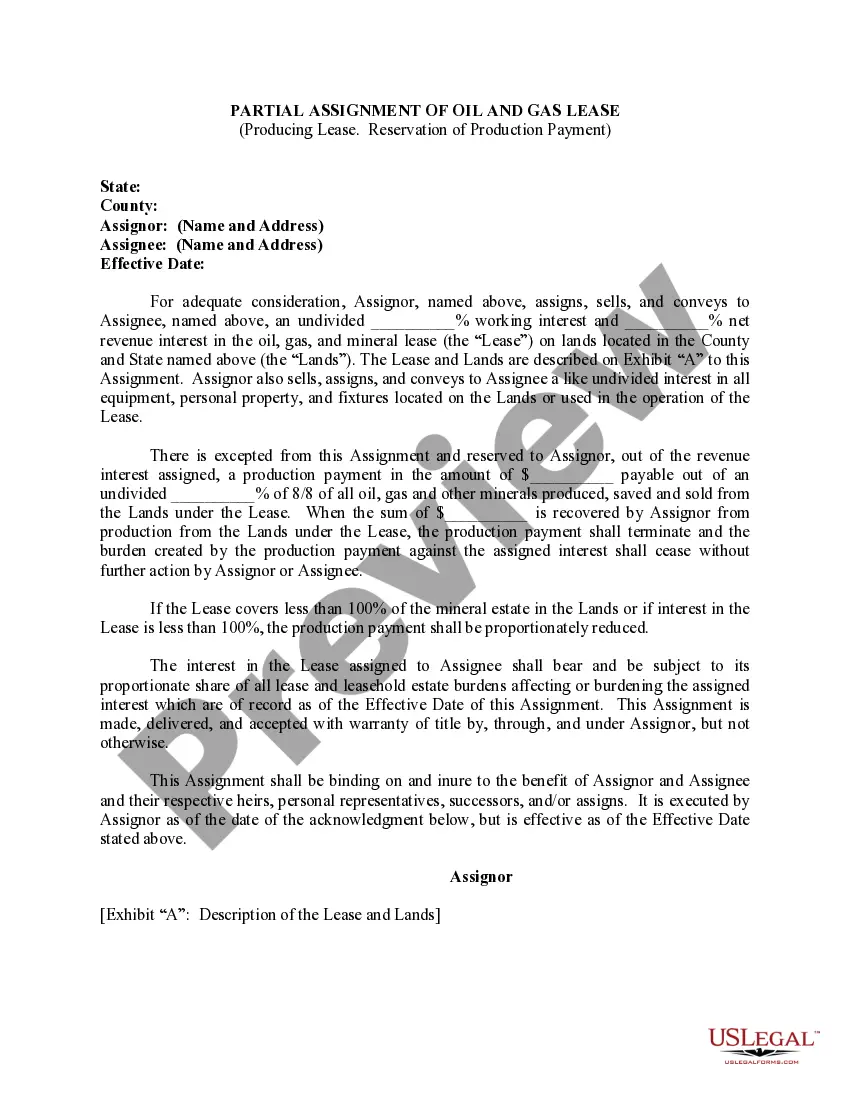

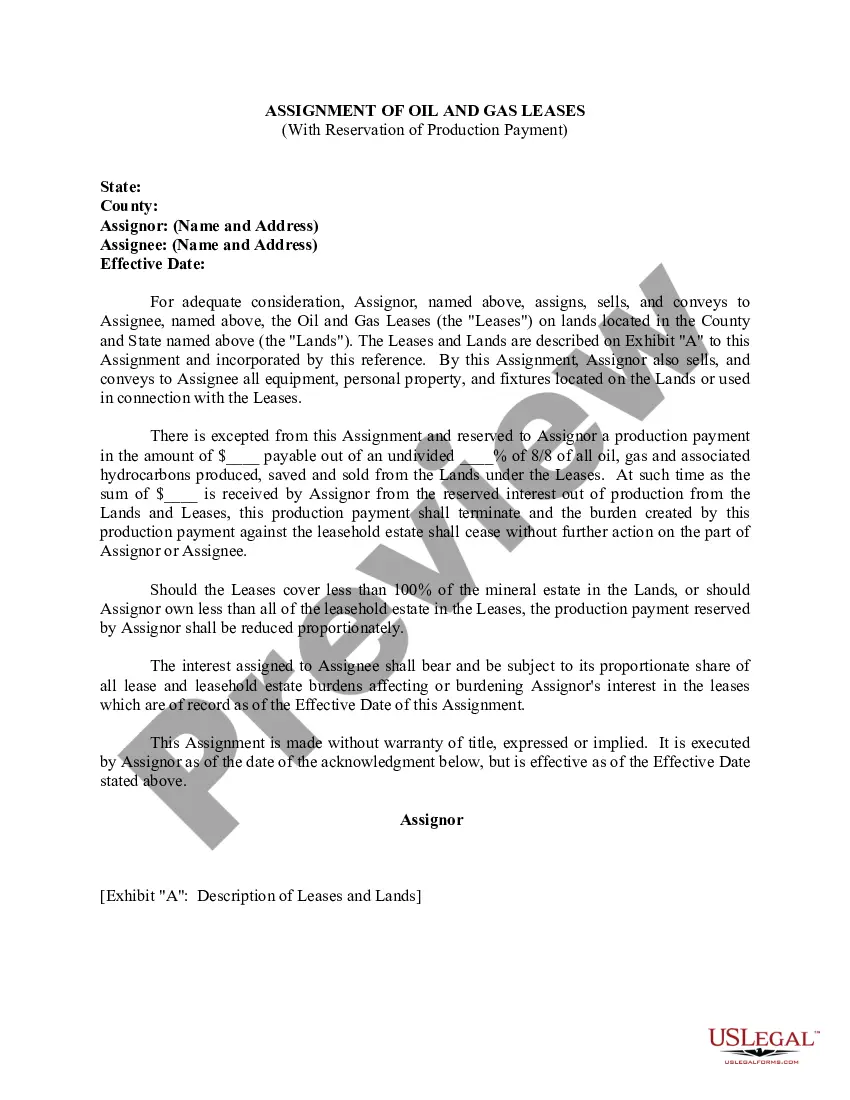

How to fill out Reservation Of Production Payment?

It is possible to commit hours on the web trying to find the legal record design that suits the federal and state needs you want. US Legal Forms offers a large number of legal forms which can be evaluated by specialists. It is possible to download or produce the North Dakota Reservation of Production Payment from the assistance.

If you already have a US Legal Forms profile, you can log in and click the Obtain option. Following that, you can full, change, produce, or sign the North Dakota Reservation of Production Payment. Each legal record design you acquire is your own eternally. To have an additional version associated with a acquired form, go to the My Forms tab and click the corresponding option.

If you use the US Legal Forms website the very first time, adhere to the straightforward recommendations beneath:

- Initial, make certain you have chosen the right record design for that county/area of your choice. Browse the form outline to ensure you have selected the proper form. If available, utilize the Review option to appear throughout the record design also.

- If you wish to discover an additional model of the form, utilize the Look for industry to get the design that fits your needs and needs.

- After you have identified the design you want, click Buy now to move forward.

- Pick the rates program you want, key in your credentials, and sign up for a free account on US Legal Forms.

- Comprehensive the purchase. You can utilize your credit card or PayPal profile to cover the legal form.

- Pick the format of the record and download it in your device.

- Make adjustments in your record if needed. It is possible to full, change and sign and produce North Dakota Reservation of Production Payment.

Obtain and produce a large number of record themes using the US Legal Forms site, that provides the most important assortment of legal forms. Use skilled and express-distinct themes to take on your organization or personal requirements.

Form popularity

FAQ

Oil & Gas Mineral Rights If your land is located in an area that is proven to have oil and gas, you have the ability to lease your mineral rights to drilling companies and receive a cash bonus just for signing the lease. The bonus is typically paid to you on a per-acre basis.

Mineral owners receive royalties from the operators as compensation for their share of all production of minerals on the property. During lease negotiations, the two parties define and record the terms of the royalty payment. Usually, the percentage of royalties ranges between 12.5% to 25%.

The number of oil and gas wells in production in North Dakota was 18,380 in August 2023, a change of +1.1 percent from the prior month and +4.2 percent from one year ago. Approximately 8 in 10 oil and gas wells are located in the four core oil and gas producing counties.

Nov. 17, 2022, at p.m. BISMARCK, N.D. (AP) ? An estimate of oil and gas mineral rights owned by North Dakota pegs their value at $2.8 billion, an 18% increase from last year, ing to an appraisal released Thursday to the state Land Board.

The coal severance tax is in lieu of sales and use taxes on the coal and commercial leonardite and property tax on minerals in the earth. Coal and commercial leonardite are taxed at a flat rate of 37.5 cents per ton. An additional 2-cent per ton tax is levied for the Lignite Research Fund.

Gross production tax - Oil. A tax of five percent of the gross value at the well is levied upon all oil produced within North Dakota, less the value of any part thereof, the ownership or right to which is exempt from taxation. The tax levied attaches to the whole production, including the royalty interest.

If you collect royalty income of $100,000, you could pay $30,000+ in taxes and only keep $70,000 and it would takes years to collect. Your basis in mineral rights can affect how much tax you owe when selling mineral rights vs collecting royalties. If you inherited mineral rights, it nearly always makes sense to sell.

As a mineral rights value rule of thumb, the 3X cash flow method is often used. To calculate mineral rights value, multiply the 12-month trailing cash flow by 3. For a property with royalty rights, a 5X multiple provides a more accurate valuation (stout.com).