North Dakota Ratification of Oil, Gas, and Mineral Lease by Nonparticipating Royalty Owner to Allow For Pooling

Description

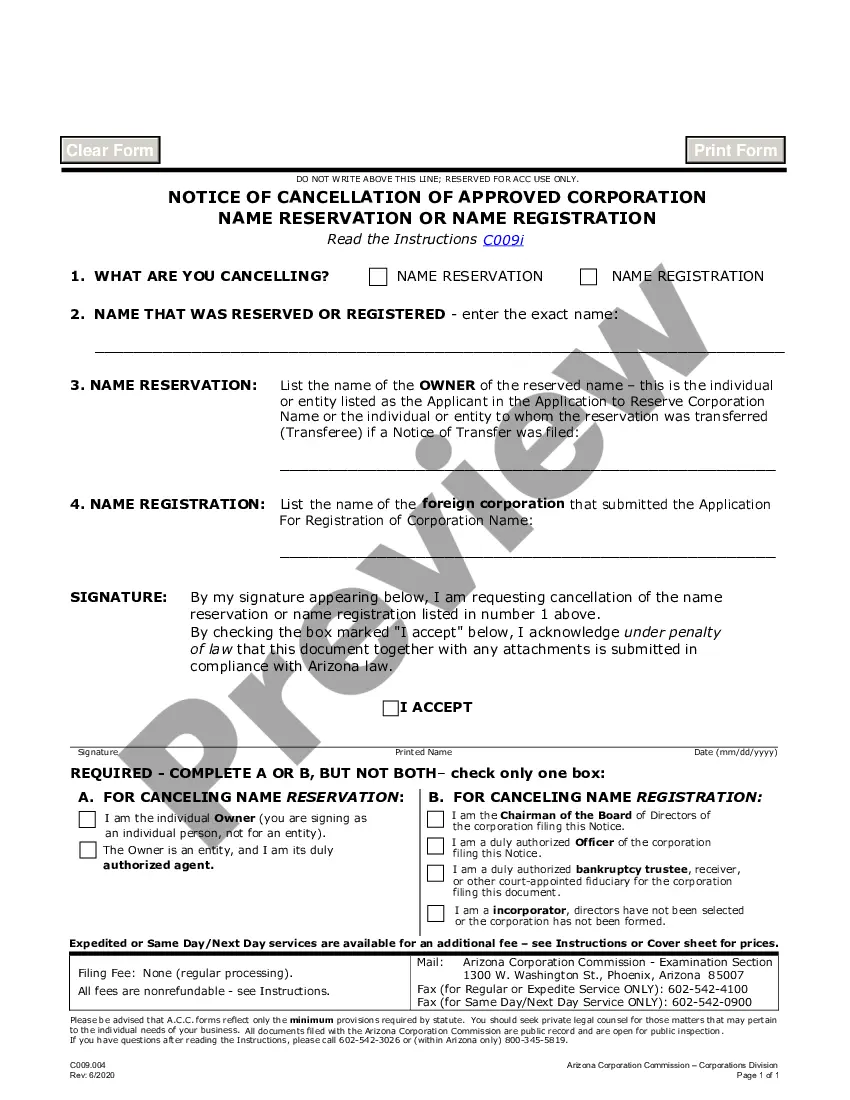

How to fill out Ratification Of Oil, Gas, And Mineral Lease By Nonparticipating Royalty Owner To Allow For Pooling?

If you wish to complete, download, or print legal papers web templates, use US Legal Forms, the greatest selection of legal forms, which can be found on the web. Take advantage of the site`s basic and practical research to get the papers you require. A variety of web templates for business and individual purposes are sorted by classes and claims, or keywords and phrases. Use US Legal Forms to get the North Dakota Ratification of Oil, Gas, and Mineral Lease by Nonparticipating Royalty Owner to Allow For Pooling in a handful of clicks.

When you are presently a US Legal Forms client, log in for your profile and then click the Acquire key to get the North Dakota Ratification of Oil, Gas, and Mineral Lease by Nonparticipating Royalty Owner to Allow For Pooling. You can also gain access to forms you previously downloaded within the My Forms tab of your respective profile.

Should you use US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Ensure you have chosen the form for that correct city/country.

- Step 2. Utilize the Preview option to examine the form`s content. Don`t overlook to read through the description.

- Step 3. When you are unhappy using the type, use the Search field towards the top of the monitor to locate other variations of the legal type template.

- Step 4. When you have discovered the form you require, select the Get now key. Pick the costs program you favor and include your qualifications to register on an profile.

- Step 5. Approach the financial transaction. You may use your bank card or PayPal profile to accomplish the financial transaction.

- Step 6. Choose the format of the legal type and download it on your product.

- Step 7. Complete, change and print or signal the North Dakota Ratification of Oil, Gas, and Mineral Lease by Nonparticipating Royalty Owner to Allow For Pooling.

Every single legal papers template you purchase is your own property eternally. You have acces to every single type you downloaded inside your acccount. Go through the My Forms portion and pick a type to print or download again.

Remain competitive and download, and print the North Dakota Ratification of Oil, Gas, and Mineral Lease by Nonparticipating Royalty Owner to Allow For Pooling with US Legal Forms. There are millions of professional and status-specific forms you can use for your business or individual requires.

Form popularity

FAQ

A ratification of an existing Texas oil and gas lease usually executed by a non-participating royalty interest owner or a non-executive mineral interest owner. It can be used for transactions involving business entities or private individuals.

To ?ratify? a lease means that the landowner and oil & gas producer, as current lessor and lessee of the land, agree (or re-agree) to the terms of the existing lease.

A mineral lease is a contractual agreement between the owner of a mineral estate (known as the lessor), and another party such as an oil and gas company (the lessee). The lease gives an oil or gas company the right to explore for and develop the oil and gas deposits in the area described in the lease.

Oil and gas royalties are typically calculated based on the value of the production. The royalty rate is negotiated between the owner of the mineral rights and the company extracting the oil and gas, and can range from 12.5% to 25% of the production value.

Is there more than one type of oil and gas lease? Yes, there are three types: a surface use lease, a non-surface use lease, and a dual purpose lease.

The royalty percentage is usually 12.5% to 15% but can change based on regional regulations or negotiations. Types of Leases: There are different types of oil and gas leases, and they affect royalty calculations differently.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain ?royalty interest? it is expensefree, bearing no operational costs of production.

In a few words, a pooling clause is written into a lease. This oil and gas clause allows the leased premises to be combined with other lands to form a single drilling unit. It's not uncommon for there to be a pool of oil or gas under numerous parcels of land.