North Dakota Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer

Description

How to fill out Mineral Deed With Grantor Reserving Executive Rights In The Interest Conveyed - Transfer?

You can devote time on the web searching for the legal document template that meets the state and federal requirements you will need. US Legal Forms offers 1000s of legal varieties that are evaluated by pros. It is simple to obtain or print out the North Dakota Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer from our services.

If you have a US Legal Forms bank account, you can log in and click on the Down load key. Following that, you can total, change, print out, or signal the North Dakota Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer. Each and every legal document template you purchase is your own property for a long time. To have an additional copy associated with a acquired develop, go to the My Forms tab and click on the related key.

If you work with the US Legal Forms website initially, follow the easy instructions under:

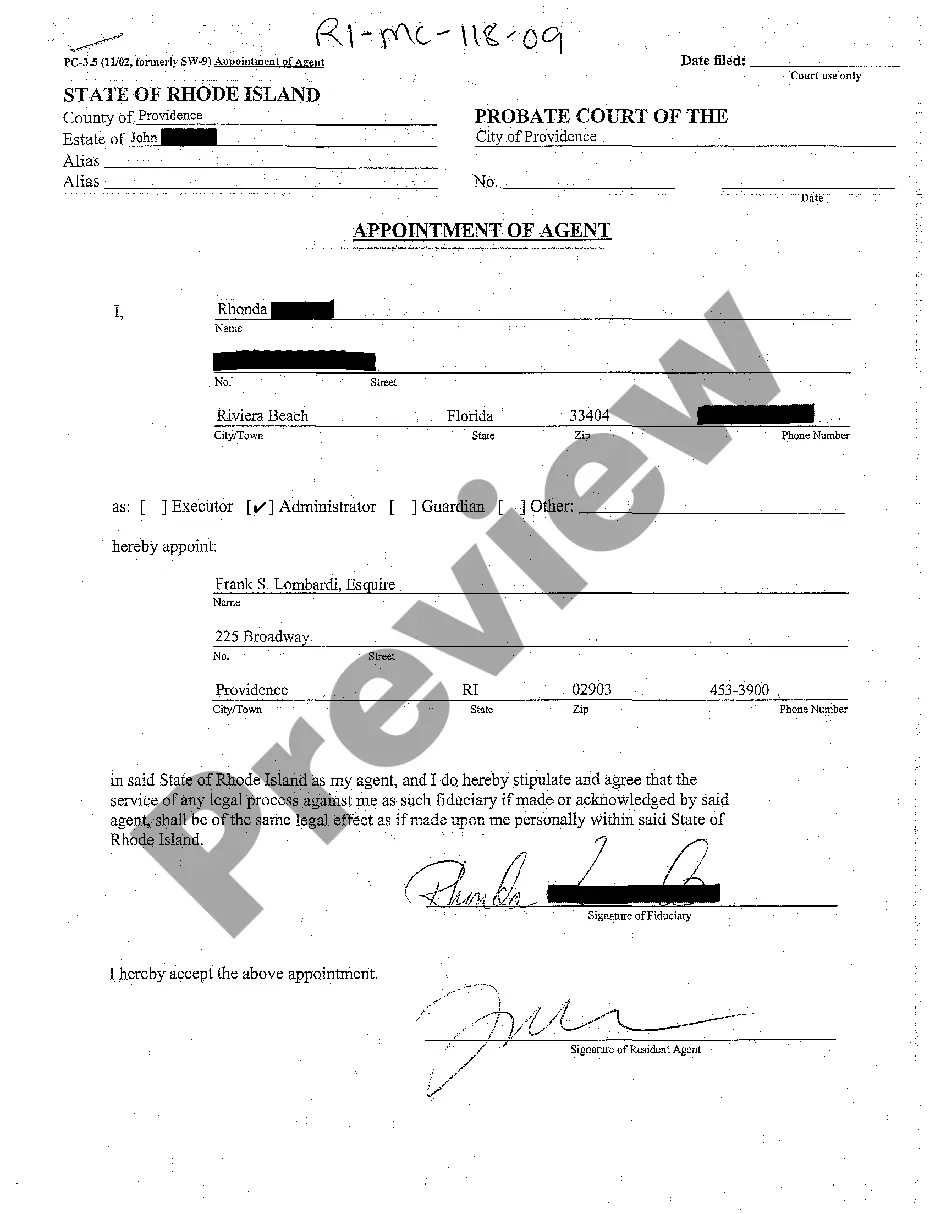

- Initial, make sure that you have selected the proper document template for the state/city of your choice. See the develop outline to ensure you have picked out the right develop. If accessible, use the Review key to look through the document template at the same time.

- If you want to get an additional variation of the develop, use the Lookup area to obtain the template that meets your needs and requirements.

- When you have identified the template you desire, simply click Acquire now to move forward.

- Pick the costs strategy you desire, type in your accreditations, and sign up for a merchant account on US Legal Forms.

- Total the purchase. You can utilize your charge card or PayPal bank account to purchase the legal develop.

- Pick the format of the document and obtain it to the product.

- Make modifications to the document if needed. You can total, change and signal and print out North Dakota Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer.

Down load and print out 1000s of document web templates making use of the US Legal Forms web site, that offers the greatest selection of legal varieties. Use specialist and status-particular web templates to handle your business or personal requires.

Form popularity

FAQ

Yes, it can be beneficial to sell your mineral rights for a fair price, even producing rights. First, sellers must be aware of the different stages of the production process. They must also know the value their minerals and royalties command in every development stage.

Mineral Rights Owner- If you are solely a mineral rights owner, you earn the royalties that come from extracting the minerals from the land in question. You do not have control over what occurs on the surface. As the mineral rights owner, you can sell, mine or produce the gas or oil below the surface.

Inheriting Oil and Gas Royalties: The Transfer Process This process is somewhat similar to inheriting real estate, but with some specific nuances. Will and Probate Process: If the deceased left a will, the mineral rights will be transferred ing to their wishes.

In general terms, the executive right holder is the party who has the right to take or authorize actions which affect the exploration and development of the mineral estate, including the right to execute oil and gas leases. Non-executive mineral interest owners do not have the power to lease the minerals.

A mineral rights owner does not necessarily have to own the land property itself but must have a legal agreement with the property owner. In North Dakota, mineral rights can be transferred in three ways: deed, probate or court action.

First International Bank & Trust's MineralTracker recently produced and presented a 40-page summary to the North Dakota Land Board estimating the total value of North Dakota-owned oil and gas mineral rights at $2.8 billion, an 18% increase from prior year.

Transfer By Will It is also possible to transfer or pass down mineral rights by will. The right to minerals transfers at the time of death to the individuals named as beneficiaries. If no specific beneficiaries to the mineral rights are designated, ownership passes to the property and real estate heir.

Mineral rights can be divided by specific mineral commodities. For example, one company can own the mineral rights to coal, while another company owns the oil and gas rights. Consequently, it is important to know which minerals are included in a mineral deed. Some deeds specify that ?all minerals? are included.