North Dakota Self-Employed Tailor Services Contract

Description

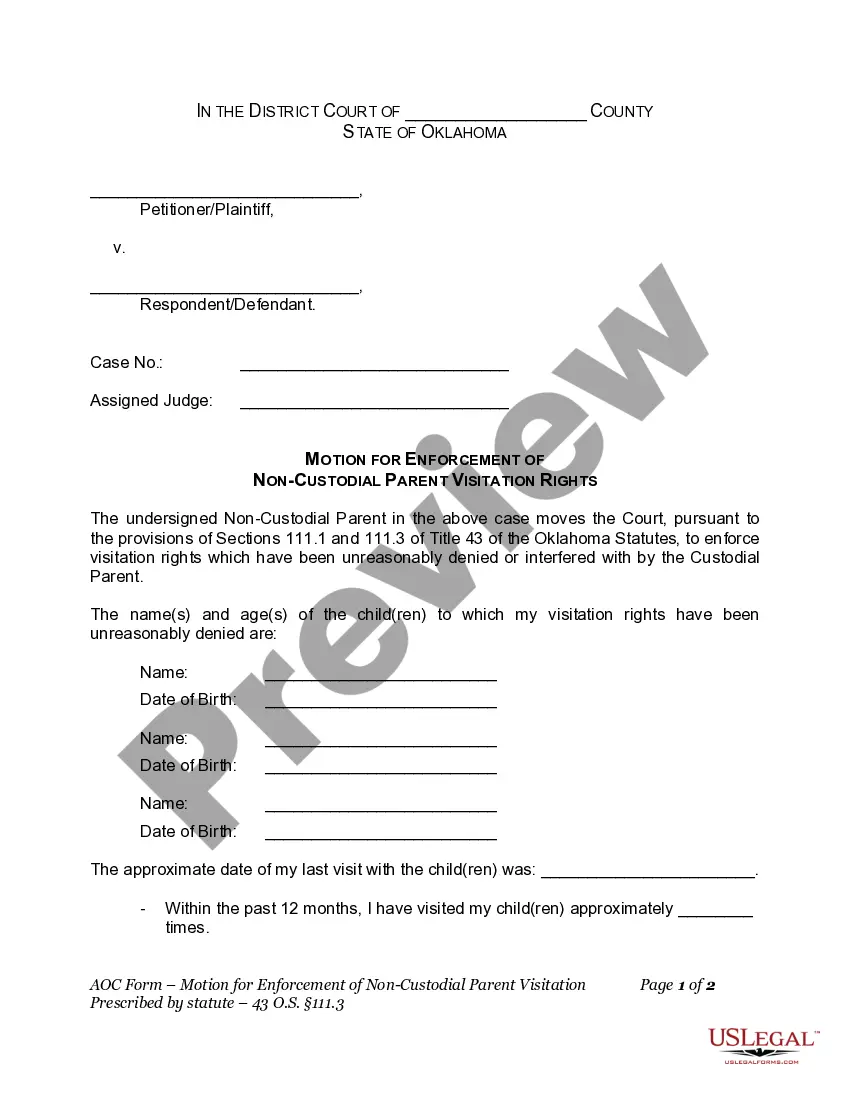

How to fill out Self-Employed Tailor Services Contract?

Locating the appropriate legal document template can be a challenge. It goes without saying that there are numerous styles available online, but how can you acquire the legal form you require? Utilize the US Legal Forms website. This service provides thousands of templates, including the North Dakota Self-Employed Tailor Services Contract, suitable for business and personal needs. All documents are reviewed by experts and comply with federal and state regulations.

If you are currently registered, Log In to your account and click the Acquire button to access the North Dakota Self-Employed Tailor Services Contract. Use your account to search through the legal documents you have previously obtained. Navigate to the My documents section of your account and download another copy of the document you need.

If you are a new user of US Legal Forms, here are some simple instructions you can follow: First, ensure that you have chosen the correct form for your area/state. You can review the form using the Review button and read the form description to confirm it is the appropriate one for you. If the form does not meet your requirements, use the Search field to find the correct form. Once you are confident that the form is suitable, click the Acquire now button to obtain the form. Select the pricing plan you desire and enter the required information. Create your account and pay for the order using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Finally, complete, modify, print, and sign the obtained North Dakota Self-Employed Tailor Services Contract.

By utilizing US Legal Forms, you can simplify the process of obtaining legal documents tailored to your specific needs.

- US Legal Forms is the largest collection of legal documents available.

- You can find numerous document templates.

- Use the service to download professionally crafted paperwork that complies with state requirements.

- Ensure you select the right form for your needs.

- Utilize the account features for easy access to your documents.

- Follow the instructions carefully to ensure a smooth process.

Form popularity

FAQ

Yes, you can write your own legally binding contract, provided it meets specific legal requirements. Make sure to include essential elements such as offer, acceptance, consideration, and mutual consent. It’s vital to ensure that both parties understand and agree to the terms outlined in the North Dakota Self-Employed Tailor Services Contract. To ensure compliance, you can refer to US Legal Forms for guidance and templates.

To write a simple employment contract, start by stating the parties involved and their roles. Clearly outline the terms of employment, including job responsibilities, compensation, and benefits. Include a section on termination conditions and any confidentiality agreements if necessary. Utilizing resources from US Legal Forms can help you draft a clear and concise North Dakota Self-Employed Tailor Services Contract.

When writing a contract for a 1099 employee, focus on the nature of the work and the relationship between you and the worker. Specify the services being provided, payment terms, and any relevant deadlines. It's crucial to emphasize that the worker is an independent contractor and not an employee. For a streamlined process, consider using templates from US Legal Forms that cater to North Dakota Self-Employed Tailor Services Contract.

Filling out an independent contractor agreement requires you to input specific information about yourself and the client. Start with your name, business name, and contact information. Then, detail the services you will provide under the North Dakota Self-Employed Tailor Services Contract, along with payment details and deadlines. A user-friendly template from US Legal Forms can guide you through this process effectively.

Writing a contract agreement for services involves outlining the services you will offer as a self-employed tailor in North Dakota. Clearly state the responsibilities of both parties, the timeline for completion, and how payment will be processed. Be sure to include any special terms or conditions that apply. Utilizing US Legal Forms can simplify this process with ready-to-use templates tailored for your needs.

To write a self-employment contract, start by clearly defining the scope of services you will provide as a tailor. Include essential details such as payment terms, deadlines, and any specific materials you will use. Make sure to specify the duration of the contract and include a clause for termination. You can use resources from US Legal Forms to find templates specifically designed for North Dakota Self-Employed Tailor Services Contract.

Independent contractors in North Dakota must comply with federal and state tax regulations, which include obtaining an EIN if necessary. Additionally, you should maintain a clear contract for your services, such as a North Dakota Self-Employed Tailor Services Contract. It's advisable to keep detailed records of your income and expenses to ensure legal compliance.

In North Dakota, not all contractors need a license, but certain trades and services may require one. For self-employed tailors, it is essential to check local regulations to determine if a license is necessary for your services. If you are unsure, resources like UsLegalForms can help clarify the requirements for your North Dakota Self-Employed Tailor Services Contract.

The amount you take home after taxes on a $100,000 income in North Dakota depends on various factors, including self-employment taxes and federal income tax rates. Typically, you may expect to retain around 70-75% after accounting for taxes. For tailored financial advice, especially if you're working under a North Dakota Self-Employed Tailor Services Contract, consider using a tax calculator or consulting a financial advisor.

While North Dakota does not legally require an operating agreement for LLCs, having one is highly recommended. An operating agreement outlines the management structure and operating procedures for your business. This is especially useful for self-employed tailors who want to clarify roles and responsibilities under a North Dakota Self-Employed Tailor Services Contract.