North Dakota Heating Contractor Agreement - Self-Employed

Description

How to fill out Heating Contractor Agreement - Self-Employed?

You might invest hours online trying to locate the valid document template that meets your state and federal requirements. US Legal Forms provides thousands of valid forms that have been evaluated by professionals.

You can download or print the North Dakota Heating Contractor Agreement - Self-Employed from our platform.

If you already possess a US Legal Forms account, you can Log In and click the Download button. After that, you can complete, modify, print, or sign the North Dakota Heating Contractor Agreement - Self-Employed. Every legal document template you purchase belongs to you for life. To obtain another copy of the acquired form, go to the My documents tab and click the appropriate button.

Choose the format of the document and download it to your device. Make modifications to your document if necessary. You can complete, alter, sign, and print the North Dakota Heating Contractor Agreement - Self-Employed. Acquire and print thousands of document templates using the US Legal Forms website, which offers the largest selection of valid forms. Utilize professional and state-specific templates to address your business or personal requirements.

- If you are utilizing the US Legal Forms website for the first time, follow these simple steps.

- First, ensure that you have selected the correct document template for the state/area of your choice. Review the form summary to confirm you have chosen the right form.

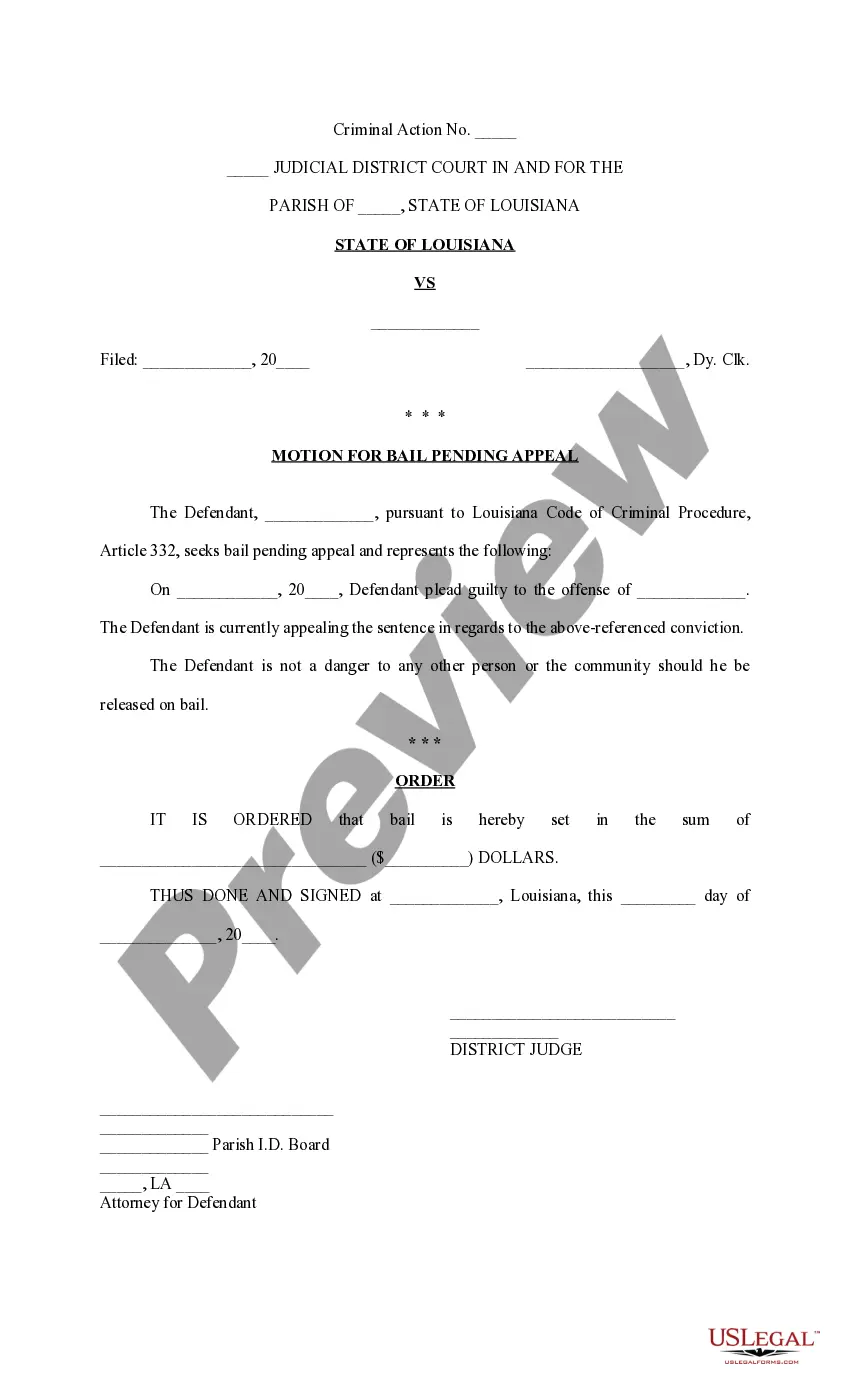

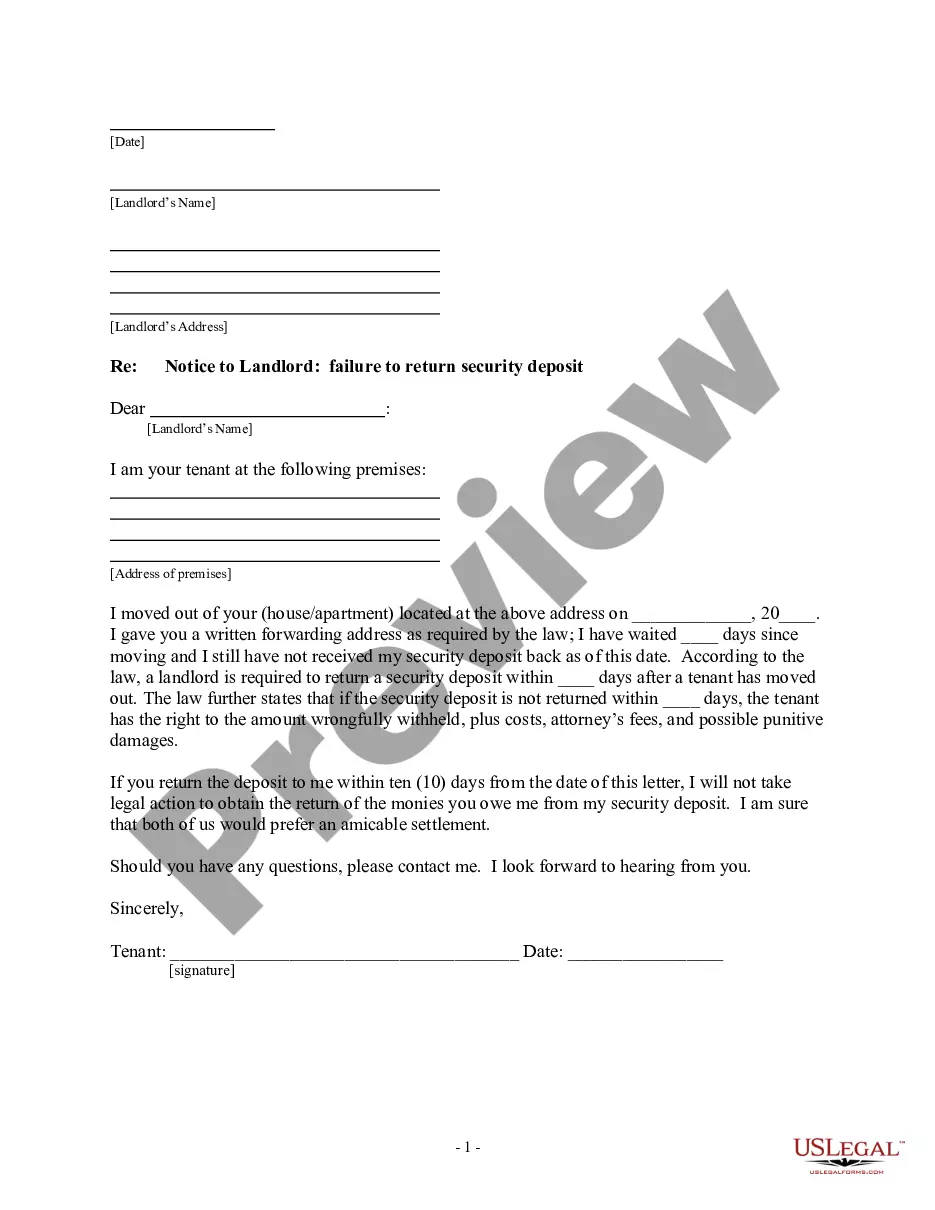

- If available, use the Preview button to examine the document template as well.

- If you wish to obtain another version of the form, use the Search section to find the template that meets your needs.

- Once you have located the template you require, click Get now to proceed.

- Select the pricing plan you want, fill in your details, and sign up for an account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the legal form.

Form popularity

FAQ

Writing an independent contractor agreement requires a clear structure that includes both parties’ information, a description of the services, and payment details. Start with an introduction that identifies the contractor and client, then outline the terms of work and payment schedule. Use simple language to define responsibilities and confidentiality terms. By utilizing resources like US Legal Forms, you can easily create a robust North Dakota Heating Contractor Agreement - Self-Employed tailored to your needs.

Filling out an independent contractor form involves providing accurate details about the contractor and the employer. Begin by entering personal information such as names and addresses, followed by the specific service to be provided. Clearly outline payment rates and duration of the work to avoid misunderstandings. When working on a North Dakota Heating Contractor Agreement - Self-Employed, this form helps set clear expectations and responsibilities.

To fill out an independent contractor agreement, start by gathering necessary information about both parties, including names, contact details, and business identifiers. Clearly define the scope of work and payment terms to establish expectations. Make sure to include project timelines and confidentiality clauses to protect sensitive information. This template serves as an effective tool for a North Dakota Heating Contractor Agreement - Self-Employed, simplifying the process.

Creating an independent contractor agreement involves several key steps. Start by detailing the scope of work, payment details, and duration of the project. Use a template like the North Dakota Heating Contractor Agreement - Self-Employed to simplify the process. Platforms like uslegalforms provide easy-to-use templates that guide you through each section, ensuring you include all necessary information to protect your rights.

In North Dakota, while an operating agreement is not legally required for an LLC, it is highly recommended. This document helps clarify the roles and responsibilities of members within the LLC. For contractors, incorporating a North Dakota Heating Contractor Agreement - Self-Employed as part of your operating agreement provides an added layer of protection. It ensures everyone is on the same page, which ultimately benefits your business.

Yes, you can definitely have a contract if you're self-employed. In fact, having a North Dakota Heating Contractor Agreement - Self-Employed is crucial for defining your responsibilities and protections. This contract outlines the terms of your work, payment details, and other essential elements. It helps establish a clear understanding between you and your clients.

Yes, a contract is essential for independent contractors. It sets clear expectations regarding the work scope, payment terms, and project timelines. Having a solid contract helps protect both the contractor and the client from misunderstandings. If you are looking to establish a North Dakota Heating Contractor Agreement - Self-Employed, using a professional template can ensure that all critical elements are included.

An operating agreement for an LLC in North Dakota outlines the company's structure, member responsibilities, and operational procedures. While not mandated by law, having this document helps establish clear guidelines and reduces potential disputes. For professionals engaged in the North Dakota Heating Contractor Agreement - Self-Employed, a well-crafted operating agreement can provide a solid foundation for business operations. Accessing tools such as those offered by uslegalforms can simplify the process of creating this document.

In North Dakota, the self-employment tax is typically about 15.3%, which includes Social Security and Medicare taxes. As a self-employed individual, understanding this tax is important for budgeting your finances. This tax applies to all net earnings from self-employment, which is particularly relevant for those involved in a North Dakota Heating Contractor Agreement - Self-Employed. To manage this effectively, consulting with a tax professional may be beneficial.

Yes, an LLC can exist without an operating agreement, but it is not advisable. Without this document, the business may face challenges in decision-making and conflict resolution. An operating agreement provides a clear outline of management and operational processes, making it invaluable. If you're forming an LLC for a North Dakota Heating Contractor Agreement - Self-Employed, consider drafting one for added protection.