North Dakota Fireplace Contractor Agreement - Self-Employed

Description

How to fill out Fireplace Contractor Agreement - Self-Employed?

Are you currently in the location where you require documentation for either professional or personal reasons nearly every day.

There are numerous legal document templates accessible online, but finding ones you can trust is not easy.

US Legal Forms provides a vast array of form templates, including the North Dakota Fireplace Contractor Agreement - Self-Employed, designed to fulfill federal and state regulations.

Choose the pricing plan you want, complete the required information to create your account, and purchase the transaction using your PayPal or credit card.

Select a convenient file format and download your copy. Retrieve all the document templates you have acquired in the My documents menu. You can access an additional copy of the North Dakota Fireplace Contractor Agreement - Self-Employed at any time, if needed. Just click on the relevant form to obtain or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service offers professionally crafted legal document templates that can be used for various purposes. Create your account on US Legal Forms and start making your life easier.

- If you are already acquainted with the US Legal Forms website and have your account, simply Log In.

- Then, you can download the North Dakota Fireplace Contractor Agreement - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

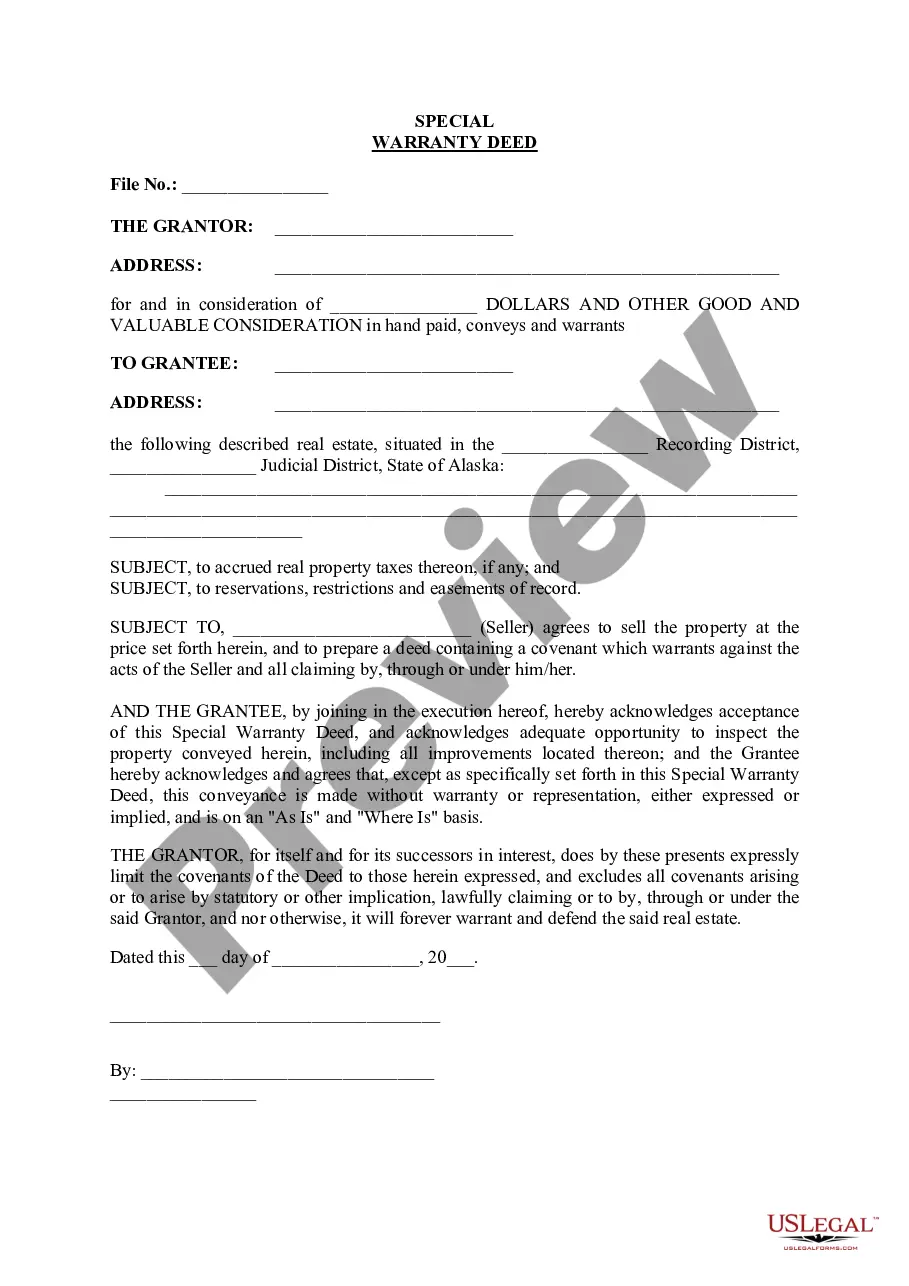

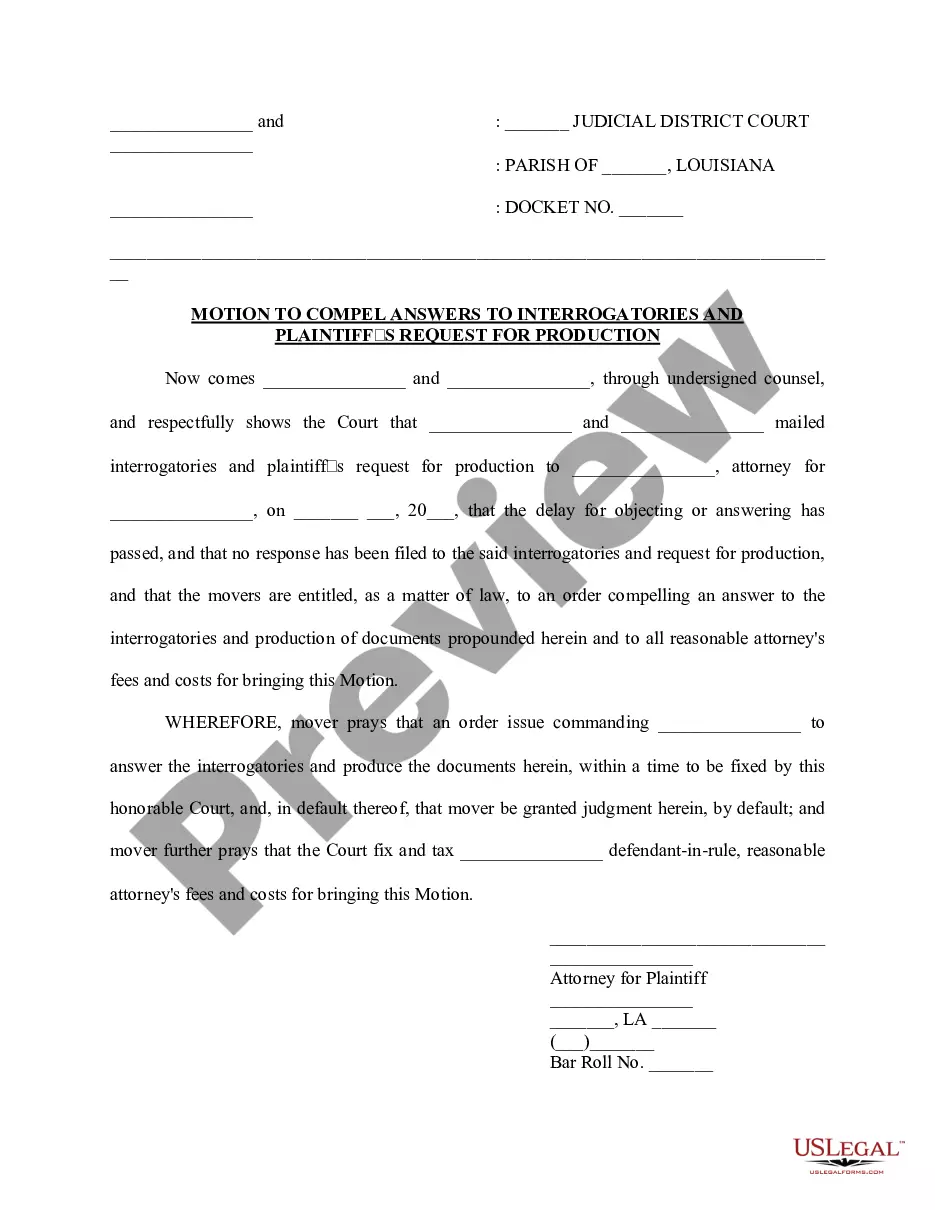

- Use the Preview button to review the form.

- Read the description to confirm you have selected the right form.

- If the form is not what you’re looking for, use the Search field to find the form that meets your needs.

- Once you find the correct form, click Buy now.

Form popularity

FAQ

A basic independent contractor agreement outlines the relationship between a contractor and the client, detailing the services to be performed. It typically includes provisions for payment schedules, deadlines, and deliverables. For those needing a North Dakota Fireplace Contractor Agreement - Self-Employed, it's essential that the contract protects both parties and clarifies expectations. Utilizing US Legal Forms can provide you with an easy-to-use template that ensures compliance with state laws.

To write an independent contractor agreement, start by clearly defining the scope of work. Include specific details such as project timelines, payment terms, and responsibilities. A North Dakota Fireplace Contractor Agreement - Self-Employed should also cover termination clauses and confidentiality, ensuring both parties understand their rights. Using a reliable platform like US Legal Forms can simplify this process by providing templates that meet legal standards.

In North Dakota, contractors typically use agreements like the North Dakota Fireplace Contractor Agreement - Self-Employed to outline the terms and conditions of their work. This legal document helps protect both the contractor and the client by clearly defining roles, responsibilities, and project expectations. Having such a contract can prevent disputes and provide a roadmap for successful completion of work. You can easily find templates and forms through platforms like US Legal Forms to meet your specific needs.

The self-employment tax in North Dakota consists of Social Security and Medicare taxes for individuals who work for themselves, such as those using the North Dakota Fireplace Contractor Agreement - Self-Employed. As a self-employed contractor, you are responsible for the full 15.3% tax rate, which includes both the employer and employee portions. It is important to keep accurate financial records and plan for this tax obligation throughout the year. You may also want to consult with a tax professional to ensure you understand your responsibilities.

To fill out an independent contractor form, start by entering the personal details of the contractor, including name and contact information. Next, outline the scope of work, payment details, and the duration of the contract. This ensures clarity and alignment between parties. The North Dakota Fireplace Contractor Agreement - Self-Employed can assist you with a structured approach to complete this form efficiently.

When writing a self-employed contract, include a comprehensive description of the services you will provide. Clearly outline payment structures, deadlines, and any terms regarding liability or termination. The North Dakota Fireplace Contractor Agreement - Self-Employed can be a beneficial resource in structuring your contract to ensure that all important aspects are covered.

Filling out an independent contractor agreement involves entering specific information in the designated sections. Begin by adding the contractor’s name, address, and contact details. Then, specify the services offered, payment terms, and both parties' signatures. Utilizing a template, like the North Dakota Fireplace Contractor Agreement - Self-Employed, can guide you through this process effectively.

An independent contractor statement offers a summary of the terms and conditions agreed upon between the contractor and client. It typically outlines the work to be performed, payment details, and the duration of the project. This statement is essential for clarity and can help prevent misunderstandings, particularly when drafting a North Dakota Fireplace Contractor Agreement - Self-Employed.

To write an independent contractor agreement, start by clearly defining the roles and responsibilities of each party involved. Include essential details such as payment terms, work scope, deadlines, and confidentiality agreements. The North Dakota Fireplace Contractor Agreement - Self-Employed can serve as a solid template to ensure you include all necessary legal elements, making the process simpler.

In North Dakota, contractors generally do not need a specific state license for most construction work. However, certain trades, like electrical and plumbing, may require licenses at the local level. It’s important to check local regulations to ensure compliance, especially for specialized jobs. If you’re drafting a North Dakota Fireplace Contractor Agreement - Self-Employed, make sure you understand the licensing requirements pertinent to your work.