North Dakota Instructions for Completing Request for Loan Modification and Affidavit RMA Form

Description

How to fill out Instructions For Completing Request For Loan Modification And Affidavit RMA Form?

If you need to finalize, obtain, or produce legal document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Take advantage of the site’s simple and user-friendly search to locate the documents you require. Various templates for business and personal use are categorized by regions and states, or by keywords.

Use US Legal Forms to secure the North Dakota Instructions for Completing Request for Loan Modification and Affidavit RMA Form within just a few clicks.

Every legal document template you purchase is yours indefinitely. You have access to every form you obtained within your account. Navigate to the My documents section and select a form to print or download again.

Stay proactive and download, and print the North Dakota Instructions for Completing Request for Loan Modification and Affidavit RMA Form with US Legal Forms. There are various professional and state-specific forms available for your business or personal requirements.

- If you are a current US Legal Forms user, Log In to your account and click the Download button to retrieve the North Dakota Instructions for Completing Request for Loan Modification and Affidavit RMA Form.

- You can also access forms you previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

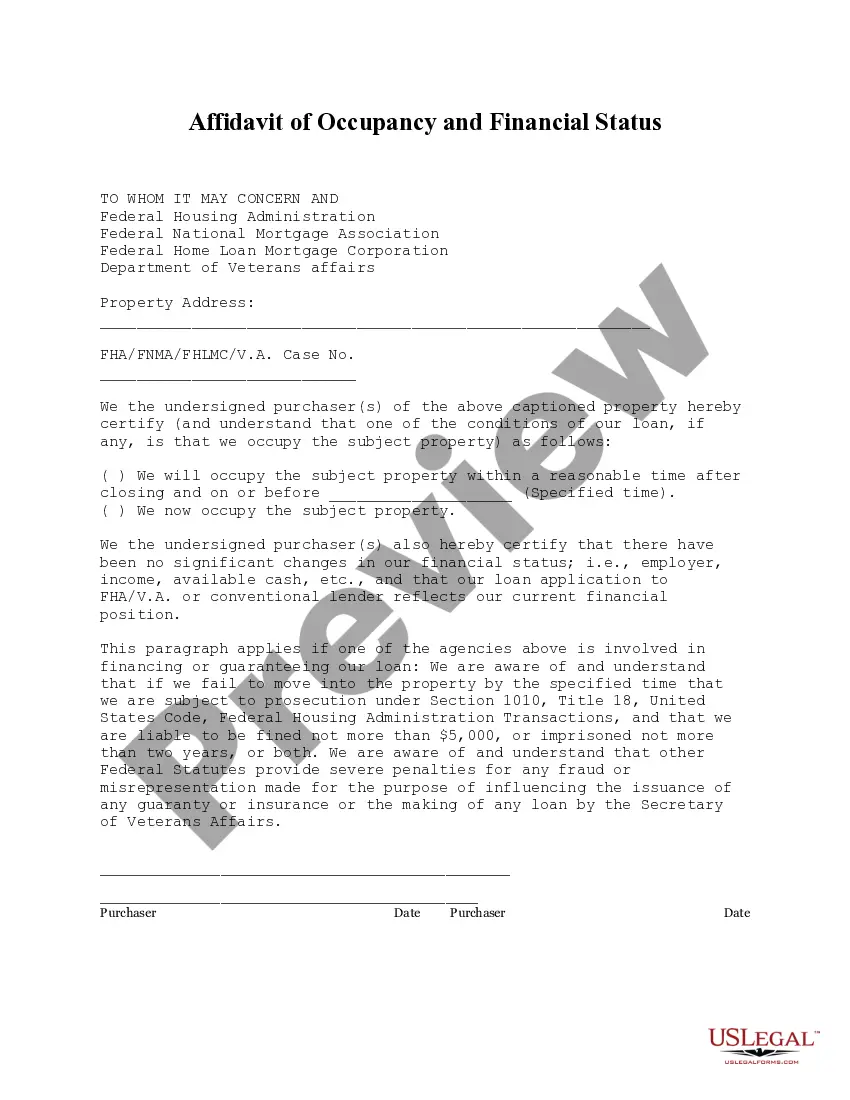

- Step 2. Use the Preview option to review the form's content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the page to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click on the Purchase now button. Select the pricing plan you prefer and enter your information to register for an account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the payment.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the North Dakota Instructions for Completing Request for Loan Modification and Affidavit RMA Form.

Form popularity

FAQ

In North Dakota, the standard redemption period following a foreclosure is typically six months. However, it can extend to one year under certain circumstances, such as if the property is agricultural land. Knowing about the North Dakota Instructions for Completing Request for Loan Modification and Affidavit RMA Form will be essential if you hope to utilize the redemption period effectively. Being prepared with this information can empower you to make informed decisions.

The FHA loan limit varies by county in North Dakota, designed to meet the local housing market needs. Generally, you can expect the limits to range from $320,000 to over $400,000 depending on specific areas and property types. To thrive in this environment, reviewing the North Dakota Instructions for Completing Request for Loan Modification and Affidavit RMA Form could assist you in understanding your financing options. This resource can help you prepare for the necessary paperwork related to your FHA loan.

The redemption rule allows property owners to reclaim their property after foreclosure by paying off the due amount within a certain period. In North Dakota, this period typically lasts for six months after the foreclosure sale. Familiarizing yourself with the North Dakota Instructions for Completing Request for Loan Modification and Affidavit RMA Form can help if you're seeking to navigate this process effectively. This support can offer you clarity on your rights and options.

Yes, you can sell your house during the redemption period after a foreclosure. This can be a strategic move, especially if you're aiming to settle debts or avoid further financial issues. However, ensure you have the North Dakota Instructions for Completing Request for Loan Modification and Affidavit RMA Form prepared, as this may impact your future financial dealings. Remember, consulting a real estate expert can also provide valuable insights into your options.

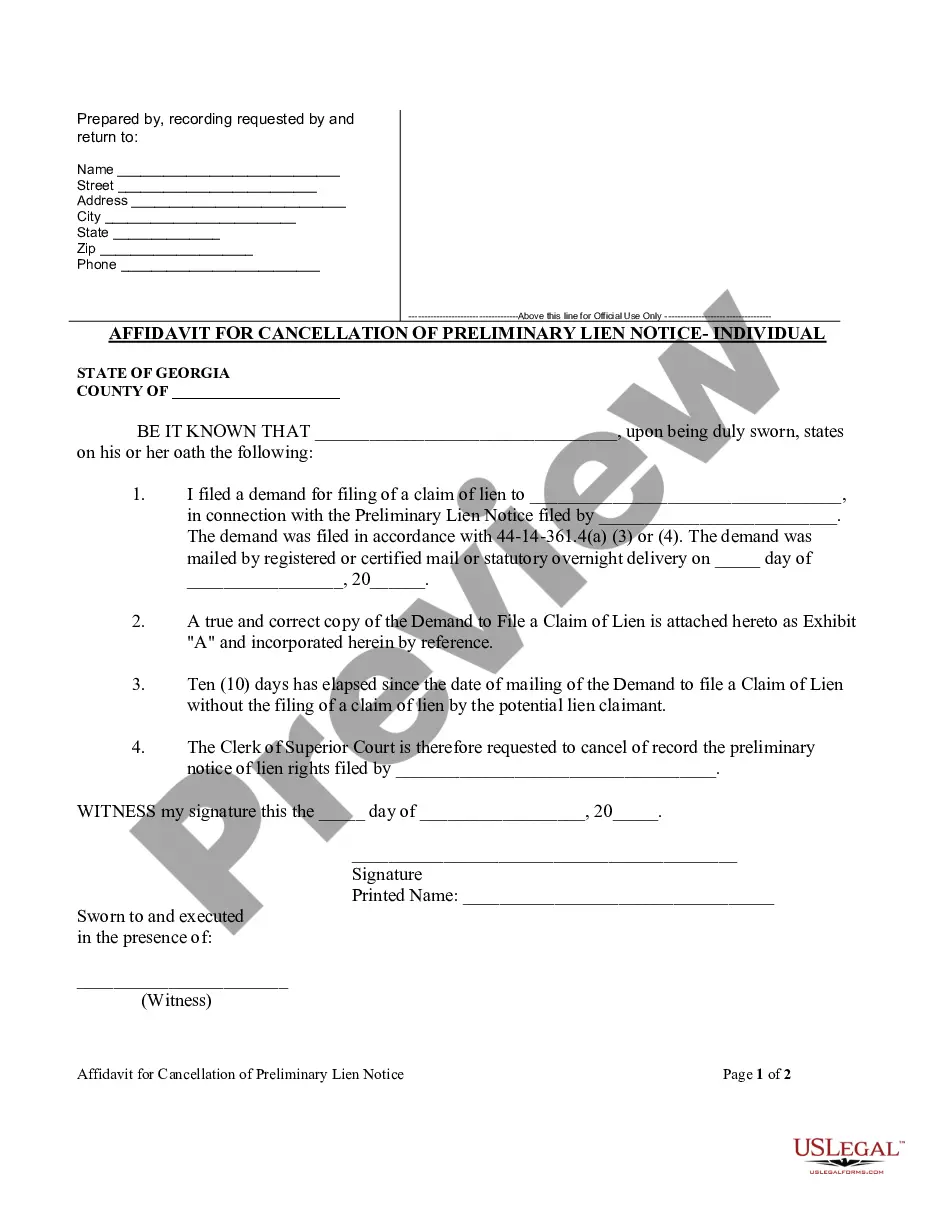

Creating an affidavit of service involves documenting the details of how you delivered legal documents to the other party. You must complete the North Dakota Instructions for Completing Request for Loan Modification and Affidavit RMA Form, detailing the date, time, and method of service. Include your personal affidavit stating the facts of the service. Once this is done, you should file the affidavit with the court to demonstrate compliance with service requirements.

An example of an affidavit might involve a person declaring the nature of their income or verifying a particular event related to their financial situation. This type of document can serve various purposes, such as supporting a loan modification request. When completing the affidavit required in the North Dakota Instructions for Completing Request for Loan Modification and Affidavit RMA Form, consider crafting a statement that fits your specific circumstances to help your case.

To write a simple affidavit, begin with a title stating it's an affidavit, followed by your personal information and a declaration of facts. Make sure your statements are clear and direct, avoiding unnecessary details. By consulting the North Dakota Instructions for Completing Request for Loan Modification and Affidavit RMA Form, you can simplify the process and focus on the essential elements your affidavit needs.

Writing an affidavit involves outlining the facts clearly and accurately, including your name, address, and the specific statements you declare under oath. A well-structured affidavit follows a straightforward format, where you start with an introduction and proceed with the body containing your statements. Use the North Dakota Instructions for Completing Request for Loan Modification and Affidavit RMA Form as a guideline to ensure your affidavit meets the necessary legal standards.

To ensure an affidavit is legally valid, it must include a clear statement of facts, be signed under oath, and be notarized by an authorized person. Without these elements, the affidavit may lack authenticity, which can affect your application. By following the North Dakota Instructions for Completing Request for Loan Modification and Affidavit RMA Form, you can create a valid affidavit that supports your loan modification request.

An affidavit PDF is a digital document that contains a sworn statement, verifying specific facts. This document usually requires a signature from a notary or authority. For those utilizing the North Dakota Instructions for Completing Request for Loan Modification and Affidavit RMA Form, understanding what an affidavit PDF entails is key to ensuring your submission meets legal requirements.