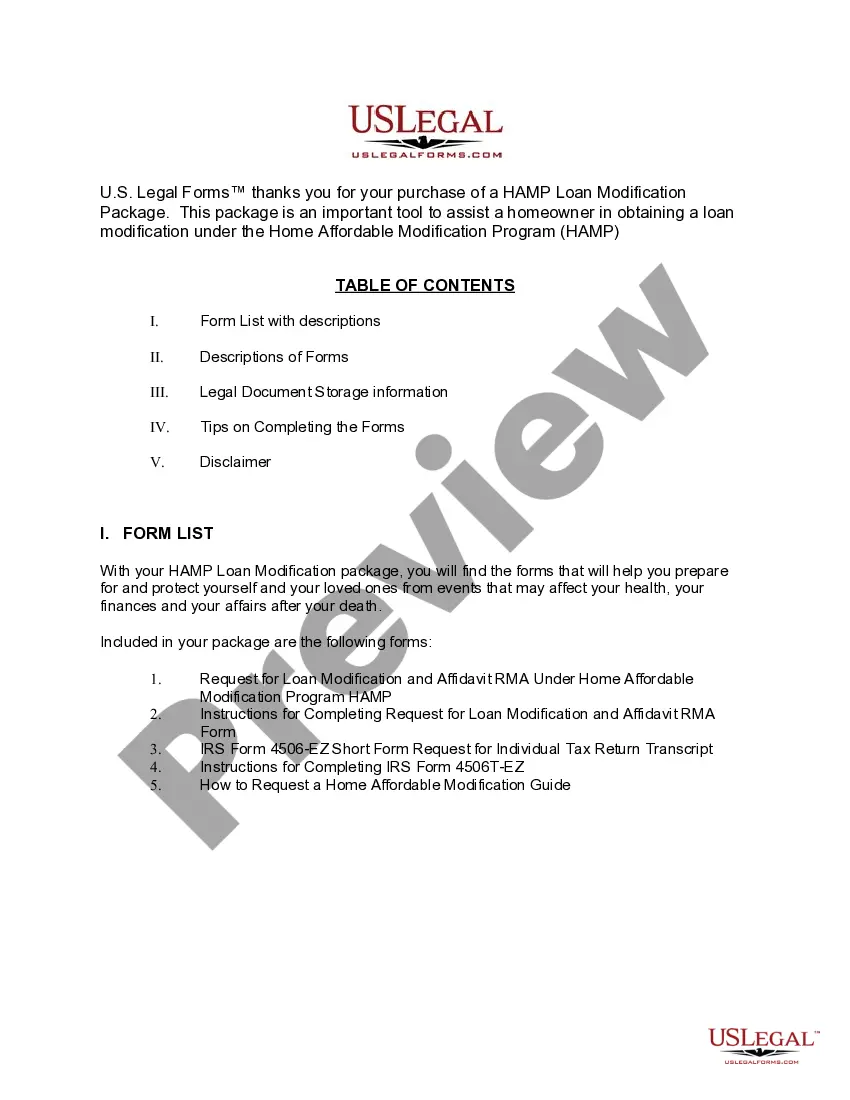

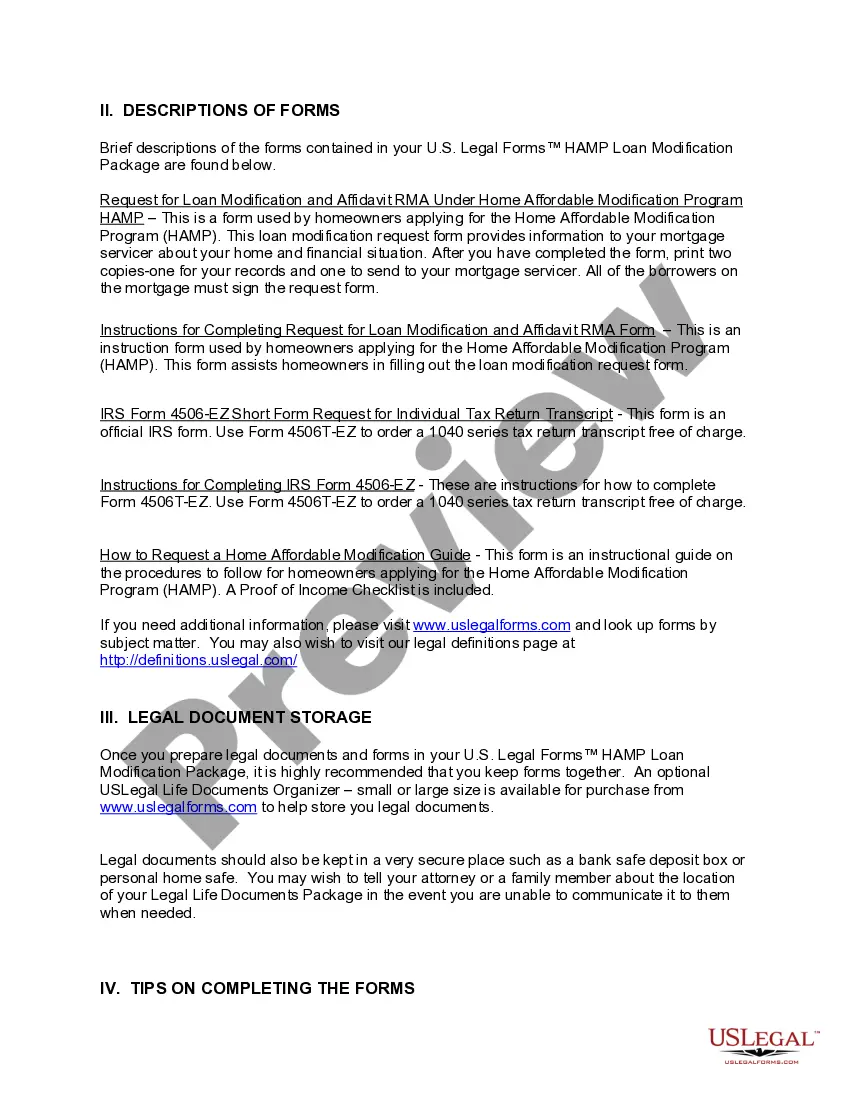

If you need to total, obtain, or print lawful file layouts, use US Legal Forms, the most important assortment of lawful kinds, which can be found on the web. Take advantage of the site`s simple and easy practical research to get the paperwork you need. Different layouts for business and specific functions are categorized by classes and claims, or keywords. Use US Legal Forms to get the North Dakota HAMP Loan Modification Package with a number of click throughs.

Should you be presently a US Legal Forms customer, log in to your account and click the Acquire key to find the North Dakota HAMP Loan Modification Package. You can also access kinds you in the past delivered electronically from the My Forms tab of your respective account.

If you are using US Legal Forms the very first time, follow the instructions below:

- Step 1. Make sure you have chosen the form to the correct metropolis/country.

- Step 2. Take advantage of the Review solution to look over the form`s articles. Never neglect to learn the description.

- Step 3. Should you be not happy using the form, use the Research industry on top of the monitor to get other variations from the lawful form web template.

- Step 4. Upon having located the form you need, select the Get now key. Pick the rates program you choose and add your references to register to have an account.

- Step 5. Approach the financial transaction. You should use your bank card or PayPal account to accomplish the financial transaction.

- Step 6. Pick the formatting from the lawful form and obtain it on your own gadget.

- Step 7. Full, revise and print or sign the North Dakota HAMP Loan Modification Package.

Every single lawful file web template you acquire is the one you have eternally. You may have acces to each and every form you delivered electronically inside your acccount. Go through the My Forms portion and select a form to print or obtain once again.

Remain competitive and obtain, and print the North Dakota HAMP Loan Modification Package with US Legal Forms. There are many specialist and express-specific kinds you may use for your business or specific needs.