North Dakota Form - Large Quantity Sales Distribution Agreement

Description

How to fill out Form - Large Quantity Sales Distribution Agreement?

If you wish to complete, download, or printing lawful record web templates, use US Legal Forms, the most important collection of lawful forms, that can be found online. Use the site`s easy and hassle-free research to find the files you will need. Different web templates for business and specific reasons are categorized by groups and states, or search phrases. Use US Legal Forms to find the North Dakota Form - Large Quantity Sales Distribution Agreement with a handful of click throughs.

In case you are already a US Legal Forms customer, log in for your profile and click the Obtain button to have the North Dakota Form - Large Quantity Sales Distribution Agreement. You can also accessibility forms you formerly downloaded inside the My Forms tab of your own profile.

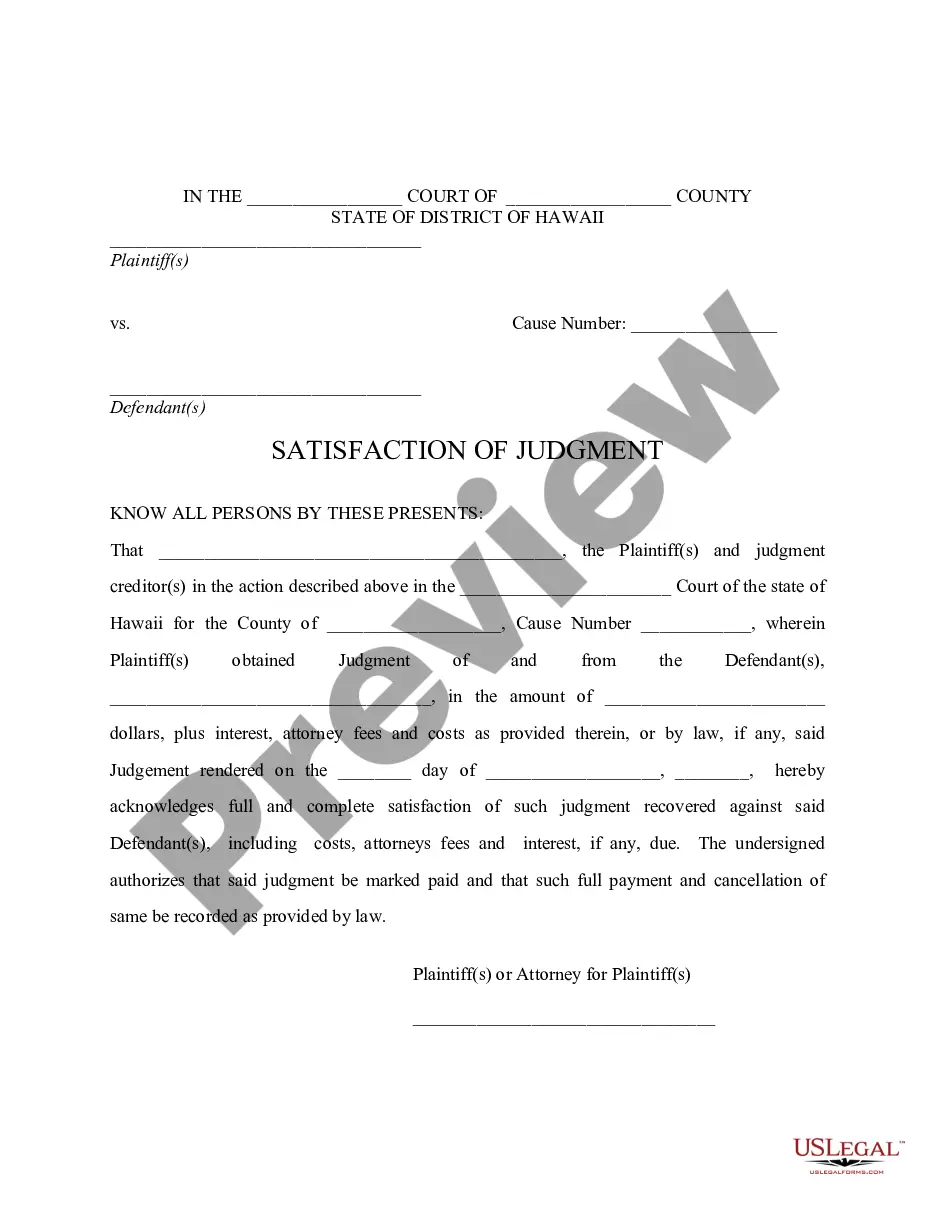

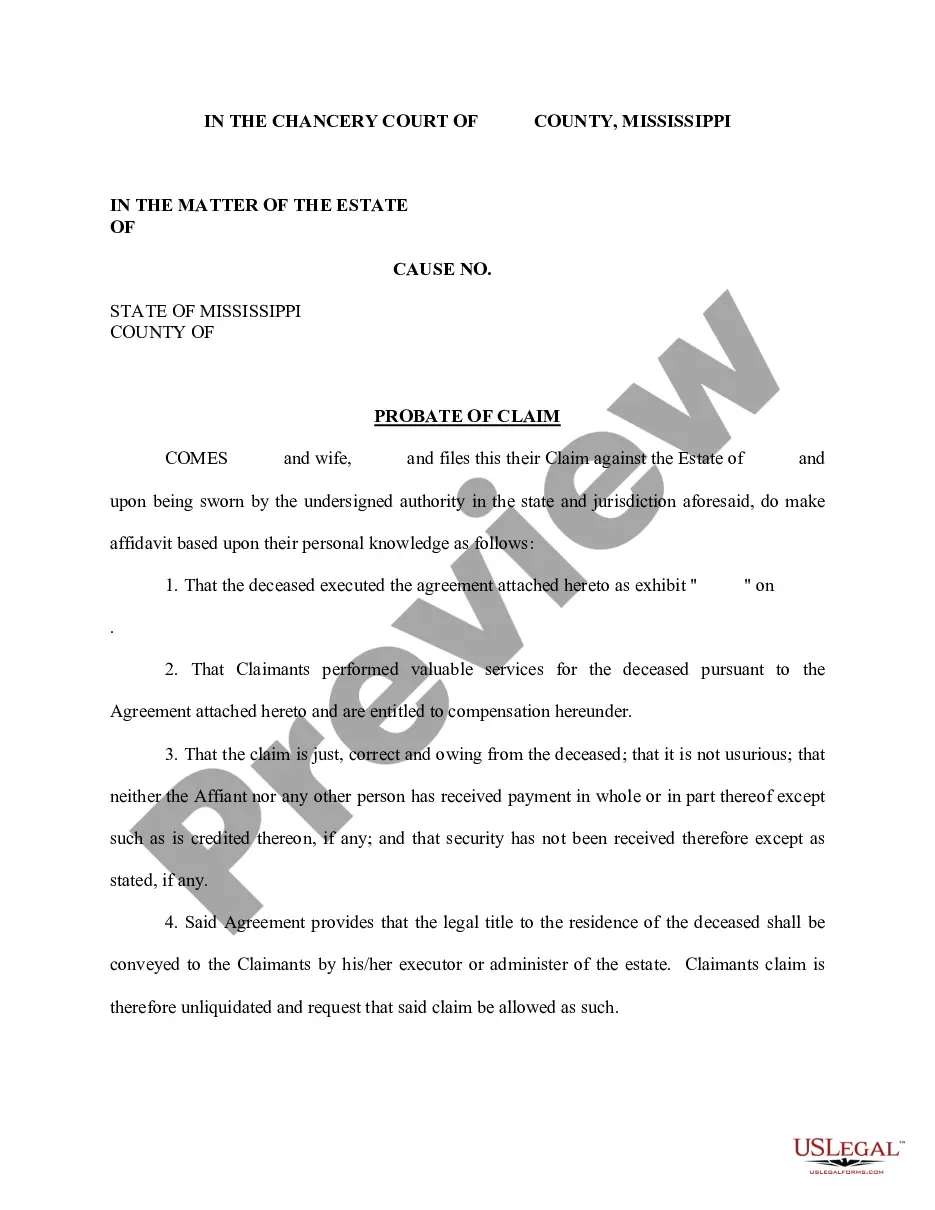

Should you use US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the shape for your appropriate area/region.

- Step 2. Use the Preview choice to look over the form`s content. Do not overlook to see the information.

- Step 3. In case you are not happy with the type, use the Look for discipline on top of the display screen to discover other versions of your lawful type design.

- Step 4. Once you have discovered the shape you will need, click on the Get now button. Opt for the costs strategy you choose and add your references to register for an profile.

- Step 5. Procedure the purchase. You should use your charge card or PayPal profile to finish the purchase.

- Step 6. Select the formatting of your lawful type and download it on your product.

- Step 7. Total, modify and printing or indication the North Dakota Form - Large Quantity Sales Distribution Agreement.

Every lawful record design you purchase is yours forever. You possess acces to each and every type you downloaded in your acccount. Select the My Forms segment and pick a type to printing or download once more.

Compete and download, and printing the North Dakota Form - Large Quantity Sales Distribution Agreement with US Legal Forms. There are millions of specialist and express-distinct forms you can utilize to your business or specific requirements.

Form popularity

FAQ

Some goods are exempt from sales tax under North Dakota law. Examples include most non-prepared food items, food stamps, prescription medications, and medical supplies.

States where Car Dealerships are closed on Sundays Maryland, Michigan, Nevada, North Dakota, Rhode Island, Texas, and Utah are those states.

A partnership may, but is not required to, make estimated income tax payments. For more information, including payment options, obtain the 2023 Form 58-ES. A partnership must withhold North Dakota income tax at the rate of 2.90% from the year-end distributive share of North Dakota income of a nonresident partner.

Accounting services are not subject to sales tax, but sales of clothing are taxable in North Dakota. In this example, the clothing retailer is required to charge sales tax to the accountant on the $300 sale of clothing and must report the sale and remit the tax on its sales and use tax return.

North Dakota Income Taxes North Dakota tax on retirement benefits: North Dakota doesn't tax Social Security retirement benefits. The state doesn't tax Military pensions or Railroad Retirement benefits, either.

81-04.1-03-03. Food and food products for human consumption. Food or food ingredients are exempt from sales tax. Food and food ingredients do not include alcoholic beverages, candy, dietary supplements, prepared food, soft drinks, or tobacco, which remain subject to sales tax.

North Dakota Century Code 57-39.2-15 defines the statute of limitations as 3 years from the later of the return due date or the return filing date. However, if no return was filed or the tax was understated by 25% or more, the statute of limitations can be extended to 6 years.

Removing the purchase from North Dakota for use exclusively outside this state. Water: The gross receipts from water sales, including bottled water, are exempt from sales tax. However, bottled water sales through coin-operated vending machines are subject to sales tax.