North Dakota Executive Stock Incentive Plan of Octo Limited

Description

How to fill out Executive Stock Incentive Plan Of Octo Limited?

You may invest several hours online attempting to find the lawful file web template that meets the federal and state demands you will need. US Legal Forms offers a huge number of lawful varieties that happen to be analyzed by experts. You can easily download or produce the North Dakota Executive Stock Incentive Plan of Octo Limited from your service.

If you currently have a US Legal Forms account, it is possible to log in and then click the Down load button. Following that, it is possible to comprehensive, modify, produce, or sign the North Dakota Executive Stock Incentive Plan of Octo Limited. Each lawful file web template you purchase is your own property for a long time. To have another duplicate of the obtained type, check out the My Forms tab and then click the corresponding button.

If you use the US Legal Forms site the very first time, keep to the easy directions beneath:

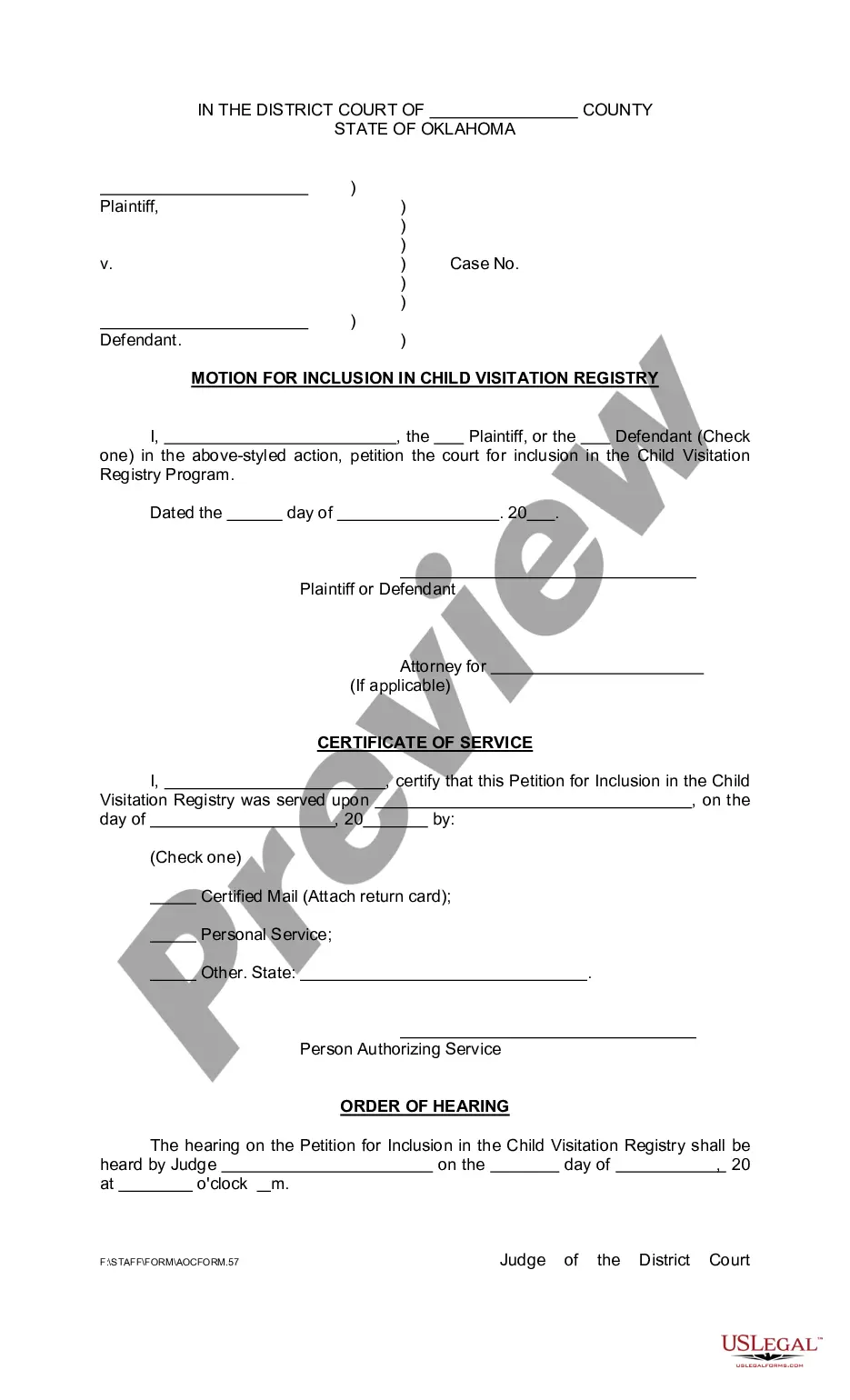

- First, make certain you have selected the correct file web template for your region/metropolis of your liking. Browse the type description to ensure you have picked the correct type. If offered, utilize the Review button to check from the file web template at the same time.

- If you wish to discover another model in the type, utilize the Look for industry to obtain the web template that fits your needs and demands.

- Upon having discovered the web template you would like, just click Get now to carry on.

- Select the rates prepare you would like, key in your references, and register for your account on US Legal Forms.

- Total the financial transaction. You can use your credit card or PayPal account to pay for the lawful type.

- Select the formatting in the file and download it for your product.

- Make changes for your file if necessary. You may comprehensive, modify and sign and produce North Dakota Executive Stock Incentive Plan of Octo Limited.

Down load and produce a huge number of file themes making use of the US Legal Forms site, that offers the most important collection of lawful varieties. Use expert and express-specific themes to deal with your company or personal needs.

Form popularity

FAQ

Executive bonus plans are often popular with top-level employees, but they also provide benefits to your company. In some cases, they can be a more tax-efficient way to reward top talent. They give employees additional compensation with a lower current cost to the employer than some other types of benefits.

They provide employees the right, but not the obligation, to purchase shares of their employer's stock at a certain price for a certain period of time. Options are usually granted at the current market price of the stock and last for up to 10 years.

Taxes and Incentive Stock Options Your employer isn't required to withhold income tax when you exercise an Incentive Stock Option since there is no tax due (under the regular tax system) until you sell the stock.

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit.