North Dakota Essay Appraisal Form

Description

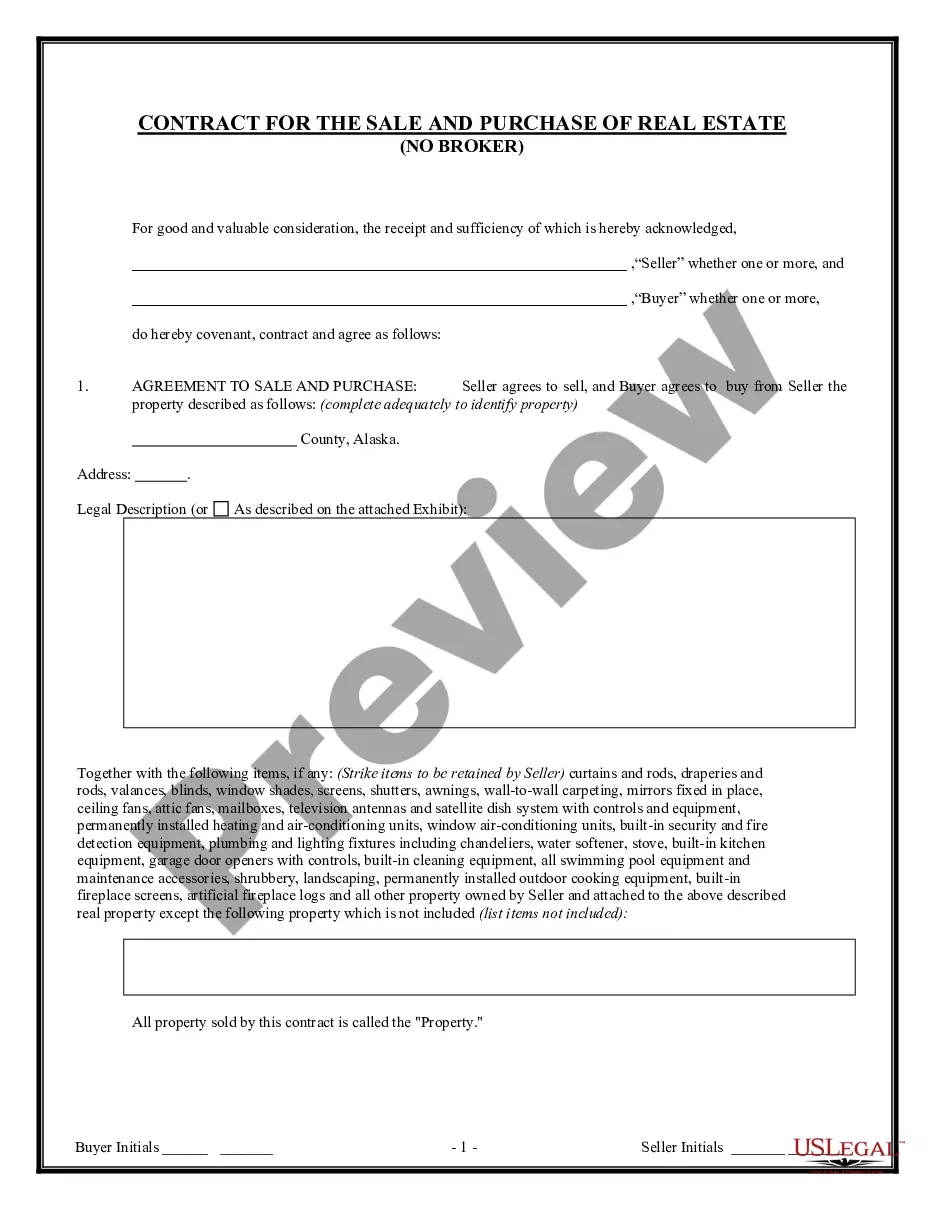

How to fill out Essay Appraisal Form?

You might spend hours online looking for the legal document template that meets the federal and state regulations you require.

US Legal Forms provides thousands of legal templates that are reviewed by experts.

You can effortlessly obtain or print the North Dakota Essay Appraisal Form from our service.

If available, utilize the Preview option to view the document template as well.

- If you possess a US Legal Forms account, you can Log In and then select the Download button.

- After that, you can fill out, modify, print, or sign the North Dakota Essay Appraisal Form.

- Every legal document template you acquire is yours permanently.

- To access another version of the downloaded template, navigate to the My documents section and select the appropriate option.

- If you are using the US Legal Forms site for the first time, follow the simple steps below.

- Firstly, ensure you have chosen the correct document template for the state/city you select.

- Review the document description to ensure you have picked the right template.

Form popularity

FAQ

Reporting threshold: If you file 250 or more 1099 forms with North Dakota you must file electronically. When filing federal copies of forms 1099 with the IRS from the state of North Dakota the mailing address is: Department of the Treasury , Internal Revenue Service Center , Kansas City, MO 64999.

University of North Dakota considers the SAT Essay/ACT Writing section optional and may not include it as part of their admissions consideration. You don't need to worry too much about Writing for this school, but other schools you're applying to may require it.

According to North Dakota Instructions for Form ND-1, you must file a North Dakota tax return if: If you were a full-year resident of North Dakota for the tax year and you are required to file a federal individual income tax return, you must file a North Dakota individual income tax return.

The basics of North Dakota state taxIf you live in North Dakota and have to file a federal income tax return, you must also file a state individual income tax return even if part of your income comes from sources outside the state.

Form 307 North Dakota Transmittal of Wage and Tax Statement - submitted by anyone who has an open withholding account with the Office of State Tax Commissioner and does not file electronically.

North Dakota relies on the federal Form W-4 (Employee's Withholding Allowance Certificate) to calculate the amount to withhold.

It's recommended that you have a cumulative GPA of 2.75 or higher when applying. Strong consideration is given to grades earned in the high school core classes listed above. You can self-report your high school GPA or provide an unofficial transcript on your application for a quicker admission decision.

Form 307 North Dakota Transmittal of Wage and Tax Statement - submitted by anyone who has an open withholding account with the Office of State Tax Commissioner and does not file electronically.

127, Bismarck, ND 58505-0599. 2022 Mail Form 307 with paper information returns to: Office of State Tax Commissioner, PO Box 5624, Bismarck, ND 58506-5624.

Apply for a North Dakota Tax ID (EIN) Number. To obtain your Tax ID (EIN) in North Dakota start by choosing the legal structure of the entity you wish to get a Tax ID (EIN) for. Once you have submitted your application your EIN will be delivered to you via e-mail.