North Dakota Sales Prospect File

Description

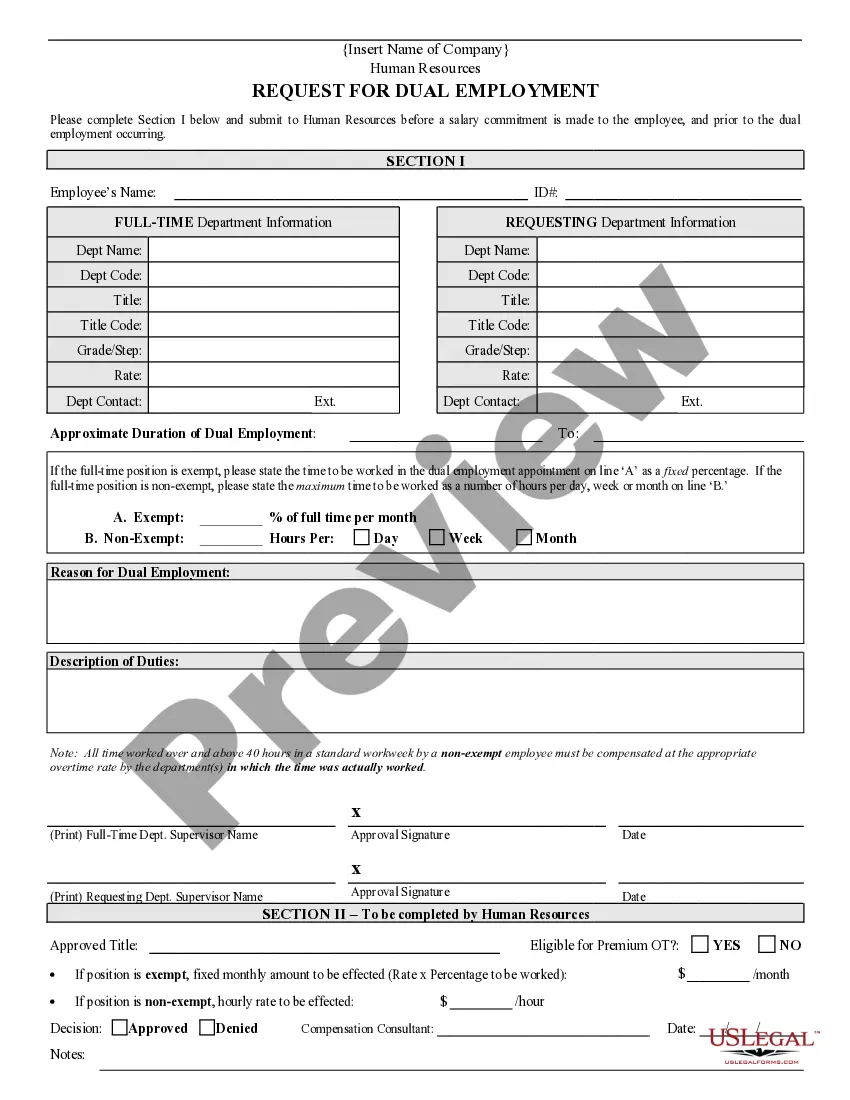

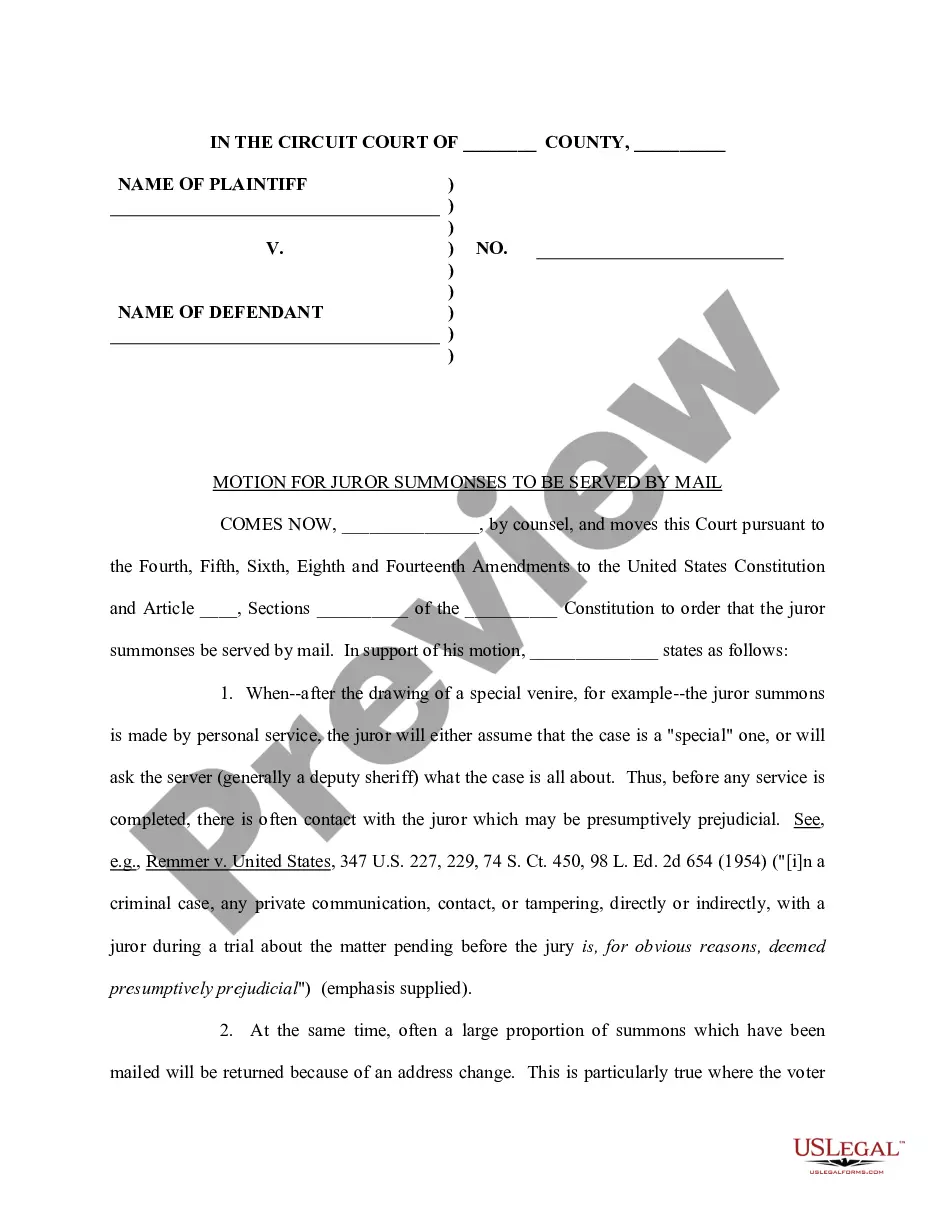

How to fill out Sales Prospect File?

If you wish to fulfill, obtain, or produce legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Use the site's straightforward and convenient search to find the documents you require.

Various templates for commercial and personal uses are organized by categories and claims, or keywords.

Step 4. After finding the form you need, click the Acquire now button. Choose your preferred pricing plan and provide your credentials to sign up for an account.

Step 5. Complete the transaction. You can use your Visa or MasterCard, or PayPal account to finalize the transaction.

- Employ US Legal Forms to find the North Dakota Sales Prospect Document with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the North Dakota Sales Prospect Document.

- You can also access documents you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Confirm you have selected the form for the correct city/state.

- Step 2. Utilize the Preview option to review the form’s content. Don’t forget to read the details.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to find other variations of the legal form design.

Form popularity

FAQ

In North Dakota, certain items are exempt from sales tax, including food for home consumption, prescription drugs, and some agricultural products. However, exemptions can vary based on specific circumstances. Using the North Dakota Sales Prospect File can help clarify which items qualify for these exclusions and ensure compliance with state regulations.

North Dakota is considered relatively tax-friendly compared to many other states, particularly due to its low sales tax rate and absence of certain taxes, like personal income tax on Social Security benefits. However, the overall tax burden can vary depending on your specific situation or business types. Understanding the tax landscape can be simplified with resources like the North Dakota Sales Prospect File, helping you make informed decisions.

To reclaim sales tax in North Dakota, you must file a sales tax refund request with the North Dakota Office of State Tax Commissioner. Make sure you have all necessary documentation to support your claim, such as receipts or proof of excess tax collected. Utilizing the North Dakota Sales Prospect File can provide relevant information to streamline your refund request process.

Sales tax nexus in North Dakota refers to the connection between a business and the state that requires the business to collect and remit sales tax. This can be established through various means, such as having a physical presence or significant economic activity in the state. Knowing the intricacies of sales tax nexus is vital, and resources like the North Dakota Sales Prospect File can assist you in understanding your obligations.

Yes, North Dakota does collect sales tax. The state sales tax rate is currently set at 5%. Additionally, local jurisdictions may impose their own taxes, which can increase the total sales tax rate, making it important for you to check specific areas when using the North Dakota Sales Prospect File.

To file retail sales tax in North Dakota, businesses must complete the appropriate tax forms, detailing the total sales and taxes collected during the reporting period. You can file online through the North Dakota Office of State Tax Commissioner’s website, which simplifies the process. Timely filing helps avoid penalties and ensures that your business remains compliant. For further assistance, refer to the North Dakota Sales Prospect File and resources available on US Legal Forms.

A North Dakota sales and use tax permit is a requirement for businesses engaged in selling tangible goods or taxable services in the state. This permit allows you to collect sales tax from customers on behalf of the state. By obtaining this permit, you can ensure compliance with North Dakota tax laws. For updated information and resources, including the North Dakota Sales Prospect File, consider visiting the US Legal Forms platform.

Various items, such as prescription drugs, certain medical devices, and most food items, are exempt from sales tax in North Dakota. Understanding these exemptions can significantly benefit individuals and businesses. The North Dakota Sales Prospect File offers detailed insights into what is exempt, helping you navigate the tax landscape more effectively.

As of now, the statewide sales tax rate in North Dakota is 5%. Local jurisdictions may impose additional taxes, resulting in varying rates depending on your location. For the most accurate and updated information, refer to the North Dakota Sales Prospect File.

North Dakota does not have a personal income tax, allowing residents to keep a larger portion of their earnings. This absence of income tax can be an attractive feature for individuals and businesses alike. The North Dakota Sales Prospect File may help you understand how this affects overall tax obligations.