North Dakota Software License and Distribution Agreement

Description

How to fill out Software License And Distribution Agreement?

Are you in a situation where you frequently require documents for potential business or specific intents almost every workday.

There are numerous legal document templates accessible online, but locating trustworthy ones can be challenging.

US Legal Forms provides a vast array of template options, including the North Dakota Software License and Distribution Agreement, designed to satisfy state and federal regulations.

Select the pricing plan you desire, fill in the required details to create your account, and complete your purchase using your PayPal or Visa or Mastercard.

Choose a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the North Dakota Software License and Distribution Agreement template.

- If you do not have an account and wish to start using US Legal Forms, proceed with these instructions.

- Find the template you need and ensure it is appropriate for your city/state.

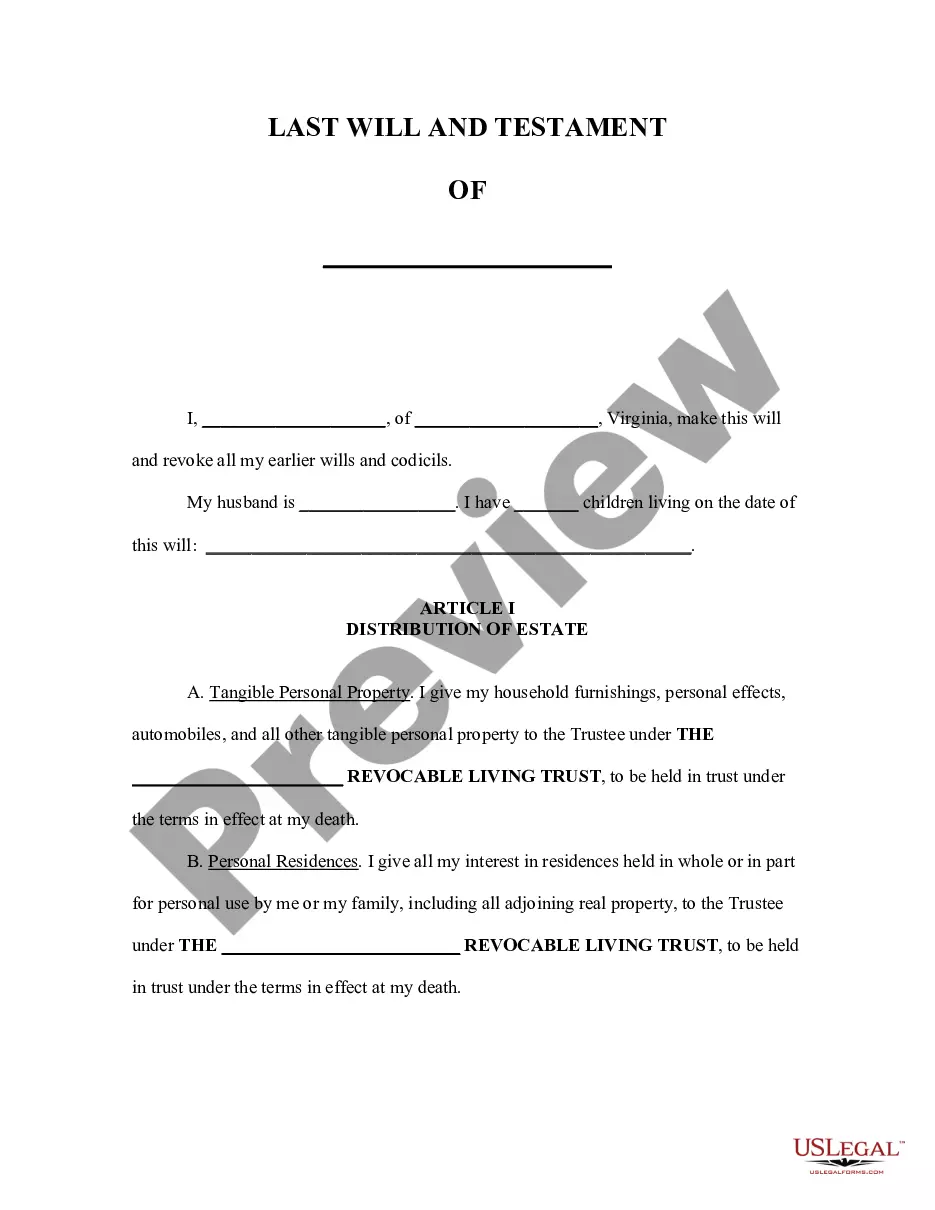

- Use the Preview button to review the form.

- Read the description to confirm you have selected the correct template.

- If the template does not match what you are looking for, utilize the Search box to find the template that meets your needs.

- Once you identify the right template, click Get now.

Form popularity

FAQ

Computer Programs (Software)Prewritten (canned) software is subject to tax, however, custom soft ware is generally exempt from tax.

Ideally, all software purchases should be taxable to final users and exempt for business users. Instead, states tax some kinds of software and exempt others, based on whether it is customized or off-the-shelf and whether it is on CD or downloaded, all silly distinctions for tax purposes.

Yes, there is a difference between state W-4s and federal Form W-4. Every employee in the U.S. will fill out a federal Form W-4, yet not every employee will fill out a state W-4. Your state tax withholdings and form requirements will vary depending on the state you reside in.

Goods that are subject to sales tax in North Dakota include physical property, like furniture, home appliances, and motor vehicles. Prescription medicine, groceries, and gasoline are all tax-exempt.

If you were a full-year resident of North Dakota for the tax year and you are required to file a federal individual income tax return, you must file a North Dakota individual income tax return. You have income from sources in or outside of North Dakota while you were a part year resident.

Some examples of items that exempt from North Dakota sales tax are prescription medications, some types of groceries, some medical devices, and machinery and chemicals which are used in agriculture.

But, in most, it's a mixed bag. California exempts most software sales but taxes one type: canned software delivered on tangible personal property an actual object you can touch or hold, such as a disc. Nebraska taxes most software sales with the exception of one type: SaaS.

North Dakota relies on the federal Form W-4 (Employee's Withholding Allowance Certificate) to calculate the amount to withhold. For more information regarding income tax withholding, see: Guideline Income Tax Withholding & Information Returns. Income Tax Withholding Rates and Instructions.

127, Bismarck, ND 58505-0599. 2022 Mail Form 307 with paper information returns to: Office of State Tax Commissioner, PO Box 5624, Bismarck, ND 58506-5624.

The following states opted to create their own state W-4 forms: Delaware, Idaho, Nebraska, Oregon, South Carolina, and Wisconsin whereas Colorado, New Mexico, North Dakota, and Utah will adopt the new inputs that the 2020 Federal W-4 put forth.