North Dakota Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor

Description

How to fill out Special Needs Irrevocable Trust Agreement For Benefit Of Disabled Child Of Trustor?

If you want to thoroughly, download, or print legal document templates, utilize US Legal Forms, the most extensive assortment of legal forms available online.

Take advantage of the website's simple and convenient search to obtain the documents you need.

Various templates for business and personal use are organized by categories and claims, or keywords.

Step 4. Once you have found the form you need, click on the Get now option. Select the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to acquire the North Dakota Special Needs Irrevocable Trust Agreement for the Benefit of Disabled Child of Trustor with a few clicks.

- If you are already a US Legal Forms client, Log In to your account and then click the Download option to locate the North Dakota Special Needs Irrevocable Trust Agreement for the Benefit of Disabled Child of Trustor.

- You can also access forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, adhere to the following steps.

- Step 1. Make sure you have chosen the form for the correct city/region.

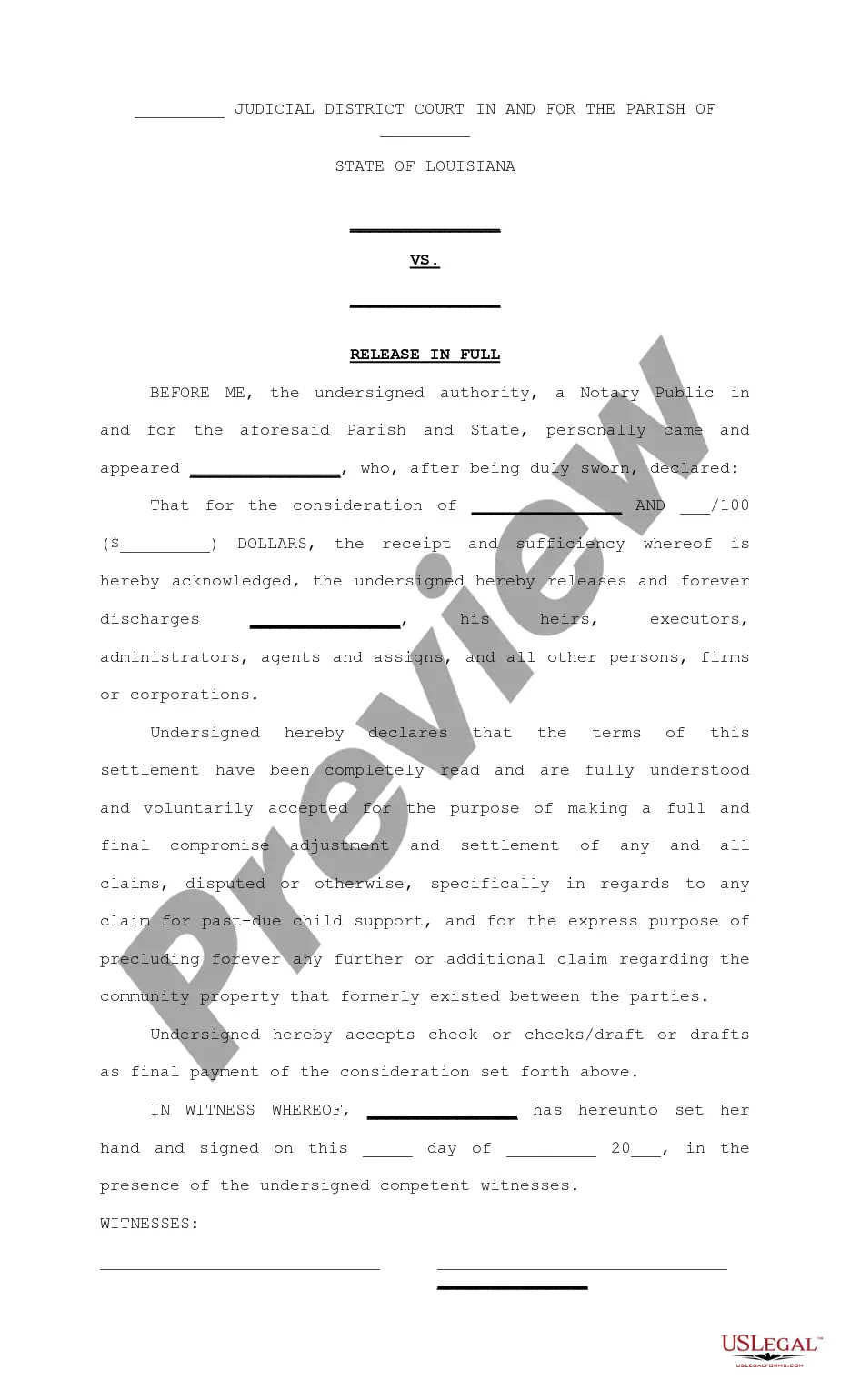

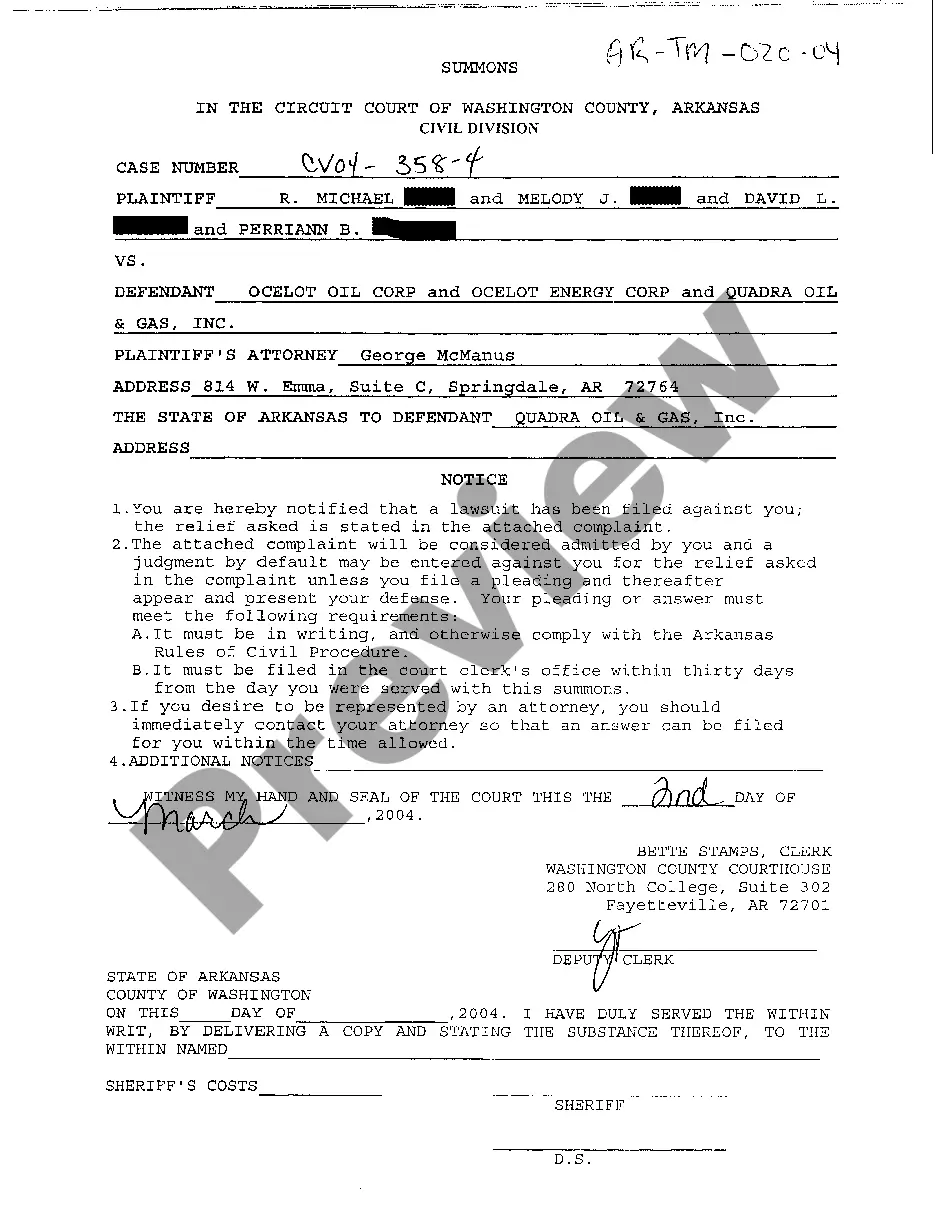

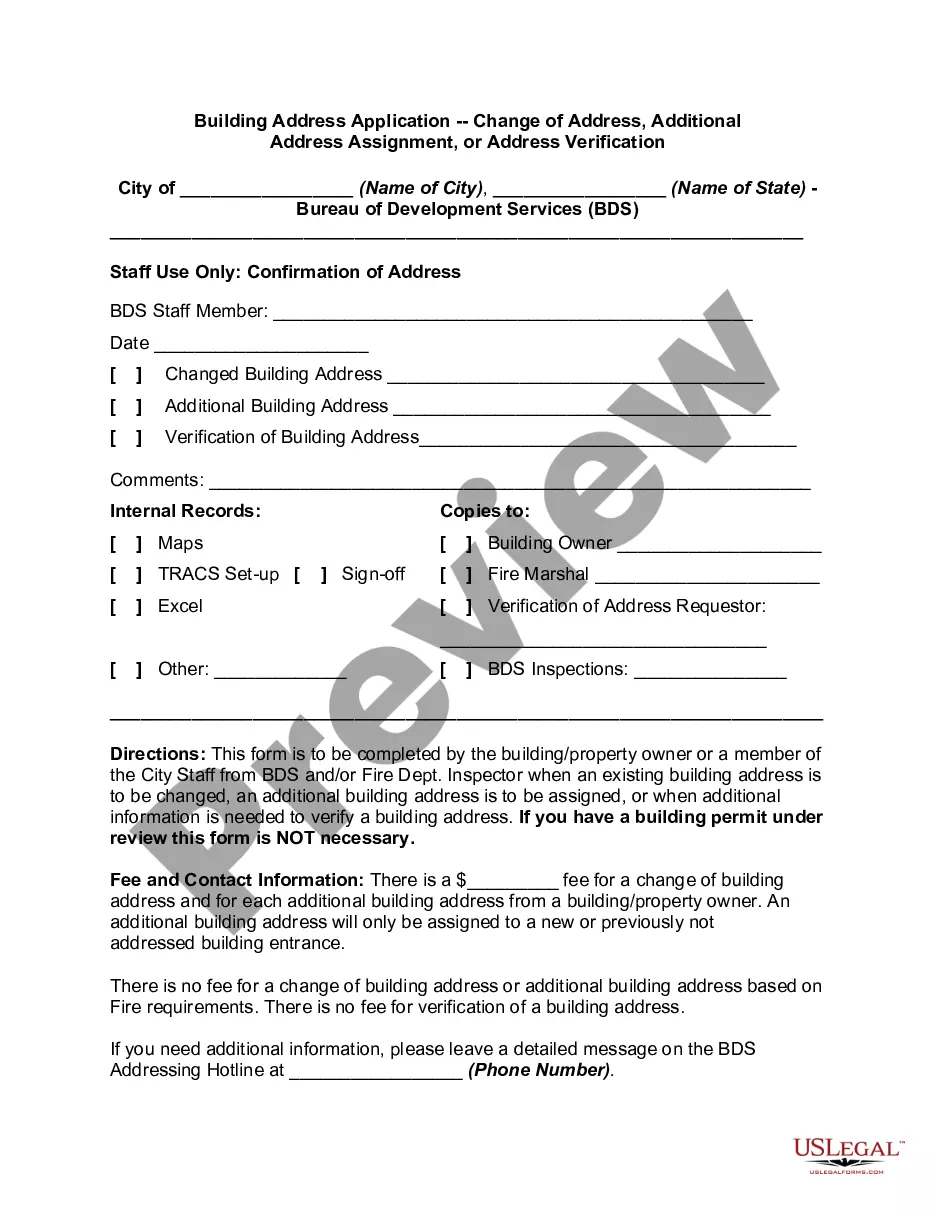

- Step 2. Use the Preview feature to review the form's content. Don't forget to go through the description.

- Step 3. If you are not satisfied with the form, make use of the Search area at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

A Special Disability Trust (SDT) is a special type of trust that allows parents and immediate family members to plan for current and future needs of a person with severe disability. The trust can pay for reasonable care, accommodation and other discretionary needs of the beneficiary during their lifetime.

A special needs trust is a legal arrangement that lets a physically or mentally ill person, or someone chronically disabled, have access to funding without potentially losing the benefits provided by public assistance programs.

So the special-needs trust is a type of trust that is used to provide assets and resources to take care of a person with a disability, while the living trust is a will substitute that I might use in place of having a will for my estate plan.

The term special needs trust refers to the purpose of the trust to pay for the beneficiary's unique or special needs. In short, the name is focused more on the beneficiary, while the name supplemental needs trust addresses the shortfalls of our public benefits programs.

If the money in an SNT is used to pay for basic costs of living, a person's public benefits might be decreased. ABLE accounts have a broader range of permitted expenses. This includes anything that helps a person with a disability improve their health, independence, or quality of life.

Some of the benefits of utilizing an SNT include asset management and maximizing and maintaining government benefits (including Medicaid and Supplemental Security Income). Some possible negatives of utilizing an SNT include lack of control and difficulty or inability to identify an appropriate Trustee.

Disadvantages to SNTCost. Annual fees and a high cost to set up a SNT can make it financially difficult to create a SNT The yearly costs to manage the trust can be high.Lack of independence.Medicaid payback.

The major disadvantages that are associated with trusts are their perceived irrevocability, the loss of control over assets that are put into trust and their costs. In fact trusts can be made revocable, but this generally has negative consequences in respect of tax, estate duty, asset protection and stamp duty.

To help you get started on understanding the options available, here's an overview the three primary classes of trusts.Revocable Trusts.Irrevocable Trusts.Testamentary Trusts.More items...?31-Aug-2015

What is Special trust? A special needs trust is also called a supplemental needs trust in some jurisdictions, is a special trust that allows the disabled or physically challenged beneficiary to enjoy the use of an asset that is held in the trust for his/her benefit.