North Dakota Collateral Assignment of Lease

Description

How to fill out Collateral Assignment Of Lease?

You can invest time on-line attempting to find the lawful record web template that meets the federal and state specifications you will need. US Legal Forms offers thousands of lawful varieties that are evaluated by pros. You can actually download or printing the North Dakota Collateral Assignment of Lease from my assistance.

If you already have a US Legal Forms profile, it is possible to log in and click the Download switch. Following that, it is possible to comprehensive, modify, printing, or indicator the North Dakota Collateral Assignment of Lease. Every lawful record web template you purchase is your own forever. To acquire an additional backup for any purchased kind, go to the My Forms tab and click the related switch.

If you use the US Legal Forms website for the first time, stick to the simple instructions listed below:

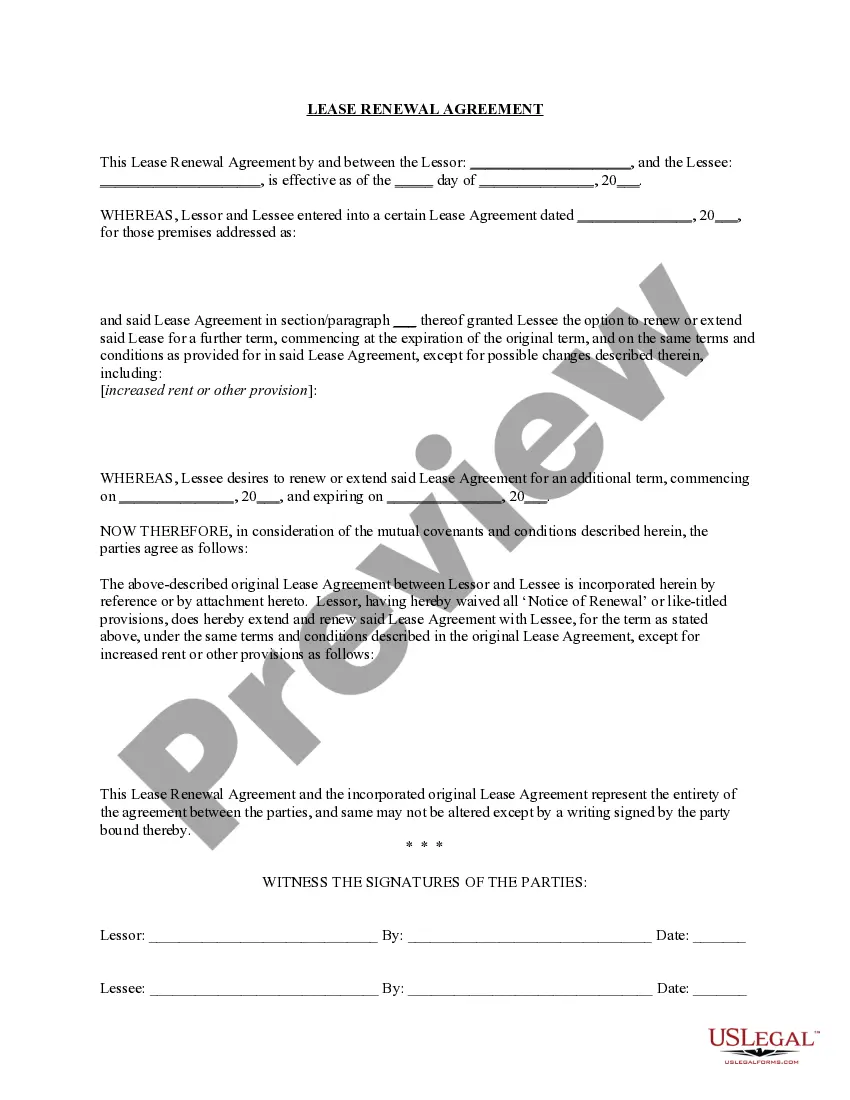

- First, be sure that you have selected the correct record web template for the area/metropolis of your choice. Browse the kind explanation to make sure you have picked out the correct kind. If accessible, make use of the Review switch to search with the record web template as well.

- If you want to locate an additional version from the kind, make use of the Research area to obtain the web template that meets your needs and specifications.

- Upon having located the web template you want, just click Purchase now to continue.

- Choose the rates prepare you want, key in your qualifications, and sign up for a merchant account on US Legal Forms.

- Comprehensive the deal. You may use your credit card or PayPal profile to cover the lawful kind.

- Choose the file format from the record and download it to your system.

- Make modifications to your record if possible. You can comprehensive, modify and indicator and printing North Dakota Collateral Assignment of Lease.

Download and printing thousands of record web templates utilizing the US Legal Forms website, that offers the most important collection of lawful varieties. Use expert and status-distinct web templates to take on your organization or person requires.

Form popularity

FAQ

A collateral assignment of lease is a legal contract that transfers the rights to rental payments from the asset's owner to a lender to secure funding. In this contract, the lease's rentals are like a loan from the funder to the lessor and the lease acts as security.

This is a standard form of acknowledgment and consent obtained from a vendor consenting to a collateral assignment of an acquisition agreement from a borrower to a lender to secure the borrower's obligations to the lender in an acquisition financing.

Collateral assignment of life insurance is a method of providing a lender with collateral when you apply for a loan. In this case, the collateral is your life insurance policy's face value, which could be used to pay back the amount you owe in case you die while in debt.

Collateral assignment concerns allocating a property's ownership privileges, or a specific interest, to a lender as loan collateral. The lender retains a security interest in the asset until the borrower entirely settles the loan.

Collateral assignment of life insurance is a method of providing a lender with collateral when you apply for a loan. In this case, the collateral is your life insurance policy's face value, which could be used to pay back the amount you owe in case you die while in debt.

This is a standard form of Collateral Assignment of Acquisition Agreements between a grantor and a secured party. It is intended to create a security interest in the grantor's contracts rights under a specified acquisition agreement under UCC Article 9.

?Collateral assignment of life insurance is typically associated with business loans and mortgages,? says Martinez. If you're launching a small business and applying for a loan to help you get started, the bank might request that you include your life insurance policy as collateral.

A collateral assignment primarily serves to protect the repayment interest of the lender. An assignment of all rights in a policy is considered an absolute assignment; this would essentially constitute a change of policy ownership.

Key Purposes of a Collateral Assignment Collateral assignment concerns allocating a property's ownership privileges, or a specific interest, to a lender as loan collateral. The lender retains a security interest in the asset until the borrower entirely settles the loan.

You have a whole life insurance policy with a cash value of $65,000 and a death benefit of $300,000, which the bank accepts as collateral. So, you then designate the bank as the policy's assignee until you repay the $50,000 loan.