North Dakota Termination of Trust by Trustee

Description

Form popularity

FAQ

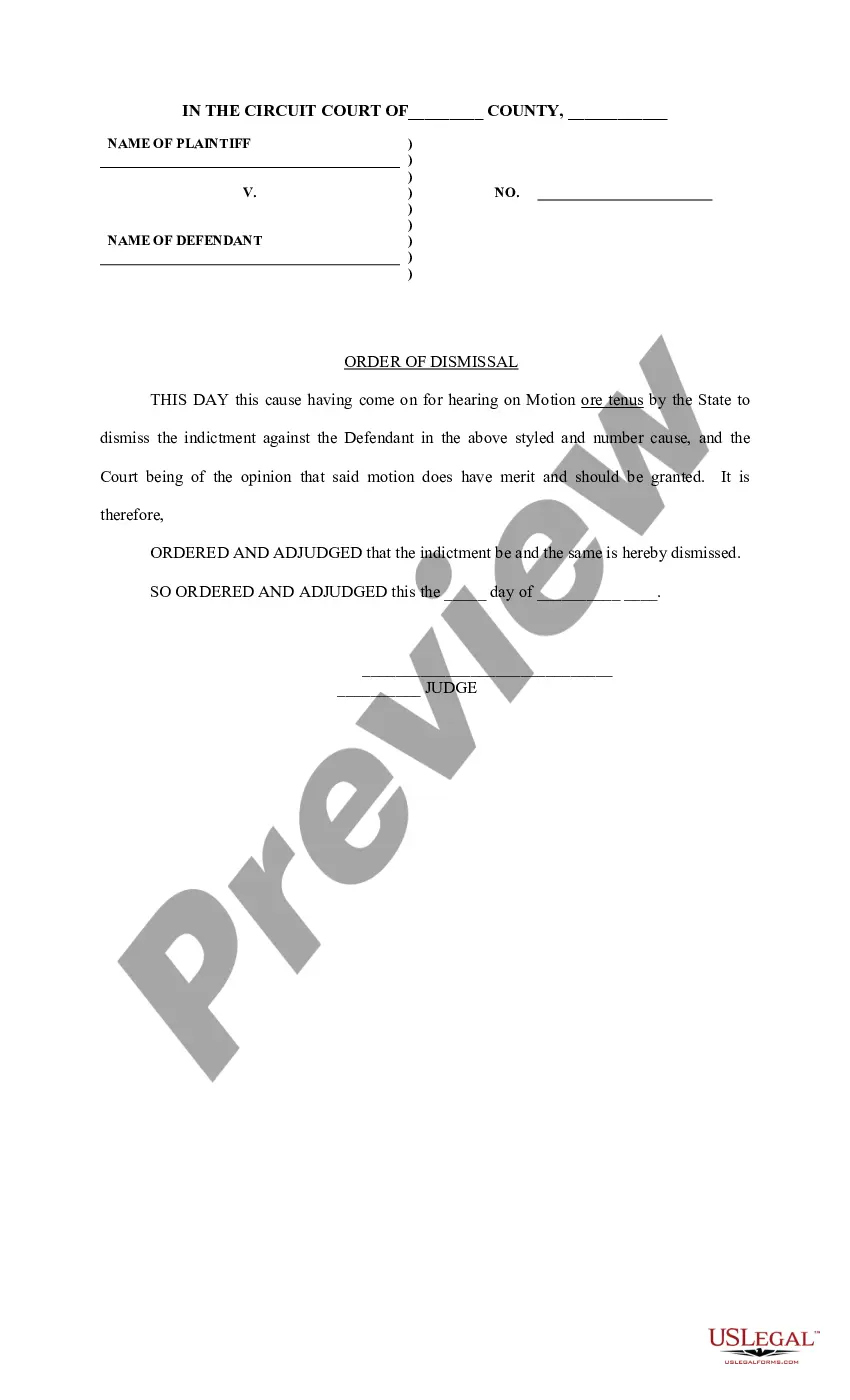

If the trust is irrevocable, you need to have the consent of all of the adult beneficiaries of the trust in order to resign. The law also allows you to petition the court to accept your resignation as trustee.

Ways a Trust Can EndIf the trust property was cash or stocks, this can happen when all of the money, plus interest, gets paid to beneficiary. If the property was some other asset, like a house, then the trust may end when the house is destroyed or the trust itself comes to an end.

The trustee cannot do whatever they want. They must follow the trust document, and follow the California Probate Code. More than that, Trustees don't get the benefits of the Trust. The Trust assets will pass to the Trust beneficiaries eventually.

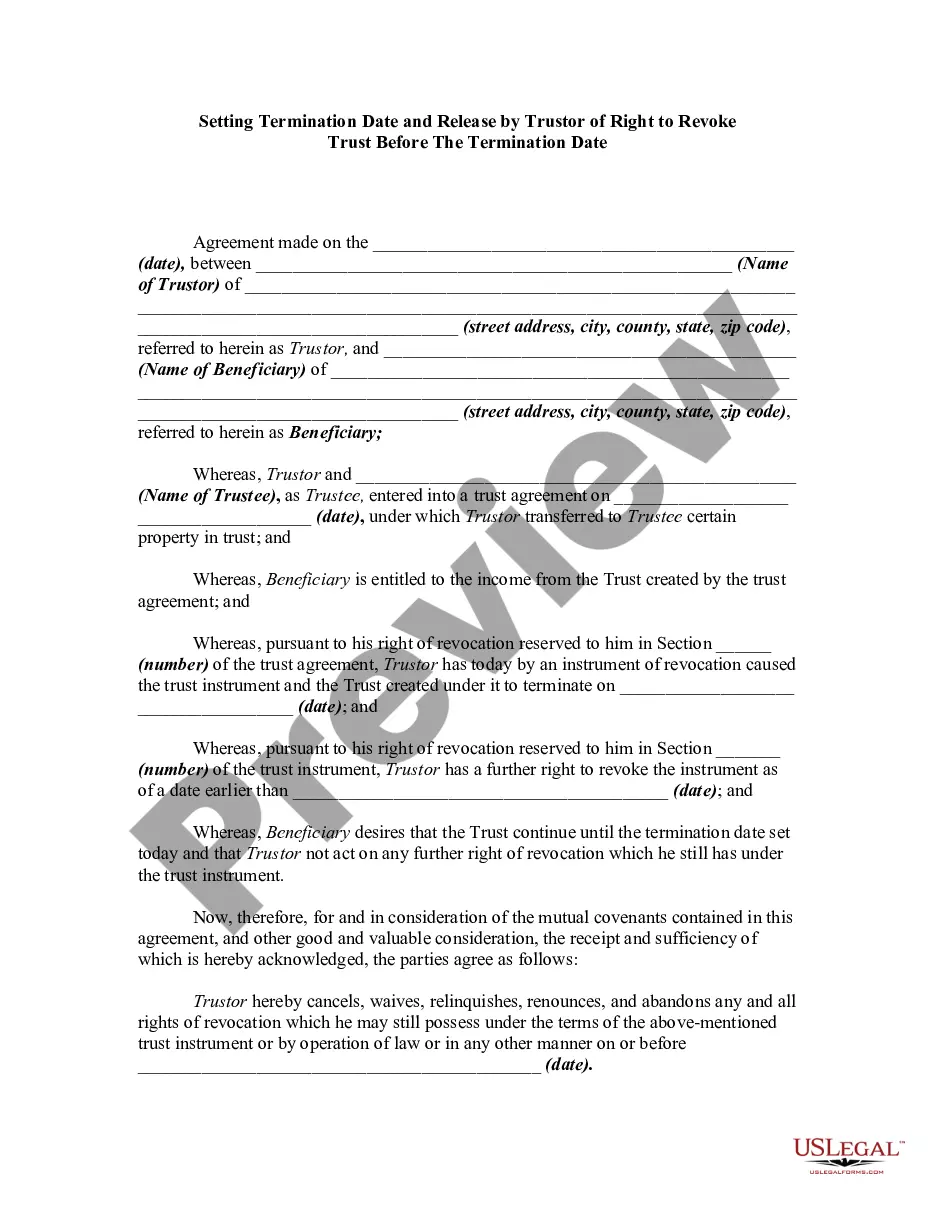

As the Trustor of a trust, once your trust has become irrevocable, you cannot transfer assets into and out of your trust as you wish. Instead, you will need the permission of each of the beneficiaries in the trust to transfer an asset out of the trust.

A trust can also be terminated if it involves illegal conduct or if it cannot operate properly as a trust due to its small size. Additionally, beneficiaries can only terminate a trust if they are all in agreement. Unless specified in the trust, trustees are never allowed to terminate a trust.

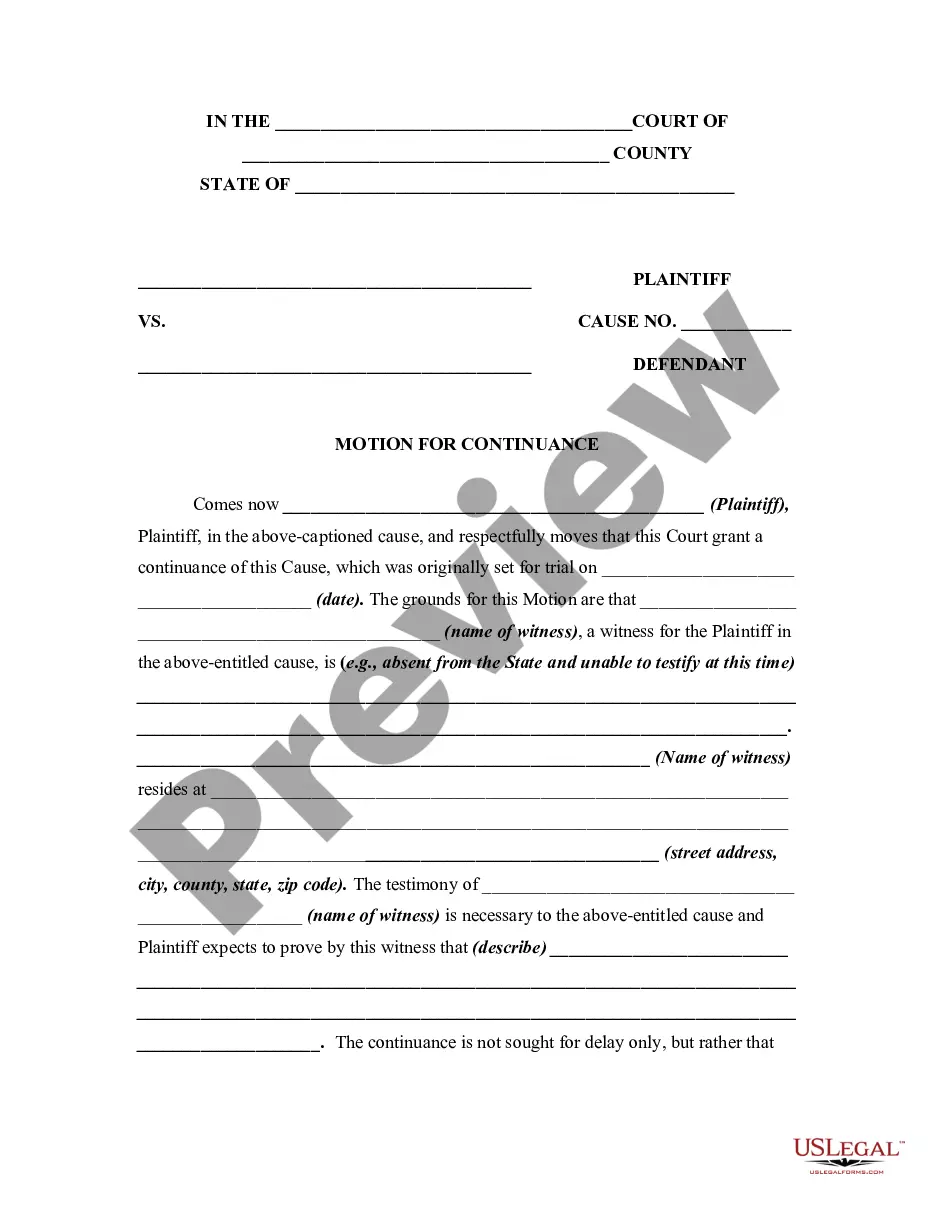

Most trusts will have a provision that describes how a Trustee may resign from acting as Trustee. In most cases, the Trustee will give written notice of their resignation to the Trust beneficiaries and to the successor Trustees. Whatever the Trust terms prescribe, the Trustee must follow.

Revocation. and the settlor is not a beneficiary, the settlor has no legal right to interfere with the trustees to change the terms of the trust or to terminate the trust, unless such rights are specifically reserved in the trust instrument.

A trust can be terminated for the following reasons: The trust assets have been fully distributed, making it uneconomical to continue with the trust. The money remaining in the trust makes it uneconomical to continue with the trust. The trust has served its purpose in terms of its stated objective.

A common reason for revoking a trust, is a divorce when the trust was created as a joint document with one's soon-to-be ex-spouse. A trust might also be revoked because the grantor wants to make changes that are so extensive that it would be simpler to dissolve the trust and create a new one.

Even without the unanimous consent of the beneficiaries, a trustee or beneficiary may petition the court to modify or terminate an irrevocable trust under the changed circumstances doctrine. Sometimes, due to circumstances not known or anticipated by the settlor (the person(s) who established the trust), continuing