North Dakota Estoppel Affidavit of Mortgagor

Description

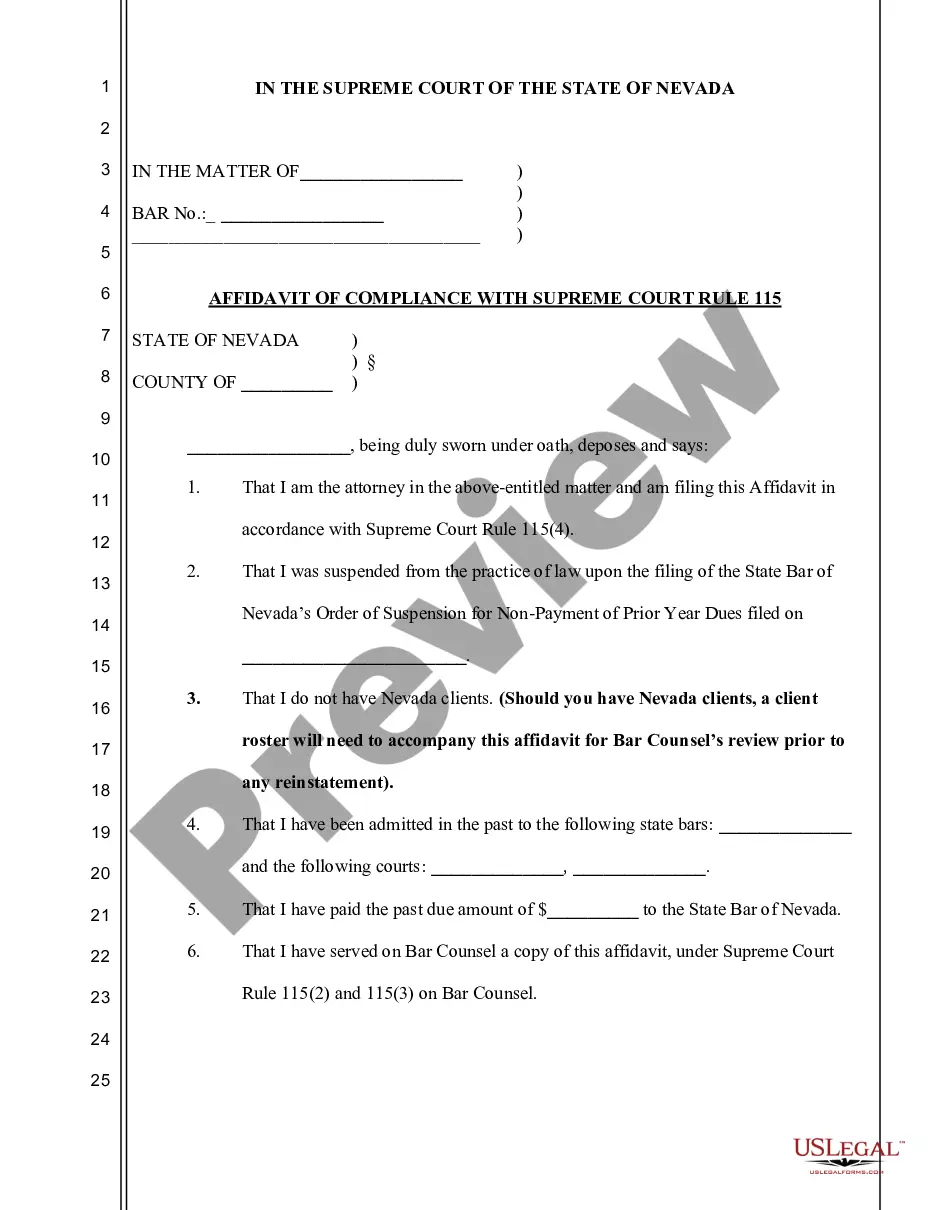

How to fill out Estoppel Affidavit Of Mortgagor?

Are you presently in a location where you need documentation for potential company or specific objectives almost every business day? There are numerous authentic document templates accessible online, but locating ones you can rely on isn't straightforward.

US Legal Forms provides thousands of form templates, including the North Dakota Estoppel Affidavit of Mortgagor, that are designed to meet state and federal standards.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. Afterward, you can download the North Dakota Estoppel Affidavit of Mortgagor template.

- Obtain the form you require and ensure it is for the correct city/region.

- Utilize the Review button to inspect the document.

- Check the description to confirm you have selected the right form.

- If the form isn't what you are looking for, use the Search field to find the form that fits your needs and criteria.

- Once you find the appropriate form, click on Get now.

- Choose the pricing plan you desire, enter the necessary information to create your account, and complete your purchase using your PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

A mortgage and a trust deed are both considered security instruments that enable lenders to secure their loans with real property. However, they differ in structure and execution; a mortgage involves a borrower directly pledging the property to the lender, while a trust deed involves a third-party trustee. Understanding these differences is vital for homeowners in North Dakota, and incorporating the North Dakota Estoppel Affidavit of Mortgagor can protect your rights during the process.

To execute a quit claim deed in North Dakota, you need to provide the names of both parties involved in the transfer, a legal description of the property, and the signature of the grantor. This document transfers any interest the grantor has in the property without guaranteeing the title's validity. Utilizing the North Dakota Estoppel Affidavit of Mortgagor can enhance the legal effectiveness of your quit claim dealings, ensuring a smoother property transfer.

The use of deeds of trust or mortgages varies by state, with some states primarily relying on mortgages, while others prefer deeds of trust. Typically, states like California, Texas, and Washington favor deeds of trust, while others like Florida and New York lean towards mortgages. Understanding the differences is essential for anyone engaged in real estate transactions, and referencing the North Dakota Estoppel Affidavit of Mortgagor can provide clarity in your dealings.

After acquired title in North Dakota refers to the legal concept where a property owner gains ownership of property that they may not have had legal title to at the time of the transaction. This principle ensures that any ownership rights obtained after a conveyance automatically attach to the property. The North Dakota Estoppel Affidavit of Mortgagor can help clarify these ownership rights, protecting both the buyer and lender in the process.

The 37-day foreclosure rule refers to the period after a notice of default, where the borrower has 37 days to respond to the lender's claims. If the borrower fails to respond, the lender may proceed with the foreclosure process. Knowing how the North Dakota Estoppel Affidavit of Mortgagor can influence your case during this crucial period is important. Being proactive can help you maintain your rights.

The 120-day rule for foreclosure involves a requirement for lenders to wait 120 days after a borrower misses a payment before initiating foreclosure proceedings. This rule provides borrowers with some time to remedy their financial situation. In North Dakota, understanding how the North Dakota Estoppel Affidavit of Mortgagor can fit into this timeframe is essential. It can serve as a safeguard during the foreclosure process, offering clarity on your obligations.

The five stages of a foreclosure action include pre-foreclosure, filing of the foreclosure complaint, court proceedings, the auction, and the redemption period. Each stage requires careful attention to detail, particularly the implications of the North Dakota Estoppel Affidavit of Mortgagor. Knowing these stages can prepare you for what lies ahead and help you navigate the process smoothly. You can take proactive steps to protect your interests.

In North Dakota, the foreclosure process can take anywhere from a few months to over a year, depending on various factors. The timeline can be affected by the complexity of the case and whether the borrower contests the proceedings. Utilizing the North Dakota Estoppel Affidavit of Mortgagor may help clarify any disputes in your case. Being informed about the timeline can aid you in making strategic decisions.

The redemption period in North Dakota allows a borrower to reclaim their property following foreclosure. Normally, this period lasts for up to six months after the foreclosure sale. During this time, you can use the North Dakota Estoppel Affidavit of Mortgagor to clarify your position regarding any claims on the property. Understanding this timeframe is crucial for anyone facing foreclosure.

Usually, family members or individuals with a pre-existing relationship benefit the most from a quitclaim deed. This type of deed allows for quick and uncomplicated property transfers, making it ideal for informal transactions. Additionally, if paired with a North Dakota Estoppel Affidavit of Mortgagor, the involved parties can ensure clarity in ownership and rights.