When the parties have not clearly indicated whether or not their business constitutes a partnership, the law has determined several guidelines to aid Courts in determining whether the parties have created a partnership. The fact that the parties share profits and losses is strong evidence of a partnership.

North Dakota Disclaimer of Partnership

Description

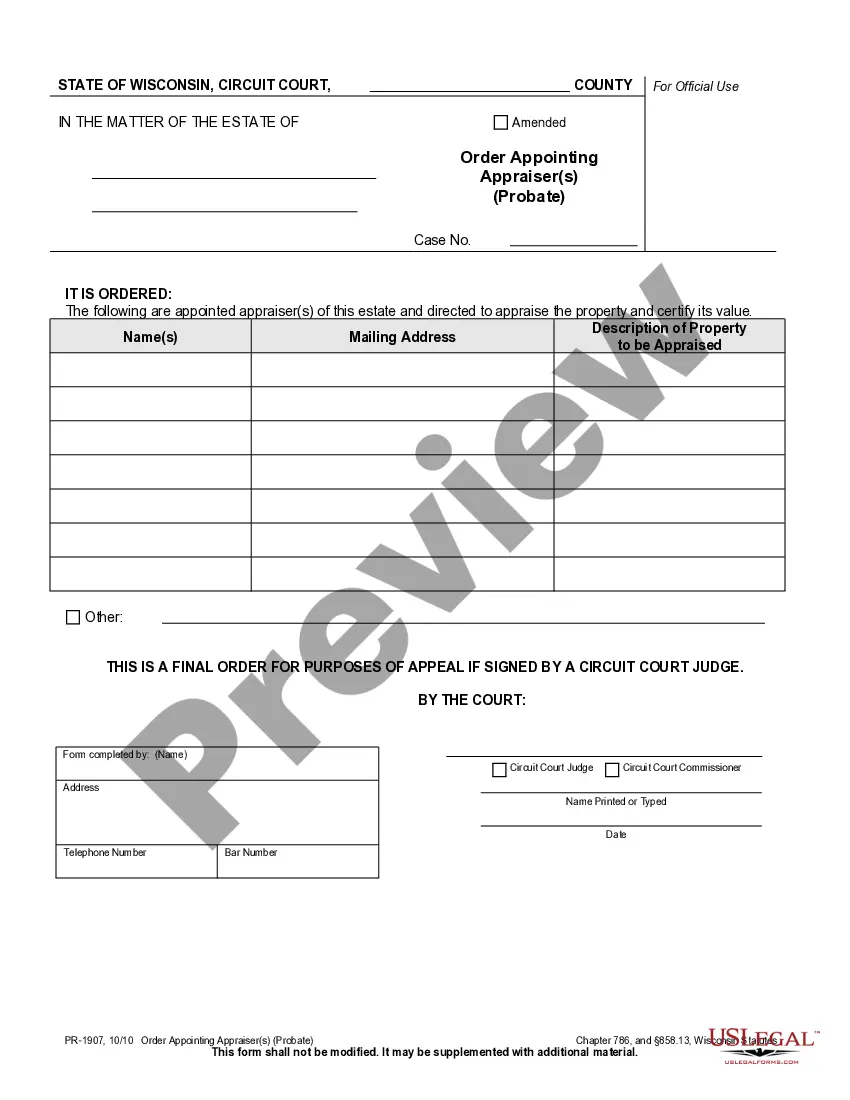

How to fill out Disclaimer Of Partnership?

If you require to finalize, acquire, or print valid document templates, utilize US Legal Forms, the largest assortment of valid forms available on the internet.

Employ the site's straightforward and user-friendly search to find the documents you need.

A variety of templates for commercial and personal purposes are organized by categories and states, or by keywords.

Step 4. Once you have found the form you need, select the Buy now button. Choose the pricing plan that suits you and enter your credentials to register for an account.

Step 5. Process the transaction. You can use your Visa or MasterCard or PayPal account to complete the transaction.

- Utilize US Legal Forms to locate the North Dakota Disclaimer of Partnership in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Acquire button to obtain the North Dakota Disclaimer of Partnership.

- You can also access forms you have previously saved from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct town/region.

- Step 2. Use the Preview option to review the form's contents. Don't forget to check the outline.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

To obtain a copy of the articles of organization in North Dakota, you can request it through the Secretary of State's office, either online or in person. This document is vital for partnerships, especially when addressing a North Dakota Disclaimer of Partnership. Ensure you have your partnership’s name and additional details ready for a smoother request process. U.S. Legal Forms can also assist you in preparing or accessing the documents you may need.

The withholding tax rate for partnerships operating in North Dakota generally varies based on the type of income earned. Typically, partnerships will face specific calculations that take into account the nature of distributions to partners. As part of your North Dakota Disclaimer of Partnership, it is crucial to calculate withholding appropriately to ensure compliance. For precise information and calculations, consulting U.S. Legal Forms can provide essential templates and guidance.

Individuals and businesses that earn income in North Dakota but reside in another state must file a North Dakota nonresident tax return. This requirement often applies to partners in a North Dakota Disclaimer of Partnership, as their earnings will be subject to state tax. The filing ensures compliance with state laws and helps avoid penalties. To accurately complete your tax return, U.S. Legal Forms offers comprehensive tools and resources.

Non-resident tax withholding refers to the process by which states like North Dakota require a portion of income to be withheld for taxes from non-residents earning income within the state. This is especially crucial for individuals and entities engaged in a North Dakota Disclaimer of Partnership, as specific tax obligations arise. Typically, the withholding ensures that the state collects taxes owed upfront, simplifying compliance for non-residents. For your ease, consider using U.S. Legal Forms to navigate through various non-resident tax requirements.

Yes, North Dakota does recognize domestic partnerships, granting certain legal rights and responsibilities similar to marriage. It is important to understand how these partnerships are treated under state law, especially when drafting a North Dakota Disclaimer of Partnership. This document can help clarify the legal implications of a domestic partnership and protect both partners' rights. If you need a thorough guide or templates, UsLegalForms is a reliable platform to explore.

A fictitious LLC name, often referred to as a 'doing business as' (DBA) name, allows a business to operate under a name other than its registered name. This can be useful for branding or marketing purposes. While it does not create a separate legal entity, a North Dakota Disclaimer of Partnership can offer clarification in scenarios where the fictitious name is involved, ensuring that all partners understand their roles and responsibilities. You can find resources on UsLegalForms to assist with the registration process.

To fill out a partnership form, gather all partner information, including names, addresses, and the nature of the business. Ensure that you specify the details of each partner's contribution, responsibilities, and profit-sharing arrangements. Additionally, it's important to include a North Dakota Disclaimer of Partnership to clarify the legal standing of the partnership and protect your interests. For an automated solution, consider using the UsLegalForms platform to guide you through the process.

Partnerships in North Dakota may have to withhold taxes on income generated by nonresident partners. This withholding ensures that tax obligations are met for income earned within the state. To navigate these requirements effectively, refer to the North Dakota Disclaimer of Partnership. It offers valuable insights into understanding your withholding responsibilities.

To check if a business name is available in North Dakota, you can use the Secretary of State's online business search tool. This tool provides instant access to registered business names in the state. Before finalizing your choice, ensure it aligns with the North Dakota Disclaimer of Partnership. This way, you can prevent conflicts and establish your brand confidently.

A fictitious partnership name, also known as a 'doing business as' (DBA) name, allows a partnership to operate under a name other than its legal name. Registering this name provides legal protection and ensures consumers know who they are dealing with. When establishing a fictitious name, ensure compliance with the North Dakota Disclaimer of Partnership to avoid legal issues.