North Dakota Sample Letter for Tax Deeds

Description

How to fill out Sample Letter For Tax Deeds?

Selecting the ideal legal document template can be a challenge. Certainly, there are numerous templates available online, but how will you find the legal document you require.

Make use of the US Legal Forms website. The service offers a vast array of templates, including the North Dakota Sample Letter for Tax Deeds, that you can utilize for business and personal purposes. All of the documents are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click on the Obtain button to download the North Dakota Sample Letter for Tax Deeds. Use your account to browse the legal documents you may have purchased in the past. Navigate to the My documents section of your account to obtain another copy of the documents you require.

Complete, modify, print, and sign the acquired North Dakota Sample Letter for Tax Deeds. US Legal Forms is the largest repository of legal documents where you can find various document templates. Utilize the service to download professionally crafted paperwork that meets state requirements.

- If you are a new user of US Legal Forms, here are straightforward instructions that you can follow.

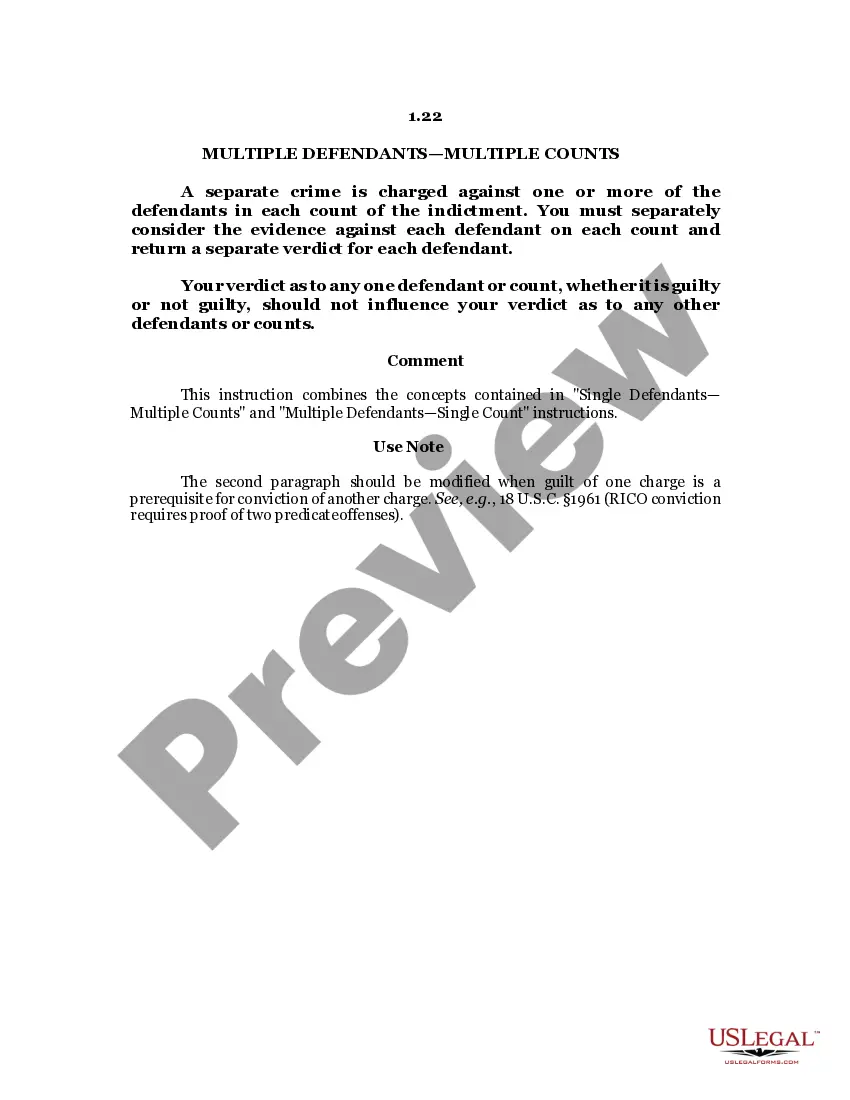

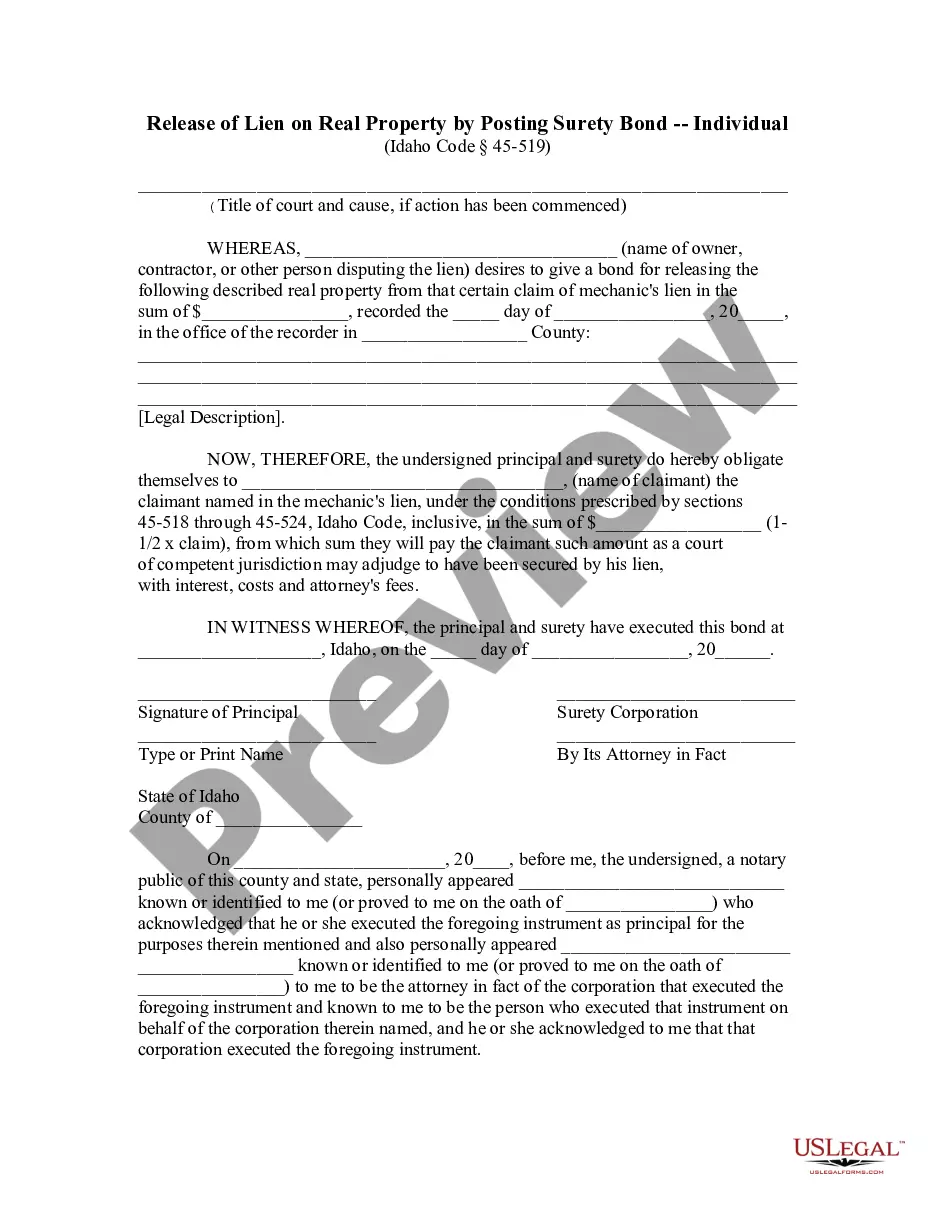

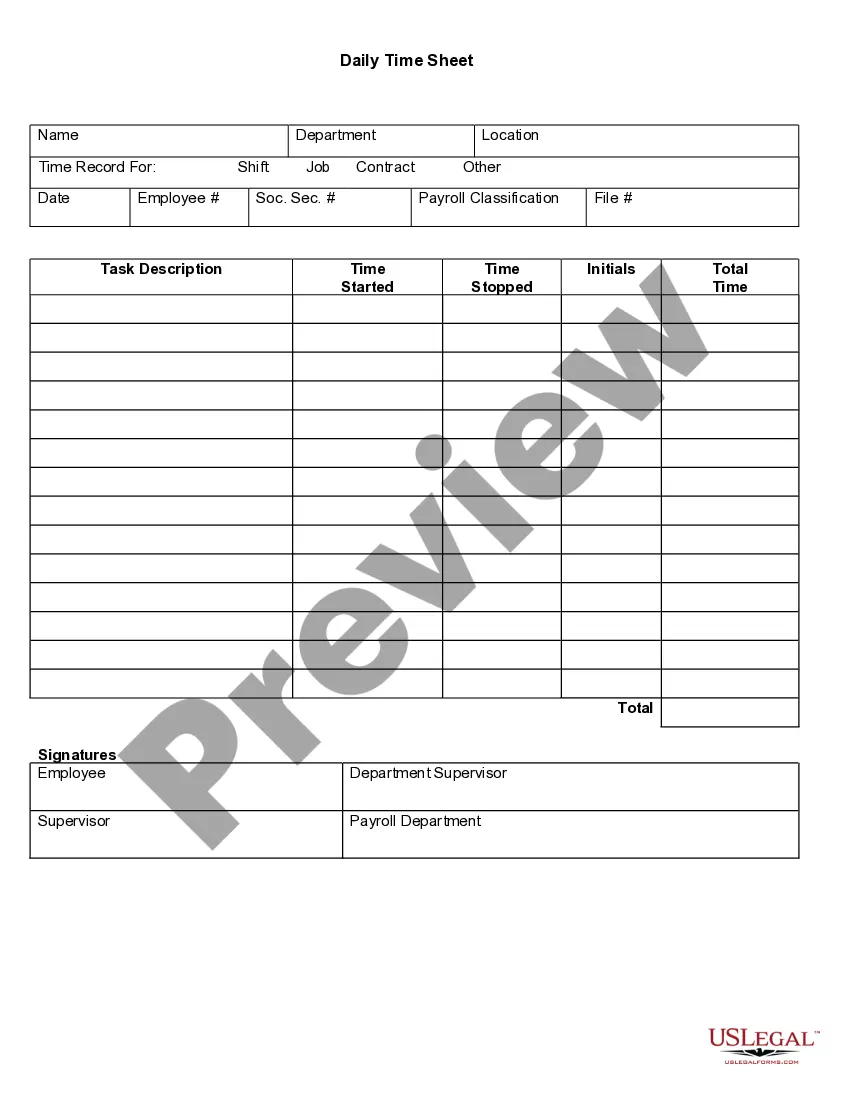

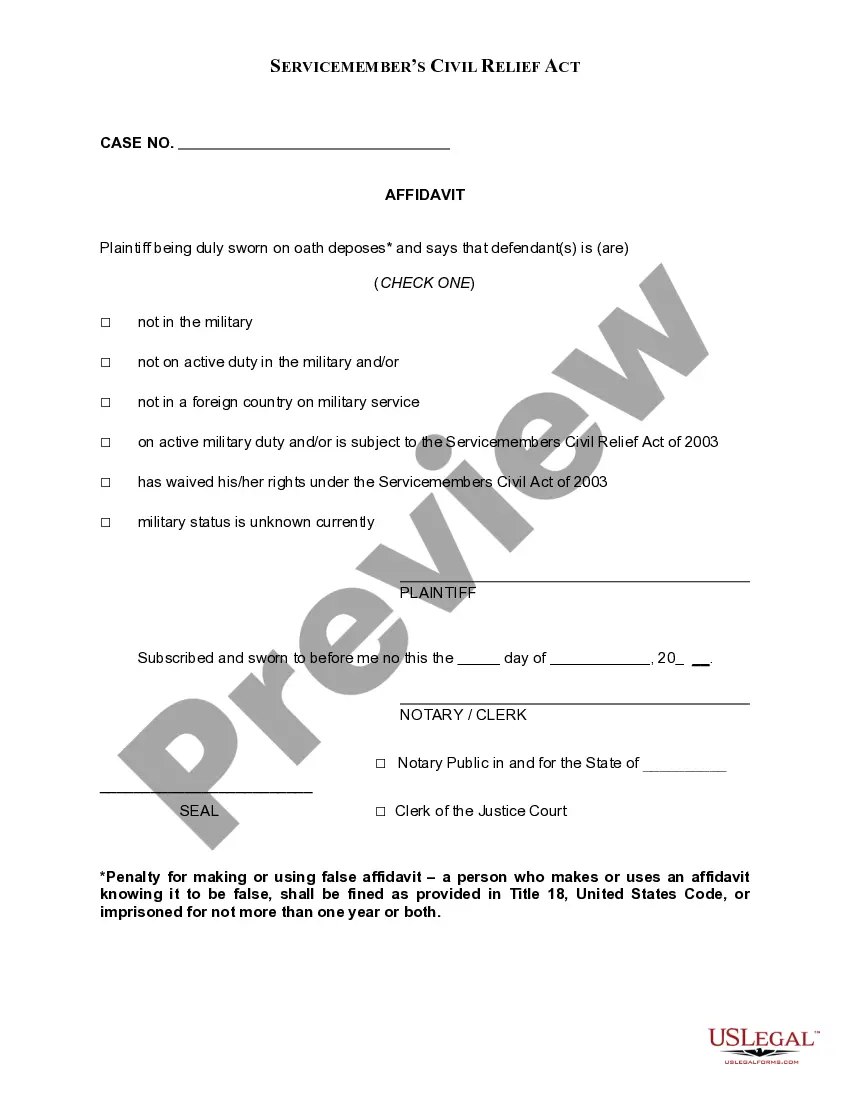

- First, ensure you have selected the correct document for your city/region. You can review the document using the Preview button and read the document description to confirm it is suitable for you.

- If the document does not meet your needs, use the Search feature to find the appropriate document.

- Once you are confident that the document is correct, click the Buy now button to purchase the document.

- Choose the pricing plan you prefer and enter the necessary information. Create your account and complete the transaction using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

Form popularity

FAQ

The assessed value of all real property in North Dakota is equal to 50% of the market value. The taxable value is just a fraction of that - 9% for residential property. That means that for residential property, taxes are based on just 4.5% of the market value.

It amended the Constitution of the State of North Dakota to prohibit the state and any political subdivision from imposing mortgage, sales or transfer taxes on the mortgage or transfer of real property.

North Dakota is generally considered a tax deed state.

65 years of age or older.

The Office of State Tax Commissioner may: Issue an assessment of the estimated tax, penalty, or interest. Place a lien on your real and personal property. A lien is a legal claim against your real and personal property that may prevent you from selling or buying current or future property without a clear title.

North Dakota has a 5.00 percent state sales tax rate, a max local sales tax rate of 3.50 percent, and an average combined state and local sales tax rate of 6.97 percent. North Dakota's tax system ranks 17th overall on our 2023 State Business Tax Climate Index.

Collection Letter ? Receiving a Collection Letter means the unpaid debt has been assigned to the Office of State Tax Commissioner's Collections Section. The letter will direct you on how to pay your tax obligation and will provide information about what may happen if you do not pay the amount due.

Form 500 may be used by a taxpayer to do one of the following: Authorize the North Dakota Office of State Tax Commissioner to disclose the taxpayer's confidential tax information to another individual or firm not otherwise entitled to the information.