North Dakota Sample Letter for Ad Valorem Tax Exemption

Description

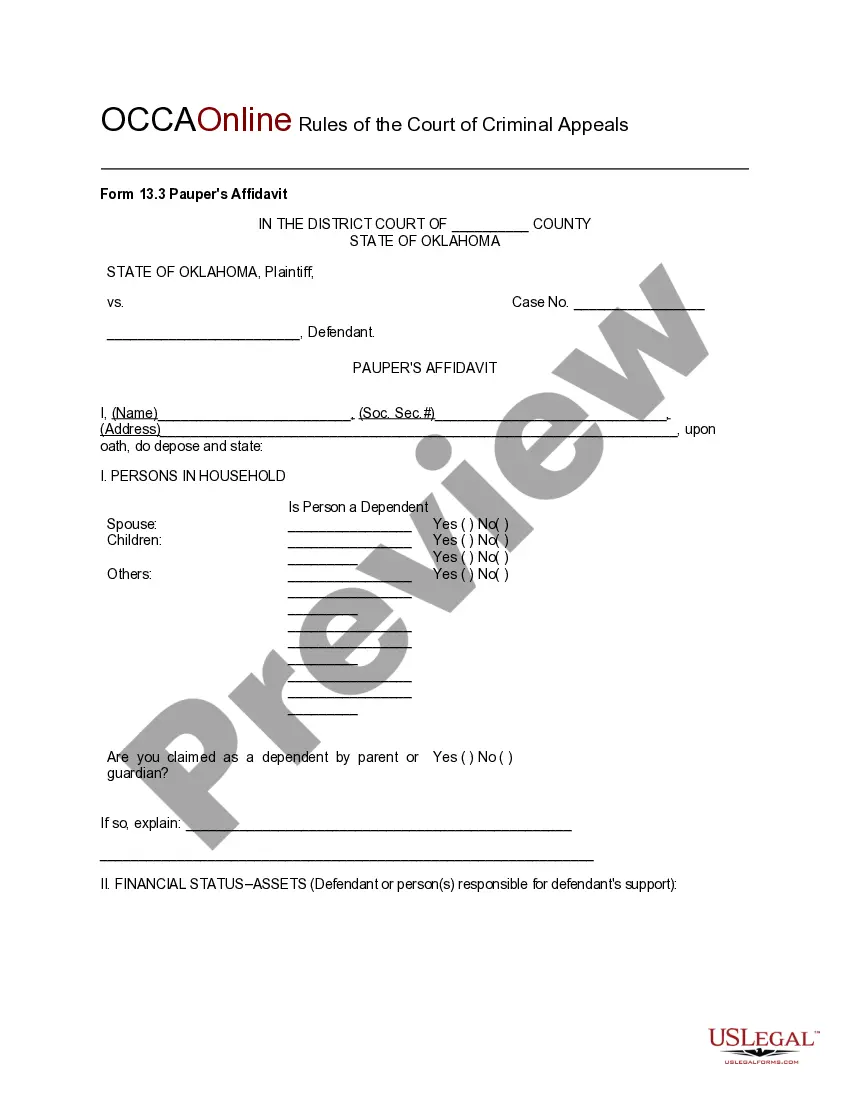

How to fill out Sample Letter For Ad Valorem Tax Exemption?

If you want to comprehensive, obtain, or print legitimate papers layouts, use US Legal Forms, the biggest variety of legitimate forms, which can be found online. Use the site`s easy and convenient search to obtain the papers you need. Various layouts for business and individual reasons are sorted by types and claims, or keywords. Use US Legal Forms to obtain the North Dakota Sample Letter for Ad Valorem Tax Exemption in just a couple of click throughs.

In case you are presently a US Legal Forms consumer, log in to your bank account and click the Acquire button to find the North Dakota Sample Letter for Ad Valorem Tax Exemption. You can even access forms you earlier delivered electronically within the My Forms tab of your own bank account.

If you use US Legal Forms initially, follow the instructions beneath:

- Step 1. Make sure you have selected the form to the appropriate metropolis/country.

- Step 2. Utilize the Preview option to check out the form`s information. Don`t forget about to see the description.

- Step 3. In case you are not happy using the kind, take advantage of the Search discipline near the top of the display to locate other types of your legitimate kind template.

- Step 4. After you have located the form you need, click on the Get now button. Pick the prices strategy you favor and put your references to sign up to have an bank account.

- Step 5. Process the purchase. You can use your bank card or PayPal bank account to finish the purchase.

- Step 6. Choose the structure of your legitimate kind and obtain it on the system.

- Step 7. Comprehensive, modify and print or indication the North Dakota Sample Letter for Ad Valorem Tax Exemption.

Each and every legitimate papers template you acquire is yours eternally. You have acces to every kind you delivered electronically with your acccount. Click on the My Forms section and decide on a kind to print or obtain again.

Compete and obtain, and print the North Dakota Sample Letter for Ad Valorem Tax Exemption with US Legal Forms. There are thousands of skilled and condition-particular forms you can utilize for your business or individual needs.

Form popularity

FAQ

65 years of age or older.

On April 27, 2023, North Dakota Governor Doug Burgum signed into law H.B. 1158, which retroactive to January 1, 2023, lowers the state's personal income tax rates by collapsing the tax brackets from five to three with tax rates of 0%, 1.95% and 2.5%. Under prior law, the highest tax rate was 2.9%.

Located in eastern North Dakota along the state border with Minnesota, Cass County has the highest average property tax rate in the state.

Full-year residents of North Dakota will receive a credit up to $350. For taxpayers who are full-year residents and married filing jointly, the tax credit is up to $700. More information is available at .tax.nd.gov/SpecialSession2021.

Some customers are exempt from paying sales tax under North Dakota law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

The following are exempt from payment of the North Dakota motor vehicle excise tax: 1. Any two motor vehicles owned by or leased and in the possession of a disabled veteran pursuant to conditions set forth in North Dakota Century Code section 57-40.3-04.

North Dakota Transmittal Of Wage And Tax Statement.

North Dakota's Homestead Tax Credit Program (NDCC 57-02-08.1) provides assistance to low-income senior citizens and disabled persons in making their property tax payments.