Whether a trust is to be revocable or irrevocable is very important, and the trust instrument should so specify in plain and clear terms. This form is a partial revocation of a trust (as to specific property) by the trustor pursuant to authority given to him/her in the trust instrument. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

North Dakota Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee

Description

How to fill out Partial Revocation Of Trust And Acknowledgment Of Receipt Of Notice Of Partial Revocation By Trustee?

It is feasible to spend multiple hours online attempting to locate the sanctioned document format that complies with the federal and state requirements you need.

US Legal Forms offers an extensive array of legal templates that are reviewed by experts.

You can obtain or print the North Dakota Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee from your assistance.

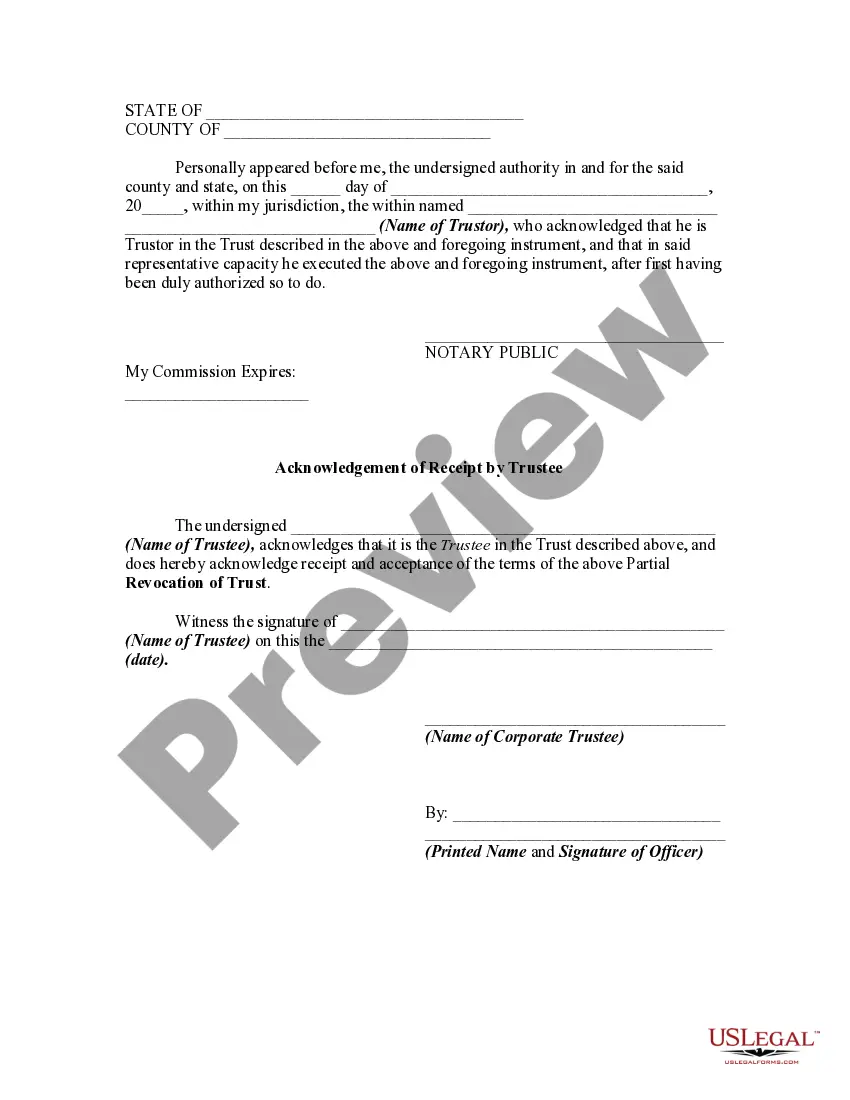

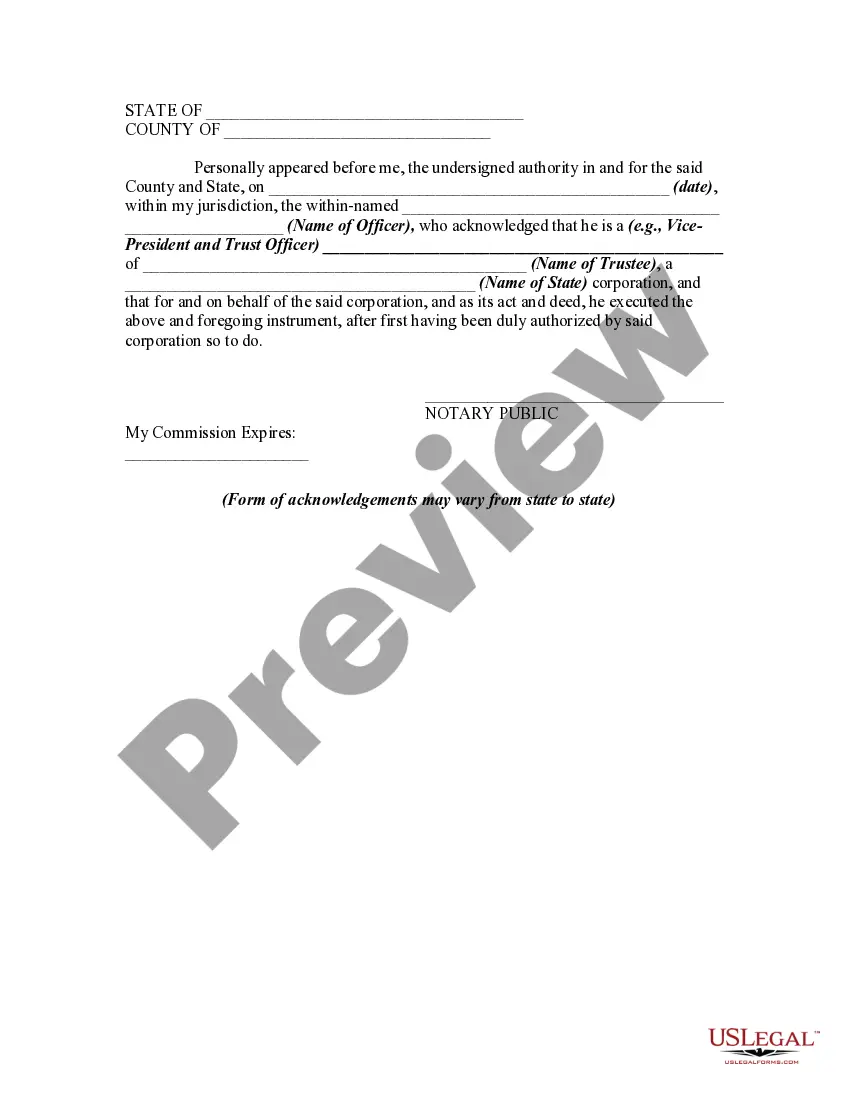

First, ensure that you have selected the appropriate format for the area/city of your preference. Review the form description to confirm you have chosen the correct form. If available, use the Preview button to examine the format as well.

- If you already possess a US Legal Forms account, you can Log In and then click the Acquire button.

- Subsequently, you can complete, modify, print, or sign the North Dakota Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.

- Each legal document you acquire is yours permanently.

- To get another copy of a purchased form, navigate to the My documents tab and click the corresponding button.

- If this is your first time using the US Legal Forms website, follow these simple steps.

Form popularity

FAQ

Dissolving a family trust typically requires formal steps, including creating a document that clearly states the intent to dissolve. In North Dakota, this process may also involve completing a North Dakota Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee. It is wise to seek assistance from a legal expert to navigate this process effectively, ensuring that all assets are distributed according to your wishes.

A trustee holds significant power over the assets placed in a trust. This authority allows them to manage, distribute, and even revoke the trust, if permitted. In North Dakota, the rules for a trustee's authority can be complex, particularly when dealing with a North Dakota Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee. Understanding these powers is essential for all beneficiaries involved.

Yes, a trustee can revoke a trust under certain conditions. In North Dakota, the process may involve creating a North Dakota Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee. This legal document helps ensure all parties are aware of the trust's changes. Consulting with a legal professional can clarify the specific circumstances under which a trust can be revoked.

Revocation of trust means that an individual has decided to cancel or alter the terms of an established trust. This can include a North Dakota Partial Revocation of Trust, which allows specific adjustments to be made without completely dissolving the trust. Understanding revocation helps maintain clarity in estate planning and ensures that your wishes are accurately reflected. Consulting a legal professional can ensure this process is handled correctly.

A nursing home cannot directly take your revocable trust, but they can potentially access trust assets if you require long-term care. It is essential to understand how assets in a North Dakota Partial Revocation of Trust may impact your financial eligibility for assistance programs. Proper planning can help protect your assets while ensuring your care needs are met. Seeking advice from an expert is advisable to mitigate risks.

To establish a trust in North Dakota, you need to create a valid written document, appoint a trustee, and specify the terms of the trust. The North Dakota Partial Revocation of Trust process also has specific requirements to ensure compliance with state laws. It is important to clarify what is required for the formation and management of the trust. Utilizing platforms like uslegalforms can help streamline this process.

An example of revocation might involve a person deciding to remove a beneficiary from their trust after a falling-out. In North Dakota, a Partial Revocation of Trust could document this change while keeping the rest of the trust intact. This allows individuals to fine-tune their estate planning without starting over completely. Always consider legal advice for accurate execution.

Revocation of trust refers to the legal process where a person cancels or modifies the terms of an existing trust. In North Dakota, a Partial Revocation of Trust involves specific procedures to ensure the trust's intentions remain clear. Understanding this concept is crucial, as it affects how assets are managed and distributed. Engaging with a knowledgeable advisor can simplify the process.

People often revoke a trust to change beneficiaries, modify terms, or simply because their needs have changed. A North Dakota Partial Revocation of Trust allows for adjustments without needing to create an entirely new trust. This process can provide flexibility, ensuring that your estate plan aligns with your current situation. When contemplating revocation, consider consulting with a professional to navigate the specifics.

The 5-year rule for trusts generally refers to the period during which certain tax treatment or asset exclusions apply to distributions made from a trust. In North Dakota, adhering to this rule can have significant tax implications for beneficiaries. Understanding the 5-year rule is crucial for effective estate planning and trust management. For those managing a trust, using the North Dakota Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee can provide clarity on adhering to regulations.