North Dakota Agreement to Purchase Condominium with Purchase Money Mortgage Financing by Seller, and Subject to Existing Mortgage

Description

How to fill out Agreement To Purchase Condominium With Purchase Money Mortgage Financing By Seller, And Subject To Existing Mortgage?

It is possible to invest time on-line searching for the authorized record template that fits the federal and state specifications you will need. US Legal Forms provides a huge number of authorized forms which can be examined by professionals. It is simple to down load or print the North Dakota Agreement to Purchase Condominium with Purchase Money Mortgage Financing by Seller, and Subject to Existing Mortgage from the assistance.

If you have a US Legal Forms account, you are able to log in and click the Down load option. After that, you are able to total, edit, print, or indicator the North Dakota Agreement to Purchase Condominium with Purchase Money Mortgage Financing by Seller, and Subject to Existing Mortgage. Every authorized record template you purchase is the one you have forever. To have another copy for any bought type, visit the My Forms tab and click the corresponding option.

If you work with the US Legal Forms website for the first time, stick to the simple guidelines listed below:

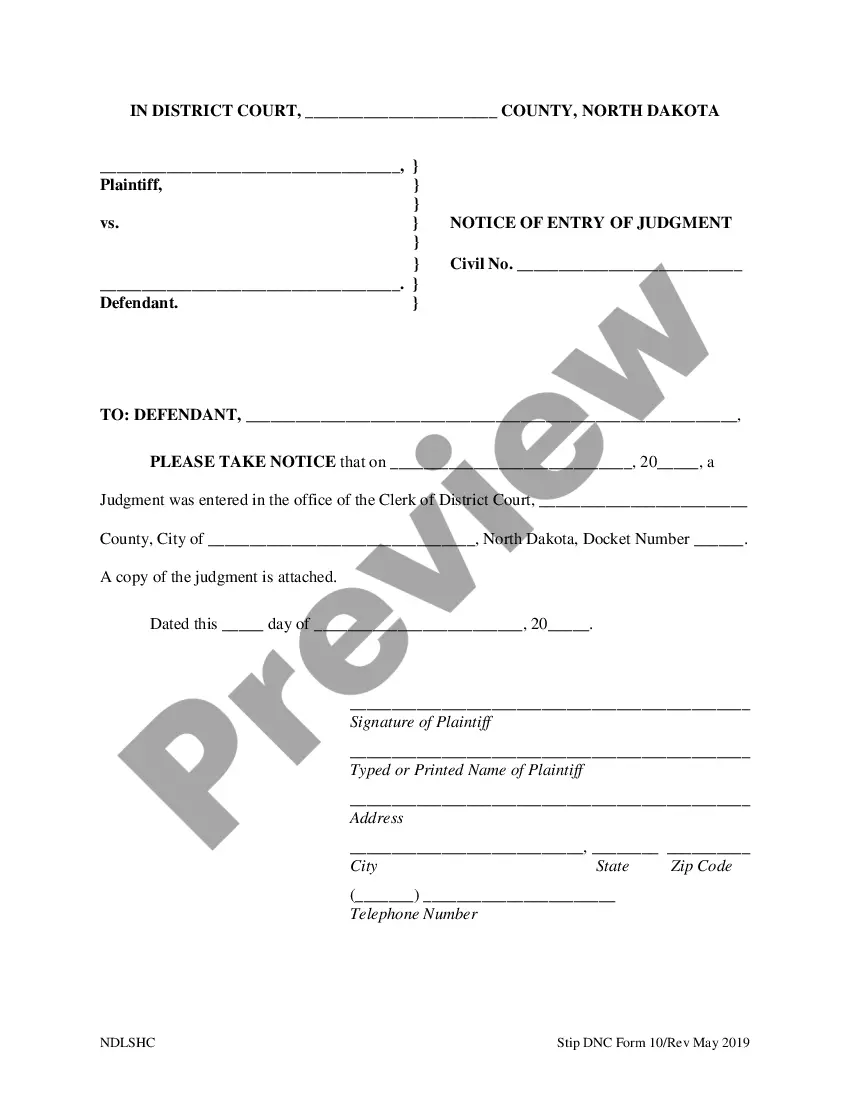

- Initially, make sure that you have chosen the proper record template for that area/metropolis of your choice. Read the type explanation to ensure you have picked the correct type. If offered, make use of the Review option to check with the record template as well.

- In order to get another variation from the type, make use of the Research discipline to find the template that meets your needs and specifications.

- After you have identified the template you would like, simply click Get now to move forward.

- Pick the rates plan you would like, type in your references, and register for an account on US Legal Forms.

- Full the transaction. You should use your charge card or PayPal account to cover the authorized type.

- Pick the file format from the record and down load it for your system.

- Make adjustments for your record if needed. It is possible to total, edit and indicator and print North Dakota Agreement to Purchase Condominium with Purchase Money Mortgage Financing by Seller, and Subject to Existing Mortgage.

Down load and print a huge number of record templates while using US Legal Forms web site, which offers the largest assortment of authorized forms. Use professional and condition-certain templates to handle your organization or personal demands.

Form popularity

FAQ

The seller's financing typically runs only for a fairly short term, such as five years. At the end of that period, a balloon payment is due. The expectation is usually that the initial seller-financed purchase will improve the buyer's creditworthiness and allow them to accumulate equity in the home.

At its most basic, a purchase agreement should include the following: Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

Examples of seller financing are all-inclusive mortgages, rent-to-own agreements, second mortgages or junior mortgages, wrap-around agreements, and land contracts.

How Do You Structure a Seller Financing Deal? Don't use current market interest rates to create the interest rate for your seller financing loan. ... The higher the price?the longer the loan term. ... Bring as little cash to the deal as possible. ... Defer payments if possible. ... Exchange down payment for needed repairs.

Here are three main ways to structure a seller-financed deal: Use a Promissory Note and Mortgage or Deed of Trust. If you're familiar with traditional mortgages, this model will sound familiar. ... Draft a Contract for Deed. ... Create a Lease-purchase Agreement.

The seller's financing typically runs only for a fairly short term, such as five years. At the end of that period, a balloon payment is due. The expectation is usually that the initial seller-financed purchase will improve the buyer's creditworthiness and allow them to accumulate equity in the home.

Any purchase agreement should include at least the following information: The identity of the buyer and seller. A description of the property being purchased. The purchase price. The terms as to how and when payment is to be made. The terms as to how, when, and where the goods will be delivered to the purchaser.

For example, if a seller-financed loan is for $100,000 at an interest rate of 8%, you would calculate that $100,000 x 0.08, which means $8,000 in interest for the year. In this scenario, a $100,000 loan at 8% would look like $666.67 in a monthly interest-only payment.