North Dakota Sample Letter for Partnership Buyout

Description

How to fill out Sample Letter For Partnership Buyout?

If you wish to be thorough, download, or print authorized document templates, utilize US Legal Forms, the premier collection of legal forms, available online.

Utilize the site’s straightforward and convenient search to find the documents you need.

Numerous templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have found the form you need, click on the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to locate the North Dakota Sample Letter for Partnership Buyout with just a few clicks.

- If you are currently a US Legal Forms customer, Log In to your account and click the Acquire button to obtain the North Dakota Sample Letter for Partnership Buyout.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

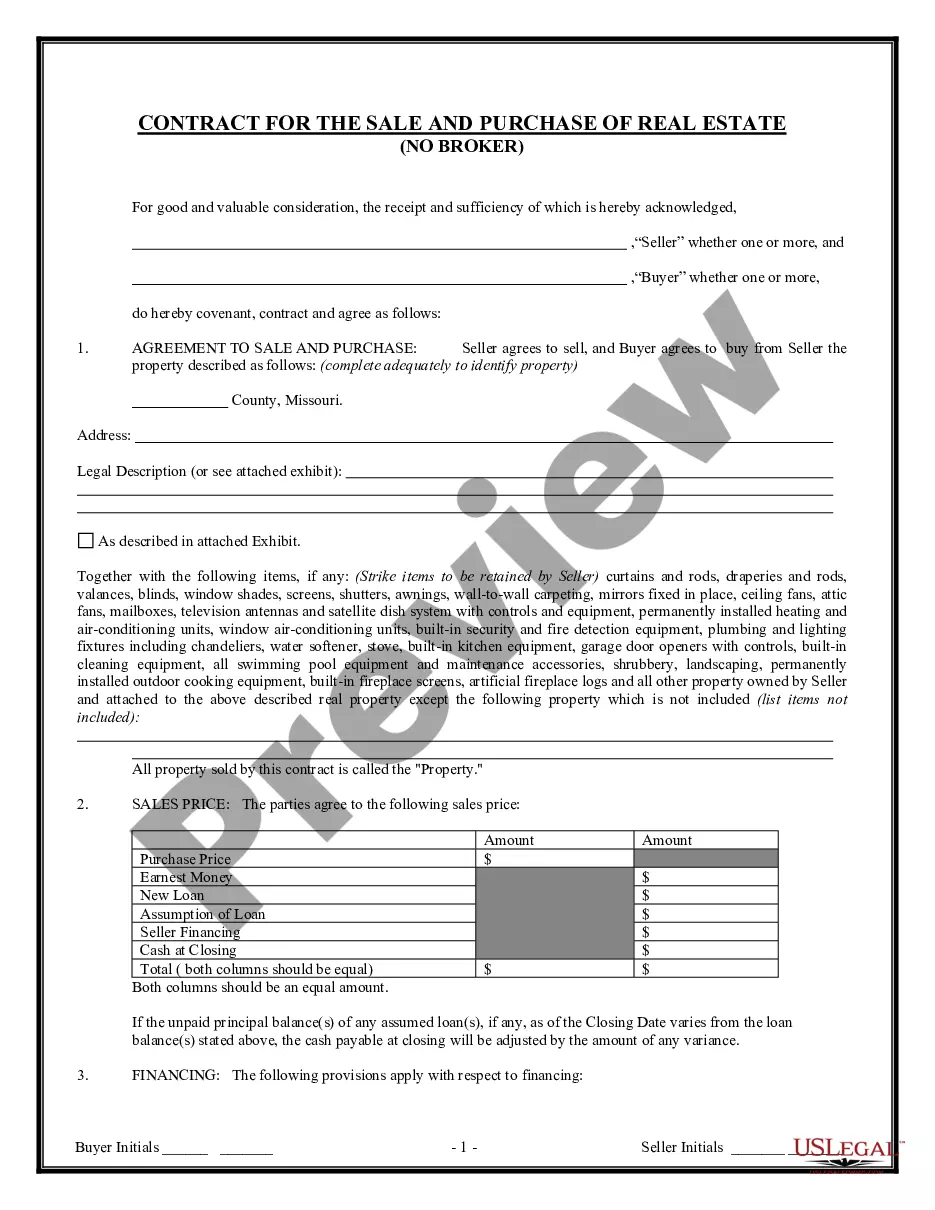

- Step 1. Ensure you have selected the form for the correct area/region.

- Step 2. Use the Preview option to review the form’s content. Always remember to read the information.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other forms in the legal form template.

Form popularity

FAQ

Getting rid of a partner in a partnership starts with consulting the partnership agreement for the correct procedures. Engage in open discussions to reach an amicable decision regarding the buyout or exit. After agreeing on the terms, document everything properly, potentially using a North Dakota Sample Letter for Partnership Buyout to capture the final agreement.

To claim a partnership, you must first ensure that you have the necessary documentation, including a partnership agreement and tax ID. You need to file Form 1065 with the IRS, which outlines the income, deductions, and profits of the partnership. For those needing guidance, platforms like uslegalforms can provide templates and resources to streamline this process.

Non-resident partners in North Dakota may face specific withholding tax requirements. Typically, the partnership must withhold state taxes from distributions made to non-resident partners. Understanding the appropriate withholding rates can be complex, so consulting a tax professional or referring to state guidelines is advisable to stay compliant.

To get someone out of a partnership, review your partnership agreement to determine the exit process. Engage in a discussion with the partner about their departure and decide on a buyout amount. Once you reach an agreement, create formal documentation, potentially including a North Dakota Sample Letter for Partnership Buyout to finalize the arrangement.

The formula for buying out a partner typically involves determining the partner's share of the business value. This can be calculated by assessing the partnership's assets, liabilities, and overall valuation. After agreeing on a value, use this calculation to outline how payments will occur in the agreement or a North Dakota Sample Letter for Partnership Buyout.

To buy out a partner in a partnership, start by evaluating the partnership agreement for any specific buyout provisions. Next, assess the value of the partnership and negotiate the terms with the outgoing partner. Finally, document the agreement and, if necessary, draft a North Dakota Sample Letter for Partnership Buyout to formalize the process.

Yes, North Dakota does accept federal extensions for partnerships. This allows partners to extend their filing deadline to align with federal allowances. By filing the appropriate forms, you can ensure compliance with both federal and state regulations. Always refer to the latest guidelines or consult with a tax professional for accurate information.

Essential elements of a partnership agreement include the names of the partners, the partnership's goals, the rights and duties of each partner, and provisions for handling disputes. It is also important to address how the partnership will manage financial matters and what happens if a partner wishes to leave or be bought out. Having these elements clearly articulated can facilitate smooth operations and assist when executing a North Dakota Sample Letter for Partnership Buyout.

A strong partnership agreement should encompass the business name, the partner’s roles, the capital contributions, and the profit distribution methods. First, include the name and purpose of the partnership to establish identity. Next, specify each partner's contributions and responsibilities, followed by clear descriptions of how profits and losses will be divided. Clearly defined contents become essential, particularly when drafting a North Dakota Sample Letter for Partnership Buyout.

To write a partnership agreement, start by clearly defining the business’s purpose and the roles of each partner. Include sections on capital contributions, profit sharing, and procedures for conflict resolution. It is also wise to describe the process for making changes to the partnership. Utilizing resources like a North Dakota Sample Letter for Partnership Buyout can help outline the necessary components, ensuring clarity and compliance with state laws.