North Dakota Corporate Resolution Authorizing a Charitable Contribution

Description

The RMBCA even authorizes a corporation to make charitable contributions. The following form is a sample of a corporate resolution authorizing a charitable contribution.

How to fill out Corporate Resolution Authorizing A Charitable Contribution?

Locating the appropriate legal document format can be a challenge. Obviously, there are many templates accessible online, but how can you find the legal form you need? Utilize the US Legal Forms website.

The platform offers a vast array of templates, including the North Dakota Corporate Resolution Authorizing a Charitable Contribution, which can be utilized for both business and personal requirements. All forms are reviewed by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click on the Download button to obtain the North Dakota Corporate Resolution Authorizing a Charitable Contribution. Use your account to browse through the legal forms you have previously ordered. Visit the My documents section of your account to obtain another copy of the document you require.

Choose the document format and download the legal document format to your device. Complete, edit, print, and sign the obtained North Dakota Corporate Resolution Authorizing a Charitable Contribution.

US Legal Forms is the largest collection of legal forms where you can find a variety of document templates. Use the service to acquire properly crafted documents that comply with state regulations.

- First, ensure you have selected the correct form for your location/region.

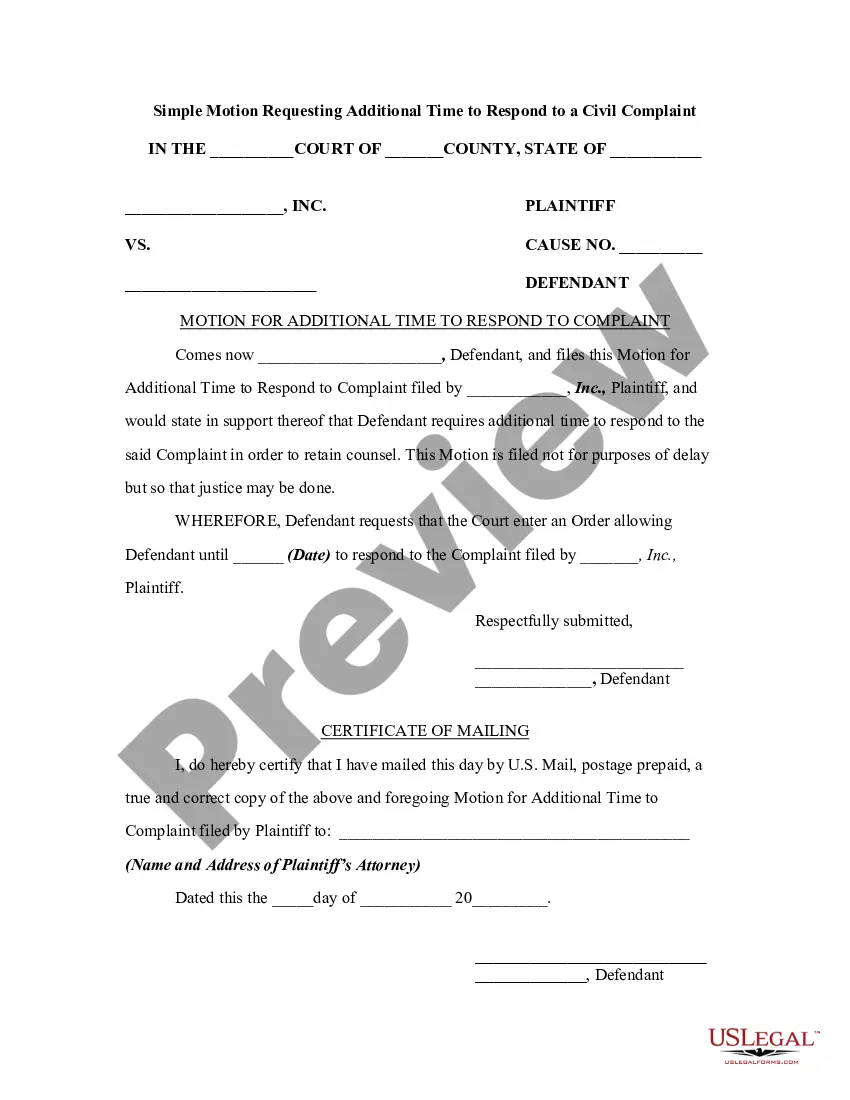

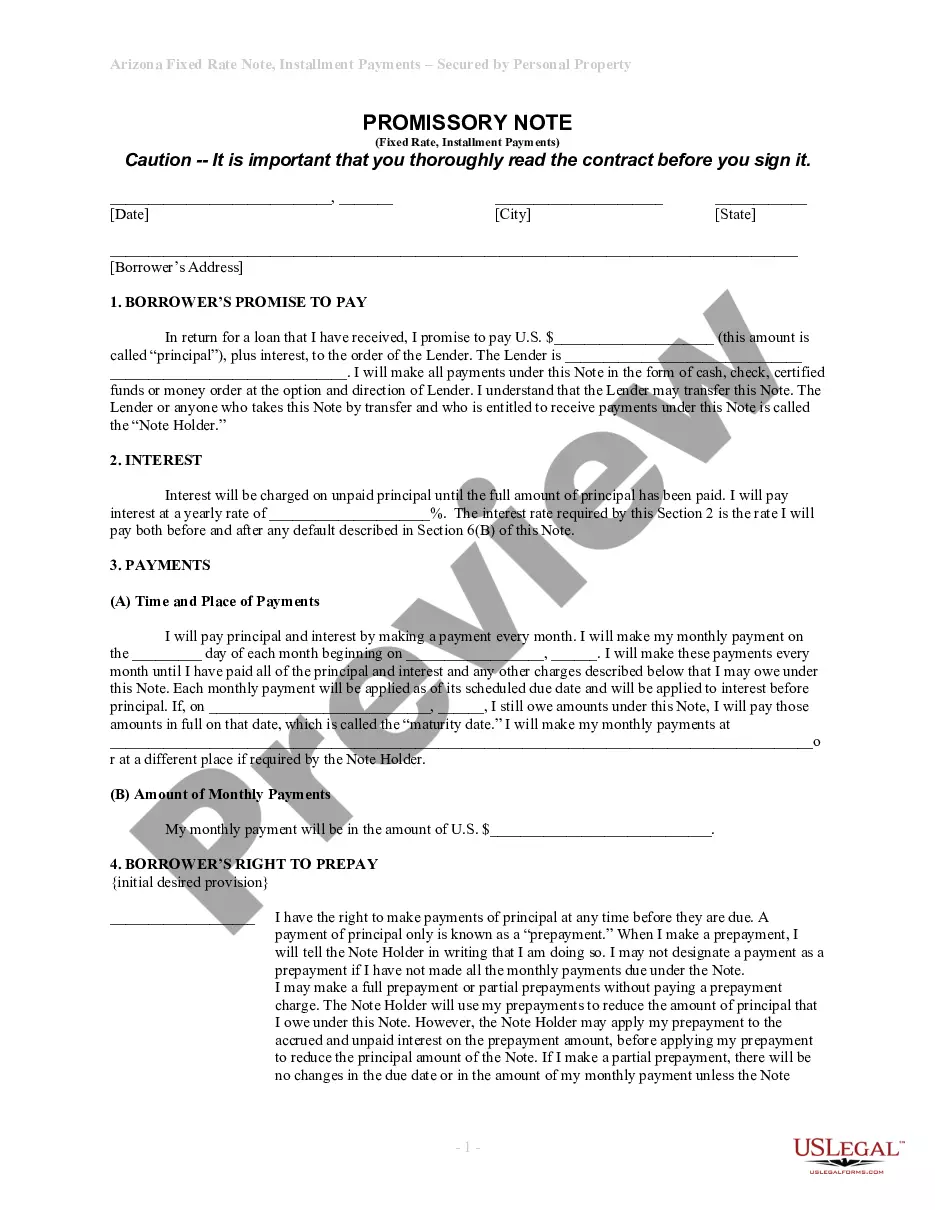

- You can view the form using the Preview button and examine the form details to confirm it is suitable for you.

- If the form does not meet your expectations, utilize the Search area to find the appropriate form.

- Once you are convinced the form is correct, click the Get now button to acquire the form.

- Select the payment plan you prefer and provide the necessary information.

- Create your account and complete the purchase using your PayPal account or Visa or Mastercard.

Form popularity

FAQ

To incorporate in North Dakota, start by choosing a unique business name and filing the appropriate paperwork with the Secretary of State. You will also need to designate a registered agent who can accept legal documents on behalf of your corporation. If you wish to authorize charitable contributions, adopting a North Dakota Corporate Resolution Authorizing a Charitable Contribution at the incorporation stage can establish clear guidelines for giving back to the community.

North Dakota employs several thousand state employees across various departments, reflecting its commitment to public services. These employees support critical functions ranging from education to health services. If you’re a state employee interested in making charitable contributions, understanding the process through a North Dakota Corporate Resolution Authorizing a Charitable Contribution can streamline your efforts and enhance community impact.

The 33% rule for nonprofits refers to a guideline that suggests an organization should allocate at least one-third of its budget towards its programs and services. This helps ensure transparency and accountability in financial practices. As you develop your non-profit in North Dakota, utilizing a resolution that authorizes charitable contributions can help clarify how funds will be utilized, ensuring you meet this standard effectively.

California, New York, and Texas lead the nation in the number of non-profit organizations. These states have large populations and diverse needs, driving a robust non-profit sector. If you are considering forming a non-profit in North Dakota, utilizing a North Dakota Corporate Resolution Authorizing a Charitable Contribution can effectively facilitate your charity's operations and align your mission with community needs.

Currently, North Dakota hosts a couple of Fortune 500 companies, primarily in the energy and agriculture sectors. These companies significantly contribute to the state’s economy. If you are considering the business landscape, understanding how these corporations organize their charitable contributions is vital. A North Dakota Corporate Resolution Authorizing a Charitable Contribution can help guide these efforts.

Yes, North Dakota does allow for extensions on charitable registration under certain circumstances. If you need additional time to submit your annual reports or renew your registration, you may apply for an extension through the Secretary of State's office. It’s a good idea to keep your North Dakota Corporate Resolution Authorizing a Charitable Contribution updated during this process to maintain clarity in your charitable activities.

In North Dakota, taxpayers can receive a tax credit for charitable contributions made to eligible organizations. The credit generally allows for a reduction in taxable income, thereby encouraging philanthropy within the state. When making such contributions, it is often useful to have a North Dakota Corporate Resolution Authorizing a Charitable Contribution, as it supports proper record-keeping and compliance.

As of the latest data, North Dakota has over 2,000 registered nonprofits. These organizations cover a wide range of causes and serve diverse communities across the state. A growing number of these nonprofits frequently undertake initiatives that may involve drafting a North Dakota Corporate Resolution Authorizing a Charitable Contribution to further their mission.

To dissolve a corporation in North Dakota, you need to file Articles of Dissolution with the Secretary of State. It is essential to settle any remaining debts and distribute the assets according to state law. As part of the dissolution process, consider reviewing any prior charitable contributions made under a North Dakota Corporate Resolution Authorizing a Charitable Contribution to ensure compliance with existing obligations.

To start a corporation in North Dakota, begin by choosing your corporation's name and ensuring its availability. Next, file your Articles of Incorporation with the Secretary of State and create bylaws for your corporation. As you proceed, consider incorporating a North Dakota Corporate Resolution Authorizing a Charitable Contribution as part of your corporate governance to facilitate charitable activities.