North Dakota Bill of Sale of Mobile Home with or without Existing Lien

Description

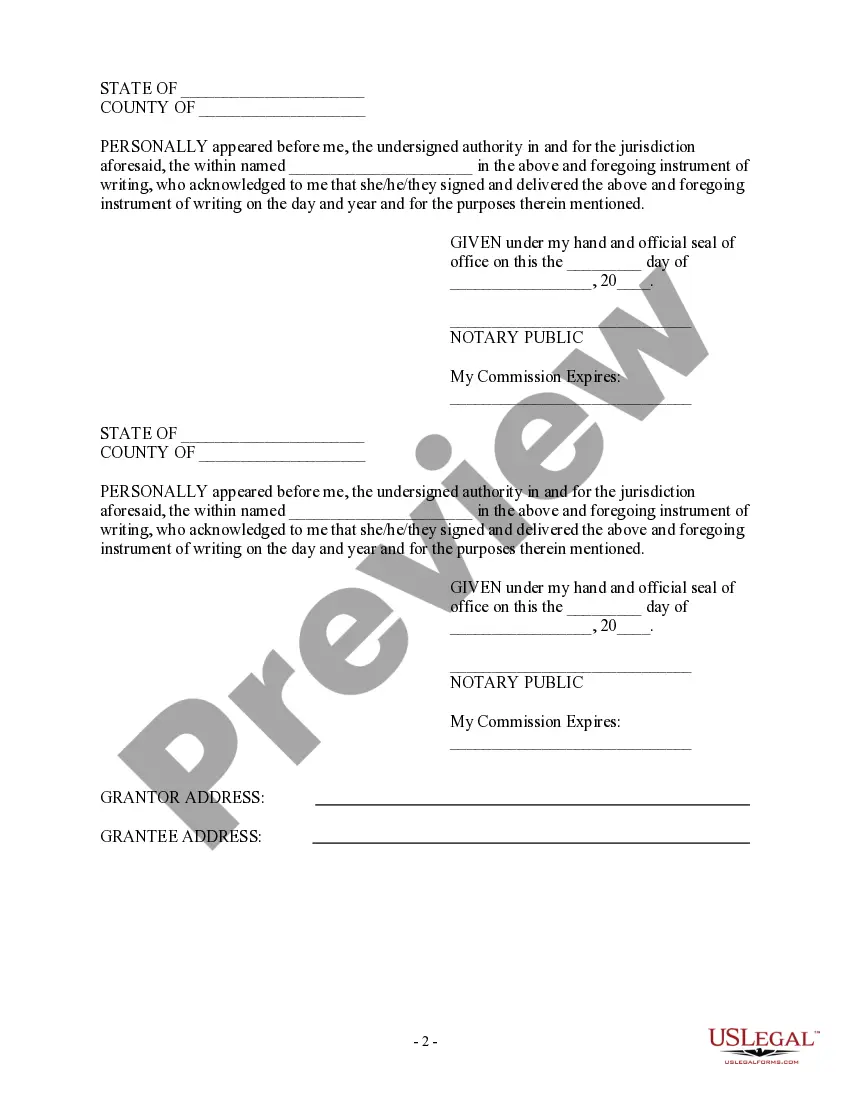

How to fill out Bill Of Sale Of Mobile Home With Or Without Existing Lien?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a wide range of legal form types that you can obtain or create.

By using the website, you can find countless forms for commercial and personal purposes, organized by categories, states, or keywords. You can access the latest versions of forms such as the North Dakota Bill of Sale of Mobile Home with or without Existing Lien in moments.

If you already have a subscription, Log In and obtain the North Dakota Bill of Sale of Mobile Home with or without Existing Lien from the US Legal Forms collection. The Download button will appear on every form you view. You have access to all previously saved forms within the My documents tab of your account.

Process the transaction. Use your Visa or Mastercard or PayPal account to complete the purchase.

Find the format and download the form onto your device. Make alterations. Fill out, edit, and print and sign the saved North Dakota Bill of Sale of Mobile Home with or without Existing Lien. Every template you added to your account does not have an expiration date and is yours indefinitely. So, if you wish to obtain or print another copy, just go to the My documents section and click on the form you need. Gain access to the North Dakota Bill of Sale of Mobile Home with or without Existing Lien via US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs.

- If you want to use US Legal Forms for the first time, here are simple steps to guide you.

- Ensure you have selected the correct form for your specific city/county.

- Click the Preview option to check the form's details.

- Review the form description to confirm you have chosen the right form.

- If the form does not suit your requirements, utilize the Search field at the top of the page to find the appropriate one.

- Once you are satisfied with the form, confirm your selection by clicking the Get now button.

- Next, choose the subscription plan you prefer and provide your information to register for an account.

Form popularity

FAQ

A notice of intent to lien in North Dakota is a formal notification that indicates an individual's or entity's intent to place a lien on a mobile home or other property due to unpaid debts. This notice must be filed with the appropriate authorities to establish the claim legally. Understanding this process is vital if you are dealing with a mobile home transaction and planning to create a North Dakota Bill of Sale of Mobile Home with or without Existing Lien.

To file for a lost or abandoned title in North Dakota, you will need to complete an application form designated for lost titles and submit it to the local Department of Transportation. If the vehicle is considered abandoned, ensure you have all necessary documentation, such as proof of the abandoned status and ownership details. This process may vary slightly based on local regulations, and having a clear understanding can aid in generating a North Dakota Bill of Sale of Mobile Home with or without Existing Lien.

If you need to file for a lost title that is not in your name, you must secure written permission from the current titleholder. The application process typically requires a form that confirms your right to apply for a replacement title. You might also need supporting documents, like a bill of sale, especially if you are planning to transfer ownership through a North Dakota Bill of Sale of Mobile Home with or without Existing Lien.

Registering a car in North Dakota without a title is possible under specific circumstances. You may need to provide proof of ownership, such as a bill of sale or an affidavit, depending on your situation. It’s advisable to check with the local Department of Transportation as they can guide you through the process. This information can be critical when creating a North Dakota Bill of Sale of Mobile Home with or without Existing Lien.

Writing a bill of sale without a title is possible. Start by including all pertinent details such as the buyer's and seller's names, the mobile home's identification number, and a description of the sale. Mention that there is no title and provide the circumstances around it, similar to how you would document a North Dakota Bill of Sale of Mobile Home with or without Existing Lien.

In North Dakota, if you need a title for a car without an existing title, begin by gathering any vehicle identification information and the bill of sale if available. You can file an application for a replacement title at the Department of Transportation, along with necessary fees. This process mirrors obtaining a North Dakota Bill of Sale of Mobile Home with or without Existing Lien, as proper documentation is key.

If you only have a bill of sale and no existing title, you can still apply for a title by providing the bill of sale at your local county treasurer's office. Be prepared to explain your situation, and submit any additional documents they may require. This situation may lead you back to the creation of a North Dakota Bill of Sale of Mobile Home with or without Existing Lien for proper documentation.

To obtain a title using a bill of sale in North Dakota, first, ensure that the bill of sale includes all necessary information about the transaction, including buyer and seller details. You should then visit your local county treasurer's office with the completed bill of sale and any other required documents. This process is essential for a smooth transition when dealing with a North Dakota Bill of Sale of Mobile Home with or without Existing Lien.

To find out if there's a lien on your mobile home, start by checking public records in your local county office. You can also search through the North Dakota Department of Transportation's website. Understanding the lien status is crucial when preparing a North Dakota Bill of Sale of Mobile Home with or without Existing Lien.

In North Dakota, a bill of sale does not need to be notarized for it to be legal. However, having it notarized may provide an extra layer of protection and authenticity. Using services like uslegalforms can simplify this process, ensuring that your North Dakota Bill of Sale of Mobile Home with or without Existing Lien is properly completed and documented.